KEYTAKEAWAYS

- Bitcoin ETFs show strong inflows, potentially driving prices higher, while Ethereum ETFs surprise with initial performance.

- Upcoming FOMC meeting and CPI report crucial for Bitcoin; Fed rate cut could push BTC above $70,000.

- Political statements increase crypto visibility; be aware of high leverage in volatile market conditions.

CONTENT

Bitcoin’s potential breakout faces hurdles as traders navigate ETF inflows, Fed policy expectations, and political rhetoric, while Ethereum struggles with selling pressure.

>>> Read more:

CURRENT MARKET TRENDS AND EXPECTATIONS

Bitcoin’s market behavior has been showing interesting patterns recently. Based on historical analysis, returns tend to be flat in August and down in September. However, several factors could potentially buffer any downside pressure:

- US interest rate policy

- Lower inflation rates

- $1 billion in token unlocks expected in August

Bitcoin dominance is currently at its highest level since April 2021, reaching 55.5%. This dominance has notable implications for the broader cryptocurrency market.

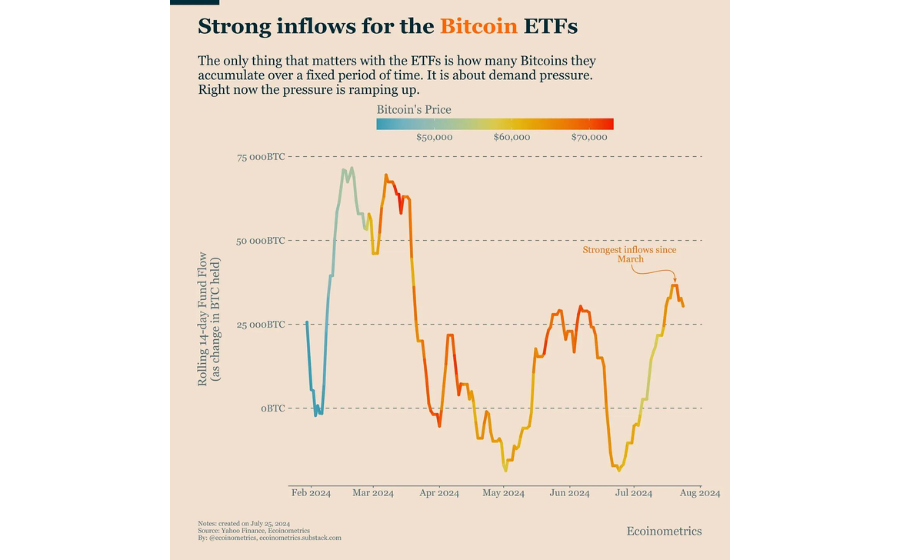

Bitcoin ETF Performance

Recent data shows that Bitcoin ETFs are gaining momentum. They’ve just experienced the strongest inflows since March (based on a 14-day moving average of net inflows). If this trend continues, Bitcoin might finally break out of its current price range.

The amount of capital flowing in per unit of time increases pressure on the circulating supply, potentially leading to a surge in BTC prices. This growing demand pressure is a positive sign for Bitcoin’s price trajectory.

(source: Ecoinometrics)

The crypto market structure fundamentals have remained relatively weak. Stable coin minting has been low since the April 20 Bitcoin halving. However, Bitcoin Spot ETF uptake has been gradually increasing, despite initial slow adoption.

