KEYTAKEAWAYS

- Bitcoin's fourth halving coincided with spot ETF approvals and Fed rate cuts, driving prices past $100K while highlighting institutional investment's growing influence.

- Despite Bitcoin's record performance, altcoins struggled to follow, suggesting a fundamental shift in market dynamics and institutional investment patterns.

- Global regulatory frameworks matured significantly, with MiCA implementation and ETF approvals marking crypto's transition toward mainstream financial integration.

- KEY TAKEAWAYS

- 2024 HIGHLIGHT 1: BITCOIN HALVING AND THE $100K MILESTONE

- 2024 HIGHLIGHT 2: THE ELUSIVE ALTCOIN SEASON

- 2024 HIGHLIGHT 3: FED RATE CUTS: MARKET IMPACT AND EXPECTATIONS

- 2024 HIGHLIGHT 4: SECTOR ROTATION: WINNERS AND LOSERS

- 2024 HIGHLIGHT 5: GLOBAL EVENTS RESHAPING CRYPTO

- 2024 HIGHLIGHT 6: REGULATORY LANDSCAPE ACROSS REGIONS

- CONCLUSION: CRYPTO’S WATERSHED YEAR

- DISCLAIMER

- WRITER’S INTRO

CONTENT

An in-depth analysis of crypto markets in 2024: Bitcoin’s fourth halving, the breakthrough to $100K, ETF approvals, altcoin struggles, and global regulatory shifts. Understanding the year that transformed digital assets.

As 2024 draws to a close and 2025 approaches, we look back at the past and forward to the future. Agen and CoinRank have specially prepared a series on cryptocurrency market review and outlook. This article is the first part of the series, focusing on “Looking Back at 2024.”

In 2024, Bitcoin completed its fourth halving, the Federal Reserve began its interest rate reduction cycle, and Bitcoin spot ETFs were finally approved by the SEC. These factors combined to bring investor enthusiasm and expectations for the fourth halving bull market to a peak.

However, the subsequent market trends left many investors perplexed: on one hand, Bitcoin continuously broke new highs, repeatedly breaking through the $100,000 mark in December. On the other hand, altcoins represented by ETH continued to underperform, following the downward trends but not the upward ones!

Of course, during this year’s market, some sectors such as BRC20 inscriptions, memecoins, AI, L1 blockchains, RWA (Real World Assets), and traditional mainstream coins showed outstanding performance, with coins in these concepts repeatedly experiencing explosive growth that attracted the entire market’s attention.

During this year, there were also numerous and complex global political and economic events. For instance, the Russia-Ukraine war and Middle East conflicts continuously impacted the cryptocurrency market, causing short-term dramatic rises and falls, making some people wealthy while leaving others penniless.

Throughout this year, countries worldwide also began actively or passively establishing cryptocurrency policies to respond to the increasingly surging crypto wave.

The crypto policies of regions including Europe, America, the Middle East, East Asia, and Southeast Asia have had increasingly significant short-term and long-term impacts on the cryptocurrency sphere.

All these factors contributed to the complex and unpredictable 2024.

Just as British author Charles Dickens wrote in “A Tale of Two Cities”: “It was the best of times, it was the worst of times; it was the age of wisdom, it was the age of foolishness; it was the epoch of belief, it was the epoch of incredulity; it was the season of Light, it was the season of Darkness; it was the spring of hope, it was the winter of despair.”

2024 HIGHLIGHT 1: BITCOIN HALVING AND THE $100K MILESTONE

On April 20, 2024, at 8:09 (UTC+8), Bitcoin successfully completed its fourth halving at block height 840,000, with the mining reward reduced from 6.25 BTC to 3.125 BTC per block.

Prior to this, in October 2023, Bitcoin had already emerged from its bottom and began a impressive seven-month streak of monthly gains.

Just before the halving, it broke through the previous bull market’s high, reaching over $73,000.

However, just as the entire market was celebrating the expected explosive start of the halving bull market, April’s halving month unexpectedly saw a sharp 20% drop.

Bitcoin Price Chart

(Source: Bitget)

The April decline not only ended the seven-month streak of monthly gains and broke the upward trend but also erased March’s gains, beginning a five-month period of oscillating decline that reached a low of around $49,000.

It wasn’t until September that Bitcoin regained its upward momentum, rising for three consecutive months, finally breaking through the $100,000 mark in December. However, the market then began to fluctuate around $100,000, breaking below and bouncing back to this level several times.

Looking back at Bitcoin’s upward logic, we can see this was a bull market driven by three major factors: the halving, the Federal Reserve’s start of an interest rate reduction cycle, and the approval of Bitcoin spot ETFs.

On January 10, 2024, the U.S. SEC approved 11 Bitcoin spot ETFs in one go, including those from ARK Investments, BlackRock, Fidelity, Invesco, Bitwise, Grayscale, and others.

The launch of Bitcoin spot ETFs undoubtedly changed the rules of the game for Bitcoin, allowing institutional and large investors to gain exposure to the world’s largest cryptocurrency without directly holding Bitcoin.

