KEYTAKEAWAYS

- Crypto myths about illegal activities and anonymity are outdated – blockchain’s transparency enables traceability and accountability.

- Financial giants like JP Morgan and BNY Mellon are embracing blockchain, disproving the myth that crypto can’t merge with traditional finance.

- Blockchain is driving real-world change, from charitable donations to small business transactions in developing regions.

CONTENT

Uncover the truth behind common crypto myths. Learn how blockchain is shaping finance, security, and real-world applications.

The emergence of blockchain technology is reshaping how people perceive and understand finance, currency, and transactions.

However, despite its growing influence, there are still numerous crypto myths surrounding this field.

These crypto myths often lead to skepticism or even fear toward blockchain and cryptocurrencies.

In this article, we will address and clarify the six most common crypto myths, aiming to enhance your understanding of blockchain technology and cryptocurrencies.

>>> More to read: What is Blockchain and How Does It Work?

5 BLOCKCHAIN AND CRYPTO MYTHS

➤ Is Cryptocurrency Only Used for Illegal Activities?

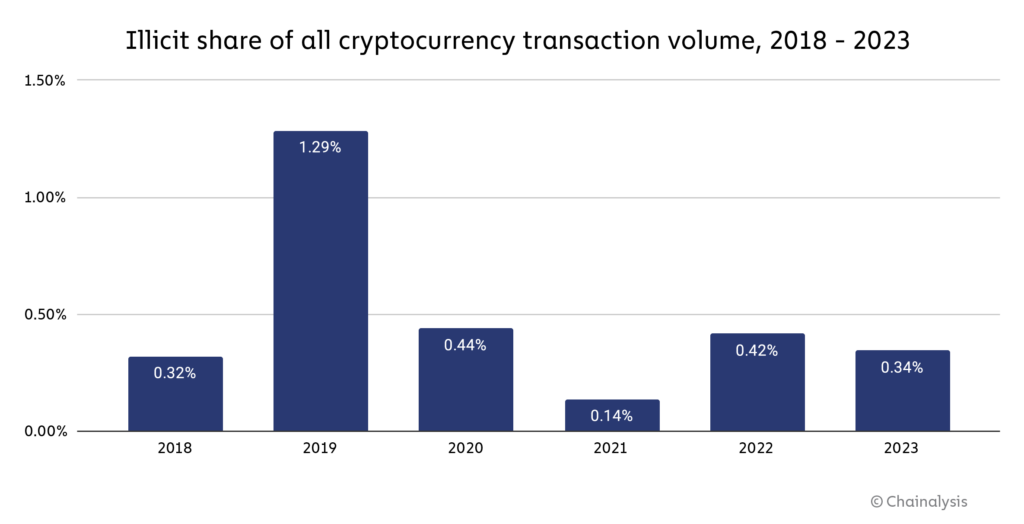

In the early days of cryptocurrency, transactions linked to criminal activities did account for a significant portion of the total volume.

For instance, the dark web platform “Silk Road” once facilitated Bitcoin transactions that made up as much as 20% of Bitcoin’s total transaction volume before it was shut down by law enforcement in 2013.

However, in recent years, with increased efforts from law enforcement agencies, stricter government regulations, and the advancement of blockchain analytics tools, it has become much easier to investigate and prevent cryptocurrency-related crimes.

As a result, illegal activities involving cryptocurrency have significantly declined.

By 2023, transactions tied to criminal activities accounted for only 0.34% of the total cryptocurrency transaction volume.

(source: chainalysis)

This challenges one of the most persistent crypto myths – the belief that cryptocurrencies are primarily used for illicit purposes.

In reality, the vast majority of crypto transactions are legitimate, contributing to financial innovation and decentralized applications.

Understanding and debunking these crypto myths helps foster more accurate perceptions of blockchain technology and its role in the global economy.

>>> More to read: 4 Most Common Crypto Scams And How To Avoid Them

➤ Is It Impossible to Prevent Crypto Hacks?

In the early days of the internet, people widely believed it was unsafe to enter credit card information on websites.

However, with the adoption of SSL encryption and the development of trusted payment tools, online credit card transactions have become increasingly secure and common.

A similar trend is emerging in the crypto space. Although hacking remains a concern, it is an issue that can gradually be resolved through technological advancements.

In the early stages of cryptocurrency, centralized exchanges were frequent targets for hackers.

A prime example is the Mt. Gox exchange, where a major hack led to its collapse.

In recent years, however, most centralized exchanges have established dedicated security departments and adopted advanced risk control technologies, significantly reducing the number of hacking incidents.

According to Chainalysis, in 2023, revenue from crypto scams and hacks dropped sharply, with illegal earnings falling by 29.2% and 54.3%, respectively.

Currently, the majority of hacking incidents occur in the emerging DeFi sector within the blockchain industry.

Despite this, DeFi technology is advancing rapidly, and numerous blockchain security companies are focusing on enhancing the security of DeFi protocols.

