KEYTAKEAWAYS

- Solana emerges as an unexpected ETF candidate, backed by its strong market position and perceived institutional support.

- Regulatory challenges, including SEC classification as a security, pose significant obstacles for SOL ETF approval.

- The SOL ETF application may pave the way for other altcoin ETFs, potentially reshaping the crypto investment landscape.

CONTENT

Solana ETF hype sweeps crypto markets despite regulatory challenges. Analysts debate its viability as the industry watches for potential impacts on future altcoin ETFs.

On July 8, Cboe submitted a 19b-4 filing to the SEC for a Solana ETF on behalf of VanEck and 21Shares, officially starting the approval process. This followed their S-1 applications announced on June 28. Rumors also suggest BlackRock might be applying for a SOL ETF.

While these rumors are unverified, they reflect growing institutional interest in this seemingly unlikely ETF. Whether this is speculation or early market positioning remains unclear, but one thing is certain: the Solana hype has begun, regardless of the application’s outcome.

>>> Read more: Cboe Files for SEC Approval to List Solana ETFs

SOLANA ETF HYPE: MARKET POTENTIAL AND CHALLENGES

Solana’s Unique Position

Looking back to June, after Ethereum ETF‘s successful turnaround, discussions about the next ETF candidate heated up and SOL emerged as the frontrunner among other tokens.

The reasons are straightforward:

- Strong Market Position

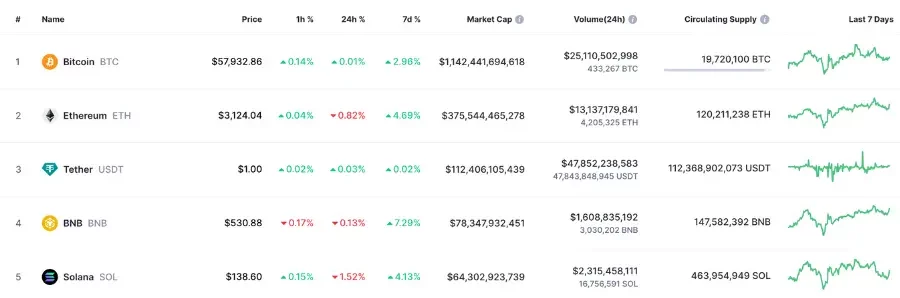

SOL consistently ranks in the top five cryptocurrencies by market cap, indicating sufficient consensus value and market depth for ETF eligibility.

(source: CoinMarketCap)

- Competitive Edge

Unlike USDT (which doesn’t meet ETF criteria) or BNB (entangled in U.S. lawsuits), SOL faces fewer immediate obstacles.

- Perceived Institutional Support

Despite no explicit disclosures, SOL is believed to have strong backing from Wall Street and tech circles

Regulatory Hurdles

Despite issuers’ progress, market skepticism persists due to SOL’s regulatory challenges. Unlike Ethereum, which faced uncertain classification, SOL has been explicitly labeled a security by the SEC in multiple lawsuits against major exchanges. This classification requires strict compliance with SEC regulations, including enhanced transparency and KYC measures, posing a significant obstacle for SOL ETF approval.

Additionally, SOL lacks a crucial precursor for ETF approval: trading on the Chicago Mercantile Exchange (CME), which only BTC and ETH currently have. Solana’s relatively recent emergence and previous concentrated ownership by FTX also raise concerns about its level of decentralization, further complicating its ETF prospects.

>>> Read more: FTX Founder Sam Bankman Fried: From Crypto King to 25 Years in Prison

SOLANA ETF HYPE: ANALYST PREDICTIONS

Bloomberg Senior ETF Analyst Eric Balchunas estimates the final deadline for Solana ETF is mid-March 2025, with this year’s election in November, meaning the final approval will be decided by the post-election regulatory group. He also emphasized, “If Trump wins, anything is possible.”