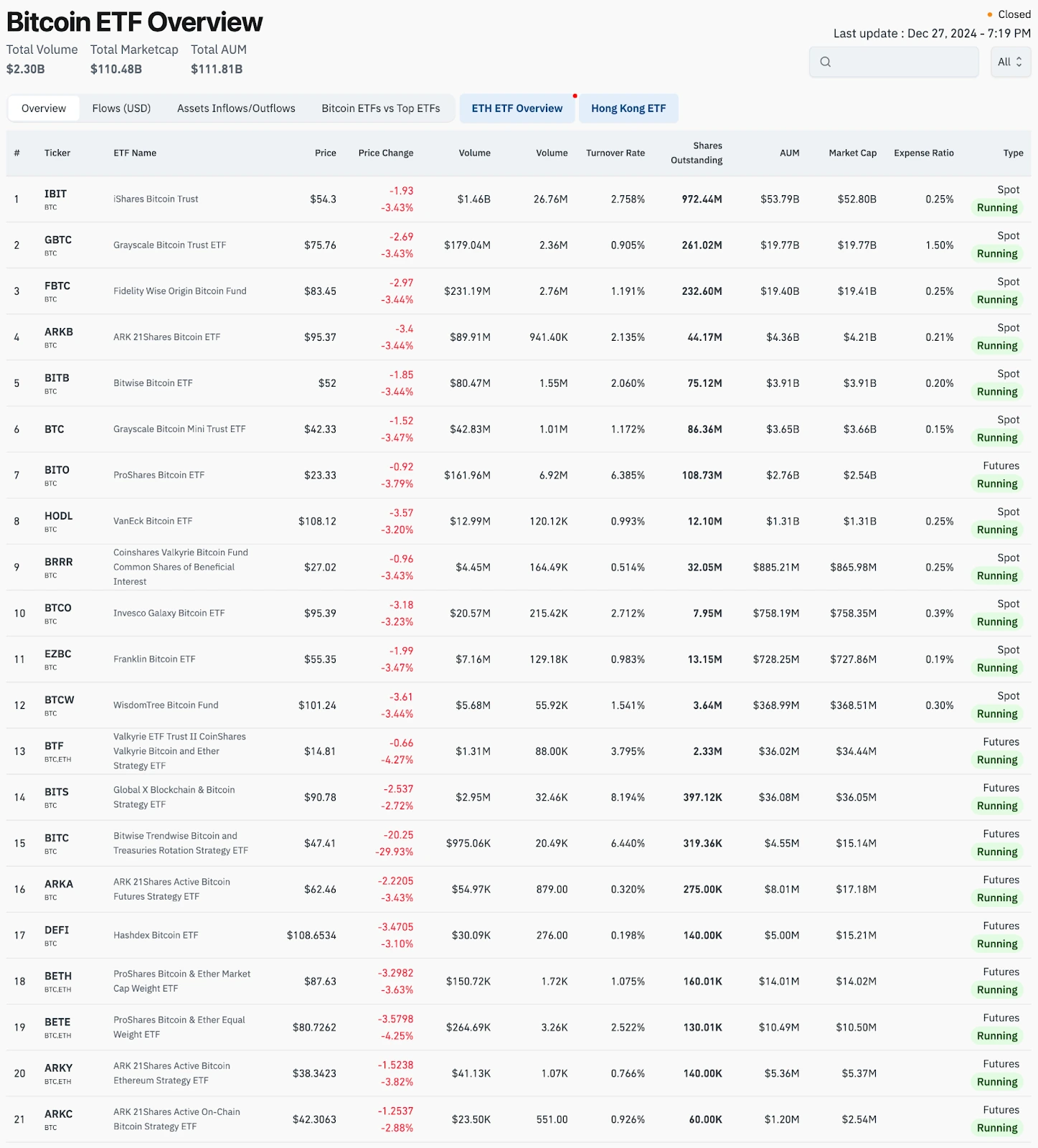

Currently, 12 Bitcoin spot ETFs and 9 futures ETFs have been approved and listed for trading, as shown in the following figure:

Overview of Bitcoin Spot and Futures ETFs

(Source: CoinGlass)

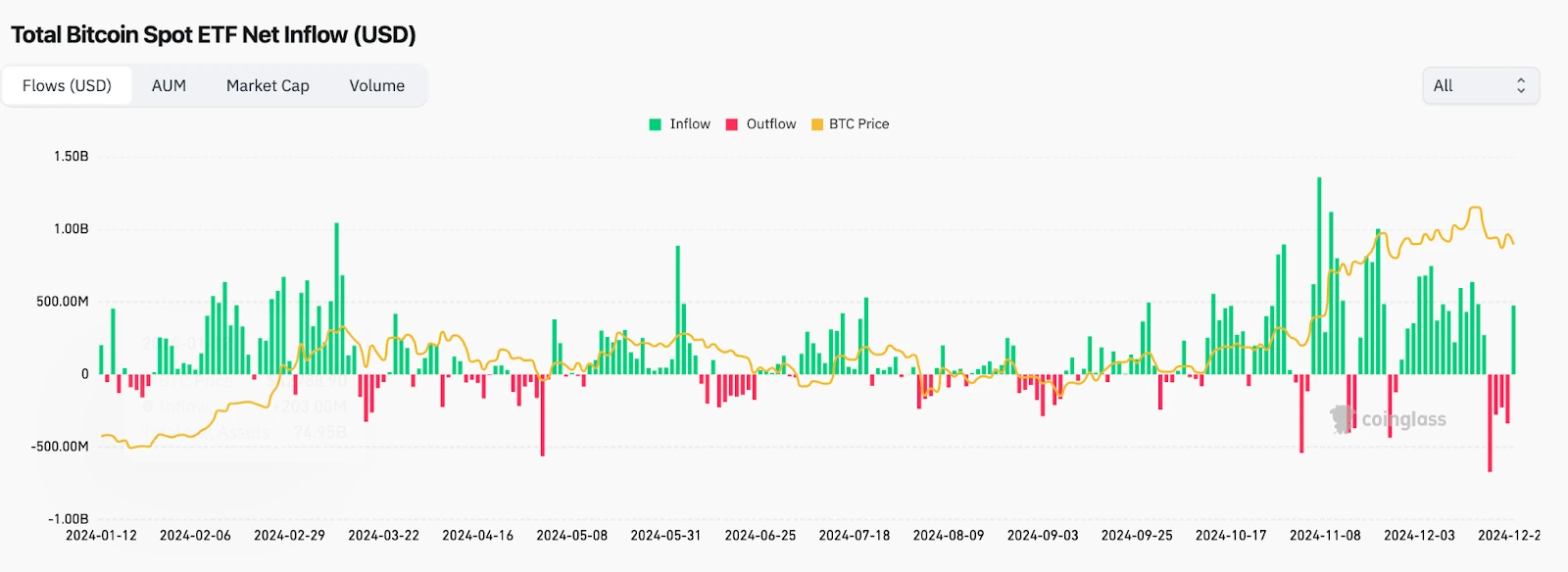

Currently, the total market value held by Bitcoin ETFs has reached $110.479 billion, and since their approval, the 12 spot ETFs have mostly seen net inflows.

The net inflow amount has continuously created new highs since late October, reaching a historic high of $1.359 billion on November 7, during which time Bitcoin also continued to reach new highs until breaking through $100,000 in early December.

