KEYTAKEAWAYS

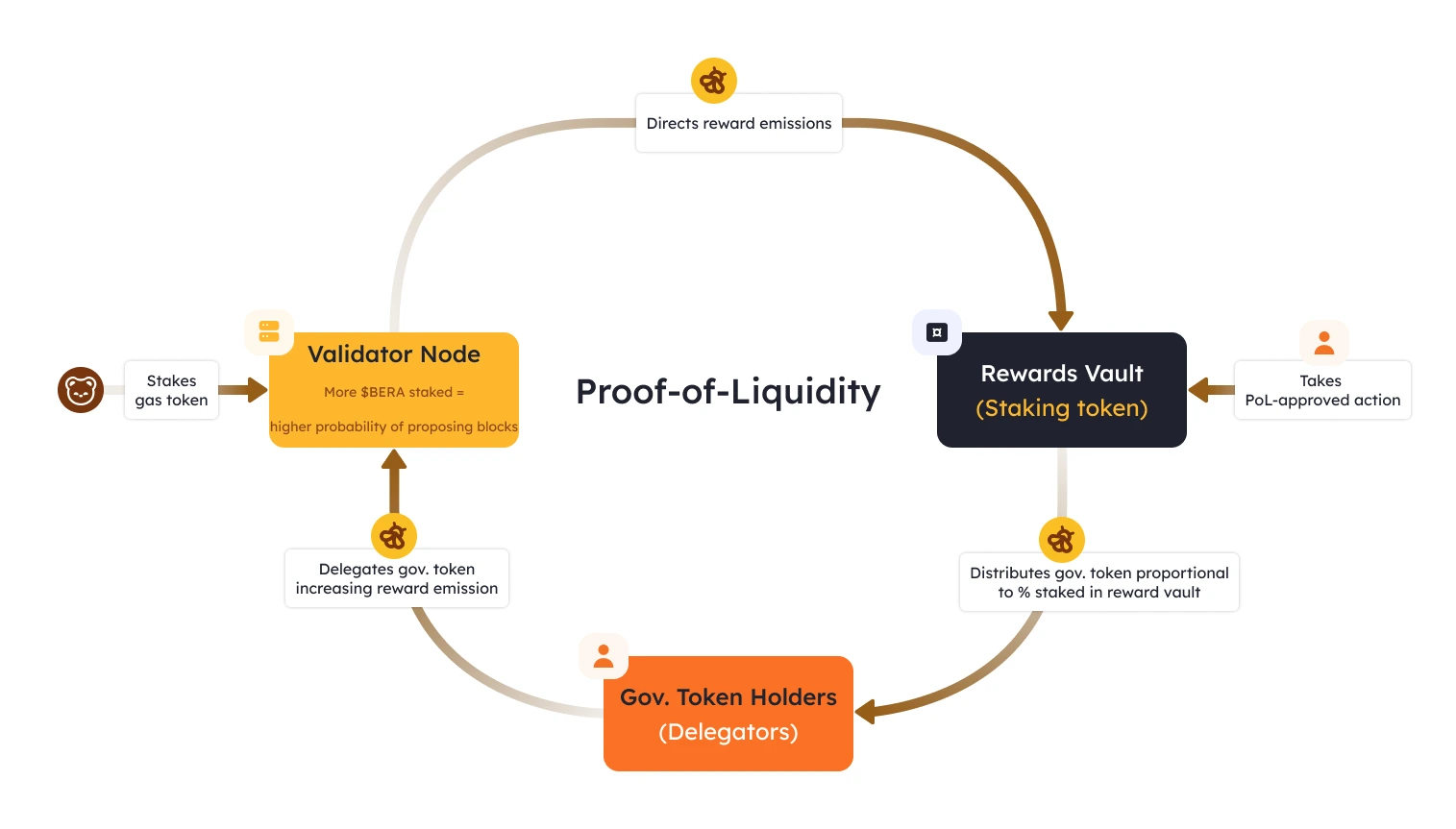

- Berachain’s Proof of Liquidity (PoL) mechanism incentivizes liquidity providers, offering sustainable growth and efficient decentralized finance on a Layer 1 blockchain.

