KEYTAKEAWAYS

- Marathon, a leading Bitcoin miner, holds over 40,000 BTC and has implemented a full HODL strategy while expanding its mining operations.

- Different companies employ varied Bitcoin strategies: Marathon focuses on accumulation, CleanSpark prioritizes operational expenses, and Tesla signals mainstream adoption.

- Companies like Semler Scientific demonstrate Bitcoin's expanding influence beyond tech, adopting it as their primary treasury reserve asset.

- KEY TAKEAWAYS

- OTHER MAJOR LISTED BITCOIN HOLDERS

- 1. MARATHON: A LEADING BITCOIN MINER

- 2. TESLA: ELON MUSK’S CRYPTO-FRIENDLY EV LEADER

- 3. CLEANSPARK: A MINER WITH NO BTC PURCHASES

- 4. COINBASE: A COMPLIANT U.S. CEX

- 5. SEMLER SCIENTIFIC: INNOVATING HEALTHCARE AND INVESTING BITCOIN

- MOVING FORWARD

- DISCLAIMER

- WRITER’S INTRO

CONTENT

An in-depth analysis of major US-listed Bitcoin-holding companies, including Marathon, Tesla, CleanSpark, Coinbase, and Semler Scientific, exploring their diverse strategies and contributions to the cryptocurrency industry.

In our previous article, we provided a detailed introduction to MicroStrategy’s development and business operations, as well as how it successfully made its way into the Nasdaq-100. However, besides MicroStrategy, there are many other cryptocurrency and Bitcoin-related companies listed on the U.S. stock market. In this article, we will introduce several important companies in detail, which will help readers better understand the current state of the entire crypto industry.

OTHER MAJOR LISTED BITCOIN HOLDERS

Apart from MicroStrategy, there are many other companies that hold significant amounts of Bitcoin. Based on the following picture, we can identify the main categories of companies that possess Bitcoin:

- Mining Companies: Companies like Marathon, are primarily focused on Bitcoin mining. It is worth noting that some mining companies not only engage in mining but also adopt a strategy of purchasing Bitcoin as part of their asset management approach.

- Crypto Industry Firms (Non-Mining): Companies such as Galaxy Digital, which are dedicated to the digital asset and blockchain technology industries, as well as centralized exchanges (CEX) like Coinbase, also hold substantial Bitcoin reserves.

- Other Crypto-Friendly Companies: These are companies like Tesla, which, while not directly involved in the blockchain industry, maintain Bitcoin holdings as part of their crypto-friendly business strategy.

(Source: BitBO)

1. MARATHON: A LEADING BITCOIN MINER

Founded in 2010, Marathon has undergone several transformations throughout its history. Initially not focused on mining, the company began its foray into the digital asset mining business in 2017.

Today, Marathon is a digital asset technology company primarily engaged in the production, or “mining,” of digital assets, focusing on the Bitcoin ecosystem. The company emphasizes mining and holding Bitcoin as a long-term investment.

(Source: Google Finance)

The Bitcoin halving event has intensified operational challenges in the mining industry, as well as competition among miners. Companies are adopting various measures to improve their competitiveness in response to this heightened competition, including increasing hash rates, lowering electricity costs, and expanding data center capacity.

