-

Alipay’s promotion of a compliant crypto fund suggests a potential shift in China’s stance on crypto investments, signaling cautious regulatory exploration.

-

This event highlights regulators’ effort to balance innovation and risk, allowing controlled promotion while limiting exposure through investment caps.

- Alipay’s crypto fund ad suggests regulators are testing market reactions and policy frameworks for crypto investments under strict compliance.

TABLE OF CONTENTS

Alipay’s crypto fund promotion reveals a shift in China’s regulatory stance, showing openness to compliant investments while maintaining control. This cautious experimentation could shape future crypto policies.

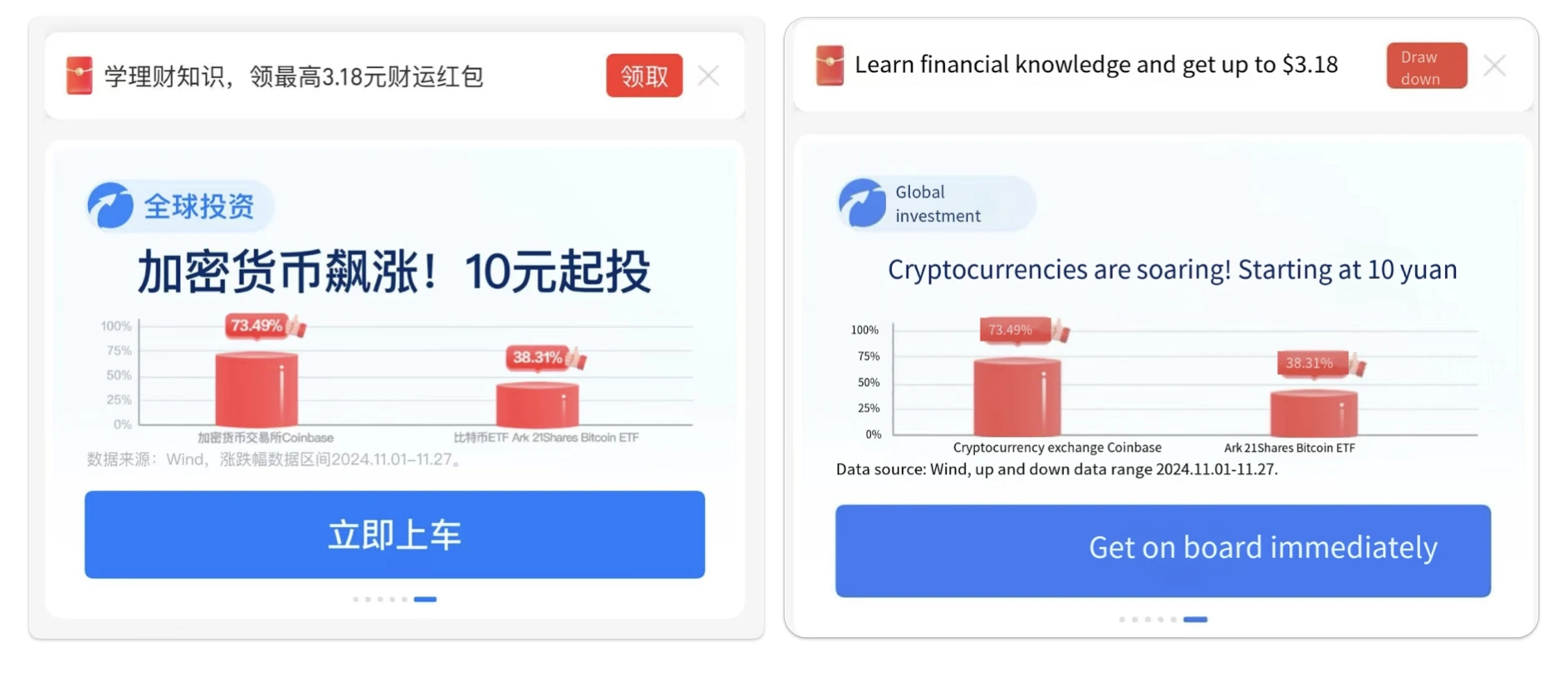

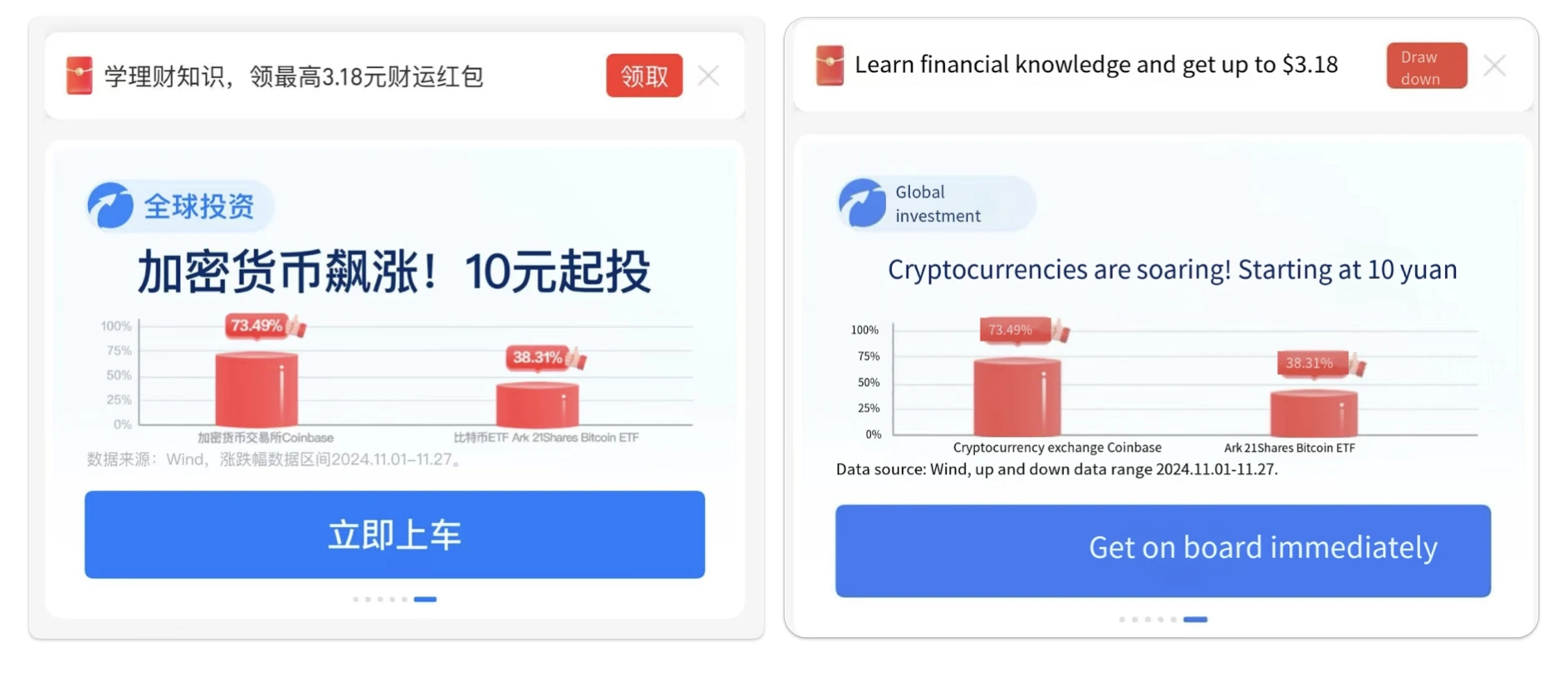

Recently, Wu Blockchain reported that Alipay featured advertisements promoting cryptocurrency funds on its homepage. The promoted product, Huabao Overseas Technology C Fund, invests in overseas assets through compliant channels, indirectly holding Coinbase stocks and Bitcoin spot ETFs.

This event reveals subtle changes in regulatory attitudes, market trends, and the complexity of China’s cryptocurrency policies, all of which warrant further exploration.

SUBTLE SHIFTS IN REGULATORY ATTITUDES

Blurred Policy Boundaries

While China enforces strict regulations on direct cryptocurrency trading and mining, it appears more lenient toward indirect investments in overseas cryptocurrency assets via compliant funds. Alipay’s promotion reflects this regulatory gray area, providing opportunities for exploring compliant investment channels.

Testing the Waters

As the largest payment platform in China, Alipay’s promotion may signal a regulatory experiment in allowing indirect participation in cryptocurrency investments. By observing market reactions and investor interest, regulators can gather valuable insights to guide future policy decisions.

Risk Control Measures

The investment limit of RMB 1,000 per day highlights regulators’ cautious approach to managing potential market risks while protecting investors. Furthermore, promoting established fund products instead of direct cryptocurrency trading strikes a balance between meeting market demand and mitigating risk.

The Evolution of China’s Crackdown on Cryptocurrency and Its Reasons

Regulatory Milestones

