KEYTAKEAWAYS

- Unlike traditional PoS (Proof of Stake), PoL directly binds network security with liquidity depth

- BERA's market cap is $428.3M, ranking 112th among public chains

- With PoL mechanism implementation, Berachain often delivers yields exceeding 100% APY through its built-in DeFi systems

CONTENT

The crypto market in 2025 is undergoing a severe test. Against the backdrop of continuous Fed rate hikes and increasing global economic uncertainty, Bitcoin prices continue to fluctuate in the $65,000-$103,000 range, while the altcoin market has fallen into a slump. However, in such a market environment, a new Layer 1 public chain called Berachain has risen against the trend, achieving remarkable results.

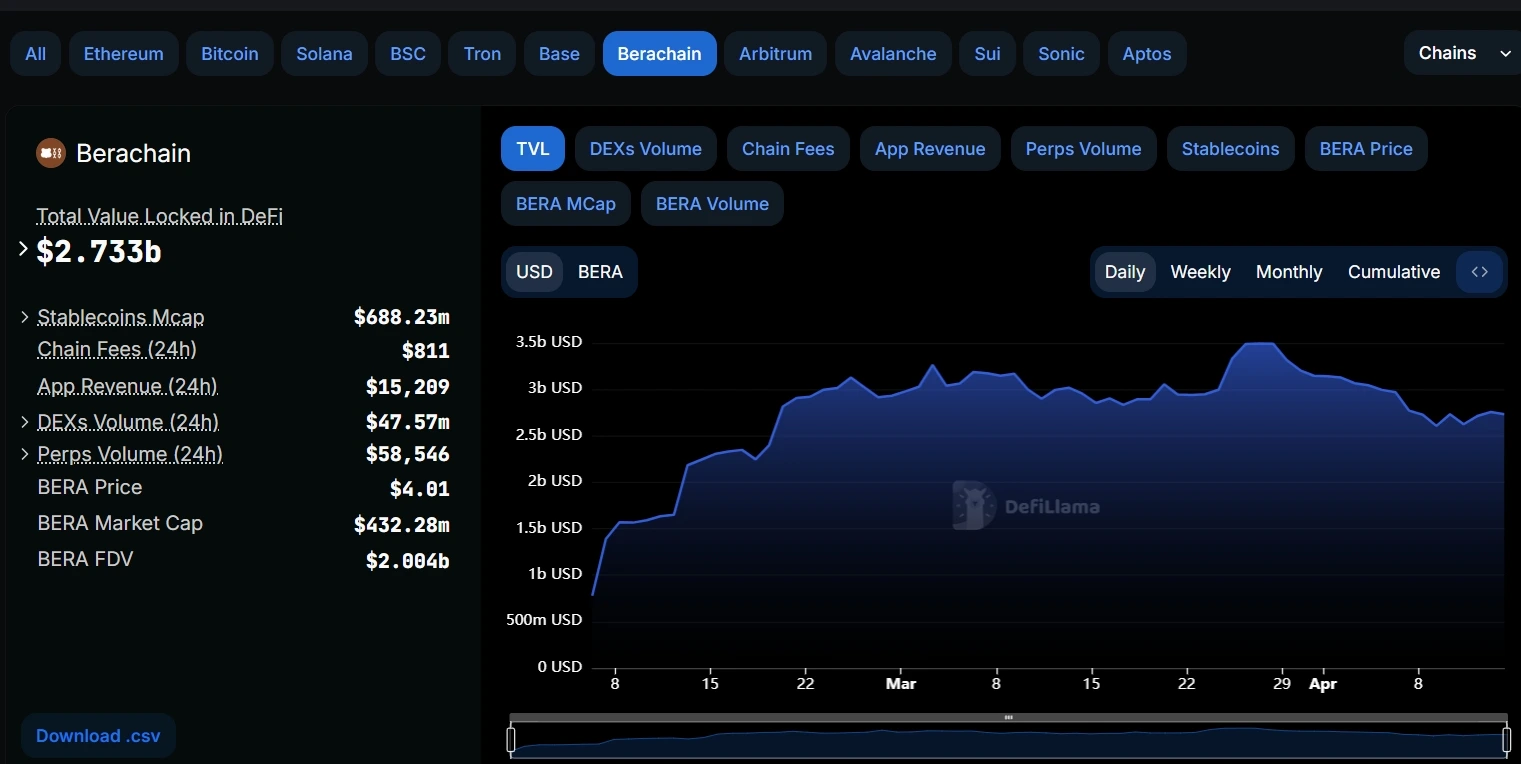

DeFiLlama data shows that Berachain achieved a net inflow of $360 million within one month after its mainnet launch, ranking second among all public chains during the same period, only behind the Coinbase-supported Base network. Even more surprisingly, its Total Value Locked (TVL) has stabilized at around $2.733 billion, successfully ranking as the sixth largest public chain across the entire network, surpassing several established competitors.

What magic does this EVM-compatible chain, which adopts the Proof-of-Liquidity (PoL) mechanism, possess to attract such a large amount of capital in a bear market? Can its innovative consensus mechanism truly solve the core problems faced by traditional blockchains? More importantly, after experiencing a series of events such as dramatic token price fluctuations and airdrop distribution controversies, can Berachain’s “liquidity narrative” be sustained?

BERACHAIN’S TECHNOLOGICAL ARCHITECTURE INNOVATION AND BREAKTHROUGHS

Proof of Liquidity (PoL): Redefining Network Security

