KEYTAKEAWAYS

- Bitcoin's fourth halving cycle peaks in late 2025, with potential $200K target supported by ETF approval, Fed rate cuts, and institutional adoption.

- Altcoin season expected mid-2025, with Layer 2, GameFi 2.0, and AI integration leading new trends in market development.

- Federal Reserve's rate-cutting cycle and regulatory compliance will significantly shape market dynamics, while monitoring potential black swan events.

- KEY TAKEAWAYS

- 2025 OUTLOOK 1: WILL BITCOIN BREAK $200,000? WHEN WILL THE BULL MARKET END?

- 2025 OUTLOOK 2: WHEN WILL THE ALTCOIN SEASON BEGIN AND PEAK?

- 2025 OUTLOOK 3: FEDERAL RESERVE RATE CUTS

- 2025 OUTLOOK 4: PROMISING CONCEPTS AND PROJECTS

- 2025 OUTLOOK 5: POTENTIAL BLACK SWAN EVENTS

- 2025 OUTLOOK 6: COMPLIANCE IMPACT ASSESSMENT

- KEY TAKEAWAYS AND MARKET OUTLOOK

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Comprehensive analysis of Bitcoin’s 2025 outlook: Exploring the potential $200K price target, fourth halving cycle impacts, altcoin season timing, Fed rate cuts, emerging crypto trends, and market risks to watch

2025 has arrived, and a new 365-day countdown begins! In our previous article “2024 Crypto Market Review (Part 1): Bitcoin’s Journey to $100K“, we reviewed the crypto market’s performance in 2024. So what can we expect from the crypto market in 2025?

Historical Halving Cycles Analysis

Looking at history, the second year after each halving has marked both the beginning and end of a crazy bull market. For example:

The first halving occurred on November 28, 2012. In the following year, 2013, Bitcoin rose from approximately $12 to $1,150, a nearly 95-fold increase. The bull market peaked in November 2013, after which prices began to decline, ending the first halving bull market.

The second halving took place on July 9, 2016. In the following year, 2017, Bitcoin climbed from about $400 to $19,800, a nearly 50-fold increase. The bull market peaked in December 2017, followed by a decline, concluding the second halving bull market.

The third halving happened on May 11, 2020. In the following year, 2021, Bitcoin surged from approximately $8,000 to $69,000, a nearly 9-fold increase. The bull market peaked in November 2021, then began declining, ending the third halving bull market.

2025 OUTLOOK 1: WILL BITCOIN BREAK $200,000? WHEN WILL THE BULL MARKET END?

In 2025, investors’ primary concern is identifying Bitcoin’s peak in this halving cycle and determining when the bull market will end. As mentioned above, Bitcoin has historically entered a crazy bull market in the second year after each halving, reaching its peak before the cycle ends and a new one begins.

Bitcoin’s fourth halving will occur on April 20, 2024, making 2025 the crucial second year! Historical patterns suggest that 2025 will mark both the peak and the end of the fourth halving bull market.

Key Data Analysis Reveals

- Price surge timing: Major price increases typically begin 7-8 months after halving, when Bitcoin starts rapid growth and gradually triggers a crypto market explosion, as seen in 2013, 2017, and 2021.

- Peak timing: Bitcoin’s price peaks typically occur 12-18 months after halving. For example, the 2021 bull market peak came about 18 months after the 2020 halving.

- Post-peak pattern: The end of a bull market is usually followed by significant corrections and a bear market lasting 18-24 months.

If historical patterns hold, Bitcoin’s price should reach its all-time high around November-December 2025, marking the end of this halving cycle’s bull market.

Where will Bitcoin’s peak be? As mentioned in our previous article “Federal Reserve May Accelerate Rate Cuts: When Will Bitcoin Reach $100,000?”, it could reach $190,000-$200,000, which might be the top for this fourth bull market.

