KEYTAKEAWAYS

- Bitcoin historically shows positive performance during US elections, driven by market uncertainty and institutional investment, with 2020 seeing a 13% post-election surge.

- Trump's potential victory could trigger rapid market growth through aggressive monetary policies, while Harris might foster steady, long-term crypto market development.

- Election-related memecoins, particularly those associated with Musk, Trump, and Harris, present high-risk opportunities in the evolving crypto landscape.

CONTENT

Explore Bitcoin’s potential bull run during the 2024 US election, analyzing historical performance, Trump vs Harris impact, and emerging memecoin opportunities. Comprehensive guide for crypto investors.

On November 5th, the first Tuesday of November, the US presidential election voting begins. As the most significant financial event for the remainder of 2024 and one of the most influential events for the next four years, whether Trump or Harris, representing the Republican and Democratic parties respectively, wins this election will have major impacts on all financial markets, including the crypto market.

This article explores who’s election would be more beneficial for driving the crypto market into a bull market and how to discover “profit opportunities” during the presidential election by examining the 2024 US election candidates, domestic and foreign policies, and interest rate reduction paths.

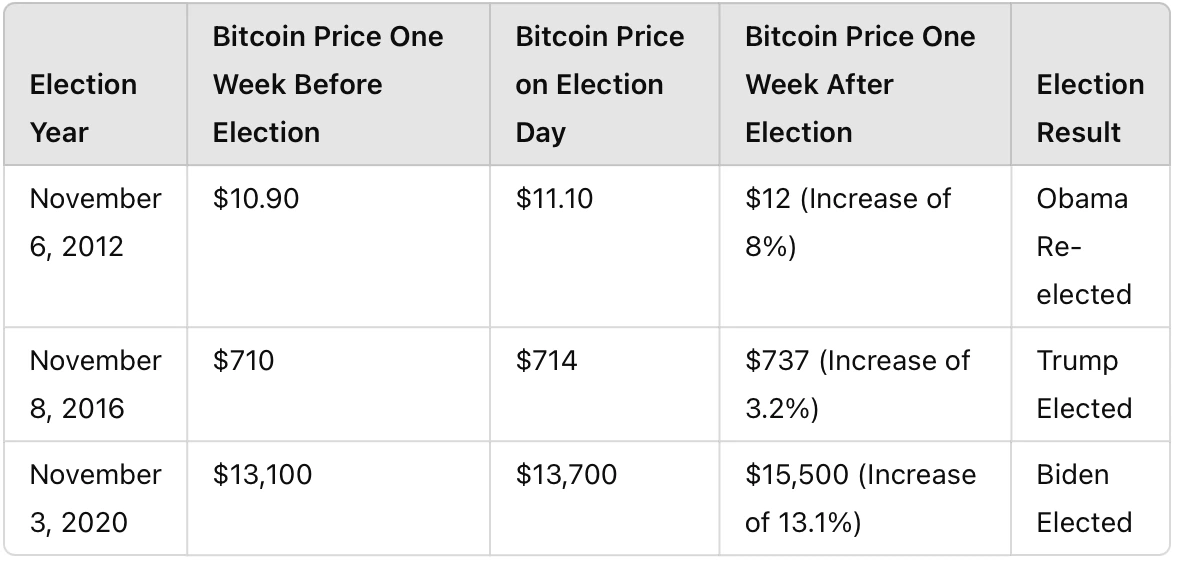

BITCOIN’S HISTORICAL PERFORMANCE DURING US PRESIDENTIAL ELECTIONS (2012-2020)

Before diving in, let’s review history: How did Bitcoin perform during the previous three US presidential elections in 2012, 2016, and 2020? The author pulled relevant data from TradingView to examine Bitcoin’s price movements during the week before, during, and after each election.

Bitcoin Price Performance During US Presidential Elections, 2012-2020

(Source: Coinrank)

In 2012, Bitcoin was in its early stages with a relatively small market size. Most investors were crypto enthusiasts who showed relatively weak reactions to election volatility. However, Obama’s re-election stabilized market expectations for future economic policies, and investors gradually became interested in the decentralized nature of Bitcoin, with some capital flowing into it. Overall, price fluctuations were minimal mainly because Bitcoin’s early ecosystem had not yet attracted widespread attention.

In the 2016 election, Trump’s victory triggered global market uncertainty. For Bitcoin, Trump’s potential tax cuts and economic stimulus policies raised investors’ inflation concerns. Combined with global investors’ increased interest in safe-haven assets, Bitcoin’s value as “digital gold” gradually gained market recognition. Although price fluctuations were minimal in the week before and after the election, Bitcoin rose from $430 at the beginning of the year to $900 by year-end, showing significant overall annual growth driven by market demand for safe-haven assets.

In the 2020 election, the US and global economy entered a period of uncertainty due to the pandemic, strengthening expectations for large-scale economic stimulus plans. Biden’s expected victory drove speculation about future monetary easing policies, triggering investor concerns about inflation and dollar depreciation. With the Federal Reserve’s quantitative easing policies and increased government fiscal spending, institutional interest in Bitcoin further rose, causing Bitcoin to increase by over 13% in the week following the election, and surge from around $7,000 at the beginning of the year to over $20,000 by year-end. Large institutional investors (like MicroStrategy and Square) buying Bitcoin as reserve assets also strengthened Bitcoin’s upward momentum.

Overall, during the three US presidential elections in 2012, 2016, and 2020, Bitcoin showed notable upward trends both during and after the elections. This growth was primarily driven by several factors:

- Market uncertainty leading to risk hedging

- Inflation concerns and safe-haven demand

- Institutional investors participating in financial innovation

- Increased market liquidity These factors contributed to Bitcoin’s broader recognition and acceptance. Additionally, when combined with Bitcoin’s quadrennial halving cycle, these elements predominantly resulted in overall price appreciation.

