KEYTAKEAWAYS

- Shiba Inu secures $12 million to develop a privacy-centric blockchain, enhancing data security.

- Sam Bankman-Fried settles with FTX customers, aiding their case against celebrity endorsers.

- Post-halving, Bitcoin and Ether show resilience amid geopolitical tensions and market indecision.

- Iconic 'Buy Bitcoin' sign from 2017 auctioned for 16 BTC, setting a record for the auction platform.

- Despite significant ETF outflows totaling over $200M, Bitcoin's price remains stable above $64K.

- KEY TAKEAWAYS

- TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

- TOP 5 CRYPTO BY MARKET CAP

- 1. Shiba Inu Raises $12M for New Privacy Blockchain

- 2. Bankman-Fried Settles with FTX Customers in Legal Deal

- 3. Crypto Markets Steady Amid Global Tensions and Halving

- 4. ‘Buy Bitcoin’ Sign Auctioned for Over $1 Million in BTC

- 5. Bitcoin Holds Steady Above $64K Amid ETF Withdrawals

- DISCLAIMER

- WRITER’S INTRO

CONTENT

In the Crypto Weekly Snapshot, we present to you 5 carefully selected stories from the crypto market and the latest crypto market data so you won’t miss anything important!

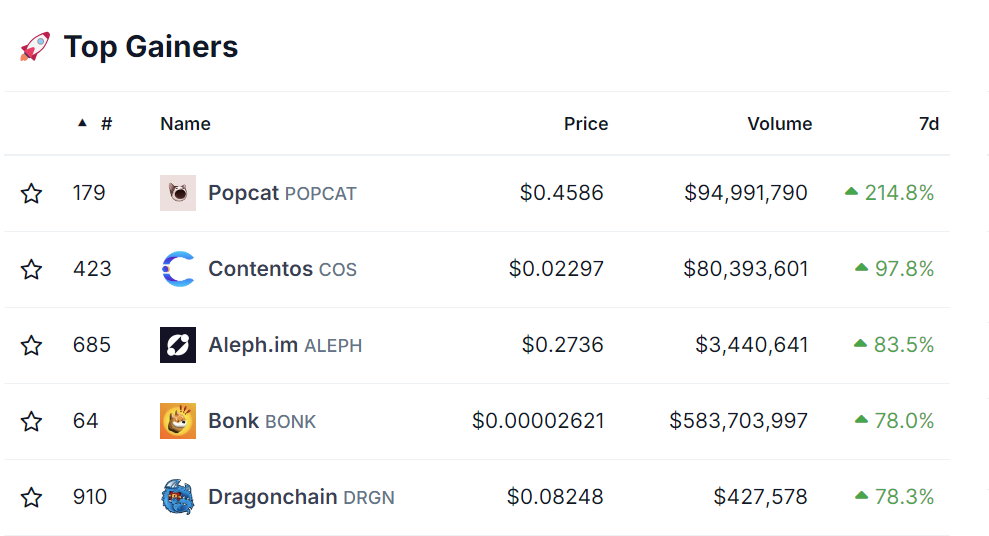

TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

(Source: CoinGecko)

- POPCAT +214.8%

- COS +97.8.%

- ALEPH +83.5%

- BONK +78.0%

- DRGN +78.3%

TOP 5 CRYPTO BY MARKET CAP

(Source: CoinGecko)

- BTC $1,267,900,773,426

- ETH $383,593,551,060

- USDT $110,428,205,169

- BNB $93,814,513,348

- SOL $64,465,822,152

Apr 22, 2024

1. Shiba Inu Raises $12M for New Privacy Blockchain

Introduction to Fundraising

Shiba Inu, the Ethereum-based ecosystem known for its SHIB token, has successfully raised $12 million in a recent token sale. This funding is aimed at developing a new privacy-focused blockchain. The announcement was made via a press release on Monday, signaling a significant advancement for the canine-themed token’s technological infrastructure.

Investor Participation

A diverse group of investors participated in the fundraising round, highlighting broad support for Shiba Inu’s new initiative. The investors include Comma 3 Ventures, Big Brain Holdings, Cypher Capital, Shima Capital, and several other prominent venture firms. These investors acquired TREAT, the upcoming utility and governance token that will be integral to the new network.