Historical data shows that generally, the amount of net inflows is proportional to Bitcoin’s price increases, demonstrating the significant impact of Bitcoin spot ETF approval on Bitcoin’s price appreciation.

However, this has also led to another consequence: new funds flowing into the market are all targeting Bitcoin, and most of these funds have settled in Bitcoin.

This has resulted in Bitcoin standing alone for most of 2024, performing a solo show, while other altcoins, without the support of Bitcoin’s capital overflow effect, not only failed to reach new highs alongside Bitcoin but many coins haven’t even emerged from their bottom ranges.

This indicates that currently in the crypto sphere, only Bitcoin is truly a breakthrough asset that has broken down the cognitive barriers between the crypto world and the real world, gaining recognition both inside and outside the circle.

While this is beneficial for Bitcoin’s rise, it also exposes the fragility of the crypto sphere, with no second truly significant coin capable of attracting external funds, relying solely on Bitcoin as the pillar supporting the market’s progress.

Spot ETF Net Inflows and Outflows

(Source: CoinGlass)

Of course, Bitcoin’s ability to break through $100,000 in 2024 was not only due to the support of spot ETFs but also the Federal Reserve’s rate cuts and halving expectations.

The interest rate issue will be discussed later, but here we mainly focus on how the consensus around Bitcoin halving continues to strengthen, as this relates to market fluctuations.

This is Bitcoin’s fourth halving, and because of the support from the previous three halving bull markets, many people firmly believed in this round of halving market.

While this strengthened Bitcoin’s consensus and was beneficial for price increases, it also greatly increased the difficulty for major players to shake out weak hands.

As we mentioned in our previous article “Bitcoin Drops 10,000 Points Three Times in One Month: Sell or Buy the Dip?“, because the consensus around Bitcoin’s fourth halving was so strong and it was so difficult to shake out weak hands, major players had to use every means possible to do so.

For instance, in December’s shakeout, there were three 10,000-point drops in a short period, repeatedly tormenting the market to make retail investors give up resistance and surrender their positions.

This not only led many altcoins to halve in value but also caused nearly 100,000 investors to face liquidation.

In other words, as the consensus around Bitcoin’s multiple halvings grows stronger, the market’s brutality also increases, and the methods of shaking out weak hands become more diverse and torturous. It’s essential to have a clear understanding and psychological preparation for this basic situation.

2024 HIGHLIGHT 2: THE ELUSIVE ALTCOIN SEASON

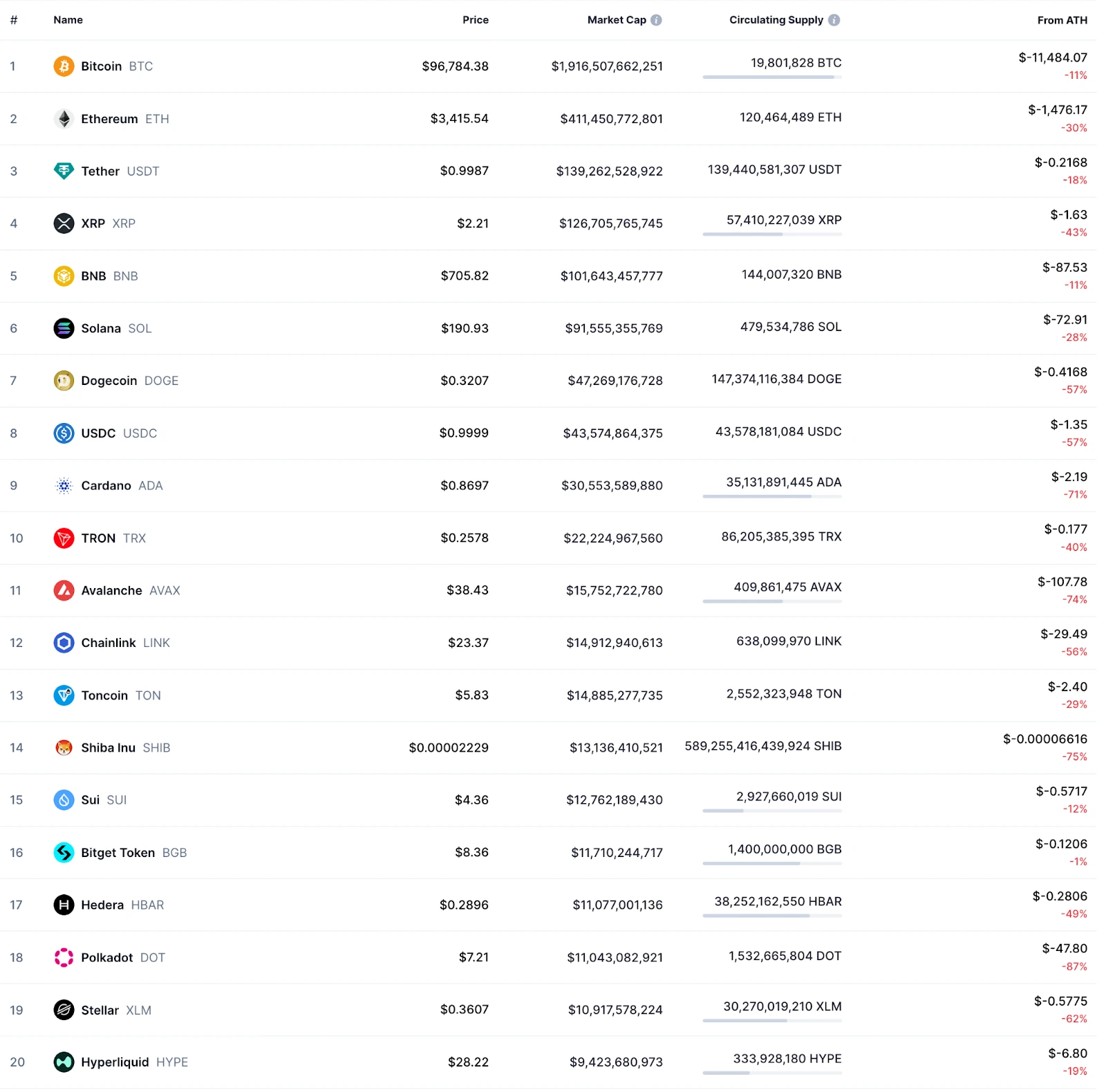

As mentioned above, while Bitcoin continuously broke new highs in 2024, altcoins performed poorly, following downward trends but not upward ones, leading some to declare that there would be no altcoin season, only a Bitcoin bull market.