Berachain’s most core innovation lies in its unique Proof of Liquidity mechanism. Unlike traditional PoS (Proof of Stake), PoL directly binds network security with liquidity depth. In this system, users earn BGT (Berachain Governance Token) rewards by providing liquidity to ecosystem dApps, while validators determine BGT allocation direction based on the incentive levels provided by various dApps.

This design creates a positive cycle: dApps increase incentives to gain more liquidity → more users are attracted by high yields → network liquidity depth increases → system security improves. According to official Berachain data, in the first month after mainnet launch, the TVL of its leading liquidity protocol Infrared Finance exceeded $1.2 billion, validating the practical effectiveness of this mechanism.

Three-Pillar Technical Stack

Berachain’s technical architecture consists of three key components: BeaconKit, Honey, and BEX.

- BeaconKit: A modular EVM consensus framework, improved based on CometBFT, achieving single-slot finality

- Honey: An over-collateralized stablecoin system, backed by mainstream stablecoins such as USDC, pyUSD, etc.

- BEX: A native decentralized exchange, adopting Balancer’s weighted pool design

This combination ensures compatibility with the Ethereum ecosystem while providing infrastructure support for liquidity through native stablecoins and DEX. According to developer documentation, Berachain’s testnet TPS has exceeded 2000, with mainnet actual latency under 2 seconds, placing its performance metrics at industry-leading levels.

BERACHAIN TOKEN ECONOMICS AND MARKET PERFORMANCE

BERA, as the network’s native token, serves multiple functions:

- Gas fee payment: All on-chain transactions are settled in BERA

- Network security: Validators need to stake BERA to participate in block production