TRUMP VS HARRIS: IMPACT ANALYSIS ON CRYPTOCURRENCY MARKETS AND BITCOIN

Currently, the market largely expects Trump’s Republican Party to win the 2024 US presidential election, but anything is possible until the final results are in. Let’s analyze who would bring a bull market to the crypto sector from both perspectives.

U.S. Electoral College Votes and State Support Distribution Map

(Source: Coinrank)

Looking at their policy inclinations and supporter bases, Trump and the Republican Party advocate for market freedom and reduced government intervention, encouraging corporate tax cuts, manufacturing revival, and protection of traditional energy, mainly representing the interests of the military-industrial complex and industrial capital. If Trump is elected, markets would expect the Federal Reserve to adopt more aggressive monetary policies. As mentioned in our previous article “Musk Endorses Trump: What Impact Would Trump’s Victory Have on the Crypto Sphere?”, a Trump victory would bring massive liquidity to the market, pushing the crypto market into the fast lane of the fourth halving cycle under this enormous liquidity boost, potentially driving Bitcoin’s price to unimaginable heights.

With endorsement from Musk, the world’s most famous crypto KOL, and support from most US crypto users, Trump might change his previous critical stance on cryptocurrencies and implement policies favorable to crypto development.

However, Trump’s consistent “America First” foreign policy might intensify global economic and political tensions, potentially triggering regional conflicts, which could cause black swan events leading to dramatic crypto market fluctuations.

Harris and the Democratic Party traditionally receive support from Wall Street financial groups and Silicon Valley tech companies, representing upper-middle-class interests. Mainstream media and liberal intellectuals also largely support Democrats. Harris’s support base is concentrated among young people, tech workers, and minorities.

These groups show high interest and participation in blockchain and cryptocurrencies. Harris’s open attitude might attract more young people to the crypto market. Her supportive stance toward tech innovation and Web3 emerging fields, coupled with Democrats’ typically open attitude toward crypto technology infrastructure and innovative applications, could benefit blockchain and Web3 projects. Additionally, if Democrats push for increased financial and tech industry regulation, it might restrict large tech companies and crypto assets, causing short-term market volatility but potentially benefiting long-term market standardization.

Regarding monetary policy, Trump leans toward rapid interest rate cuts and quantitative easing. For the crypto market, quick rate cuts and quantitative easing might increase safe-haven demand for Bitcoin and other crypto assets, especially when the market expects dollar weakness. Bitcoin could attract institutional and individual investors for risk hedging, accelerating and heightening this halving cycle’s bull run, though it might overdraw the crypto market’s future potential.

If Harris wins, she might promote a more moderate interest rate reduction path and gradual monetary easing to control inflation while promoting economic growth. For the crypto market, Harris’s moderate policy approach might attract more investors open to cryptocurrencies, especially in DeFi and Web3. While this might not cause immediate market surges, it could foster a steadier bull market with longer duration.

Overall, if Trump wins, Bitcoin might experience a short-term bull market, though potentially limited by regulatory risks and mainly affecting mainstream coins. A Harris victory might drive overall crypto market innovation and diversification, but with lower probability of an immediate bull market, the fourth halving cycle might unfold as a steady bull run.

ELECTION-RELATED MEMECOINS: COMPLETE INVESTMENT GUIDE AND RISK ANALYSIS

In this US election, Musk’s public endorsement of Trump has brought massive attention and traffic to the crypto market, creating several surging concept coins, mainly memecoins.

As the US election progresses, more related concept memecoins will likely emerge. We can track these coins according to the election process timeline.

U.S. Presidential Election Timeline

(Source: Coinrank)

The three major concept coin categories currently hot in this election are: Musk concept coins, Trump concept coins, and Harris concept coins.

Musk concept coins include memecoin pioneer DOGE and tokens with market caps exceeding $100 million like SHIB and FLOKI. These coins have gained broad market recognition, offering lower risk but limited growth potential.

In contrast, smaller coins like STARL (referencing SpaceX’s satellite internet project), TES (leveraging Tesla brand effect), MARS (aimed at Mars exploration), MUSK (memecoin themed after Musk himself), and X Token (derived from Twitter’s rebranding to “X”) mainly capitalize on Musk-related traffic and are high-risk, high-return tokens.

Coins previously “endorsed” by Musk, such as LADYS, PEPE, and TROLL, have performed well. If Musk’s Trump endorsement proves correct, these coins could see good performance.

Trump concept coins and projects currently have relatively small market caps, including: TRUMP (pro-Trump memecoin), MAGA (Trump’s campaign slogan), Trump Inu (Trump-themed Shiba Inu coin imitation), Trump Digital Trading Cards (Trump’s first NFT series), and WLFI (directly issued by Trump). Compared to Musk concept coins, Trump concept coins have lower recognition and community engagement, but could surge significantly if Trump wins.

Currently, Harris concept coins are relatively few, mainly including: KAMA (First Female US President), HARRIS-ETH (Twitter account fan project), KAMALA-ETH (Twitter account @CoinKamala), HARRIS-SOL (Harris project issued on pump.fun platform), and Walz (Harris running mate coin). Due to mainstream market’s low expectations for Harris’s victory, Harris concept coins are currently underperforming.

Please note that these coins are highly volatile in the market, and investment requires caution.

Additionally, as the US election progresses, more new coins will emerge in the market with short-term surges attracting market attention. To discover them earlier and earn high returns, you can refer to our previous two articles:

– Ultimate Guide: How to Find and Invest in High-Potential Memecoins (2024)

– GOAT Token Case Study: How AI Memecoins Changed Crypto Trading