- With a three-token economy (BERA, BGT, HONEY), Berachain balances rewards, governance, and stability, creating a flexible ecosystem for DeFi participants and developers.

- Berachain’s interoperability with the Cosmos SDK and Ethereum makes it adaptable, enabling seamless cross-chain interactions while maintaining low-cost, gas-free DeFi applications.

CONTENT

Discover Berachain, a Layer 1 blockchain with innovative Proof of Liquidity (PoL) and a unique three-token system, reshaping decentralized finance and solving liquidity challenges in DeFi.

Berachain is a Layer 1 blockchain built using the Cosmos SDK and is compatible with Ethereum Virtual Machine (EVM). It aims to solve the long-standing liquidity issues in decentralized finance (DeFi) with its innovative Proof of Liquidity (PoL) consensus mechanism and a unique three-token economic model.

(Source: Berachain)

By leveraging these innovations, Berachain seeks to create a highly efficient, flexible, and liquidity-rich ecosystem for decentralized finance.

THREE-TOKEN ECONOMY: BERA, BGT, AND HONEY

Berachain’s tokenomics is quite different from traditional blockchain models. It uses a three-token structure, consisting of BERA, BGT, and HONEY, with each token serving a distinct function. This design breaks away from the one-token model and provides multiple layers of incentive mechanisms to support the ecosystem’s growth and sustainability.

• BERA: The Lifeblood of the Network (Gas Token)

BERA is the native gas token of the Berachain network, used to pay transaction fees on the chain, similar to Ethereum’s ETH. However, BERA also plays a role in rewarding users. By participating in activities like staking and providing liquidity, users can earn BERA tokens. This circulation model not only drives user engagement but also helps sustain the network’s health and growth.

• BGT: The Foundation of Governance (Governance Token)

BGT is a non-transferable governance token. Users can earn BGT by staking assets that meet the PoL standard. Holders of BGT tokens can participate in the governance of the Berachain network and share in the protocol’s revenue distribution. Additionally, BGT can be burned to obtain BERA, creating a healthy cycle of interaction between the tokens.

• HONEY: The Stable Foundation (Stablecoin)

HONEY is Berachain’s native stablecoin, designed with an over-collateralized model. Users can mint HONEY by collateralizing other digital assets. HONEY serves as a core tool in Berachain’s DeFi applications, acting as a stable medium for lending, borrowing, and trading within the ecosystem.