Let’s examine the reasons behind this prediction

1. From a macroeconomic perspective:

- The Federal Reserve will still be in its rate-cutting cycle throughout 2025

- Market liquidity will be more abundant

- Bitcoin’s attractiveness as both an inflation hedge and risk asset will further increase

- The approval of spot Bitcoin ETFs will attract more institutional investors

- Geopolitical tensions (Russia-Ukraine war, Middle East conflicts) may highlight Bitcoin’s role as “digital gold” and safe-haven asset

- The demand-side momentum for Bitcoin will be stronger

2. Looking at on-chain data and market sentiment:

- The market is currently in a “middle” state – neither too “hot” nor too “cold”

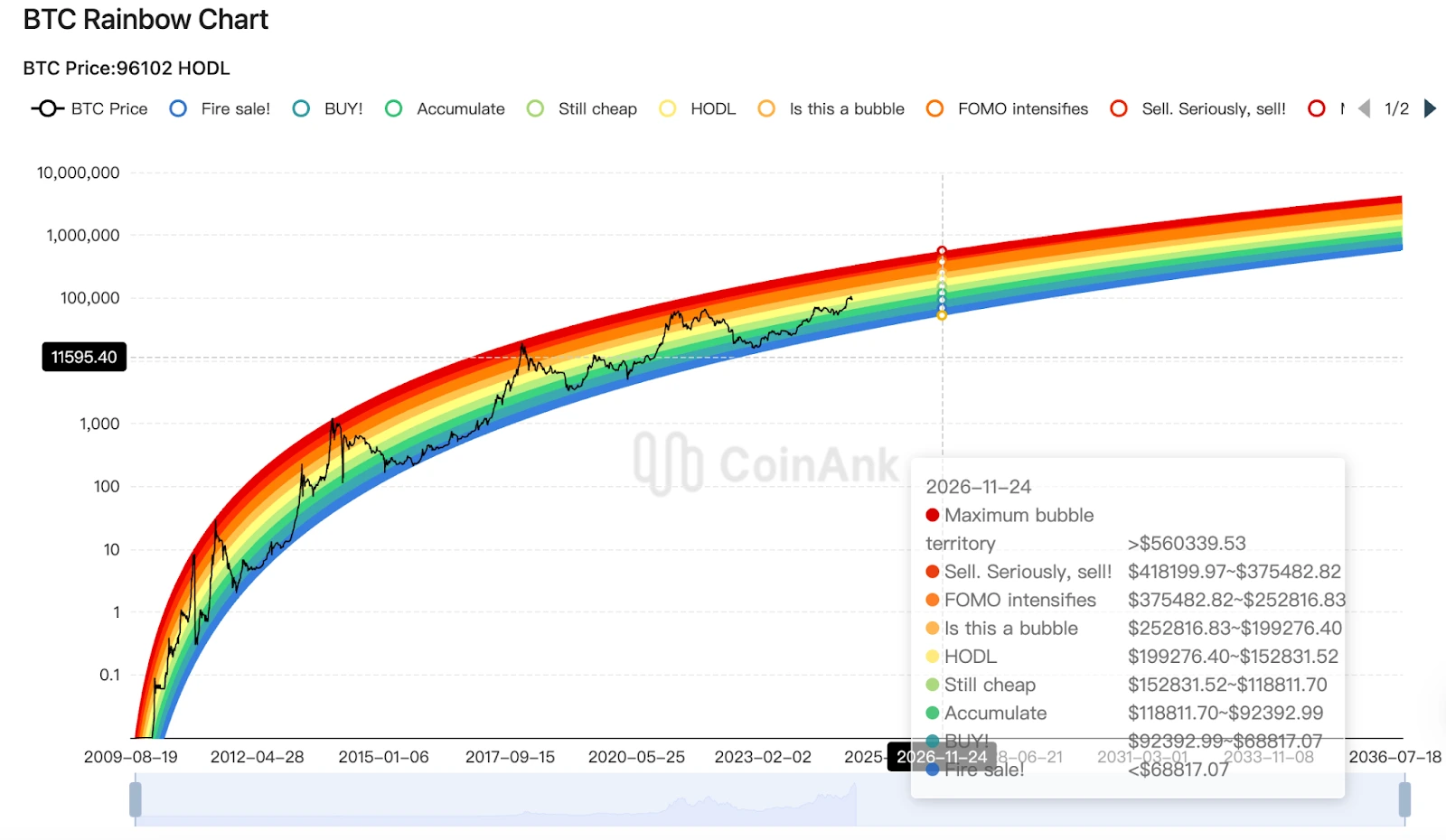

- Bitcoin Rainbow Chart shows we’re in the “HODL” phase, with four more phases above (including “bubble” and “maximum bubble”)

- This indicates most Bitcoin holders are still in a hold-and-wait position

(Source: CoinAnk)

