KEYTAKEAWAYS

- Technical indicators suggest a continuation of Bitcoin's price decline with weak momentum and failed resistance levels.

- High U.S. interest rates and strong dollar reduce Bitcoin's attractiveness, impacting its price.

- Stagnation in stablecoin growth and upcoming options expiry may lead to increased volatility and potential price corrections.

CONTENT

Learn why Bitcoin is likely to drop further with insights into technical signals, U.S. interest rates, seasonal weakness, stablecoin activity, and options expiry.

You’ve probably seen more than enough pessimistic headlines these past couple of days. Last week, we saw the highest weekly net outflows of institutional funds in several months, and prominent crypto investors are even discussing the possibility of Solana dropping to $80.

Well, here’s more bad news: Bitcoin is likely to drop even more, (but don’t worry, if it’s any consolation, we’re all in this together) and here’s 5 reasons why. Without further ado, let’s dive in!

REASON 1: STRONG BEARISH SIGNALS

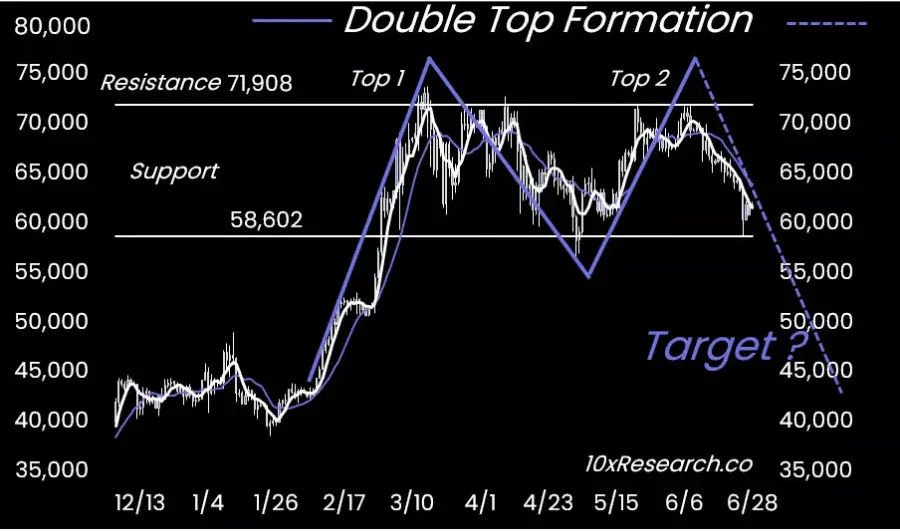

(source: 10x Research)

Technical analysis across different time frames reveal a likely continuation of Bitcoin’s price decline. The weekly RSI and monthly Stochastics, indicators reflective of past major market corrections (such as in January 2018 and May 2021), signal a weakening momentum despite Bitcoin’s price holding above $60,000.

On the daily charts, despite high trading volumes indicating panic selling, the lack of strong rebound suggests bearish sentiment persists. With prices failing to break key resistance levels at $63,000 and $67,000 and recent sessions showing rejection at higher prices, the data points towards a bearish trend with potential further corrections.

REASON 2: HIGH U.S. INTEREST RATES

Market dynamics driven by U.S. interest rate concerns and upcoming inflation data have pushed traders towards the safer U.S. dollar, impacting cryptocurrency prices, including Bitcoin. The dollar’s strength, reinforced by solid U.S.

Purchasing Managers’ Index (PMI) data, has caused Bitcoin prices to fall. Traders doubt the Federal Reserve will cut rates soon, especially with this week’s critical Personal Consumption Expenditures (PCE) Price Index data expected to show inflation cooling but still above the Fed’s 2% target.

Higher interest rates decrease the attractiveness of speculative, risk-driven assets like Bitcoin. Federal Reserve Chair Jerome Powell’s focus on controlling inflation suggests that high rates may continue, keeping pressure on Bitcoin and other cryptocurrencies.

REASON 3: SEASONAL WEAKNESS IN Q3

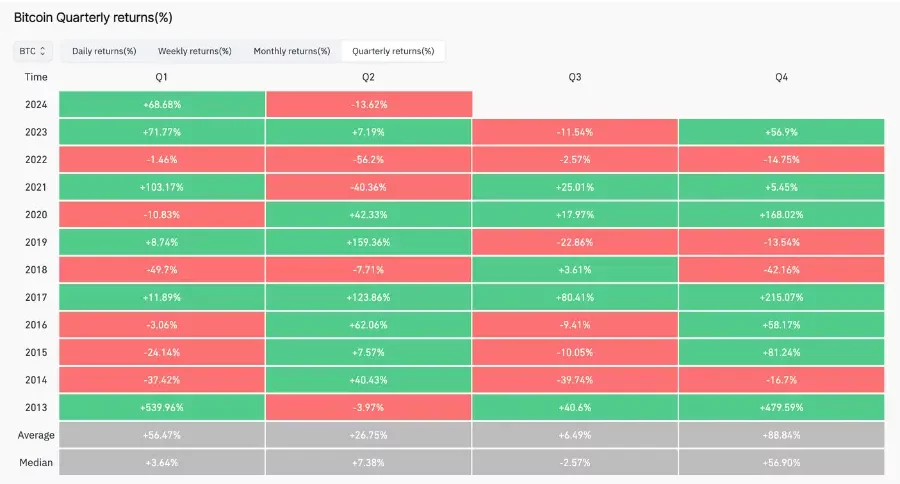

Historically, the third quarter (July, August, and September) has been the least profitable for Bitcoin, showing an average return of just +6.49% since 2014. This is significantly lower compared to the gains typically seen in the first quarter (+56.47%) and the fourth quarter (+88.84%).

(source: CoinGlass)

Given this pattern of weaker performance during the third quarter, particularly with declines often observed in August and September, there is a likelihood of Bitcoin experiencing a correction over the next three months.

REASON 4: STAGNATION IN STABLECOIN ACTIVITY

Stablecoins like USDT, USDC, and DAI, pivotal for liquidity and fiat-to-crypto conversions, have seen halted growth since the Bitcoin halving on April 20. Before the halving, these dollar-pegged cryptocurrencies drove the bull market, boosting their combined market value by over 23% to nearly $149 billion and propelling Bitcoin’s price up by over 50% to $65,000.

Post-halving, however, the expansion of these top stablecoins has stagnated, with their market value fluctuating narrowly between $149 billion and $150 billion. The absence of fresh stablecoin inflows and reduced Bitcoin futures leverage points to a bearish market outlook.

>>> Read more: Bitcoin Halving 2024 Prediction: Here’s What Crypto Visionaries Say

Without renewed stablecoin activity, the liquidity needed to support higher cryptocurrency prices isn’t materializing, suggesting potential price corrections for Bitcoin to $55,000.

REASON 5: BITCOIN AND ETHEREUM OPTIONS EXPIRY

On June 28, Bitcoin and Ethereum options worth $10 billion are set to expire. Until then, the options expiry is likely to keep Bitcoin’s price hovering around $60,000. However, following this expiry, Bitcoin’s price movement could become more volatile. The subsequent options expiries are relatively smaller, reducing the impact of delta hedging by market makers.

The price level of $60,000, potentially supported by recent purchases of call options, may no longer be sustainable after June 28. This could lead to the establishment of a new, possibly lower price range for Bitcoin.

>>> Read more:

-

Reasons Why Bitcoin is Dumping Like CRAZY and What to Expect

-

Why Is Crypto Market Down? 3 Factors You Should Keep an Eye On