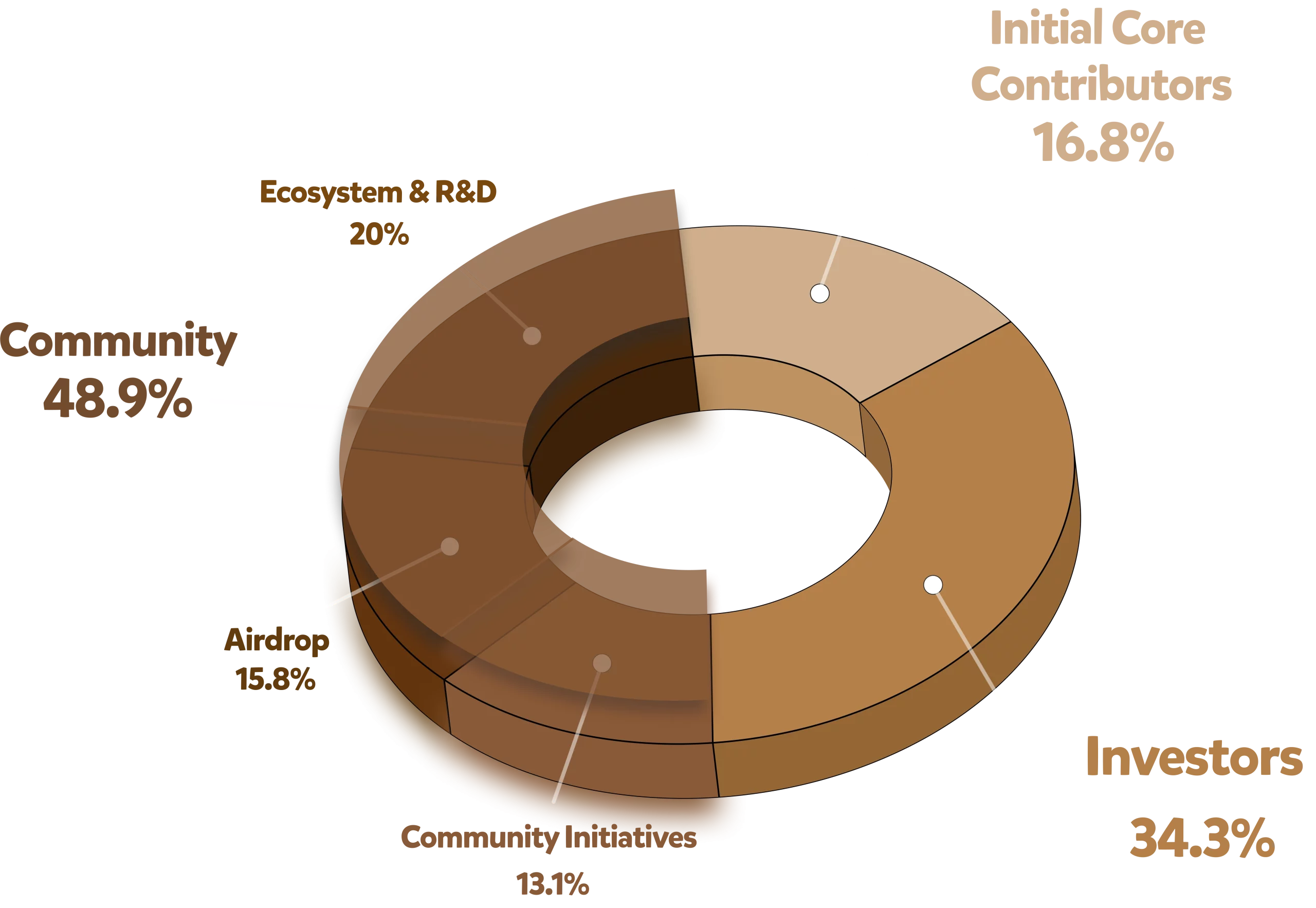

TOKEN DISTRIBUTION AND LIQUIDITY SUPPORT

To promote the healthy growth of its tokenomics and ensure initial liquidity for the ecosystem, Berachain adopted a variety of strategies, including the Boyco, RFA (Request for Application), and RFC (Request for Community) programs. These mechanisms provide liquidity support for early teams and help distribute tokens more effectively to bootstrap the network.

As of January 31, the Pre-Boyco vaults, managed by protocols like Stakestone, Ether.fi, and Ethena, along with the Boyco vaults launched on January 28, have already secured 2% of the initial BERA token supply. This initiative, which has seen a total deposit of $2.35 billion, demonstrates the strong interest and support for Berachain’s early-stage liquidity.

(Source: Berachain)

The partnership with Ramen Finance also gained significant attention. Once Berachain’s mainnet launches, Ramen Finance will initiate a token issuance campaign, collaborating with several partners to build out the ecosystem. The total supply of $RAMEN tokens is capped at 100 million, with no further issuance planned. The distribution of $RAMEN tokens will be as follows:

• 21 million $RAMEN will be unlocked in the form of gRAMEN and distributed to Hungrybera NFT holders and community members;

• 8 million $RAMEN will be allocated for liquidity and initial pool injection;

• 71 million $RAMEN will be released linearly over 12 to 18 months and allocated to community incentive funds, ecosystem vaults, and key contributors.