- Governance voting: Holders can participate in key protocol decisions

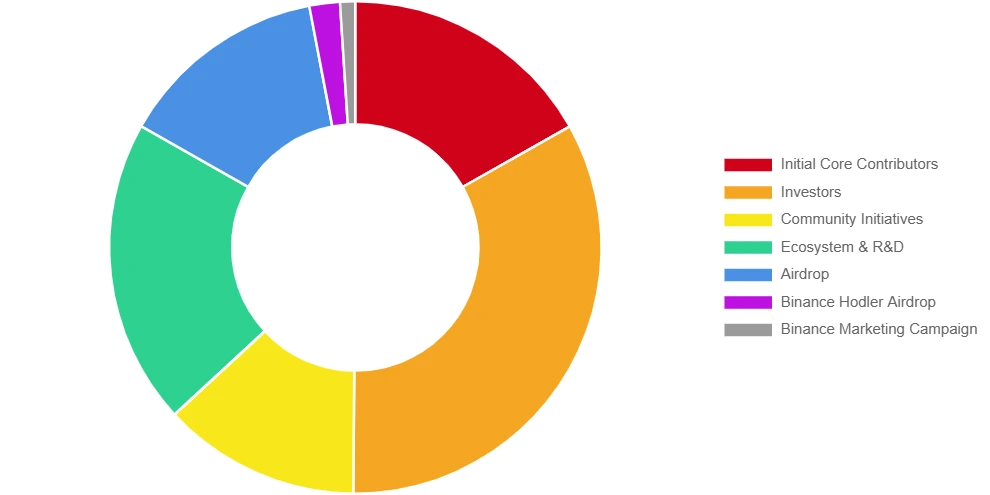

Its economic model design is quite distinctive: initial supply of 500 million tokens, no hard cap, with an annual inflation rate of 10%. As of April 2025, the circulating supply is approximately 107 million tokens, of which 21.5% has entered circulation through airdrops and market distribution.