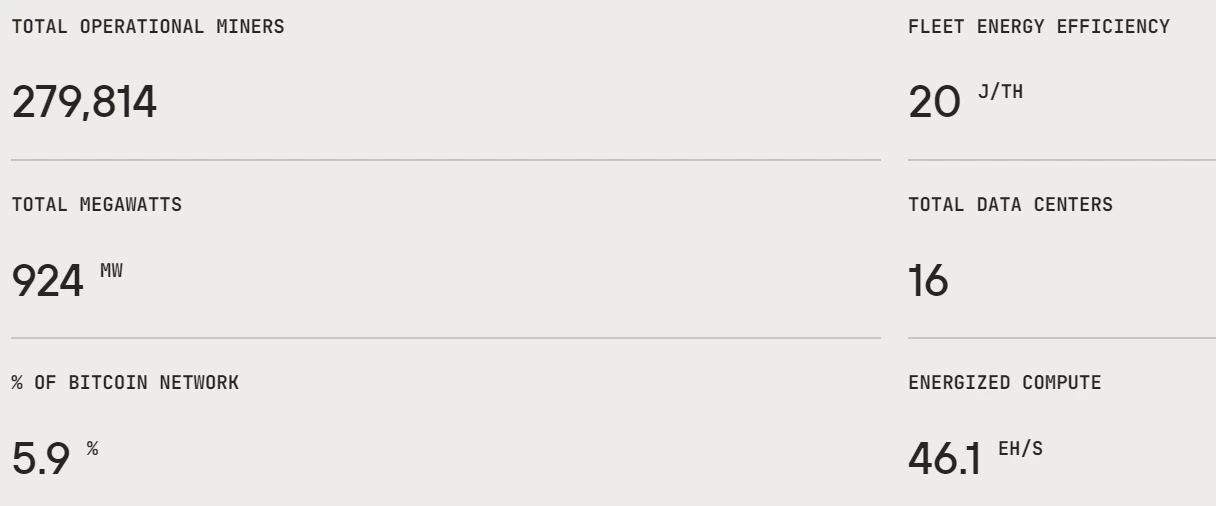

With its substantial scale, Marathon operates 16 data centers, 279,814 operational miners, and an energized compute capacity of 46.1 EH/S.

(Source: Marathon’s Website)

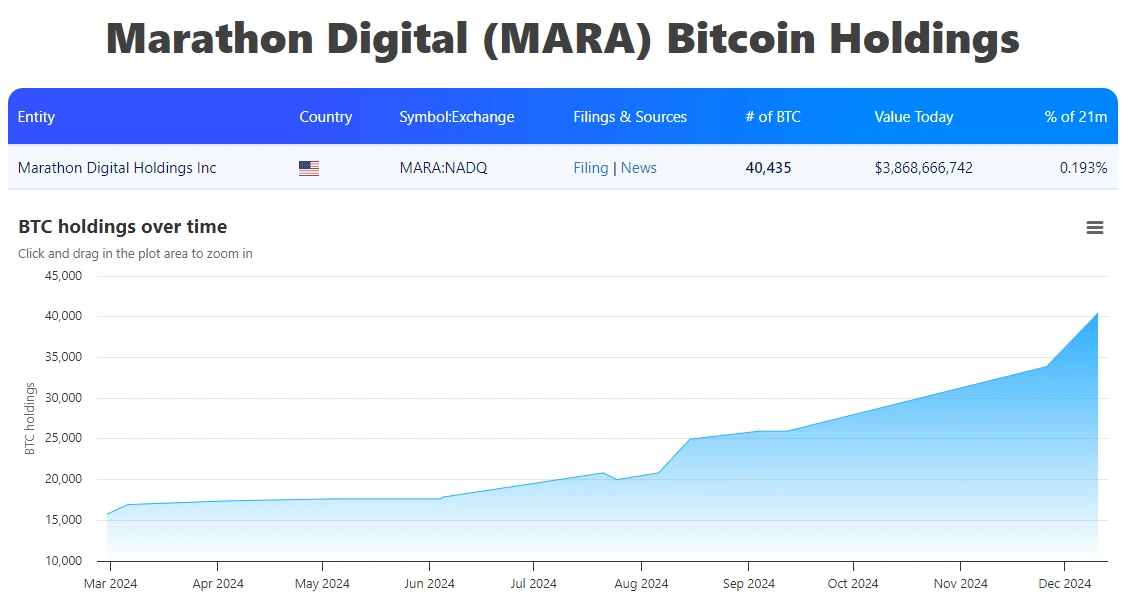

Beyond mining Bitcoin, Marathon has adopted a proactive approach to accumulate more Bitcoin.

Salman Khan, MARA’s Chief Financial Officer, stated, “Bitcoin’s recent price decline, coupled with the strength of our balance sheet, afforded us an opportunity to add to our holdings. We look forward to continuing to leverage our technological expertise to support Bitcoin and distributed digital asset ecosystems.”

On July 25, 2024, Marathon purchased $100 million of Bitcoin.

Furthermore, effective immediately, Marathon will implement a full HODL (Hold On for Dear Life) approach toward its Bitcoin treasury policy. This marks a major shift for the company and reflects its confidence in Bitcoin’s long-term value.

Since then, Marathon has continued to issue convertible preferred notes to acquire more Bitcoin. As of now, the company holds 40,435 Bitcoin, as shown in the picture below.