DIVERSE DEFI APPLICATIONS: UNLOCKING BERACHAIN’S POTENTIAL

Berachain’s technological innovations are not limited to its underlying architecture. The platform also features a variety of DeFi applications that are already showing great potential for growth. These applications offer users a range of opportunities to engage with the ecosystem and earn value.

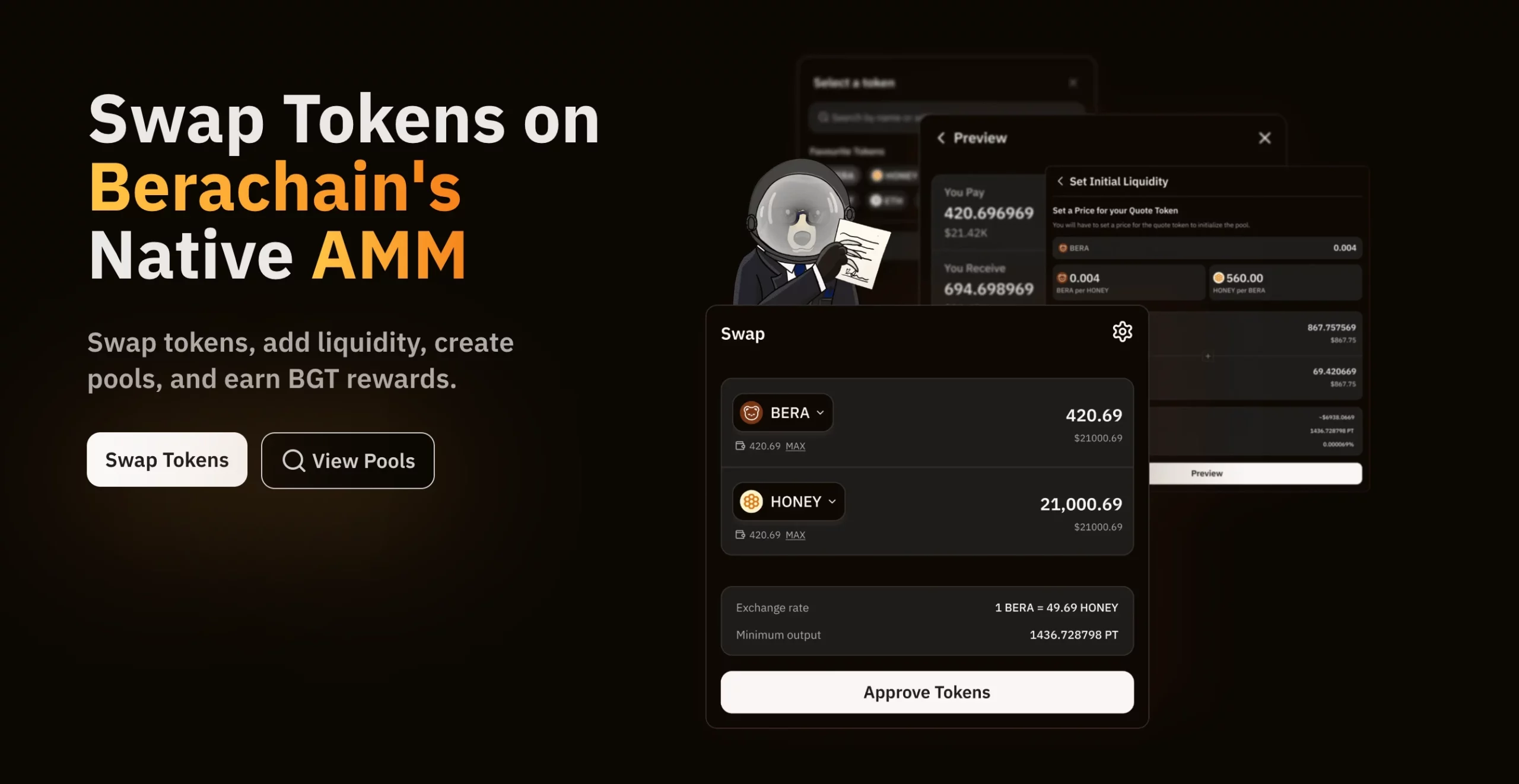

• BEX: A Gas-Free DEX Experience

(Source: Berachain)

BEX is the native decentralized exchange (DEX) on Berachain, allowing users to trade various tokens without paying gas fees. This feature significantly reduces transaction costs for users. Additionally, BEX’s cross-chain compatibility enables seamless token swaps between different blockchain networks, enhancing user experience.