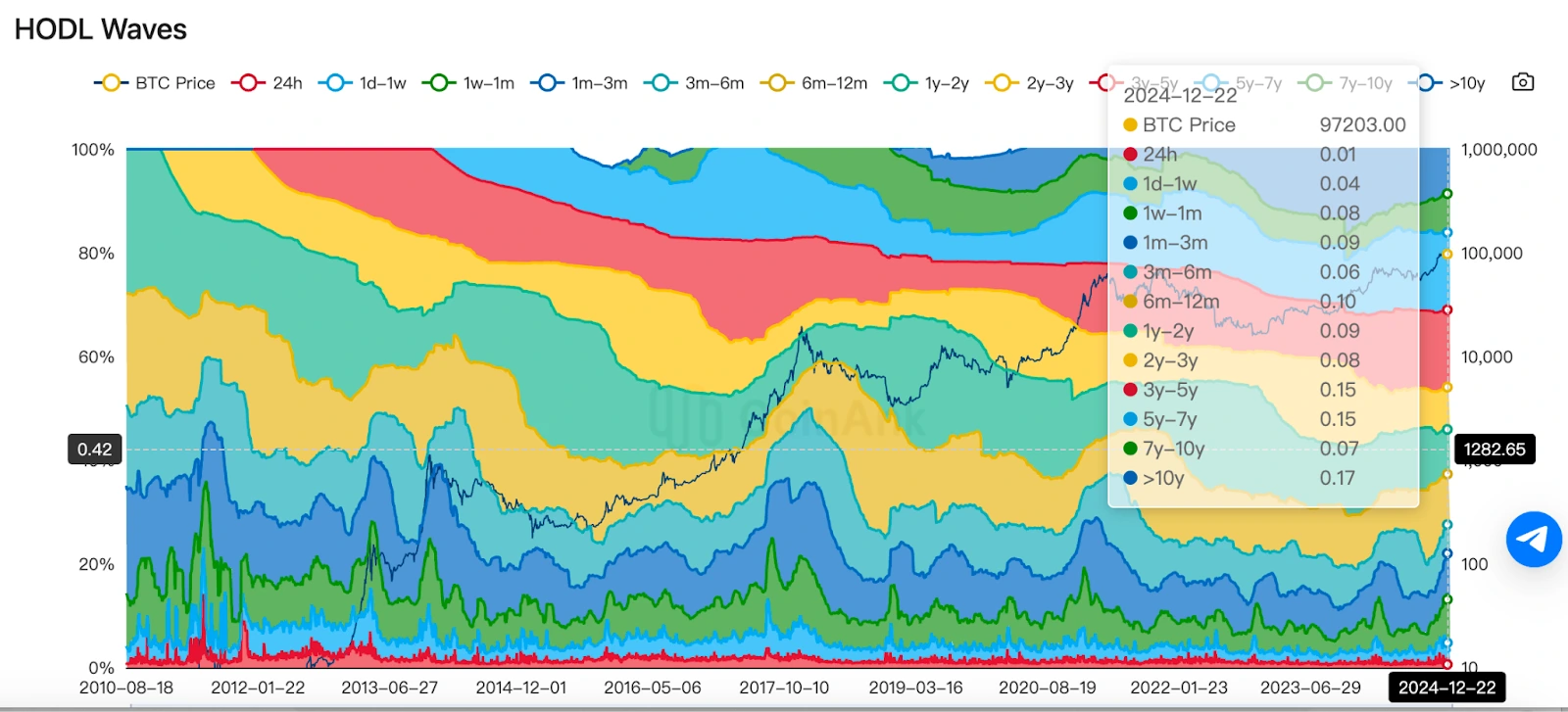

The Bitcoin HODL waves show that short-term holders (less than one year) have been declining as Bitcoin broke above $100,000, indicating many new investors who bought Bitcoin have already sold. This aligns with the purpose of the three major drops in December, which successfully cleared out weak hands. Meanwhile, long-term holder percentages continue to increase, showing that whales remain bullish on the market.

Bitcoin HODL Wave

(Source: CoinAnk)

3. Supporting factors for the $200,000 target include:

- The combination of halving + spot ETF approval + Fed rate cut cycle laying the foundation

- Overall crypto ecosystem development

- Retail FOMO sentiment

- Geopolitical and economic uncertainty driving safe-haven demand

- Major economies (US, EU, China) providing clearer legal frameworks for Bitcoin and crypto assets

4. Regarding Bitcoin’s market cap comparison with gold:

- Current Bitcoin market cap: $1.9 trillion

- Gold market cap: nearly $20 trillion

- 10x difference While catching up to gold’s market cap seems unlikely in the short term, becoming the second-largest asset after gold is possible, requiring a 2-3x increase from current prices – hence the $200,000 target.