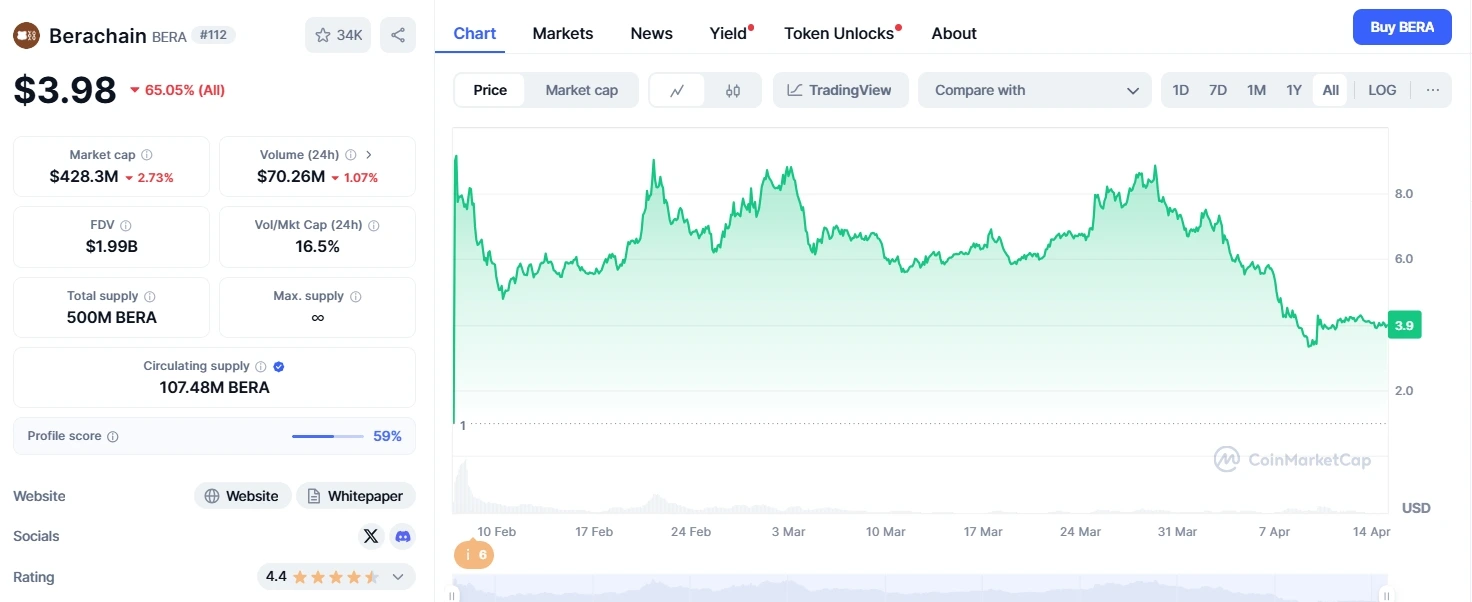

BERA’s market performance has been volatile. The price initially surged to $15.5 shortly after listing, then quickly fell back to fluctuate in the $5-9 range. This dramatic volatility reflects the market’s conflicted psychology toward new public chain tokens: optimistic about their innovative potential, yet concerned about early bubble risks.

The greater controversy comes from token distribution:

- NFT holders received airdrops worth tens of millions of dollars, while ordinary testnet users were allocated only tens of dollars

- 35% of tokens were allocated to institutional investors like VCs, and unlocked tokens were allowed to participate in staking for profit

- Project co-founders were exposed for selling 200,000 BERA tokens received from airdrops

These events have led to community questioning about the project’s degree of decentralization. Even co-founder Smokey the Bera had to admit: “If we could do it again, we might reduce the share given to VCs.”

According to CoinmarketCap data, as of April 14, 2025, BERA is priced at $3.98, with a daily trading volume of $70.26M and a market cap of $428.3M, ranking 112th among public chains.