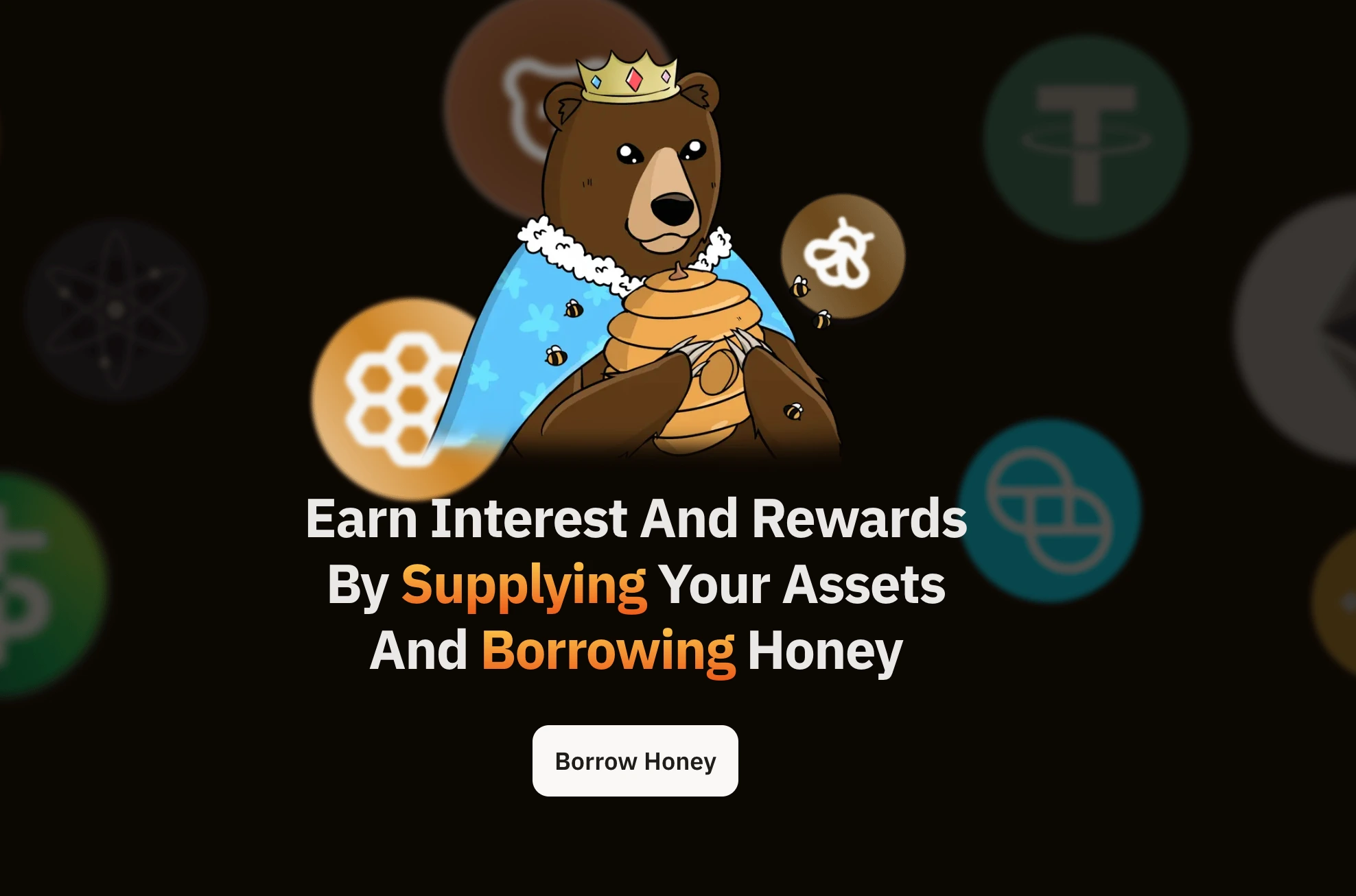

• BEND: Earning Passive Income with Ease

(Source: Berachain)

BEND is a lending platform on Berachain where users can deposit HONEY stablecoins to earn interest. This platform provides a low-barrier way for DeFi users to earn passive income while also stabilizing the supply of HONEY tokens.