Looks like Solana ETFs are going to have a final deadline of mid-March 2025. But between now and then the most imp date is in November. If Biden wins, these likely DOA. If Trump wins, anything poss. https://t.co/ywkf6oA8Rc

— Eric Balchunas (@EricBalchunas) July 8, 2024

Beyond regulatory issues, the commercial viability of SOL ETF is also questionable. Many market analysts believe SOL ETF will have far lower inflows than Bitcoin or Ethereum ETFs, inevitably reducing issuers’ profitability. Previously, Cathie Wood’s ARK Invest withdrew its Ethereum ETF application due to fierce fee competition, with crypto ETF management fees significantly lower than regular ETFs, resulting in an unfavorable input-output ratio.

Former analyst at Huobi Research points out that ARK’s BTC ETF ranks 4th among 11 ETFs, with annual management fees of about $7 million, yet they concluded it wasn’t profitable enough to pursue an Ethereum ETF. This implies ARK doesn’t believe ETH can reach this scale. Applying the same logic to SOL, with a market cap of about $66.2 billion, just one-sixth of ETH’s and 5% of Bitcoin’s, issuers would need to manage at least 20 million SOL to reach the $7 million threshold, about 4.5% of SOL’s circulating supply. In comparison, BlackRock, the leader in Bitcoin ETFs, manages only 1.5% of BTC. A lower market cap corresponding to higher holdings is clearly not cost-effective for issuers.

This situation isn’t unique to SOL. Even for Ethereum ETFs, some institutional figures hold relatively pessimistic views, believing net inflows will be at most 15% of Bitcoin’s. However, some are optimistic. Market maker GSR believes if SOL ETF is approved, SOL has 1.4x upside potential in a bear market, 3.4x in normal conditions, and up to 8.9x in a bull market.

>>> Read more: Crypto Market Update in Early July: Ethereum ETFs, Bitcoin Trends, and Future Influences

SOLANA ETF HYPE: IMPLICATIONS FOR THE CRYPTO MARKET

Potential for Other Altcoin ETFs

Compared to SOL, from an ETF perspective, analysts are more optimistic about Litecoin and Dogecoin. Both lack the securities history baggage and rank in the crypto top 10 by market cap. BitMEX founder Arthur Hayes and Real Vision CEO Raoul Pal mentioned in a Youtube program that “a Dogecoin ETF might launch by the end of this cycle.”

Overall, whether approved or not, SOL ETF has paved the way for altcoin ETFs, with more cryptocurrencies likely to attempt this capital crown in the future. If the FIT21 bill passes, even memecoin ETFs might become a reality.

Legislative Landscape

This bill, already passed by the House, clarifies CFTC’s jurisdiction over cryptocurrencies, sets decentralization criteria, and stipulates that cryptocurrencies without a single entity holding over 20% of the digital asset or voting rights can be considered digital commodities rather than securities, potentially clearing obstacles for ETFs. The bill is now with the Senate, but considering the Senate might decide to redraft related bills, it still faces a long waiting period.

Market Response to Solana ETF Hype

On the other hand, Solana ETF hype is immediate. On June 28, when the application news broke, SOL rose 7% then rose another 8% when the 19b-4 form was submitted.

>>> Read more: Solana ETF Buzz Propels Dogwifhat to the Forefront, WIF Price Soars 12% in a Day

From a price trend perspective, this indeed raises suspicions of capital-driven ETF hype for SOL. Even if not approved, during the 240-day approval period, with continuous news push, true or false, prices are likely to see a support effect. The election outcome will directly affect overall market prices.

However, from retail investor comments, there seems to be a wait-and-see attitude towards this ETF, with little buy-in so far. There’s still a long way to go, and perhaps everyone is waiting for the next, more promising ETF.

>>> Read more:

-

Bitcoin Plunge: One Statistic Reveals Who’s Panicking and Who’s Not

-

2024 Crypto Market Alert: Dangerous Bubbles in Altcoins, Tap-to-Earn, and AI Stocks

▶ Buy Solana at Binance

Enjoy up to 20% off on trading fees! Sign up Now!

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!