The severity of this situation can be seen from how far major coins are from their all-time highs: ETH is -30% from its all-time high, BNB is -11%, DOGE is -57%, ADA is -71%, TRX is -40%, and AVAX is -74%.

Top 20 Coins’ Distance from All-Time Highs

(Source: CoinMarketCap)

Even coins that showed strong performance in 2024 are still far from their historical highs, such as: XRP at -43% from its all-time high, SOL at -28%, PEPE at -36%, and AAVE at -49%.

Traditional mainstream coins performed even worse, with BCH at -89% from its all-time high, LTC at -75%, XLM at -62%, and LINK at -56%; this is after experiencing an upward trend at the end of the year.

The popular coins from the previous bull market performed even more dismally, with ICP at -99% from its all-time high, FIL at -98%, DOT at -87%, and UNI at -69%.

It can be said that the poor performance of altcoins while Bitcoin continuously broke historical highs is unprecedented in the previous three halving bull markets.

The main reason is that there’s too little money in the market – funds from the Federal Reserve’s rate cuts, after flowing through banks, bond markets, stock markets, and real estate markets, finally reached the crypto sphere through ETFs, inflating Bitcoin first, and only then would overflow to irrigate other coins.

As mentioned in our previous article “Bitcoin’s Recent Record Surge and the Coming Altcoin Season: A Market Analysis,” institutional attention is currently focused mainly on Bitcoin, and altcoin narratives aren’t attractive enough to draw in old money.

Moreover, the current unfavorable and uncertain political and economic environment has led most investors to adopt conservative strategies, making Bitcoin investment the most stable choice.

Given this situation, does it mean there truly won’t be an altcoin season in this bull market? I think quite the opposite – now is precisely the time when Bitcoin’s bull market is transitioning toward an altcoin season.

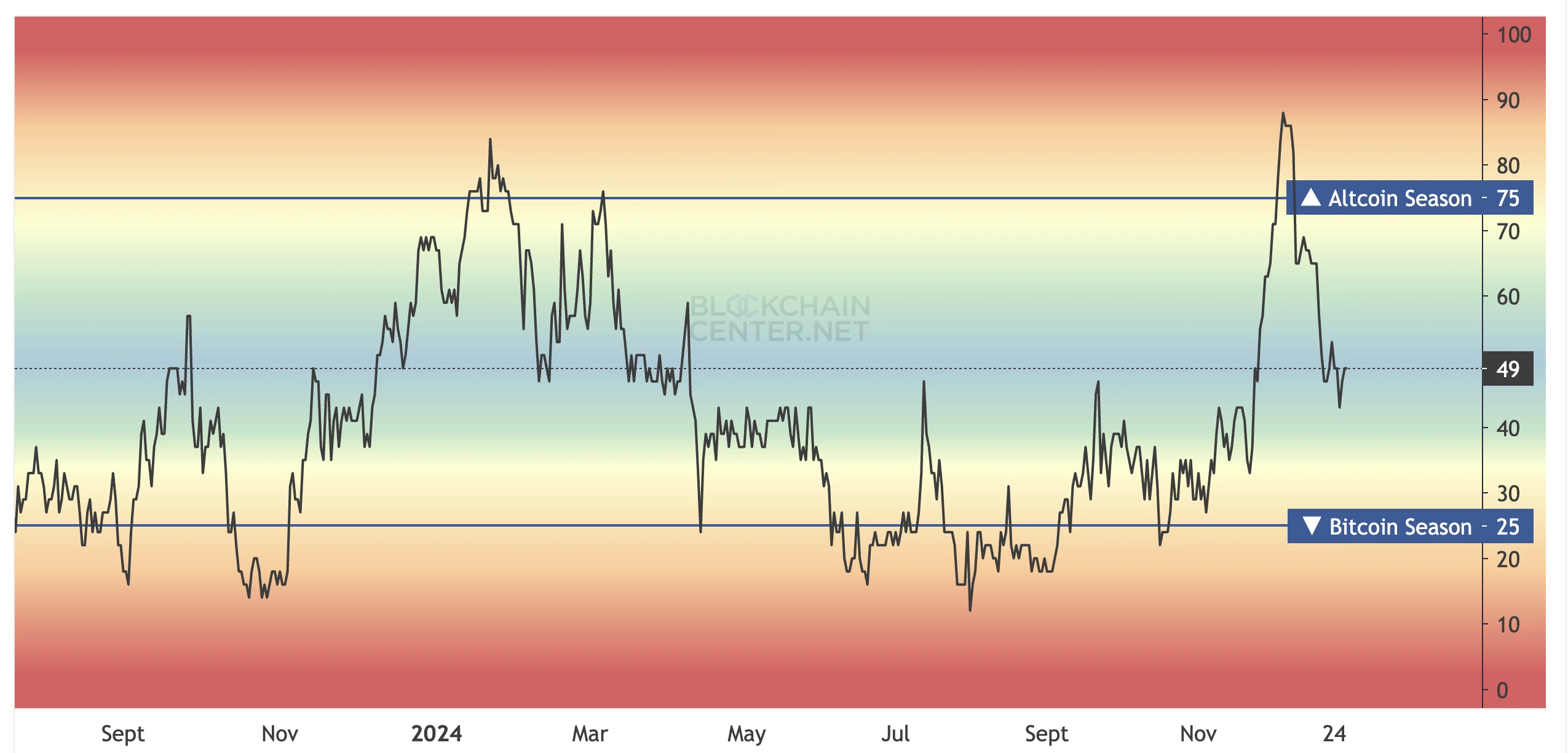

Both the bottoming out and rebound of visible data like the altcoin season index and the market’s grinding coupled with sentiment changes are pointing toward the arrival of altcoin season.