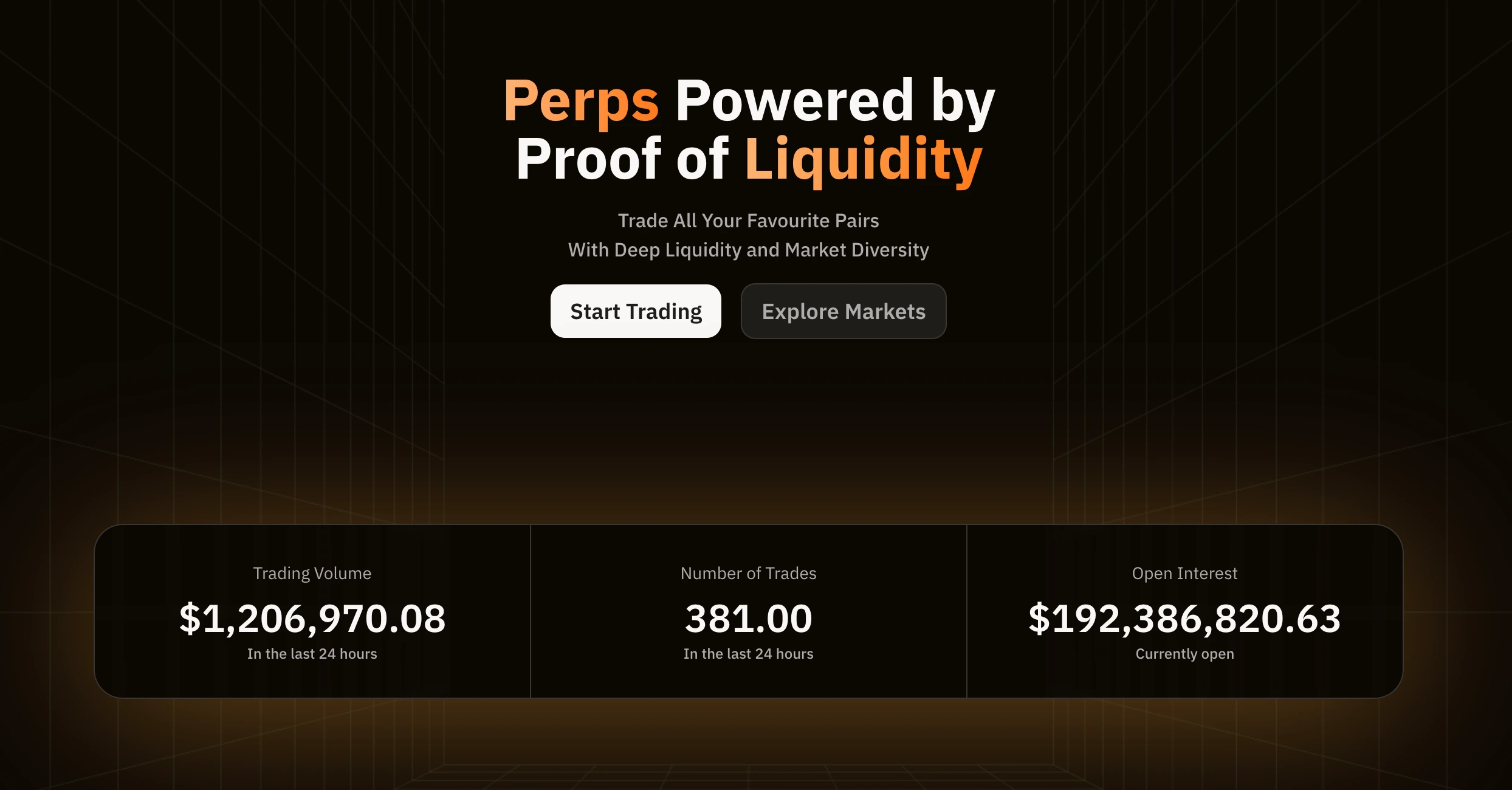

• BERP: A Perpetual Contract Trading Platform

(Source: Berachain)

BERP offers perpetual contract trading based on HONEY. Users can engage in leveraged trading and earn rewards through liquidity mining, making it a valuable addition to the DeFi space on Berachain.

• Seamless Integration with the Cosmos Ecosystem

Built on the Cosmos SDK, Berachain enjoys seamless interoperability with other Cosmos-based chains. This compatibility opens the door to a range of cross-chain applications, enabling developers and users to access a broader set of decentralized finance tools.

LONG-TERM PROSPECTS: OPPORTUNITIES AND CHALLENGES AHEAD

While Berachain presents significant opportunities, its long-term development will face several challenges. The platform’s success will depend on how well it can maintain user and protocol engagement, build a unique competitive edge, and ensure sustainability over time.

Opportunities

• Innovative PoL Consensus Mechanism

The Proof of Liquidity (PoL) consensus mechanism is one of Berachain’s core innovations. It encourages liquidity providers to stake their funds in the network and share the profits. Unlike traditional PoS or PoW mechanisms, PoL directly ties incentives to market needs, fostering healthier and more sustainable growth for the network.

• Strong Ecosystem and Community

Berachain has already built a strong ecosystem and community before the mainnet launch, which is a rare achievement in the blockchain space. This early-stage development has attracted a wide range of developers and users, laying a solid foundation for future growth and innovation.

• Modular Architecture and EVM Compatibility

Berachain’s modular architecture gives it greater scalability and flexibility, allowing it to adapt quickly to changes in the DeFi ecosystem. Additionally, its compatibility with Ethereum makes it easier for developers to migrate existing Ethereum-based projects to Berachain with minimal costs.