(Source: BiTBO)

2. TESLA: ELON MUSK’S CRYPTO-FRIENDLY EV LEADER

Founded in 2003, Tesla is a global leader in electric vehicles (EVs) and sustainable energy solutions, known for its innovative technology. Headquartered in Palo Alto, California, Tesla designs, manufactures, and sells electric vehicles, battery storage systems, and solar energy products.

(Source: Google Finance)

Tesla’s CEO, Elon Musk has been a prominent advocate for cryptocurrency, with his tweets often causing significant market movements, known as the “Musk Effect.”

In February 2021, Tesla made headlines by investing $1.5 billion in Bitcoin, signaling its commitment to cryptocurrency. The company also began accepting Bitcoin as payment for vehicles in March 2021, though it paused this in May due to environmental concerns surrounding Bitcoin mining.

This was seen as a significant step towards the mainstream adoption of cryptocurrency in commercial transactions. As of now, Tesla holds 9,720 BTC, as illustrated in the screenshot below.

(Source: BiTBO)

3. CLEANSPARK: A MINER WITH NO BTC PURCHASES

Founded in 2014, CleanSpark is an American Bitcoin miner primarily known for its efforts to integrate clean energy solutions with cryptocurrency mining, positioning itself as a leader in eco-friendly Bitcoin mining.

Similar to MARA, CleanSpark’s core business revolves around Bitcoin mining. However, unlike traditional mining companies, CleanSpark differentiates itself by using renewable energy sources to power its operations.

(Source: Google Finance)

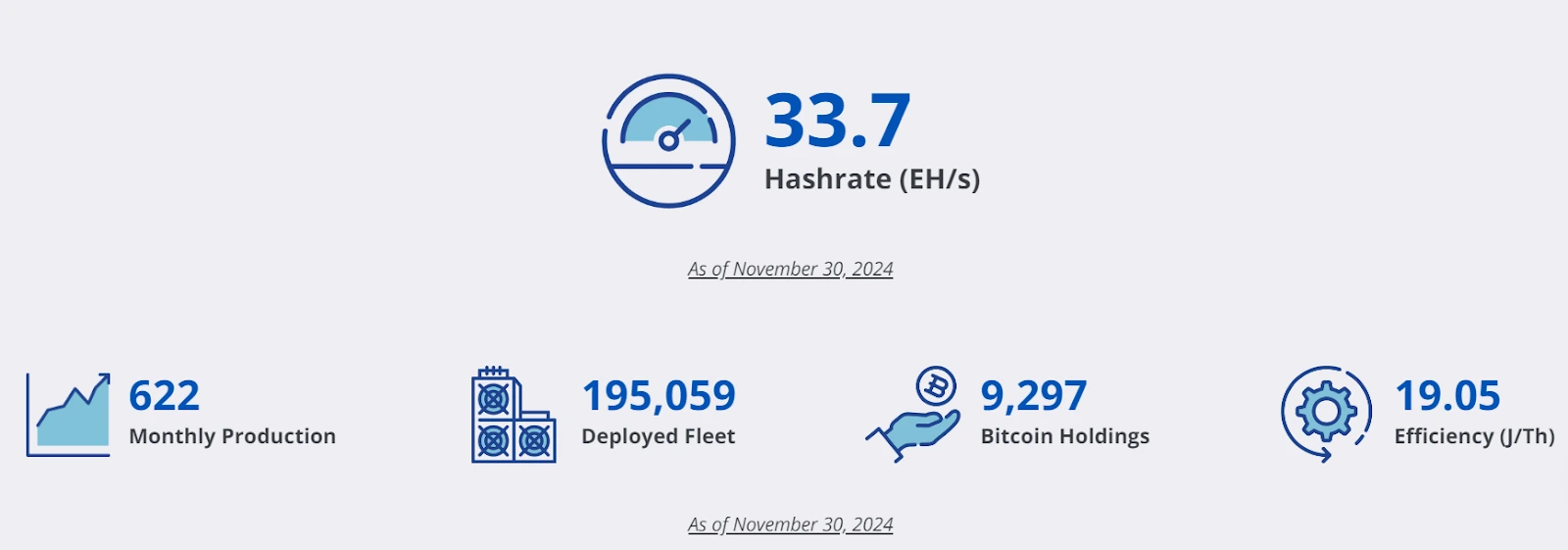

CleanSpark operates Bitcoin mining facilities in several U.S. states, including Wyoming, Mississippi, Georgia, Tennessee, and New York. As of now, the company’s deployed fleet consists of 195,059 miners, with a total hash rate of 33.7 EH/s.