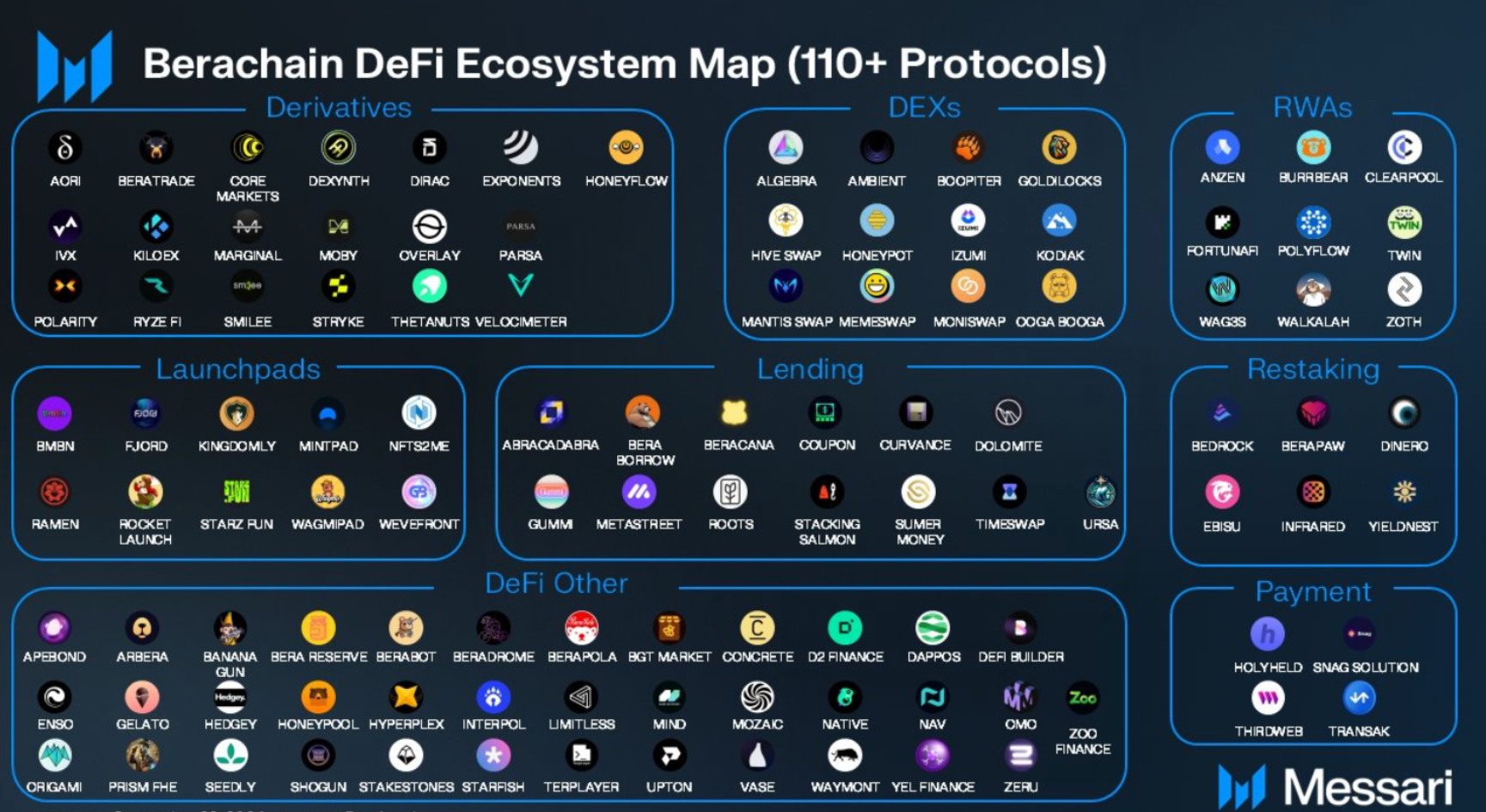

BERACHAIN ECOSYSTEM STATUS AND USER OPPORTUNITIES

DeFi Ecosystem’s “Bribe Economy”