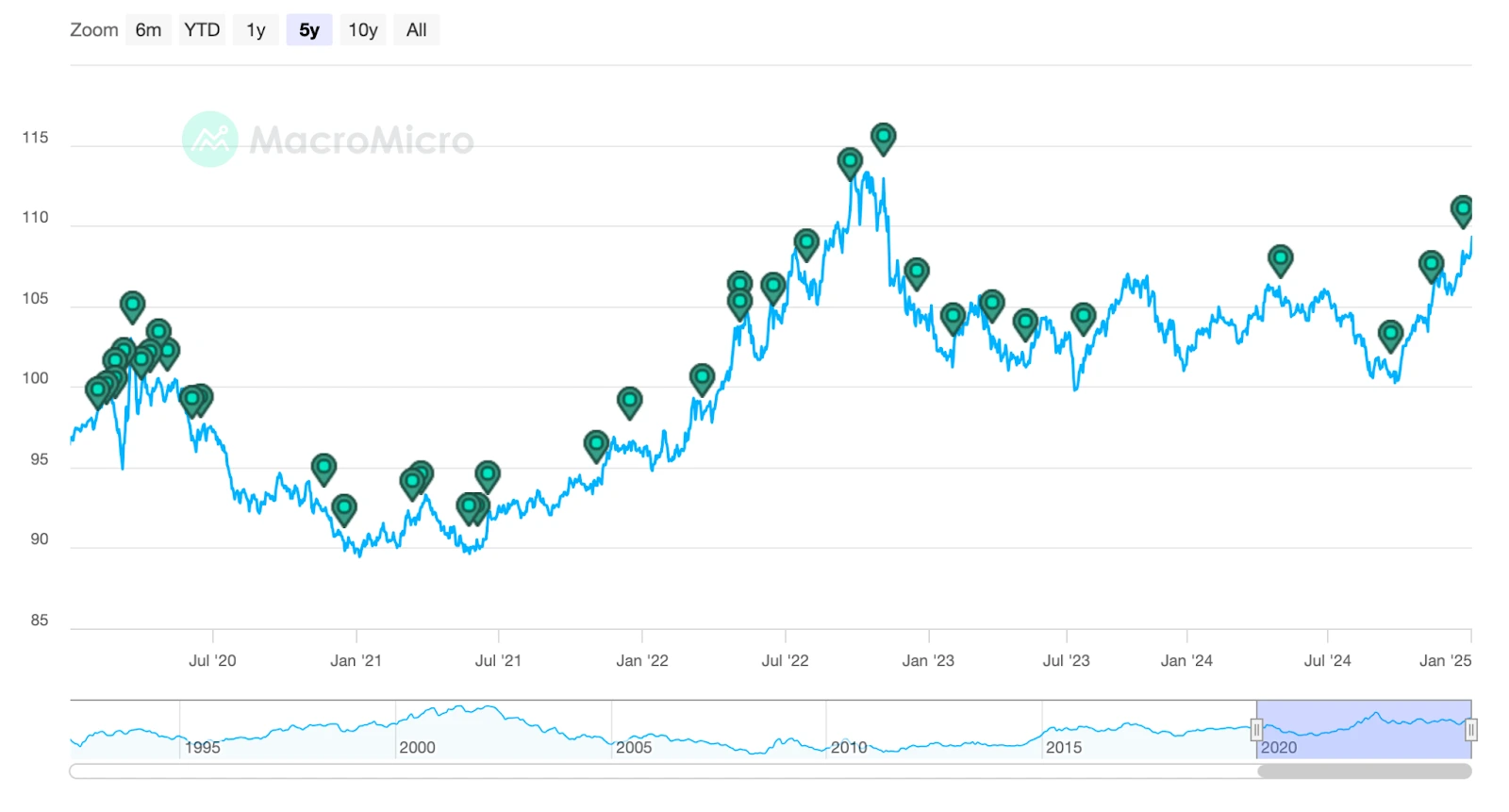

Bitcoin Market Cap vs Gold Market Cap

(Source: MacroMicro)

Bull market peak indicators to watch for

Market overheating:

- Extreme greed sentiment

- Massive speculative capital inflow

- Peak mainstream media coverage of Bitcoin

Abnormal on-chain indicators:

- Extremely high on-chain transaction fees

- Large Bitcoin inflows to exchanges

Macro environment reversal:

- Fed policy turning hawkish again

- Market liquidity reduction

2025 OUTLOOK 2: WHEN WILL THE ALTCOIN SEASON BEGIN AND PEAK?

The most exciting phase of each halving cycle is the altcoin season, which hasn’t been notably present in this cycle yet, as Bitcoin has dominated the stage. So when will the 2025 altcoin season arrive, and when will it peak? Let’s analyze this from historical data, market structure, and ecosystem innovation perspectives.