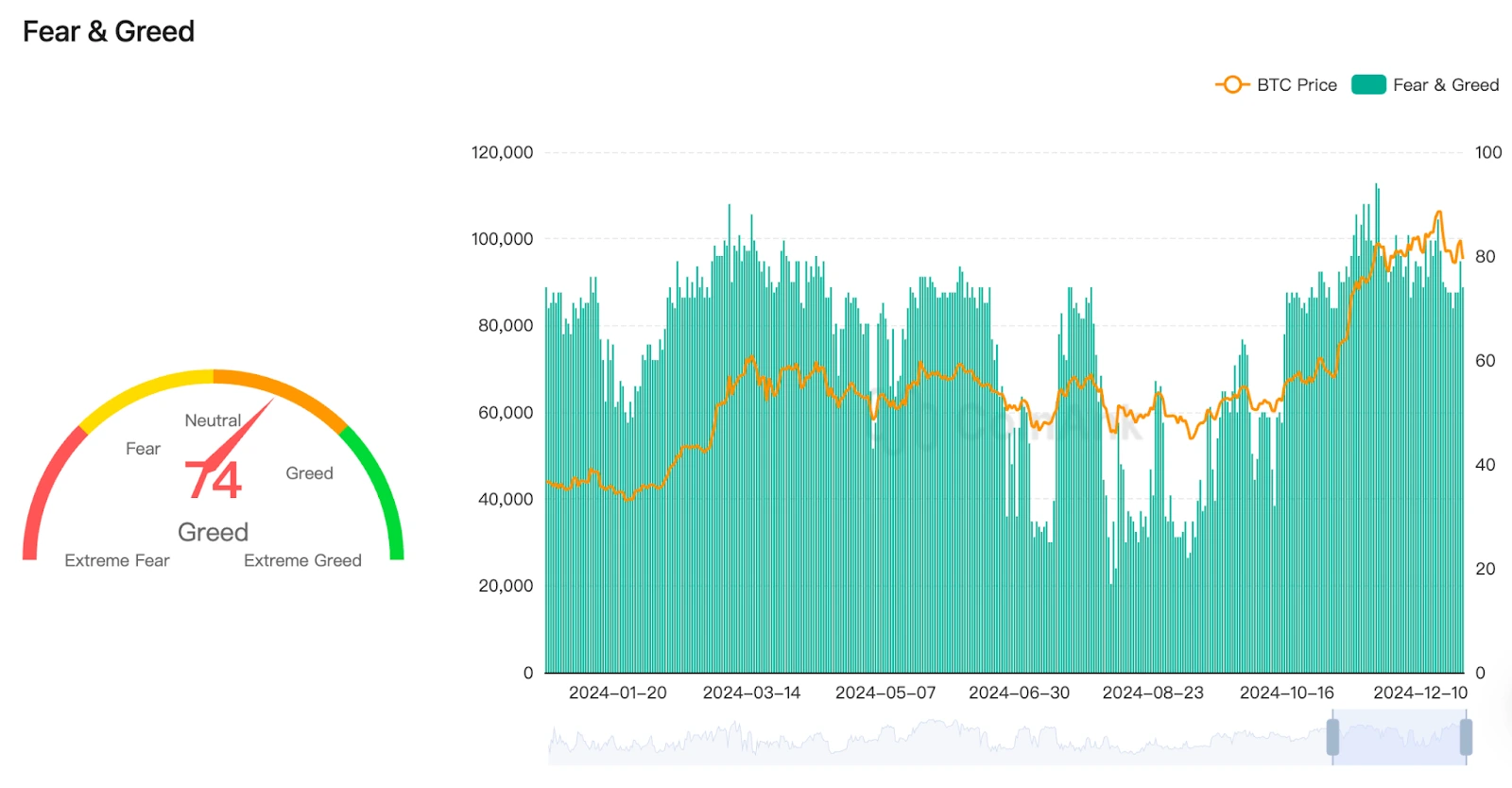

Since October, the Fear & Greed Index has consistently remained above 50, and even after experiencing three 10,000-point drops in December, this value still leans toward greed.

Fear & Greed Index Changes

(Source: CoinAnk)

This means market sentiment continues to be elevated, which is one of the basic conditions for the arrival of the altcoin season. Only when the market experiences FOMO can altcoins take over and continuously reach new highs.

Looking at historical trends, we’re now exactly eight months after the halving, which is typically when altcoin seasons explode. Moreover, the Federal Reserve’s rate cut cycle continues, and all these factors point toward the arrival of the altcoin season.

Altcoin Season Index

(Source: BLOCKCHAINCENTER)

Looking at ETH as the bellwether for altcoin season, in December, ETH already broke through March’s mini-bull market high, although it was later pulled down again by Bitcoin.

However, this also indicates that the progress of altcoin season has reached a crucial point.

From current market conditions, ETH might exceed its all-time high before March 2025, at which time other altcoins might also begin rising consecutively and successively surpass their historical highs.

2024 HIGHLIGHT 3: FED RATE CUTS: MARKET IMPACT AND EXPECTATIONS

Bitcoin’s ability to break through $100,000 in 2024 owes much to the Federal Reserve’s rate cuts, which is also one of the most important bases for market bull market judgments.

However, since the Federal Reserve’s 50 basis point rate cut in September until now, there have been three rate cuts totaling 100 basis points, yet market performance has fallen short of expectations, especially altcoins performing nothing like a bull market.

Why is this?

The first reason is the diminishing marginal effect of rate cuts – that is, the market tends to react strongly in the initial stages of rate cuts, but as the number of cuts increases, market sensitivity to policy gradually decreases.

Federal Reserve Interest Rate Changes in the Last 10 Years

(Source: Trading Economics)

All investment markets trade on expectations, with sentiment being most enthusiastic and anticipatory before good news materializes. After multiple implementations, if there isn’t greater stimulus, then sensitivity isn’t as high.

The second reason is the current high level of macroeconomic uncertainty. This is also why when the Federal Reserve cut rates by 25 basis points in the early hours of December 19, the market actually fell sharply.

This was mainly because U.S. economic data was mixed, leading to cautious market sentiment. Consequently, Federal Reserve Chairman Powell took a “hawkish” tone in his subsequent speech, suggesting a slowdown in the rate cut pace.