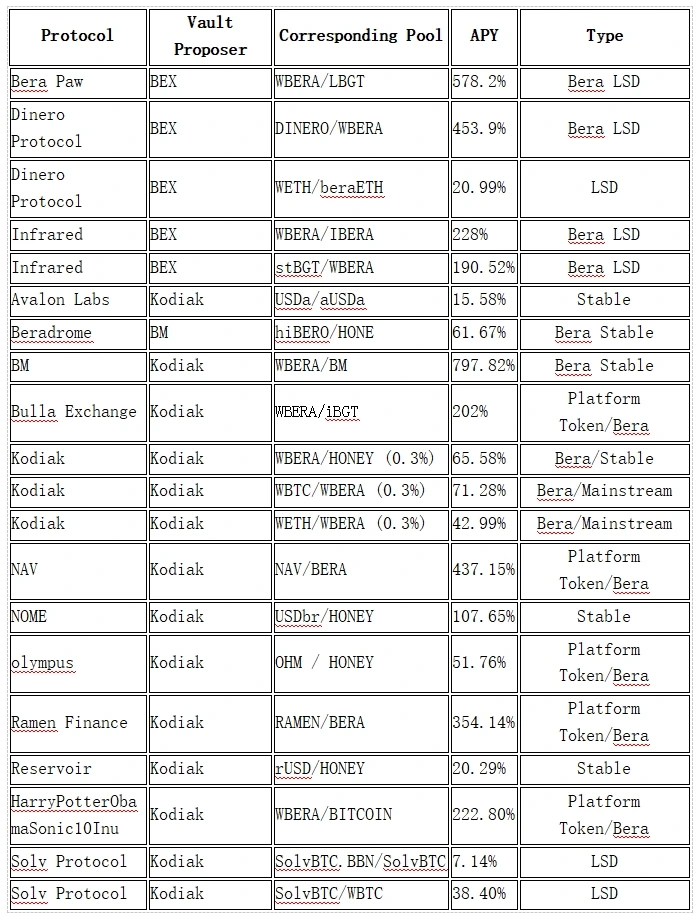

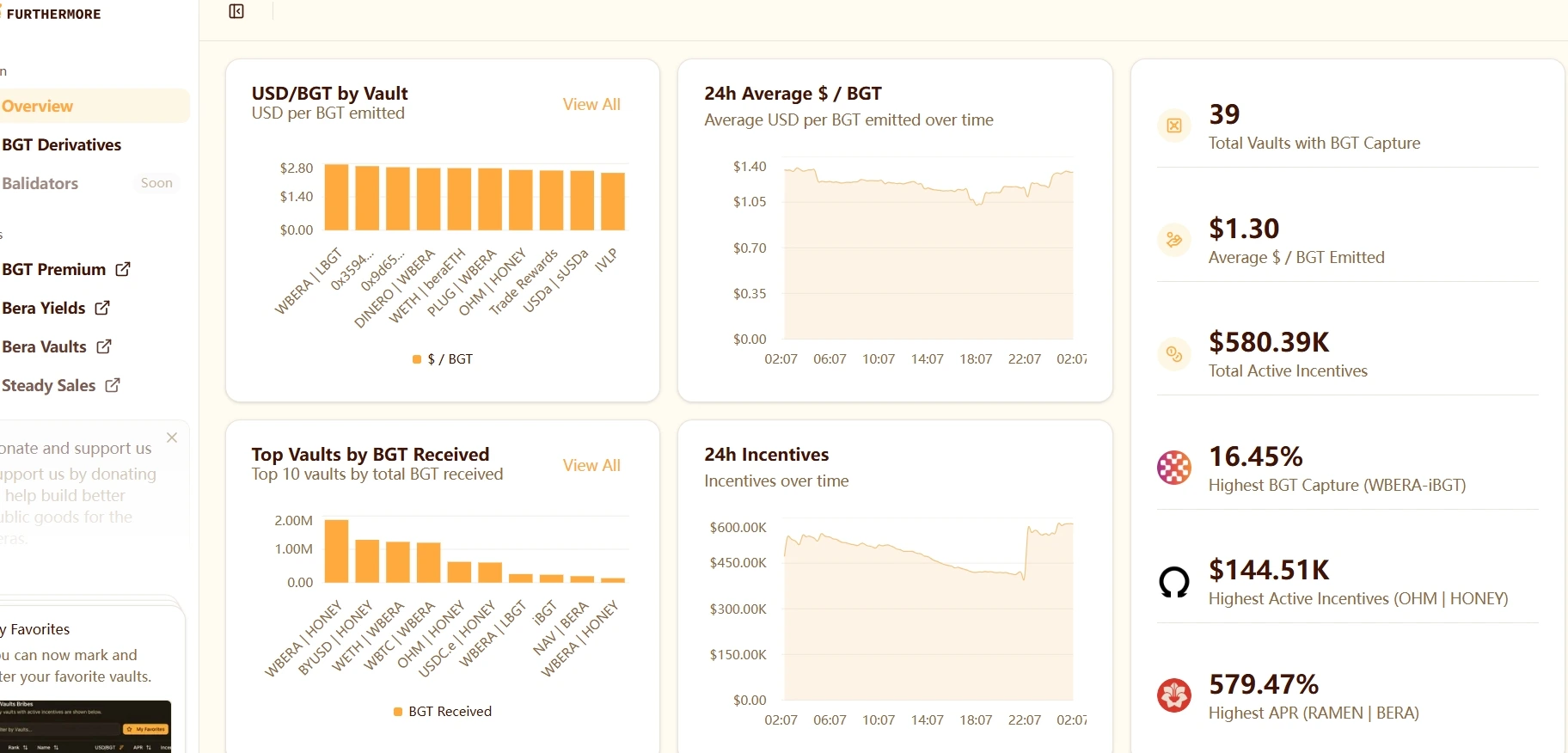

Berachain’s DeFi ecosystem displays unique “bribe competition” characteristics. Various protocols compete to attract liquidity by offering higher incentives:

- Infrared Finance offers up to 95.45% APR for WBERA-HONEY pools

- BEX exchange’s stablecoin pools maintain average APRs around 60%

- Emerging Meme coin pools frequently exceed 1000% APR in the short term

After implementing the PoL (Proof of Liquidity) mechanism, Berachain as a public chain with built-in DeFi mechanisms often delivers yields exceeding 100% APY. Current PoL reward pools organization (data fluctuates significantly, figures in the table are for reference only).