• Balanced Token Economics

The three-token model provides a balanced incentive structure that caters to different types of users, including liquidity providers, governance participants, and ecosystem builders. This design ensures that all stakeholders are incentivized to actively participate in the ecosystem, supporting its growth in a sustainable manner.

Challenges

• Sustainability of the Ecosystem Reward Structure

While Berachain’s reward system through Boyco and RFA/RFC programs has provided early-stage liquidity, it remains to be seen whether this structure can sustain itself in the long term. The continued success of the network depends on its ability to attract enough protocols and users to maintain its ecosystem.

• Intensifying Competition

As a Layer 1 blockchain, Berachain faces competition from other major platforms. It will need to establish a differentiated value proposition and a competitive edge to succeed in an increasingly crowded market.

• Stability of the Token Economic Model

The sustainability of Berachain’s tokenomics depends on how well it balances incentives and risks. If the network lacks sufficient incentives or if the economic model doesn’t align with actual demand, the value of the tokens may fluctuate, undermining the network’s stability and growth.

CONCLUSION

Through its innovative technology and economic model, Berachain is addressing liquidity challenges in the blockchain space while creating a highly capital-efficient DeFi ecosystem. As the mainnet launches and more projects join the network, Berachain has the potential to become a significant and unique player in the DeFi ecosystem.

Also Read:

Berachain Mainnet Launch and Proof of Liquidity Mechanism: A New Paradigm in Blockchain Economics