KEYTAKEAWAYS

- Crypto contract trading enables speculation on digital asset prices without owning them, using derivatives like futures and perpetual contracts.

- Traders can profit by going long (betting on price increase) or short (betting on price decrease) with leverage.

- Success in contract trading demands solid strategies, risk management, continuous learning, and choosing reliable trading platforms.

CONTENT

WHAT IS CONTRACT TRADING?

Crypto contract trading offers an exciting opportunity for traders to predict where the prices of digital assets will go in the future, without the need actually to hold those assets in their digital wallets.

This method utilizes financial tools known as derivatives, including futures and perpetual contracts, to offer traders the chance to see considerable gains from their activities.

Perpetual Contracts vs. Futures Contracts: What’s the Difference?

- Perpetual Contracts: Think of these as ongoing bets on cryptocurrency prices. There’s no set time to finish, so you can decide when to end it based on your strategy. They’re great for staying flexible and moving with the market prices.

- Futures Contracts: These are like promises to buy or sell cryptocurrencies at a specific price on a certain date. Once that date arrives, the deal must happen at the agreed price, making it a way to plan against or hope for future price changes.

Essentially, it enables traders to place a “wager” on whether the value of popular cryptocurrencies such as Bitcoin and Ethereum will rise or fall, using leverage to increase the amount of money they can trade beyond what they actually own.

This way, traders have the potential to boost their investment returns significantly by predicting market movements accurately.

CONTRACT TRADING: HOW TO MAXIMIZE YOUR EARNINGS

There are two main ways to profit from contracts

- Going Long: When you go long on a contract, you are essentially betting that the price of the underlying asset will go up. If your prediction is correct, you will profit when you close the contract.

- Going Short: When you go short on a contract, you are essentially betting that the price of the underlying asset will go down. If your prediction is correct, you will profit when you close the contract.

Or, multiply your investment by using leverage.

Leverage Explained with Examples

Leverage allows you to control a larger position in the market than what your initial capital would permit. It’s like borrowing money to increase your investment size, aiming for higher returns. However, leverage also increases the risk of higher losses.

Profit Scenario:

- Susan has $10.

- She wants to invest in a cryptocurrency.

- She uses 10x leverage, so her $10 controls a $100 position.

- The market moves up by 10%.

Calculations for Profit:

- Market increase: 10% of $100 = $10 profit.

- Susan’s initial $10 investment is now worth $20 ($10 initial + $10 profit).

Loss Scenario:

- Susan starts again with $10.

- She uses 10x leverage, so her $10 controls a $100 position.

- The market drops by 10%.

Calculations for Loss:

- Market decrease: 10% of $100 = $10 loss.

- Susan’s initial $10 investment is now worth $0 ($10 initial – $10 loss).

- Susan has $0 left from her leveraged investment.

