KEYTAKEAWAYS

- 9 spot Ethereum ETFs are set to launch on July 23rd, trading on major U.S. exchanges and available through popular brokerage platforms.

- ETH ETF fees range from 0.15% to 2.5%, with most offering temporary fee waivers. Grayscale's new Mini Trust leads with a 0.15% fee.

- Currently, ETH ETFs don't offer staking services due to liquidity concerns, but issuers are exploring solutions for potential future implementation.

CONTENT

Explore the launch of spot Ethereum ETFs: dates, trading platforms, purchase options, and comparisons. Learn about fees, staking possibilities, and what investors need to know before the July 23rd debut.

After years of regulatory resistance and numerous amendments to registration documents, spot Ethereum Exchange-Traded Funds (ETFs) are finally entering the market. This launch marks a decisive moment for the cryptocurrency market and presents an opportunity for millions of American institutional and retail investors.

LAUNCH DATE AND TRADING PLATFORMS OF ETH ETFs

The Chicago Board Options Exchange (CBOE) has confirmed July 23rd as the launch date for five ETFs trading on its platform:

- 21Shares Core Ethereum ETF

- Fidelity Ethereum Fund

- Invesco Galaxy Ethereum ETF

- VanEck Ethereum ETF

- Franklin Ethereum ETF

Four additional spot ETH ETFs will trade on Nasdaq or NYSE Arca. While these exchanges haven’t released official announcements, they’re also expected to launch on July 23rd.

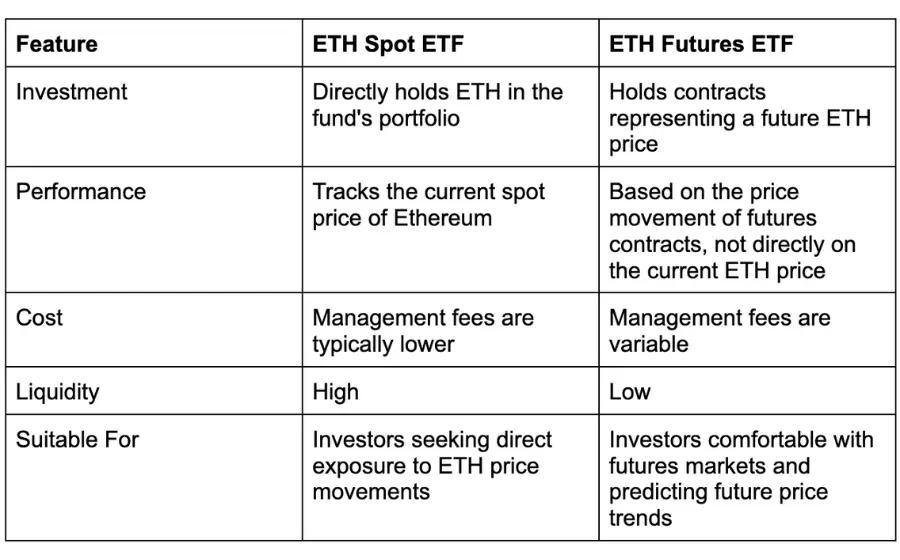

Differences Between ETH Spot ETFs and Futures

Read More:

9 ETH Spot ETF Applications Under SEC Review

WHERE AND HOW TO PURCHASE ETH ETFS?

Ethereum ETF shares will be available on most major brokerage platforms. Each ETH spot ETF launching in the last week of July has received regulatory approval to trade on at least one major U.S. exchange – specifically Nasdaq, NYSE Arca, or Cboe BZX.

Everyday investors don’t trade directly on these exchanges. Instead, they rely on brokerage platforms like Fidelity, E*TRADE, Robinhood, Charles Schwab, and TD Ameritrade as intermediaries. Once ETH ETF shares are listed on public exchanges, all reputable brokerages and other institutions are expected to facilitate trading.