The third reason is the uncertainty in global crypto policies.

For example, although Europe implemented the MiCA regulations, which officially took effect on June 30 this year, the transition period won’t end until June 30, 2026, and the implementation details are still being adjusted, not yet fully releasing policy benefits.

Meanwhile, ongoing disputes over U.S. crypto industry tax policies have dampened investor enthusiasm. Under these circumstances, large funds will be more cautious in their investment approach, making it difficult for altcoins to gain much recognition.

It can be said that Federal Reserve rate cuts are not the only determining factor for a bull market.

While Fed rate cuts certainly created conditions for the market, crypto sphere performance is still influenced by multiple factors including technological progress, policy support, and capital flows.

Currently, we need to view market rotation in stages – waiting for Bitcoin to complete its rise before altcoins can follow.

Overall, while Federal Reserve rate cuts indeed played a crucial role in Bitcoin breaking through $100,000 in 2024, the market performance falling short of expectations reflects macroeconomic uncertainties, policy environment complexities, and the market’s internal adjustment needs.

2024 HIGHLIGHT 4: SECTOR ROTATION: WINNERS AND LOSERS

2024 showed clear sector divergence in the crypto sphere, with most concept sectors remaining lukewarm, but some strong concepts such as BRC20 inscriptions, memecoins, AI, L1 blockchains, and traditional mainstream coins taking turns in the spotlight.

Inscriptions and BRC-20 became entirely new breakthrough points in the Bitcoin ecosystem. At the beginning of this bull market, they attracted the attention of the vast majority of investors, with projects like ORDI, SATS, RATS, and others experiencing 10x or even 30x explosive growth.

These projects leveraged Bitcoin network’s security and decentralization characteristics, along with Bitcoin ecosystem hype, attracting large numbers of developers and capital inflow.

Although the Ordinals protocol further activated Bitcoin’s expansion potential, and the BRC20 standard’s simplicity and ease of use lowered development barriers, Bitcoin network’s inherently high transaction fees and network congestion problems remain unsolved.

This is also why many investors don’t favor this sector, with significant ongoing controversy about the pros and cons of the Bitcoin ecosystem.

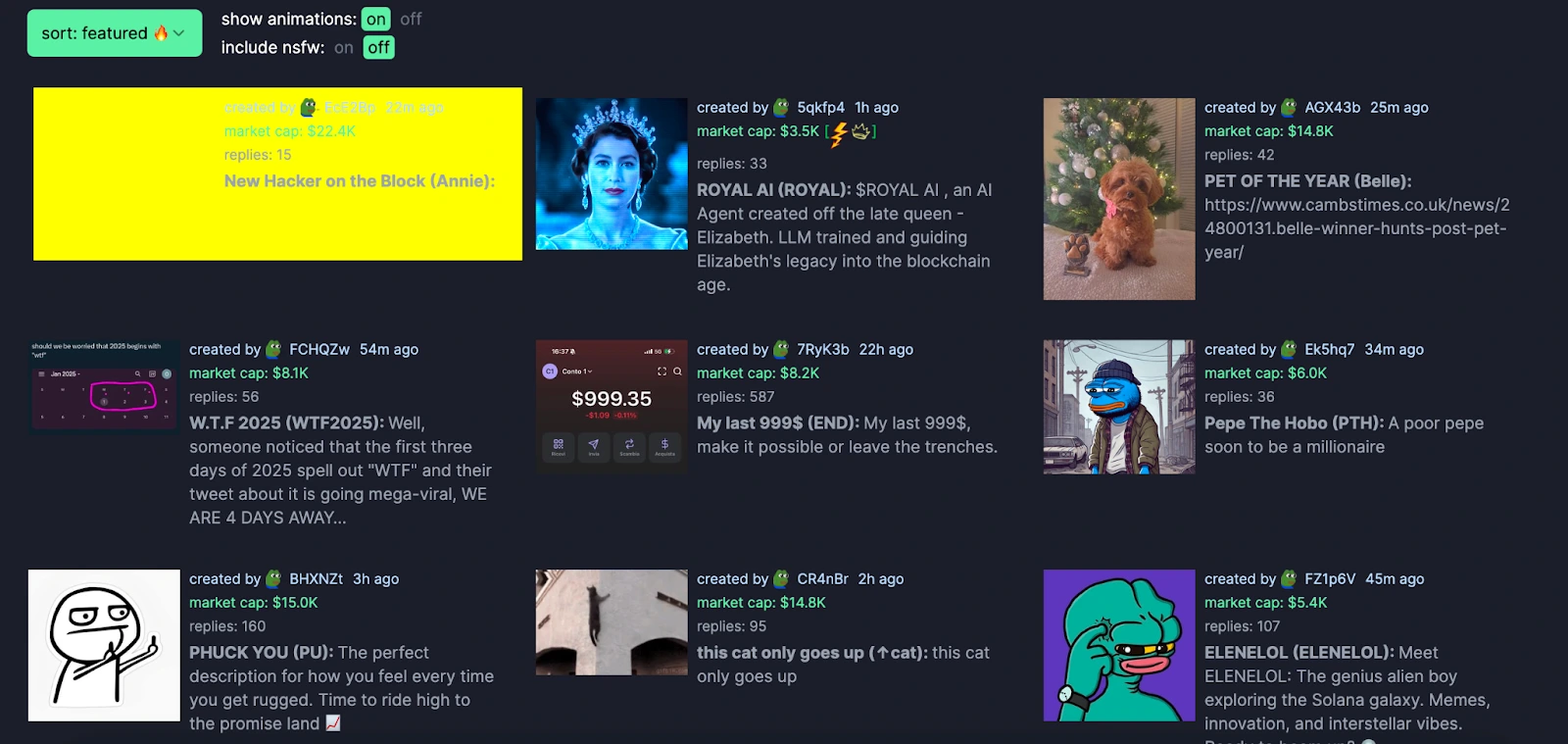

The meme sector saw both frenzy and bubble coexistence.

MEME and Related Coins on Pump.fun Platform

The meme concept, sparked by Musk’s DOGE endorsement, performed particularly prominently in this market cycle, even becoming the hottest concept by position for a period. PEPE, PENGU, SHIB, BONK, FLOKI, PNUT, and many other memecoins emerged out of nowhere.