There is strong reason to believe that, over time and with continuous technological innovation, this type of crypto myths will gradually be dispelled.

Addressing and clarifying these crypto myths is essential for fostering trust and driving the growth of blockchain technology.

>>> More to read: Crypto Risks 101 | Beginner’s Guide

➤ Is Cryptocurrency Anonymous and Untraceable?

Many tutorials claim that cryptocurrency is anonymous and untraceable, but the reality is quite the opposite.

In the Bitcoin whitepaper, Satoshi Nakamoto did reference Bitcoin’s anonymity; however, he also outlined the vision of cryptocurrency as traceable.

To be precise, cryptocurrency can provide you with a “pseudonym,” but it is far from truly anonymous.

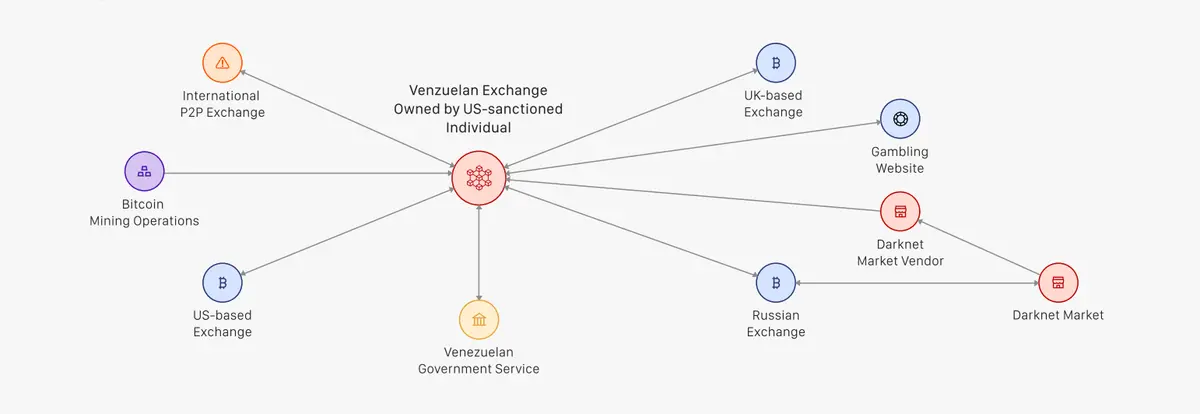

When a wallet address is linked to static, publicly visible transactions, it is often possible to trace the wallet’s owner.

The widespread use of KYC (Know Your Customer) processes in the blockchain industry has further diminished the anonymity of cryptocurrencies.

For example, the wallet address 34xp4vRoCGJym3xR7yCVPFHoCNxv4Twseo has been confirmed to belong to Binance.

Additionally, as shown below, many address-tracking tools can now clearly display the origin and movement of cryptocurrency transactions.

These tools can trace assets, indicate their sources, and even identify relationships between wallet owners – a common feature for addresses linked to international sanctions lists or political figures.

This crypto myth about complete anonymity often misleads newcomers. In reality, blockchain’s transparency is one of its core strengths, allowing for accountability and fostering trust in decentralized networks.

Debunking crypto myths like this is essential for developing a clearer understanding of how blockchain technology operates.

“Most cryptocurrency transactions can be tracked in detail, as shown in the diagram.”

(source:chainalysis)

>>> More to read: Key Crypto Terms You Need to Know

➤ Can Cryptocurrency and Traditional Finance Coexist?