Strategic Developments

The development is spearheaded by Shiba Inu Mint S.A., a Panama-incorporated firm dedicated to the ecosystem’s growth. This move follows a February report by CoinDesk, which detailed Shiba Inu developers’ collaboration with cryptography experts at Zama to build atop Shibarium, their Ethereum-based layer-2 blockchain. This collaboration underscores a strategic pivot towards enhancing privacy and security in blockchain operations.

Technological Advancements

The proposed privacy network will leverage Fully Homomorphic Encryption (FHE), a sophisticated privacy tool that allows developers to work with data in untrusted domains without decryption. This technology represents a cutting-edge approach to privacy and security in the blockchain space, positioning Shiba Inu at the forefront of blockchain privacy innovation.

Apr 23, 2024

2. Bankman-Fried Settles with FTX Customers in Legal Deal

Settlement Agreement Details

Sam Bankman-Fried has reached a settlement agreement with a group of FTX customers, marking a significant development in the aftermath of the cryptocurrency exchange’s collapse. Filed in a Miami court on Friday, the agreement is pending judicial approval. If sanctioned, it will absolve Bankman-Fried of both current and future civil liabilities related to the downfall of FTX.

Terms of the Settlement

Under the terms of the settlement, Bankman-Fried will cooperate with the plaintiffs’ legal team by providing crucial information and documents. This includes testimony and financial records aimed at bolstering the plaintiffs’ efforts in recovering losses and pursuing litigation against various celebrity promoters and venture capital firms that supported FTX.

Recent Developments and Co-defendant Agreements

The settlement follows Bankman-Fried’s recent conviction on fraud charges and a 25-year prison sentence, which he has since appealed. Additionally, several of Bankman-Fried’s former colleagues and co-defendants, including Caroline Ellison, Nishad Singh, Gary Wang, and FTX lawyer Dan Friedberg, have negotiated similar agreements to aid the plaintiffs.

Celebrity and Venture Capital Involvement

While smaller celebrity promoters have settled and contributed to a fund aiding the lawsuit, high-profile figures and numerous venture capital firms continue to contest the claims. This ongoing legal battle underscores the widespread impact of FTX’s collapse and the complex web of endorsements that preceded it.

Apr 24, 2024

3. Crypto Markets Steady Amid Global Tensions and Halving

Market Conditions and Stability

Following the recent Bitcoin halving, Bitcoin (BTC) and Ether (ETH) continue to trade within narrow ranges, reflecting a cautious market climate. At press time, Bitcoin is trading above $66,600, while Ether is priced around $3,240. This period of market calm comes after a few volatile weeks, which saw geopolitical tensions and significant excitement about Bitcoin’s halving event. Jun-Young Heo, a trader at Presto, reported to CoinDesk that the market volatility has notably decreased post-halving, although traders are still cautious, monitoring global economic indicators closely.

Liquidity and Market Movements

Recent data from CoinGlass indicates a significant amount of liquidation in the past 12 hours, totaling $52.46 million, with the largest liquidations seen in Ether and BTC. This points to ongoing nervousness in the market, despite the stabilization in major crypto prices. Additionally, lesser-known cryptocurrencies like HBAR experienced $6.86 million in liquidations due to a recent surge in trading volume, showcasing the market’s sensitivity to rapid shifts in trading activity.

Investor Sentiment and Market Reactions

The crypto market is currently experiencing a phase of indecision, with traders hesitant to take a definitive bullish or bearish stance. This sentiment of uncertainty is reflected in the CoinDesk 20 Index, which remains flat, indicating a period of stagnation or stability among the largest digital assets by market cap. According to Justin d’Anethan of Keyrock, this indecision is partly due to a flurry of negative news, including regulatory hesitations by the SEC regarding ETF applications and critical comments on crypto mining by President Joe Biden.

Future Outlook and Strategic Movements

Despite the challenges and the current market indecision, some market participants remain optimistic about the long-term potential of cryptocurrencies. Investors are holding onto their assets, anticipating potential price increases in the future, especially since the halving event traditionally sets the stage for upward price trends in the long term. This cautious optimism is underpinned by a belief that recent market corrections have removed some speculative excess, potentially leading to a more stable market environment moving forward.

