KEYTAKEAWAYS

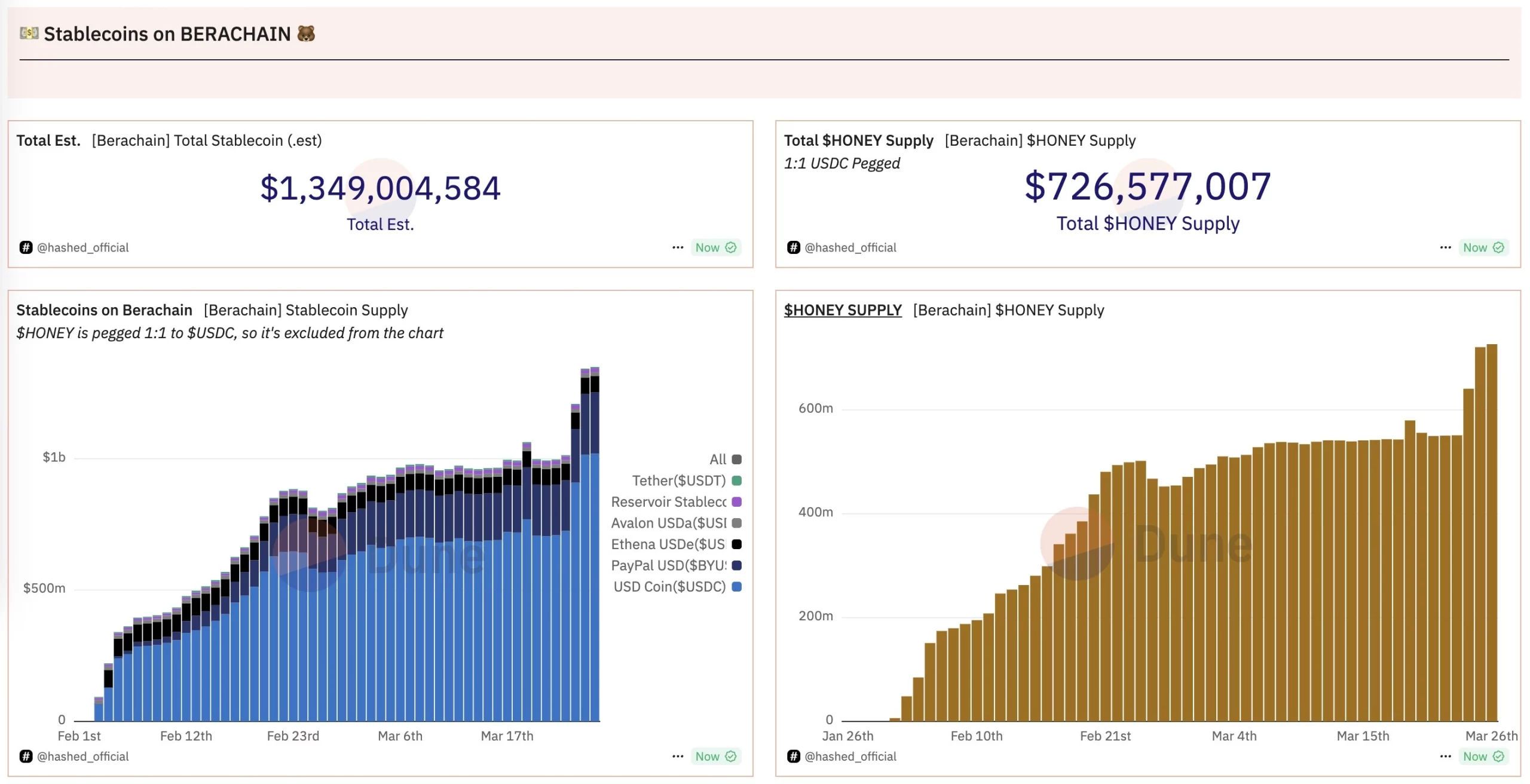

- Berachain stablecoin supply exceeds $1.3 billion

- Proof of Liquidity (PoL) Redefines DeFi Incentives

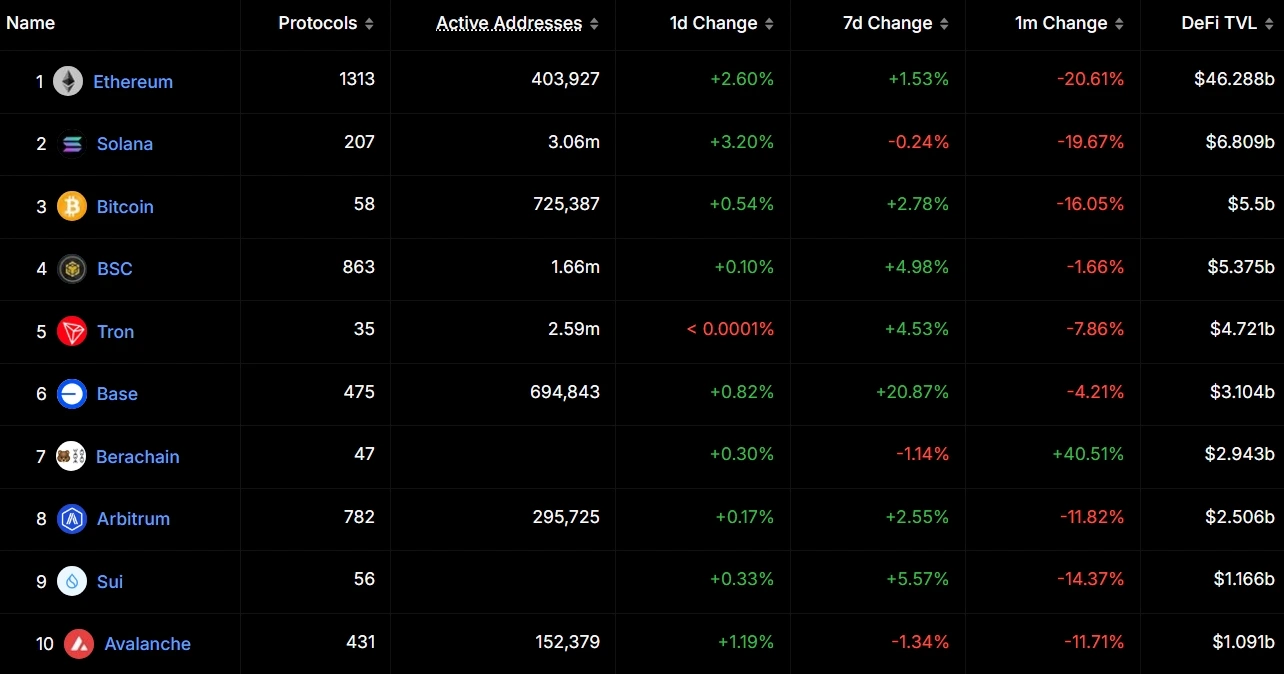

- Berachain Reached Public Chain TVL Top 7 in Two Months

CONTENT

In the first quarter of 2025, the public chain sector welcomed a dark horse—Berachain. Since the launch of its Proof of Liquidity (PoL) mechanism, within just two months, on-chain data has shown explosive growth: total stablecoin supply has reached $1.3 billion, $HONEY token market cap stands at $726 million, and Total Value Locked (TVL) on-chain has soared to $2.943 billion (ranking 7th among public chains), with stablecoin Annual Percentage Rate (APR) reaching over 20%. This series of impressive performances has quickly made Berachain the focus of the industry.

What exactly has allowed Berachain to stand out in the highly competitive public chain market? The answer lies in its innovative PoL consensus mechanism, unique dual-token economic model, and self-reinforcing liquidity flywheel effect. This article will deeply analyze Berachain’s growth logic and explore its future potential.

PROOF OF LIQUIDITY (POL) REDEFINES DEFI INCENTIVES

Traditional Proof of Stake (PoS) mechanisms require users to stake tokens to maintain network security, but this leads to a fundamental contradiction: staked funds are locked and cannot simultaneously be used for DeFi liquidity. Berachain’s PoL mechanism cleverly solves this problem by directly linking liquidity provision (LP) with network security.

There are two core native assets in the Berachain ecosystem: BERA and BGT.

- BERA: Gas token, used to pay transaction fees and serves as the base asset for validator staking.

- BGT: Governance token, non-transferable but can be earned through liquidity mining and can be exchanged 1:1 through burning.