(Source: CleanSpark’s website)

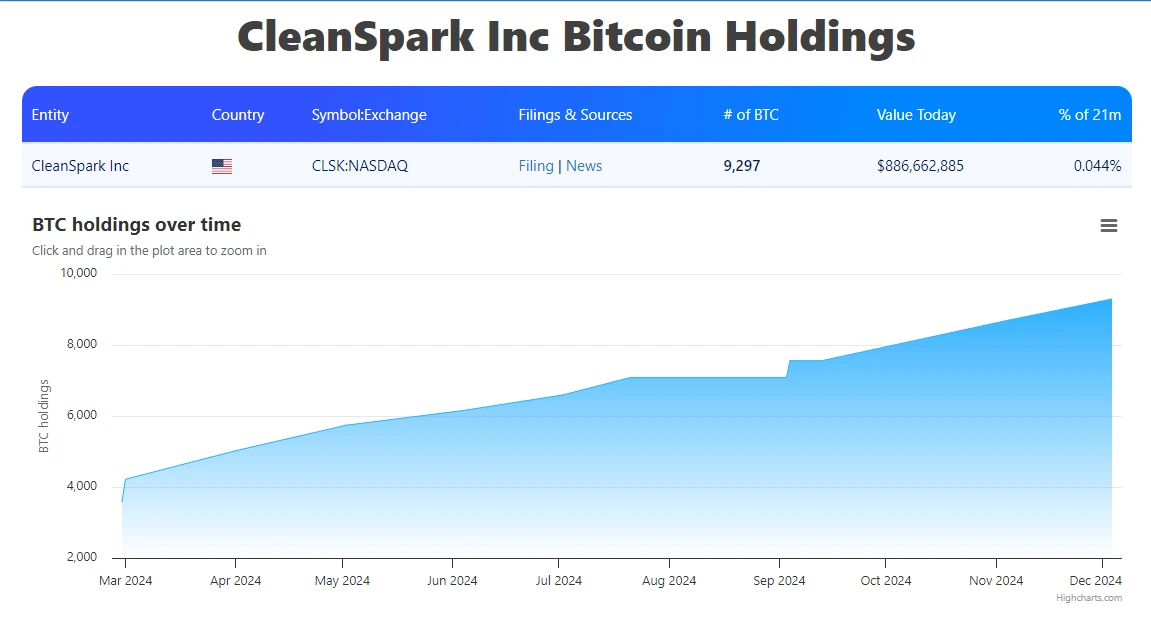

Marathon Corporation has adopted a full HODL strategy for its Bitcoin reserves, in contrast to CleanSpark, which continues to sell a portion of its mined Bitcoin to cover operational expenses.

For instance, in November, CleanSpark sold 26.11 BTC. Additionally, CleanSpark has utilized convertible senior notes as a financing strategy. On December 13, 2024, the company announced the pricing of its offering of $550 million aggregate principal amount of 0.00% Convertible Senior Notes due 2030.

The proceeds from this offering are not intended for Bitcoin acquisitions but will be used for purposes such as covering the cost of capped call transactions, repurchasing shares of its common stock, repaying outstanding balances, and so on.

CleanSpark’s CFO, Gary A. Vecchiarelli, explained that the company prefers to allocate resources toward enhancing its mining capabilities rather than purchasing Bitcoin at prices exceeding $100,000.

He emphasized that “investing in our ability to mine Bitcoin at a production price below $40,000” is a more strategic approach. As of now, CleanSpark holds 9,297 BTC, as illustrated in the screenshot below.

(Source: BiTBO)

4. COINBASE: A COMPLIANT U.S. CEX

Founded in 2012, Coinbase Global is one of the largest and most prominent cryptocurrency exchanges in the world, providing a platform for buying, selling, and storing digital assets. Coinbase generates revenue from three main sources:

- Transactions: Coinbase charges fees on transactions made by retail and institutional investors on the platform.

- Subscription and Services: This includes offerings like Coinbase Pro, which provides advanced trading tools and lower transaction fees.