China’s cryptocurrency regulations have evolved from banning ICOs in 2017 to comprehensive crackdowns on mining, trading, and other crypto-related activities. Key stages include:

• 2017: Ban on ICOs and shutdown of domestic cryptocurrency trading platforms.

• 2021: Large-scale crackdown on cryptocurrency mining and prohibition of financial institutions from facilitating crypto transactions.

• 2022 and beyond: Strengthened control over virtual asset trading and overseas crypto exchanges to prevent capital outflow.

REASONS BEHIND THE CRACKDOWN

Financial Stability: The high volatility of cryptocurrencies poses risks to financial systems and small investors.

Preventing Capital Outflows: Cryptocurrencies, with their decentralized and anonymous nature, could facilitate illegal capital outflows and money laundering.

Environmental Concerns: The high energy consumption of mining activities conflicts with China’s carbon neutrality goals.

Mitigating Speculative Risks: Cryptocurrency speculation and price fluctuations can create asset bubbles and negatively impact the real economy.

Potential Policy Space

Although direct trading and mining activities face strict regulations, compliant channels for investing in overseas crypto assets seem to enjoy some tolerance. This “strict on direct trading, open to indirect participation” stance leaves room for future policy adjustments.

Also read:

Conflux Network (CFX): China-Recognized Public Blockchain

Evergrande Storm Sweeps Across China

MARKET RESPONSE AND TRENDS

The market’s response to Alipay’s promotion demonstrates sustained interest in cryptocurrency investments among Chinese investors. By investing in overseas cryptocurrency assets through compliant funds, the market is exploring new paths.

As international markets gradually standardize crypto asset frameworks, the integration of traditional finance and emerging crypto assets will become increasingly evident. These compliant channels offer valuable experiences for any potential future market liberalization.

The promotion of cryptocurrency funds on Alipay highlights the unique position of crypto assets in China’s market. Exploring innovative financial products within regulatory boundaries provides low-risk opportunities for investors while serving as a testing ground for regulators.

As market demand and international trends evolve, China may seek to strike a new balance between innovation and risk management.

CoinRank x Bitget – Sign up & Trade to get $20!