Historical Timing Analysis:

- Altcoin seasons typically begin when Bitcoin reaches its peak

- First halving cycle: Altcoins weren’t significant

- Second halving (2017): First major altcoin explosion occurred after Bitcoin hit $20,000 in December 2017, lasting through Q1 2018

- Third halving cycle: Altcoin season began in early 2021 after Bitcoin broke previous cycle highs, with concentrated explosive growth in April and peaking in May

For 2025, some altcoin season triggers are in place, while others aren’t:

- Bitcoin has reached a relative high of $100,000, but price hasn’t fully stabilized

- Market sentiment is warm but hasn’t sustained extreme levels

- Fear & Greed Index hasn’t broken above 90, let alone maintained such levels

Fear & Greed Index

(Source: CoinMarketCap)

Market Metrics:

- While sectors like Layer 2, MEME, BRC-20 inscriptions, AI, and RWA show good performance, none have reached explosive growth

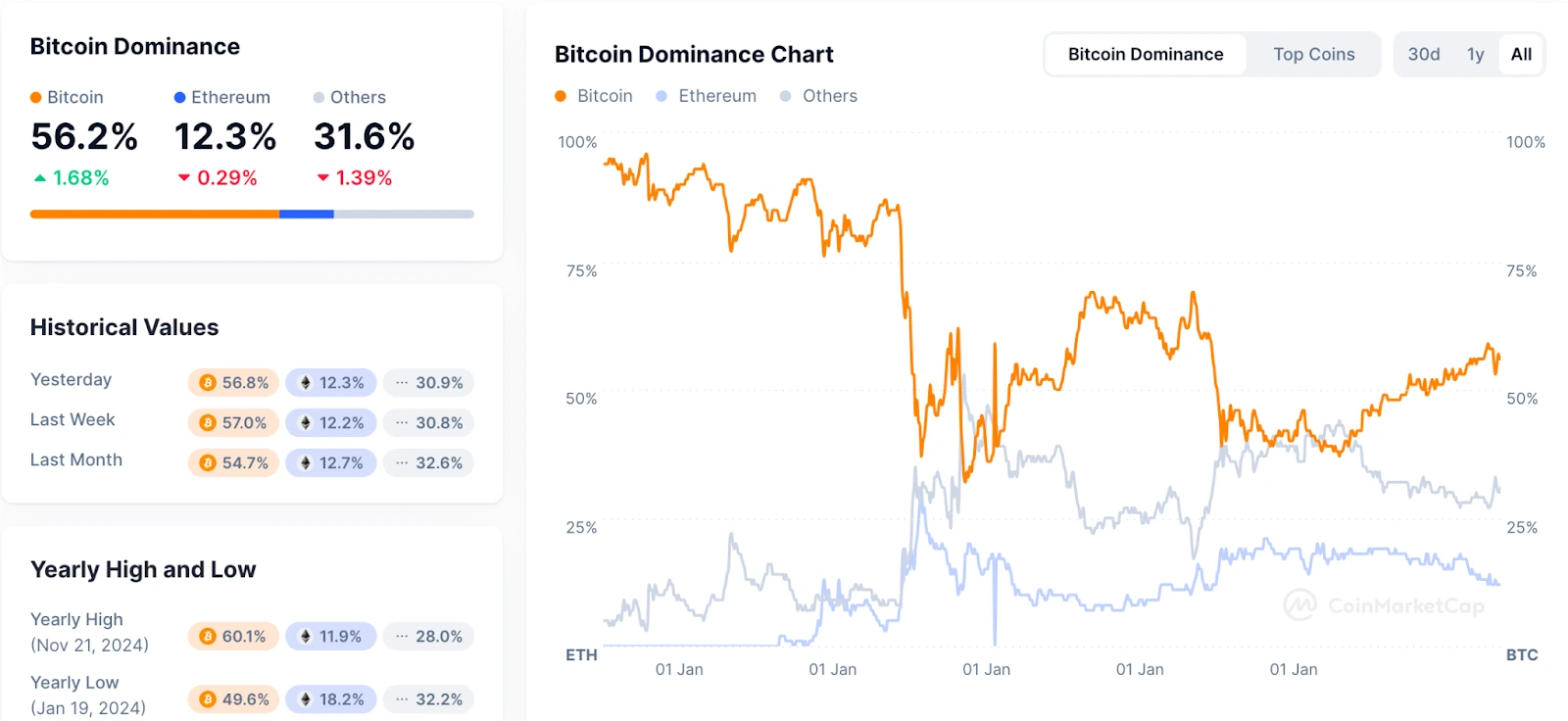

- Bitcoin’s market dominance remains high at 56.2%, showing an upward trend since last year

Bitcoin Market Dominance

(Source: CoinMarketCap)

Current Assessment:

- Altcoin season shows early signs but hasn’t entered full momentum

- Based on historical patterns and market expectations, mid-2025 could mark the real beginning of altcoin season

- Major explosion likely in the second half of the year

- Currently still in accumulation phase

2025 OUTLOOK 3: FEDERAL RESERVE RATE CUTS

The importance of the Federal Reserve’s monetary policy to the crypto world is self-evident. It largely determines the presence and shape of bull markets, as the crypto market, being a product of abundant liquidity, lives and dies by the amount of money available in the market.