For ordinary users, participation strategies can be divided into three categories:

- Conservative: Configure LSD assets (such as beraETH) for stable returns

- Balanced: Participate in mainstream trading pair liquidity mining

- Aggressive: Chase high APR Meme coin pools, but with higher risks

Breaking Out Attempts: GameFi and SocialFi

Beyond DeFi, the Berachain ecosystem has seen a batch of innovative applications emerge:

- Over/Under: A game livestream prediction platform with over 5,000 daily active users

- Honey Chat: A token-incentivized social network

- bera.tv: An AI-generated entertainment content platform

While these attempts remain small in scale, they demonstrate Berachain’s ambition to build a “full-stack blockchain.” Particularly, Honey Chat’s design of tokenizing social reputation might provide new insights for Web3 social networking.

Business and Development Progress

Google Cloud Platform: Berachain has partnered with Google Cloud Platform (GCP) as its primary cloud provider, collaborating on multiple ecosystem and technical initiatives. These include offering Berachain nodes for deployment through GCP, providing testnet and mainnet data in BigQuery, collaborating on AI initiatives, GCP operating mainnet validators, and supporting Build-a-Bera by offering $200,000 in cloud credits to startups.

LayerZero: An omnichain interoperability protocol connecting different blockchains, enabling secure cross-blockchain communication and asset transfers without relying on traditional bridges. LayerZero will serve as the canonical bridge for Berachain mainnet.

Magic Eden: A leading NFT marketplace allowing users to buy, sell, and trade NFTs across multiple blockchains including Solana, Ethereum, and Bitcoin. Magic Eden has partnered with Berachain and the Berachain ecosystem to build a hub for users interested in Berachain ecosystem NFTs and will launch some of the first NFTs on Berachain mainnet.

Paypal USD: Paypal USD (pyUSD) is a dollar-backed stablecoin issued by PayPal, designed to maintain a 1:1 value with the US dollar. It is fully backed by US dollar deposits, short-term US treasuries, and similar cash equivalents. pyUSD is one of the stablecoins backing Berachain’s native stablecoin HONEY.

USDT0: USDT0 is Tether’s new omnichain USD stablecoin designed to unify liquidity across multiple blockchains. Built on LayerZero’s Omnichain Fungible Token (OFT) standard, USDT0 enables seamless and secure cross-chain transfers without separate deployments, liquidity pools, or bridging solutions. USDT0 participated in the Berachain Boyco program.

Goldsky: Goldsky provides real-time blockchain data services for Web3 developers, offering tools like instant subgraphs and flexible data flow pipelines to simplify the creation of data-driven decentralized applications.

The Graph: The Graph is a decentralized indexing protocol for organizing and querying blockchain data, enabling developers to easily access and use on-chain data for their applications through open APIs called subgraphs.

A GREAT EXPERIMENT ABOUT LIQUIDITY

The emergence of Berachain represents a rethinking of the essential nature of liquidity in the blockchain industry. It introduces the concept of “liquidity premium” from traditional finance into the blockchain’s foundation, attempting to solve the fundamental problem of liquidity fragmentation in DeFi lego blocks. Although its economic model and governance structure remain controversial, it’s undeniable that this project has brought new ideas to Layer 1 competition.

As a senior analyst said: “Berachain will either become a disruptor that redefines public chain rules, or it will become one of the most fascinating experiments in crypto history.” For ordinary investors, perhaps they should participate with an experimental mindset: using affordable funds to experience its innovative mechanisms while maintaining a clear awareness of the risks.

In this great experiment concerning liquidity, the only certainty is that the pace of blockchain innovation will never stop. Whether Berachain can grow from a newcomer to an evergreen tree, time will provide the best answer.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!