CONTRACT TRADING: HOW TO GET STARTED

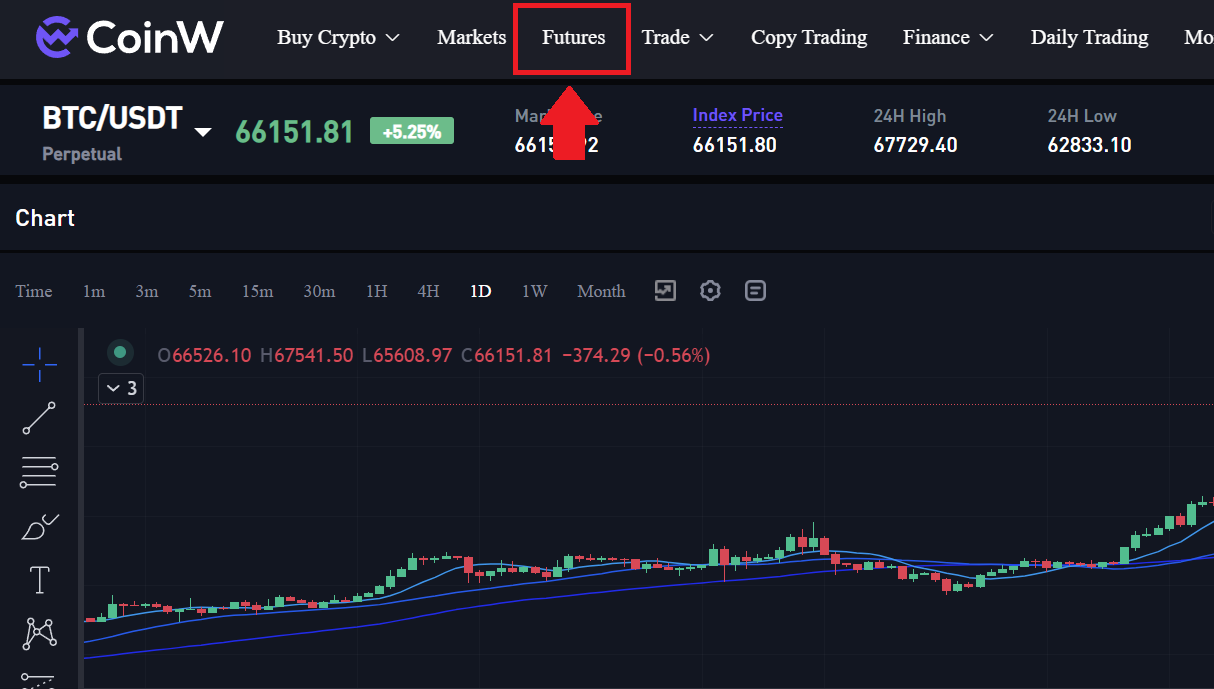

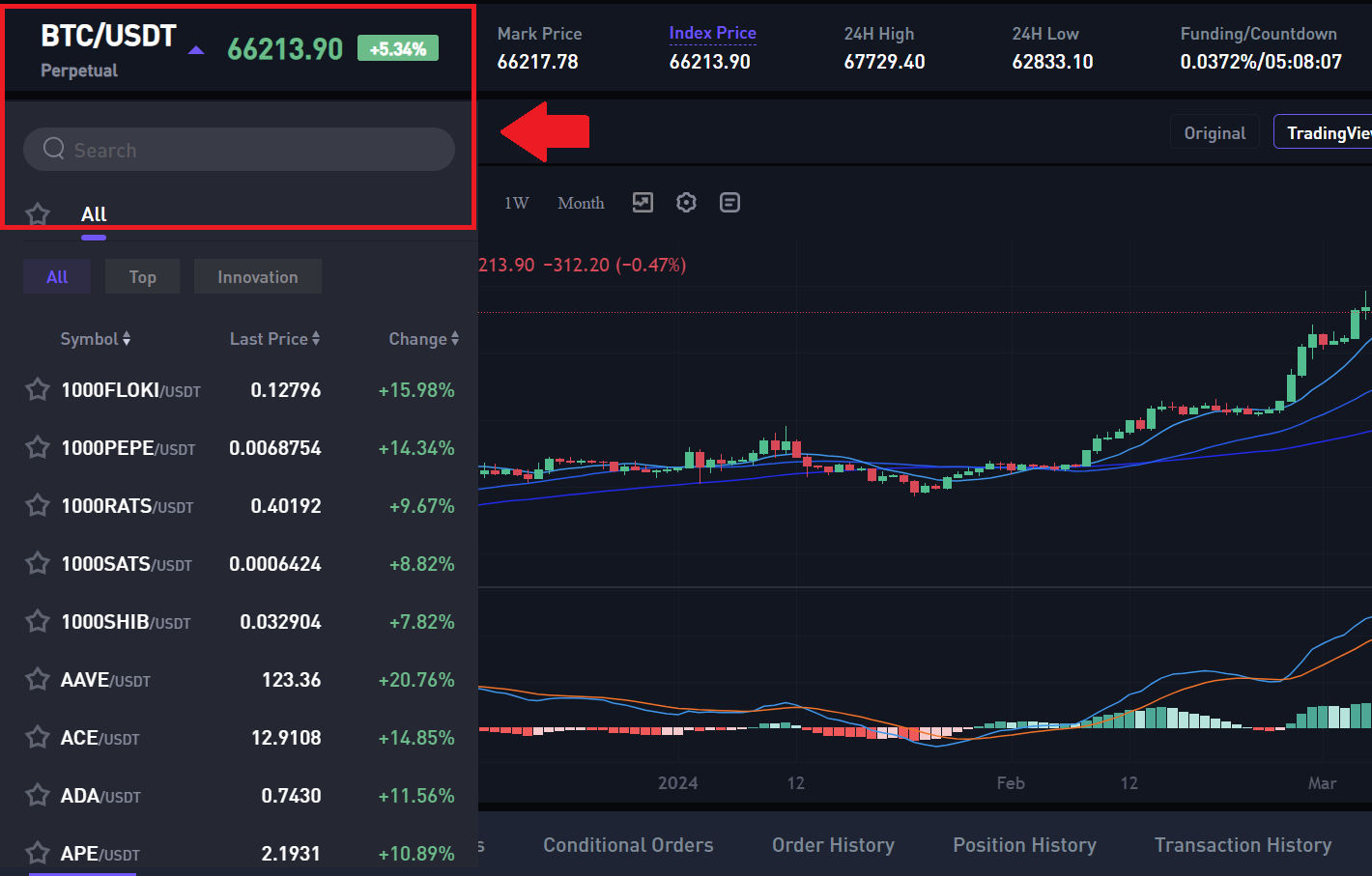

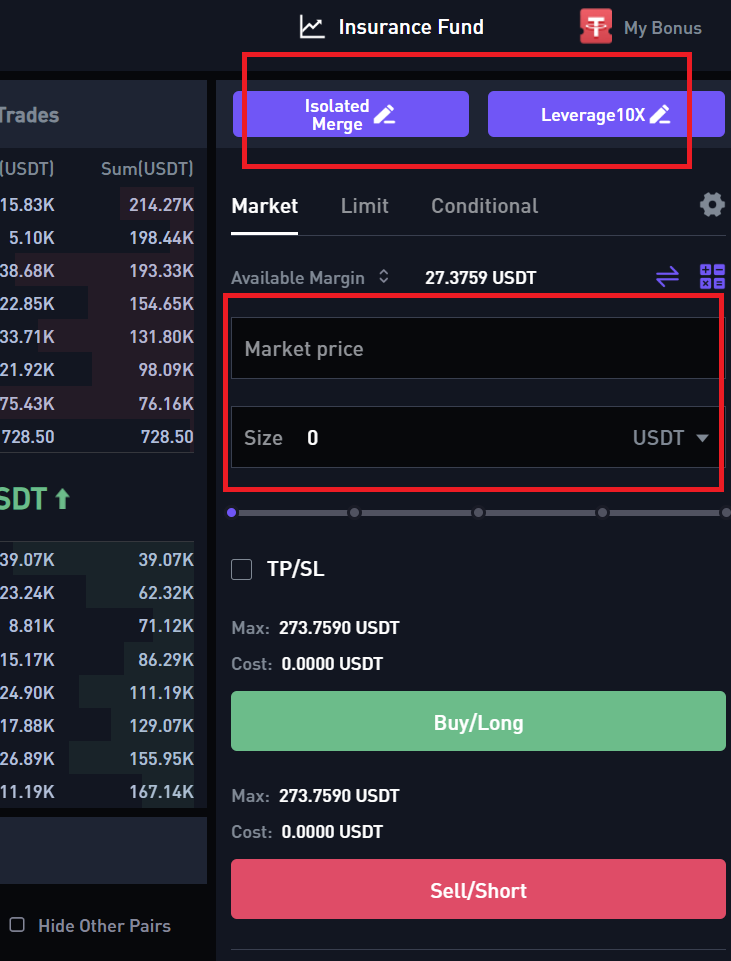

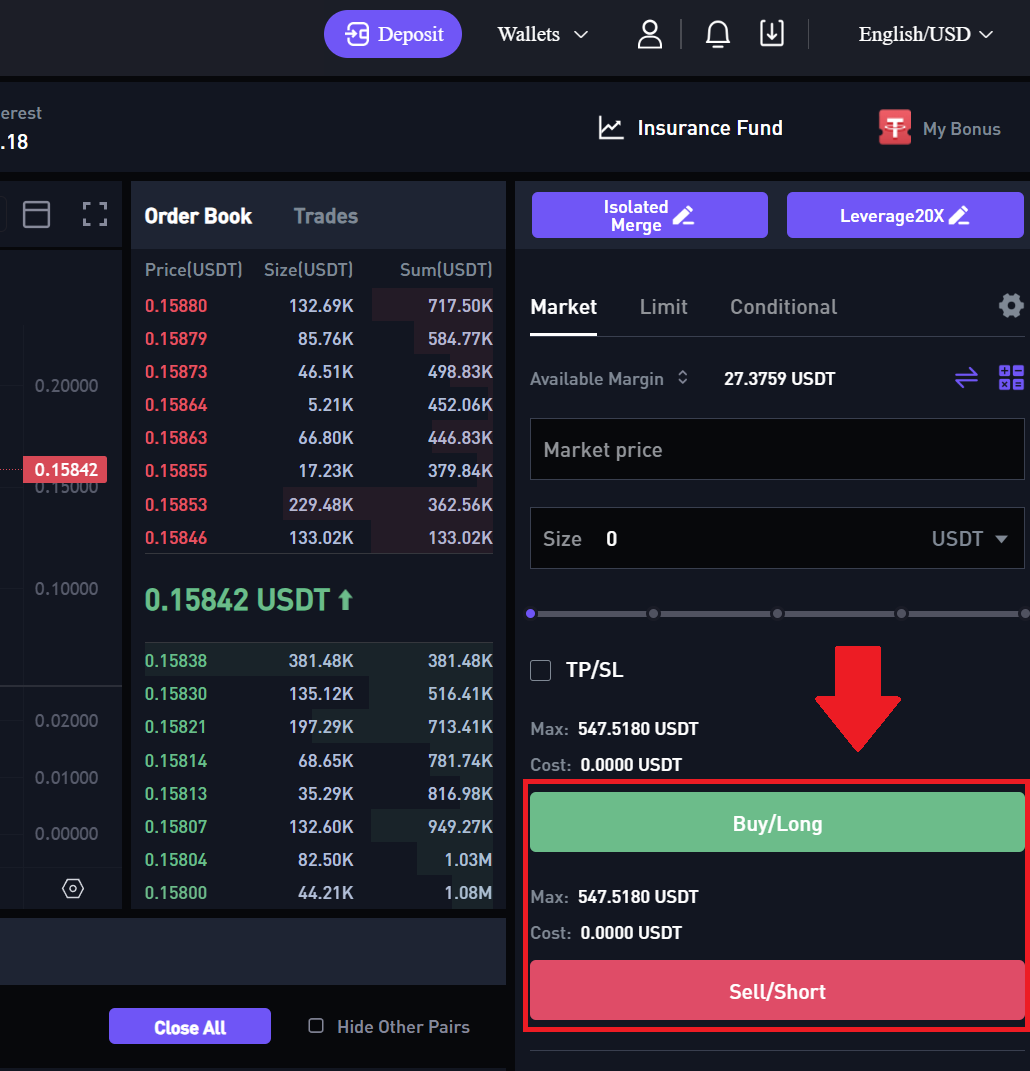

Let’s use the CoinW platform for this demonstration. To trade contracts, follow this step-by-step guide:

1. Create an account and deposit funds on your chosen trading platform.

2. Navigate to the “Trading” page and select “Contract Trading.”

3. Choose the underlying asset and contract type (perpetual / futures) you want to trade.

4. Select the contract size and the leverage you want to use (borrowed funds to amplify gains / losses).

5. Enter the price you want to enter at.

6. Execute the trade by clicking “Buy” or “Sell.”

CONTRACT TRADING TIPS: BOOSTING YOUR PROFITABILITY

- Develop a Trading Strategy: It’s crucial to establish a plan that clearly outlines when you’ll enter and exit trades and how you’ll handle risks.

Here are a few common trading strategies to consider:

- Trend Trading: Identify trends based on trend indicators (such as moving averages, trend lines) and trade in the direction of the trend.

- Reversal Trading: Look for reversal opportunities when the price reaches key resistance or support levels.

- Range Trading: Take advantage of price volatility by selling at highs and buying at lows.

- Risk Management: Spread your investments across various trading accounts to reduce risk, and use stop-loss and take-profit orders to manage your trades effectively:

- Stop-Loss Orders: Automatically close losing trades when the price reaches a certain level to limit losses.

- Take-Profit Orders: Automatically close profitable trades when the price reaches a certain level to lock in profits.

- Continuous Learning: Given the intricacies of contract trading, it’s essential to continually educate yourself to improve your trading abilities. This can include reading up-to-date books and articles on trading, or enrolling in courses designed to enhance your trading knowledge and skills.

CONTRACT TRADING RISKS: WHAT YOU NEED TO KNOW

The market’s notorious volatility means prices can dramatically rise or fall in no time, making it a double-edged sword for traders.

Additionally, liquidity—or the ease of executing trades without affecting prices—can vary, particularly with less popular cryptocurrencies.

The unregulated nature of crypto markets also exposes investors to scams and fraud, underlining the importance of diligence and choosing reputable platforms.

Therefore, choosing the right broker becomes crucial, as a reliable platform can provide security, fair trade execution, and transparency.

CONCLUSION

Contract trading is a strong strategy you can use to guess where cryptocurrency prices will go. But, it’s important to remember that it comes with big risks too. Before you start contract trading, make sure you really know what risks you’re facing and have a solid plan for your trades.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!