Apr 25, 2024

4. ‘Buy Bitcoin’ Sign Auctioned for Over $1 Million in BTC

Record Sale and Historical Context

The famous ‘Buy Bitcoin’ sign, which gained notoriety when displayed behind Janet Yellen during her 2017 Congressional testimony, has been sold at an auction for 16 BTC, equivalent to just over $1 million. This sale, facilitated by Scarce.City, marks a record transaction for the auction house, highlighting the sign’s significant cultural value within the cryptocurrency community.

And that’s a wrap on one of the most ICONIC pieces of Bitcoin history. 🏆🍾

Made a little history of our own … meet the official new https://t.co/rNz9DWL5WE record. 🏅 pic.twitter.com/3ixQmEHbd0

— Scarce.City (@scarcedotcity) April 24, 2024

Auction Details and Venue

The bidding took place at PubKey, a Bitcoin-themed bar located in New York City, underscoring the strong ties between cryptocurrency culture and social venues that cater to enthusiasts. The auction event not only celebrated the historic moment but also turned into a social gathering for Bitcoin advocates and collectors.

New Ownership

The new owner of the sign, known only by the pseudonym Squirrekkywrath, remains largely an enigma in the cryptocurrency world. According to Alex Thorn, head of research at Galaxy, Squirrekkywrath is a “bitcoin OG that no one has ever heard of.” This adds a layer of intrigue to the auction, as community members speculate about the identity and background of the buyer.

Congratulations to Justin, A.K.A. Squirrekkywrath, winner of the #BitcoinSignGuy auction for 16 #BTC. 🏆@tpacchia Get this man a Whale! 🐳 pic.twitter.com/DPpczcEzkJ

— PUBKEY (@PubKey_NYC) April 24, 2024

Plans for Proceeds

Christian Langalis, the person who famously held up the sign during the televised testimony, has announced that the proceeds from the auction will fund his startup, Tirrel Corp. This new venture aims to develop a Bitcoin Lightning network wallet on the Urbit platform, potentially advancing Bitcoin’s usability and integration into new technology spaces. Langalis’s act of protest not only went viral but has now transitioned into a venture that could support the broader Bitcoin ecosystem.

Apr 26, 2024

5. Bitcoin Holds Steady Above $64K Amid ETF Withdrawals

Market Stability and ETF Trends

Bitcoin continues to exhibit resilience, trading steadily above $64,000, despite witnessing substantial outflows from exchange-traded funds (ETFs). Recent market data reveals that U.S.-listed Bitcoin ETFs have experienced a net outflow of $217 million in a single day, escalating the total weekly outflows to $244.49 million. This trend underscores a cooling investor interest in ETFs even as the direct investment in Bitcoin appears relatively unaffected.

Price Performance and Outflow Impact

Despite the notable ETF outflows, Bitcoin’s market performance has been positive, with an approximate 3.7% increase over the last week. This suggests a decoupling of ETF activity from Bitcoin’s direct market movements, a shift highlighted by JPMorgan’s recent analysis. The correlation between Bitcoin ETF prices and inflows has weakened significantly, moving from 0.84 in January to just 0.60 recently, indicating reduced synchrony between ETF flows and BTC prices.

Specific ETF Movements and Market Analysis

Grayscale’s Bitcoin ETF, in particular, has seen a dramatic outflow of $417 million this past week, according to SoSoValue. Despite this, Bitcoin’s price has not only held but also increased, showcasing the cryptocurrency’s robustness against potential market pressures from institutional movements. This anomaly continues to attract the attention of traders and analysts who are gauging the impact of institutional behaviors on the broader crypto market.

Liquidation Data and Broader Crypto Market

In terms of market liquidations, the situation remains stable with GoinGlass reporting total liquidations of $60 million in the past 24 hours, of which Bitcoin-related liquidations constituted $13.48 million. The balance between liquidated longs and shorts is also nearly even, suggesting a market in equilibrium. Meanwhile, the CoinDesk 20, which tracks the performance of the top 20 digital assets, shows no significant movement, further indicating a period of market stability.