However, compared to the 2021 enthusiasm, this year’s meme sector was more rational, with many investors gradually realizing its short-term speculative nature, and most projects experiencing significant price drops after the enthusiasm faded.

AI and blockchain represented the fusion of technology and value. The sector combining AI with blockchain continued to heat up, becoming one of the most promising sectors in this halving market cycle.

AI-driven decentralized protocols and smart contract applications became market focus points; coins like FET, AGIX, WLD, and AI all showed decent gains at different periods.

AI tools were used to optimize trading strategies, predict market trends, and improve NFT generation and application efficiency. The AI sector attracted substantial venture capital funding during this market cycle, showing strong growth potential.

RWA (Real World Assets) represented the tokenization of real-world assets. This was a concept that heated up right at the beginning of this market cycle and was considered an important breakthrough in the DeFi field.

For example, tokenizing real assets like real estate and bonds through blockchain not only expanded DeFi application scenarios but also provided an entry point for traditional financial institutions to participate in the crypto sphere.

However, this sector’s development still faces regulatory and legal challenges. Currently, related concept coins like ONDO, SNX, USUAL, and RSR have shown decent performance, but they’re still far from true breakthrough and implementation.

The public chain sector saw old and new alternating with fierce competition. ETH remained the leader, but new public chains like SOL, APT, SUI, and TIA achieved rapid rise through performance advantages and innovative ecosystems.

Other established public chains like ADA, TRX, AVAX, DOT, MATIC, and NEAR also showed decent performance. It can be said that each bull market sees public chain projects rise, and with extremely high upper limits, basically rising to become one of the top 10 by market cap.

Traditional mainstream coins showed old trees blooming new flowers. In the fourth quarter of 2024, BCH, LTC, XRP, XLM, LINK, and other traditional mainstream coins successively exploded, overturning the concept of “trade new, not old.”

This was mainly because institutional “old money” entering the market valued risk control more than return rates, so after these institutional funds pushed up Bitcoin, some overflow went to mainstream coins that had already withstood market tests, reminding us of the limitations of historical experience.

The sector divergence in 2024 reflected structural changes in market capital flows and shifts in investor preferences.

The performance of strong sectors like BRC20 inscriptions, MEME, AI, and public chains indicates that projects with strong narratives, practical applications, and technical support can still attract capital and attention.

We should closely monitor changes in market narratives and continuously update our understanding.

2024 HIGHLIGHT 5: GLOBAL EVENTS RESHAPING CRYPTO

In 2024, cryptocurrency market performance was driven not only by internal industry factors but also increasingly by external financial events.

From U.S. economic data to central bank monetary policies to geopolitical situations, these external factors had profound impacts on crypto prices, capital flows, and investor sentiment.

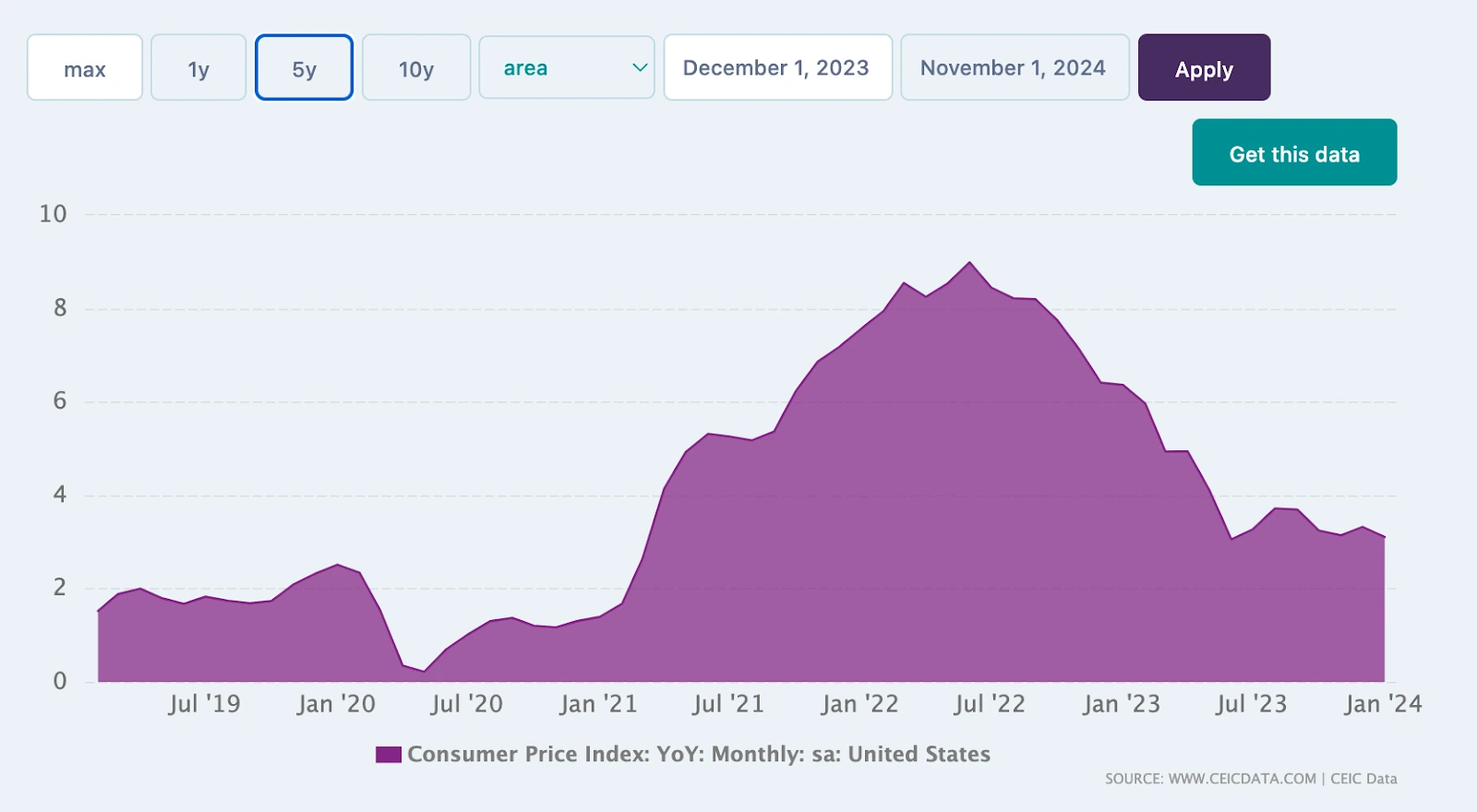

U.S. economic data, mainly including PCE, Non-Farm Payroll data, and CPI, are published on fixed dates each month.