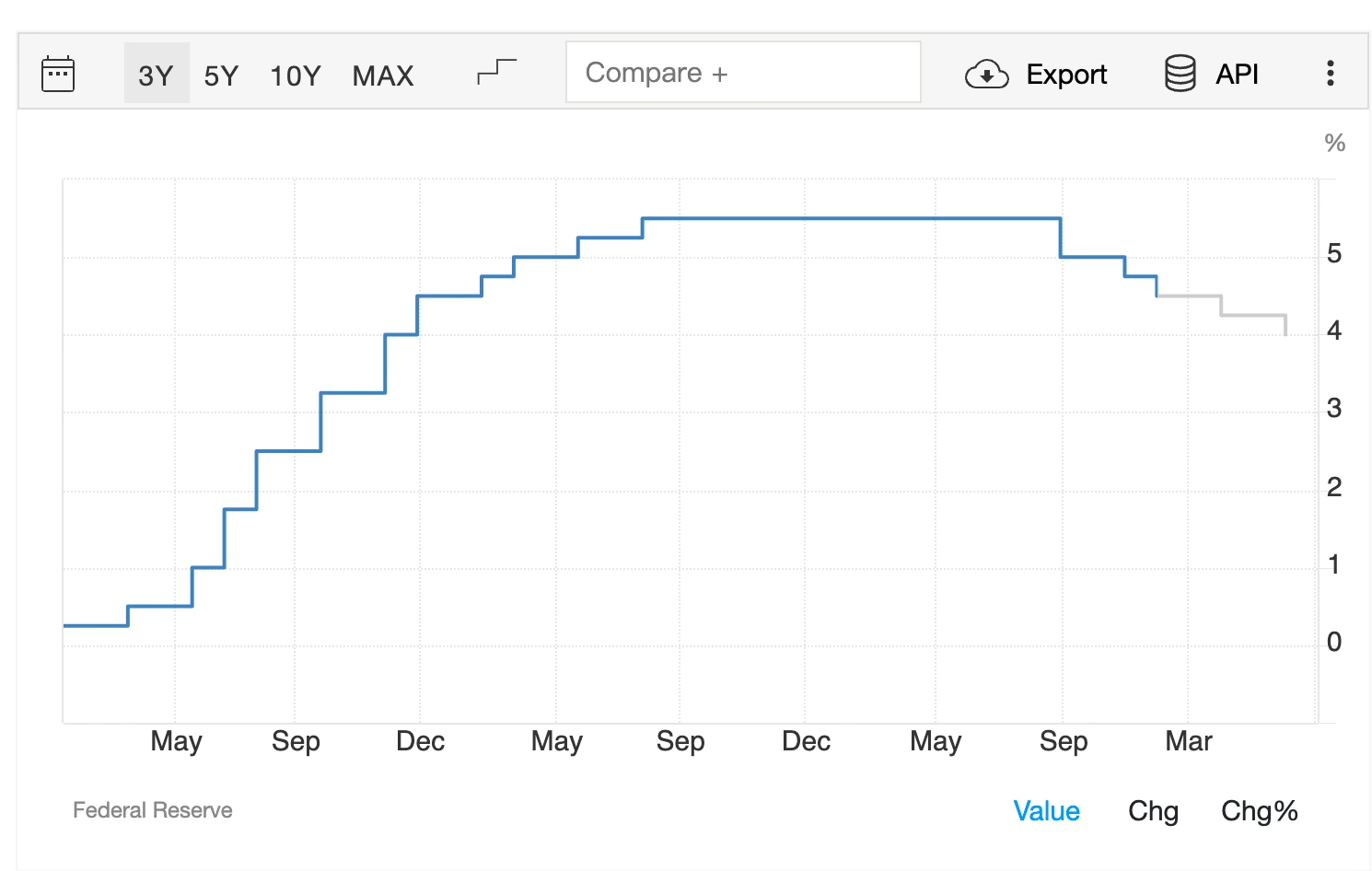

Starting from September 2024, the Federal Reserve officially entered its rate-cutting cycle, with three rate cuts totaling 100 basis points. This not only directly drove Bitcoin to break through the $100,000 barrier but also pushed the entire crypto market capitalization to a peak of $3.7 trillion, expanding the market’s ecosystem pool and laying the foundation for subsequent explosive growth across various sectors.

Fed Meeting Schedule 2025 (All times listed in US time)

- January 28-29

- March 18-19

- May 6-7

- June 17-18

- July 29-30

- September 16-17

- October 28-29

- December 9-10

Current Rate Status and Projections:

- Current Fed rate: 4.25-4.50%

- Trading Economics projection: ~3.50% by 2025, ~3.00% by 2026

Federal Reserve 2025 Interest Rate Forecast

(Source: Trading Economics)

Institutional Predictions:

- CITIC Securities: 50 basis points of cuts in 2025

- Goldman Sachs: Skip January, three cuts in March, June, and September to 3.625%

- Wells Fargo: Three cuts in 2025, potentially every other meeting

Types of Rate Cuts

Relief Rate Cuts

- Implemented during economic recession or major crises

- Larger cuts with longer duration

- Common during regional or global crises

Preventive Rate Cuts

- Implemented when economy shows signs of slowing

- Smaller cuts with shorter duration

- Examples: 1995 and 2019 rate cut cycles

2025 Analysis

- Currently appears to be preventive rate cuts

- Without major economic recession or global financial crisis:

- -Smaller rate cut magnitude expected

- -Slower implementation pace likely

- Reasonable expectation: 2-3 cuts totaling 50-100 basis points in 2025