- BGT can be exchanged (or burned) 1:1 for BERA, but more importantly, BERA cannot be converted back to BGT.

Berachain’s Proof of Liquidity mechanism creates a win-win ecosystem through a carefully designed incentive system. Its core operating logic can be broken down into the following key components:

First, validators need to stake BERA to qualify for block production. Notably, while block production rights depend on the amount of BERA staked, the validators’ main source of income comes from $BGT rewards. This design cleverly separates network security from economic activity, making validators focus not only on simple staking behavior but also on actively participating in ecosystem building.

Second, the majority (about 84%) of the BGT generated by the system is distributed as rewards. This allocation mechanism ensures that incentive funds flow to the most valuable application scenarios, forming a market-based resource allocation.

Finally, the entire system forms a self-reinforcing positive cycle: users earn $BGT rewards by providing liquidity, then delegate these governance tokens to validators they trust; validators with more delegations can allocate more incentives to quality protocols; and quality protocols with incentives can provide more attractive yields, attracting more users to participate. This flywheel effect continuously drives the ecosystem toward higher efficiency and deeper liquidity.

This mechanism design not only solves the problem of capital idling in traditional PoS but, more importantly, creates a new economic model that closely combines network security, liquidity supply, and protocol development. Each participant can find their own interest point while jointly promoting the value growth of the entire network.

Berachain’s PoL mechanism builds an ingenious ecological closed loop, directly transforming liquidity supply into network security guarantees. This self-reinforcing model presents a clear evolutionary path: more liquidity → lower slippage → higher transaction volume → more fee income → attracting more users and developers. The mechanism not only improves capital efficiency but also deeply binds network security with DeFi growth.

HOW BERACHAIN REACHED PUBLIC CHAIN TVL TOP 7 IN TWO MONTHS

High-yield Mining: Stablecoin APR Exceeds 20%

The most notable aspect of the Berachain ecosystem is currently its impressive yield performance. The platform’s stablecoin pool annual percentage rate (APR) has broken through the 20% mark, a figure that not only crushes traditional financial markets but also leaves other mainstream DeFi protocols in the dust. Such attractive returns mainly come from two major sources:

- $BGT Release: Liquidity providers (LPs) can receive additional incentives through reward vaults.

- Protocol Bribe Competition: Various DApps are adding “bribe” rewards to compete for limited liquidity resources, creating a compounding effect on returns.

Top Protocols Boost Ecosystem Prosperity

- Infrared Finance (TVL exceeding $2 billion) has launched liquid staking solutions iBGT/iBERA, allowing users to maintain flexibility while staking.

- 37 whitelisted reward vaults have been launched simultaneously, covering core tracks such as DEX and lending, forming diversified income opportunities.

Revolution in Capital Efficiency

Compared to the capital idling problem in traditional PoS mechanisms, Berachain’s PoL achieves breakthrough innovation:

- Dual Asset Utility: Staked funds can simultaneously participate in DeFi liquidity provision, increasing fund utilization by 15-25%.

- Stacked Yield Model: Users only need to provide liquidity on DEX to simultaneously earn: regular trading fees, BGT token rewards, and additional income from delegated BGT. This “three-in-one” design completely rewrites the logic of DeFi returns.

CAN BERACHAIN CONTINUE TO LEAD?

Despite Berachain showing strong development momentum, its innovative PoL mechanism still faces several key challenges. Berachain’s PoL involves multi-layer incentives, which can be complex to operate, making it difficult for ordinary users to optimize returns. If DApp bribes are insufficient, the sustainability of incentives is hard to guarantee. BGT holders may sell BERA, putting pressure on the token price.

If the PoL mechanism continues to be successfully validated, Berachain could become the first L1 to achieve deep integration of DeFi and network security, possibly even driving a new wave of “DeFi 2.0.” If its model is widely adopted, it could disrupt the competitive landscape of traditional PoS public chains.

Berachain’s rise is no coincidence. Its innovative PoL mechanism, high-yield incentives, and capital efficiency optimization have quickly propelled it into the ranks of top public chains in a short time. Despite existing challenges, Berachain has proven its potential; it is an economic system that integrates liquidity, security, and DeFi growth.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!