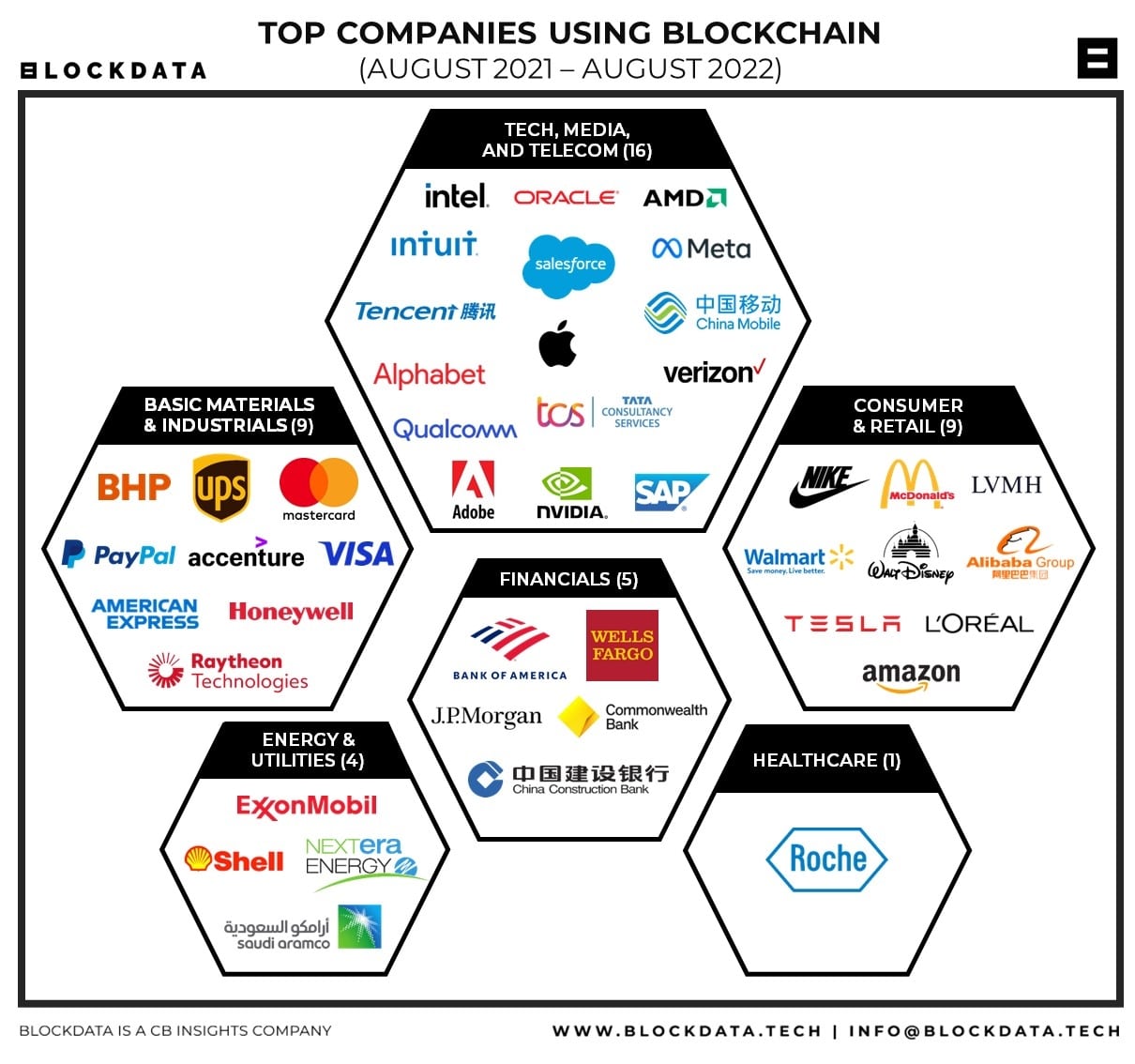

Contrary to popular belief, cryptocurrency can not only integrate with traditional finance but has already done so successfully in numerous cases.

The transparency of cryptocurrency can streamline risk management processes in traditional finance.

Financial institutions are increasingly leveraging blockchain analysis tools to monitor transaction data on public blockchains and track the movement of funds between wallets and service providers.

Additionally, many institutions have hired blockchain experts to develop new services.

- In 2016, USAA Federal Savings Bank (FSB) integrated with Coinbase, allowing users to access their Coinbase accounts directly from USAA’s website. This enabled customers to view their cryptocurrency balances and monitor transactions.

- In 2020, JP Morgan launched Onyx, a platform using blockchain technology to facilitate the exchange of value, information, and digital assets in the financial services industry.

- In October 2022, BNY Mellon, the oldest financial institution in the U.S., introduced cryptocurrency custody services.

This crypto myth about the incompatibility between crypto and traditional finance is gradually being debunked as more major financial players adopt blockchain technology.

More developments are expected in the future, further bridging the gap between digital assets and traditional financial systems.

>>> More to read: What is FOMO in Crypto?

➤ Does Blockchain Lack Real-World Applications?

Blockchain technology has made a significant impact in underdeveloped regions.

In everyday business activities, individuals and small business owners are increasingly accepting payments in cryptocurrency due to faster transactions and lower costs.

Blockchain has also advanced charitable efforts in these areas.

Following the outbreak of the Russia-Ukraine war, cryptocurrency users donated over $56 million in crypto to Ukraine within a year.

Similarly, in February 2023, after the earthquake in Turkey and Syria, crypto users donated nearly $6 million in cryptocurrency within days of the disaster.

This crypto myth suggests that blockchain lacks real-world applications is contradicted by the growing use of cryptocurrency in humanitarian aid and financial inclusion.

Blockchain’s utility continues to expand, proving its relevance beyond digital assets.

(source:blockdata)

>>> More to read: How to Get Crypto Passive Income Easily?

CRYPTO MYTHS | CONCLUSION

Through our in-depth analysis, we hope to dispel these crypto myths and provide a clearer, more comprehensive understanding of blockchain and cryptocurrency.

The world is evolving rapidly, and blockchain and cryptocurrencies are at the forefront of this transformation.

While these emerging technologies pose certain challenges, they also unlock unprecedented opportunities.

Rather than being constrained by misconceptions and misunderstandings, we should continue to learn and explore.

As we venture into the unknown, we will witness the birth of a new world. Let’s embrace this exciting future together.