Impact on Crypto Market: Positive Factors

- Any rate cut increases market liquidity

- Supports continuation of halving cycle bull market

Negative Factors

- Slower rate cuts may affect investor expectations

- Could impact Bitcoin’s price ceiling and bull market duration

- Need to monitor:

- -Market overheating

- -Rate cut uncertainty

- -Regulatory risks

2025 OUTLOOK 4: PROMISING CONCEPTS AND PROJECTS

Each halving cycle brings different leading concepts:

- 2017: ICOs and Bitcoin-imitating altcoins

- 2021: DeFi, NFTs, new public chains, GameFi, metaverse

Key Areas for 2025:

Layer 2 Ecosystem

- Solves Ethereum’s high fees and scalability issues

- Natural migration path for ETH ecosystem projects

- Lower costs attract retail users

- Notable projects: OP, ARB, MOVE

ETH TVL

(Source: defillama)

Memecoins

- Statistics: 3% of top 300 coins, 6-7% of trading volume

- 0.02% success rate shows high risk

- Evolution from pure speculation to functional assets

- Integration with DeSci and AI technology

- Focus on practical applications in DeFi, NFT, scientific research

GameFi 2.0

- Enhanced gaming experience

- Long-term value focus

- Deep integration of gaming and finance

- Combines metaverse, NFT, AI technologies

- Success metrics for 2025:

- -Quality gaming experience

- -Metaverse integration

- -Functional NFT assets

RWA (Real World Assets)

- Concept revival with expanded scope

- Favorable conditions:

- -Clearer regulations

- -Countries more open to blockchain assets

- -Increased institutional investor interest

- -Expanded use cases in supply chain finance and real estate

AI & Blockchain Integration

- Core focus: Enhancing decentralized smart applications

- Key features:

- -Data privacy protection

- -Smart contract optimization

- -Decentralized AI marketplace

- Driven by:

- -Global AI boom

- -Decentralized data training environments

- -Automated smart contracts

- -AI model decentralized hosting

DeFi 2.0

- Improvements over traditional DeFi

- Focus areas:

- -Capital efficiency

- -Sustainable liquidity incentives

- -Financial innovation

- Features:

- -Optimized liquidity

- -Lower risk designs

- -Regulatory compliance

- -Institutional investor appeal

Cross-chain & Interoperability

- Solves blockchain ecosystem isolation

- Enables seamless asset/data/application interaction

- Driven by:

- -Diverse market ecology

- -Multi-chain coordination trends

- -User demand for cross-chain transfers

- -Maturation of technologies like IBC

Additional Promising Sectors

- BRC-20 & Bitcoin inscriptions

- Privacy technology and privacy coins

- Social tokens & Web3 social

- NFT 2.0 with enhanced functionality

- On-chain data analytics

- Decentralized identity (DID)

- DAO governance

- Stablecoins and decentralized payments

2025 OUTLOOK 5: POTENTIAL BLACK SWAN EVENTS

(Source: MacroMicro)

Geopolitical Risks:

- Military conflicts escalation

- Trade disputes

- Political instability in key regions

- Energy price spikes

- Capital flight risks

Financial System Risks:

- Asset bubbles from rate cuts

- Overleveraged institutions

- Potential bank failures

- Debt defaults

- Local debt crises

- Market liquidity crises

Debt Crisis Escalation:

- Global debt bubble burst risks

- Particularly concerning in highly leveraged economies

- Potential impacts:

- -Bitcoin could become safe-haven asset

- -Increased demand during crisis

- -Short-term severe volatility if liquidity tightens

- -Market panic scenarios

Regulatory Risks:

- Stricter global crypto regulations

- Potential actions:

- -Complete trading bans

- -Stablecoin restrictions

- Historical precedent: “9.4” and “5.19” crashes during bull market peaks

2025 OUTLOOK 6: COMPLIANCE IMPACT ASSESSMENT

Market Maturation through Compliance

Reduced Legal Uncertainty:

- SEC and global regulators establishing clearer frameworks

- Market confidence enhancement

- Institutional participation growth

Mainstream Financial Integration:

- Traditional institutions entering crypto:

- -Banks

- -Fund companies

- -Insurance providers

- Services expansion:

- -Crypto asset management

- -Investment products

- -Trading platforms

Investor Protection Enhancement:

- Market transparency increase

- Market manipulation prevention

- Implementation of:

- -Anti-money laundering (AML)

- -Know Your Customer (KYC)

- Black market reduction

Long-term Benefits:

- Increased institutional capital

- Example: Bitcoin spot ETF success

- Future product possibilities:

- -Ethereum ETFs

- -Additional crypto investment vehicles

- Market capital growth

- Development of:

- -Compliant futures

- -Options

- -Fund products

- Risk hedging improvements

- Market stability enhancement

2025 Regulatory Trends:

- More legal recognition of crypto assets

- DeFi and NFT sector development

- Global regulatory standard harmonization

- Cross-border transaction facilitation

- Market maturation

- Increased institutional participation

KEY TAKEAWAYS AND MARKET OUTLOOK

2025 will be the most crucial year in Bitcoin’s fourth halving cycle, with Bitcoin potentially reaching $200,000, which could become a globally significant event and possibly mark the peak of a new bull market. However, the end of the bull market depends not only on price itself but also on whether the industry’s long-term value and ecosystem can sustainably support its growth.

With deepening institutional participation, continuous technological advancement, and differentiated regional market development, the crypto market’s future remains promising. However, investors need to maintain composure, properly assess risks, and capture both short-term and long-term opportunities to prepare for what could be the most exciting year.

In Part 1 of our Crypto Market Review and Outlook: “2024 Crypto Market Review (Part 1): Bitcoin’s Journey to $100K”, we quoted Charles Dickens’ “A Tale of Two Cities”: “It was the best of times, it was the worst of times!”

This vivid description of the world from 166 years ago still resonates today. After 166 years, despite tremendous changes and technological progress, the world seems both vastly different and somehow unchanged, because human nature has never really changed!

▶ Buy Crypto at Bitget