- Other Activities: Revenue is also generated from the sale of held crypto assets, completing customer-specified trades, and providing storage and transfer services.

(Source: Coinbase’s Website)

As one of the first publicly listed cryptocurrency exchanges, Coinbase went public in April 2021 through a direct listing on the NASDAQ. The company’s IPO marked a significant milestone in the integration of cryptocurrency with traditional financial markets, attracting attention from both retail and institutional investors.

However, it faces ongoing challenges, particularly from regulatory scrutiny. Coinbase has grown to become a key player in the digital currency ecosystem. Notably, several custodians for U.S. Bitcoin and Ethereum ETFs are Coinbase, underscoring its leading position in the industry.

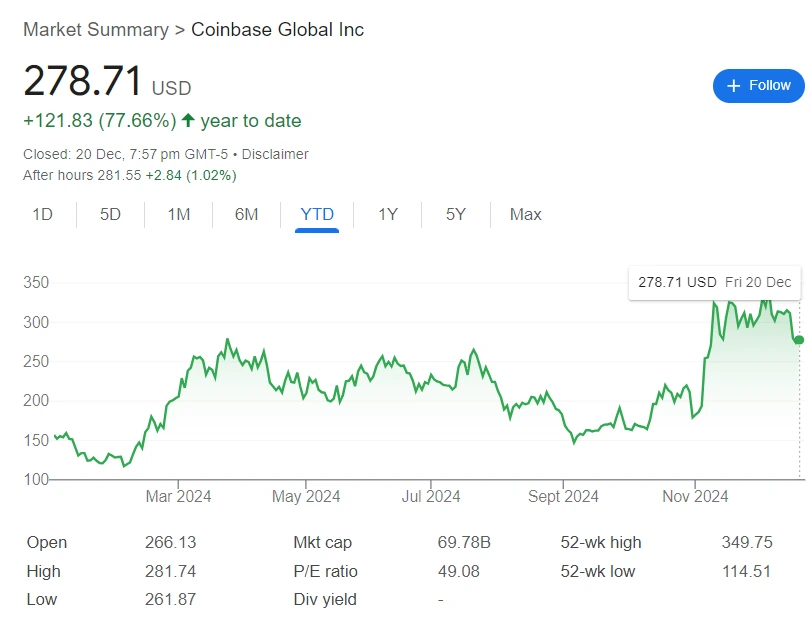

(Source: Google Finance)

According to Coinbase’s latest public filings and financial reports, the company holds a significant amount of Bitcoin as part of its corporate treasury. As of now, Coinbase holds 9,000 BTC, as illustrated in the screenshot below.

(Source: BiTBO)

5. SEMLER SCIENTIFIC: INNOVATING HEALTHCARE AND INVESTING BITCOIN

Founded in 2008, Semler Scientific is a U.S.-based medical technology company focused on developing innovative healthcare solutions.

Their patented and FDA-cleared product, QuantaFlo, measures arterial blood flow in the extremities to aid in the diagnosis of cardiovascular diseases, such as peripheral arterial disease, or PAD (peripheral arterial disease).

The company operates primarily through a leasing model for its products, generating additional variable fee revenues based on usage (fee-per-test). In addition to its medical technology focus, Semler Scientific has invested in Bitcoin and has adopted Bitcoin as its primary treasury asset.

(Source: Google Finance)

“Our Bitcoin treasury strategy and purchase of Bitcoin underscore our belief that Bitcoin is a reliable store of value and a compelling investment,” said Eric Semler, Chairman of Semler Scientific.

The company’s board of directors has adopted Bitcoin as its primary treasury reserve asset, and on May 28, 2024, Semler Scientific acquired 581 BTC for a total cost of $40 million. The company follows a similar strategy to MicroStrategy, utilizing an ATM (at-the-market) approach for purchasing Bitcoin.

As of now, Semler Scientific holds 2,084 BTC, as shown in the chart below.

(Source: BiTBO)

MOVING FORWARD

MicroStrategy’s inclusion in the Nasdaq 100 highlights the growing role of Bitcoin in corporate strategy. As more companies adopt Bitcoin as a treasury asset, we’ve seen a range of strategies emerge, from miners to tech giants.

Looking ahead, the increasing adoption of Bitcoin as a treasury asset could influence how businesses manage their financial reserves and investment strategies, potentially leading to greater institutional participation in the digital asset space.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!