COMPARING 9 ETH ETFS

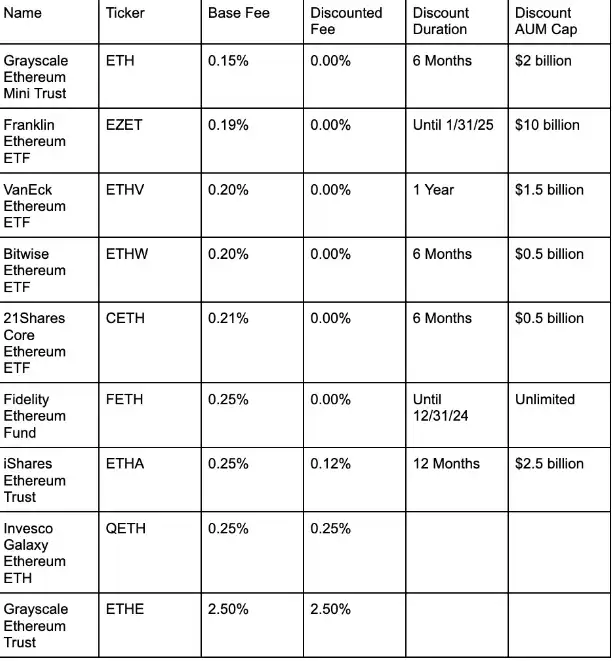

Nine spot Ethereum ETFs are set to begin trading. In terms of underlying mechanisms, these funds are almost identical. Each ETF is sponsored by reputable fund managers, holds spot ETH through qualified custodians, and relies on a core group of professional market makers to create and redeem shares. They also all enjoy the same standard investor protections, including insurance against broker bankruptcy and cybersecurity risks.

For most investors, the deciding factor comes down to fees. Eight of the nine ETFs have management fees ranging from 0.15% to 0.25%. The exception is the Grayscale Ethereum Trust (ETHE), which began trading in 2017 with a different fund structure and maintains a 2.5% management fee.

Most (but not all) Ethereum ETFs are temporarily waiving or reducing fees to attract investors. The Grayscale Ethereum Trust stands out again, tied with the Invesco Galaxy Ethereum ETF (QETH) for the highest fees.

Ironically, the apparent leader in the fee race is also a Grayscale product. The Grayscale Ethereum Mini Trust (ETH), a new fund created specifically for ETF listing, has a management fee of just 0.15%. These fees will be completely waived for the first six months after listing or until the fund’s assets under management (AUM) reach $2 billion.

Another notable option is the Franklin Ethereum ETF (EZET) from Franklin Templeton. Its management fee is 0.19%, the second-lowest among its peers, and these fees will be completely waived until January 2025 or until the fund’s AUM reaches $10 billion.

Read More:

Bitcoin Spot ETFs: Risks You Need to Know Beyond the Hype

WILL ETH ETFS OFFER STAKING SERVICES?

Currently, spot Ethereum ETFs do not offer staking services. Staking involves depositing ETH into validator nodes on the Ethereum Beacon Chain. Staked ETH earns a percentage of network fees and other rewards but can also be “slashed” – or have the staked collateral confiscated – if the validator misbehaves or fails.

Staking is attractive because it can significantly boost returns. According to StakingRewards.com, the annualized yield was approximately 3.7% as of July 19th.

Earlier this year, several issuers, including Fidelity, BlackRock, and Franklin Templeton, sought regulatory approval to add staking functionality to spot ETH ETFs. The SEC rejected these requests.

According to several anonymous negotiators, the issue boils down to liquidity. Staked ETH typically takes several days to withdraw from the Beacon Chain. This poses a problem for issuers who need to redeem ETF shares for underlying fund assets on demand in a timely manner.

Insiders told Cointelegraph that issuers are still exploring ways to add staking functionality to existing ETH spot ETFs – possibly by maintaining a “buffer” of liquid spot ETH – but viable plans are at least several months away. For now, ETH ETFs cannot stake.

▶ Buy Ethereum at BingX

Sign up to claim 5,000+ USDT in rewards & 20% off trading fees!

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!