U.S. CPI Data Changes in the Last 5 Years

(Source: CEIC Data)

For example, Non-Farm Payroll data is released on the first Friday of each month, while CPI is released between the 10th and 15th of each month.

Because Federal Reserve monetary policy relies on these data, the market adjusts liquidity and risk preference expectations based on the data, and each data release time can potentially cause major market rises or falls.

Related information can be obtained from the U.S. Bureau of Labor Statistics (BLS) and U.S. Bureau of Economic Analysis (BEA) websites to assist in making investment decisions.

Federal Reserve and other central banks’ monetary policies were decisive influencing factors for this halving market cycle.

For example, the Federal Reserve’s three rate cuts in 2024 (totaling 100 basis points) and improved liquidity directly led to Bitcoin breaking through the $100,000 new high.

2024 was overall about waiting for rate cuts to materialize and the subsequent arrival of liquidity, all of which pushed the crypto bull market to new heights.

Other major events such as the Russia-Ukraine situation, Middle East conflicts, financial crises, and banking industry turbulence all caused short-term or long-term impacts on the crypto sphere.

These major events led to increased market volatility, requiring short-term investors to pay more attention to risk control and market sentiment analysis; long-term investors could focus on how the macro environment supports core assets like Bitcoin and capture trend opportunities.

In 2024, the impact of external financial events on the crypto sphere deepened further, indicating increasingly tight connections between crypto assets and the global economic system.

Factors such as Federal Reserve rate cuts, geopolitical conflicts, and financial crises drove the performance of core assets like Bitcoin but also intensified market volatility.

Looking ahead, investors need to pay more attention to macroeconomic indicators, policy changes, and regional market opportunities, combining external financial events with crypto industry trends to better handle market uncertainties and capture potential growth opportunities.

2024 HIGHLIGHT 6: REGULATORY LANDSCAPE ACROSS REGIONS

In 2024, cryptocurrency regulatory and policy attitudes in regions including Europe, America, the Middle East, East Asia, and Southeast Asia played important roles in the crypto sphere.

These regions’ policies not only directly affected capital flows, market sentiment, and project development but also shaped the industry’s long-term landscape.

The United States mainly saw Federal Reserve monetary policy easing, coupled with Bitcoin spot ETF approval, significantly benefiting the crypto asset market.

Additionally, tax regulation intensity increased, especially targeting capital gains tax and cross-border transactions for crypto assets. Stablecoin regulatory frameworks gradually took shape, but altcoins faced significant restrictions.

Europe fully implemented the MiCA (Markets in Crypto-Assets) regulation in 2024, providing a clear compliance framework for crypto asset trading and services in the EU region, focusing on user protection and anti-money laundering (AML) measures while maintaining an open attitude toward innovative projects.

After MiCA implementation, some non-compliant platforms and assets were cleared out, with market trading volume declining in the short term.

However, the crypto sphere’s compliance and stability increased, helping attract more traditional financial institutions and long-term investors to the European market.

The Middle East region, with the UAE continuing crypto-friendly policies, saw Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) become regional crypto asset hubs. The Middle East may become an important global crypto industry innovation center, demonstrating effects for technical research and development and compliance frameworks.

In East Asia, Japan maintained an open attitude toward crypto assets, continuing to support institutional development. They introduced clear tax incentive policies, encouraging enterprise and investor participation in the crypto sphere, attracting substantial trading volume back, with Japanese exchanges showing active performance.

The Korean government strengthened crypto sphere regulation through tax and compliance requirements while supporting blockchain technology R&D. This enhanced market transparency but reduced high-risk asset speculation in the short term. In the long run, Korea might promote more innovative crypto projects through combining blockchain with artificial intelligence technology.

China still prohibits most crypto asset trading but has increased support for blockchain technology and central bank digital currency (CBDC). Crypto sphere activities shifted to Hong Kong, Singapore, and other locations. However, China might indirectly influence global crypto sphere structure through CBDC global promotion.

In Southeast Asia, Singapore continued crypto-friendly policies, emphasizing investor protection and compliance, becoming an operational center for many crypto asset funds and projects. Singapore might subsequently consolidate its position as Asia’s crypto asset center and drive regional innovation.

Emerging markets like Thailand, Indonesia, and Malaysia showed more relaxed attitudes toward crypto assets, focusing on developing blockchain technology applications in financial inclusion and payment areas. This might make Southeast Asia an important market for DeFi and GameFi projects.

In summary, different regions’ crypto policies will make them play different roles in the crypto market.

For example, stricter regulation and tax policies in Europe and America limited short-term speculation but attracted more institutional capital; friendly policies in the Middle East and Southeast Asia attracted project migration and capital inflow; Japan and Korea strengthened regional market stability and attractiveness through policy incentives and technical support.

In the long term, different countries’ crypto policies will intensify regional competition, such as the Middle East and Southeast Asia competing for innovation center status.

But they also make the industry more standardized, with European, American, and East Asian compliance policies setting standards for the global market, promoting the entire industry’s development toward mainstream and institutional directions.

Meanwhile, some policy-friendly regions will attract more technical innovation and project incubation, thereby having profound impacts on the global crypto industry.

CONCLUSION: CRYPTO’S WATERSHED YEAR

2024 was a magnificent year for the crypto sphere, whether in Bitcoin’s continuous new highs, the rise of hot sectors, or the impact of macroeconomic and geopolitical factors, the crypto sphere demonstrated strong adaptability and innovation capability.

Looking ahead, as regulatory frameworks gradually improve and technology continues to iterate, the crypto sphere will continue to attract more capital and participants, embarking on an increasingly diverse development journey.

▶ Buy Crypto at Bitget