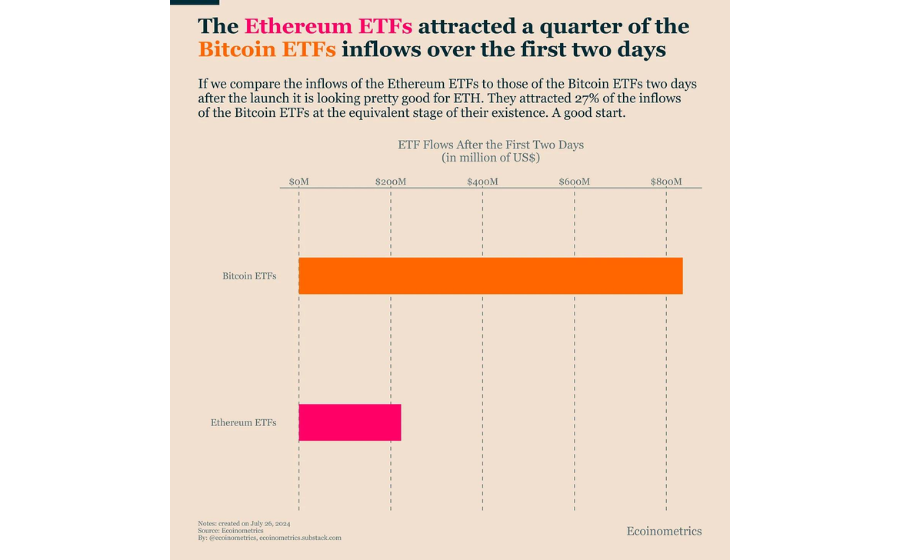

Ethereum vs Bitcoin ETFs

Interestingly, spot Ethereum ETFs have performed well in their initial launch. Comparing the net flows of the first two days:

- Ethereum ETFs attracted about a quarter of the funds that Bitcoin ETFs did in the same initial phase.

- This is a pleasant surprise, given that Ethereum ETFs were initially considered less attractive than Bitcoin ETFs.

(source: Ecoinometrics)

This strong start for Ethereum ETFs suggests growing investor interest in diversifying their cryptocurrency exposure through regulated financial products.

MACROECONOMIC FACTORS AND THEIR IMPACT

Federal Reserve Policy

The upcoming FOMC meeting on July 31 and the US CPI report on August 14 will be critical for Bitcoin’s performance. There are expectations that Fed officials might signal a possible interest rate cut at the September meeting, given:

- Lower inflation rates

- Cooling labor market

- Potential unnecessary economic weakness due to restrictive interest rates

Historically, the Fed has waited 5-10 months between the last rate increase and the first cut. The current pause of 12 months is among the longest in Fed history. A rate cut could push Bitcoin back above 70,000.

Economic Indicators

Recent US GDP growth was strong at 2.8%, but this figure may be overstated due to inventory building. The real GDP (adjusted for inflation) grew by 3.1% year-over-year, indicating strong economic performance.

The 2-year treasury yield has declined to 4.38%, indicating that current Fed Funds rates (at 5.25%) might be too high relative to market pricing and inflation (at 3.0%).

It’s important to note that strong GDP performance in one quarter doesn’t guarantee continued growth. Historically, it’s challenging to predict next quarter’s GDP based on the previous quarter’s performance.

POLITICAL LANDSCAPE AND GOVERNMENT HOLDINGS

Recent statements by presidential candidates during Bitcoin 2024 have brought Bitcoin into the political spotlight:

- Robert Kennedy Jr. proposed buying 4 million BTC as a strategic reserve

- Donald Trump made comments about firing SEC Chair Gensler (which is constitutionally impossible)

While these proposals may be unrealistic or demonstrate a superficial understanding of Bitcoin, they indicate growing political interest in cryptocurrencies.

Furthermore, the US government holds Bitcoin, but the exact amount is lower than some estimates suggest. Out of the reported 200,000 BTC, 65,000 belong to Bitfinex, significantly reducing the actual government holdings.

CRYPTO TRADING ANALYSIS

Bitcoin: Bitcoin’s short-term trend is showing a series of higher highs and higher lows, forming an upward channel. However, recent breakouts haven’t led to sustained momentum, suggesting caution at these levels. Traders might consider entries on pullbacks to the channel’s support line. Bitcoin recently found strong support at $63,200.

The Fear and Greed Index reading of 74 indicates excessive optimism, often a contrarian signal. With upcoming economic data releases, increased volatility is likely. It’s advisable to avoid high-leverage positions in this environment.

Ethereum: Ethereum remains relatively weak, failing to reach $3,300 in its recent rally. While ETF launches are generally bullish, they can cause short-term selling pressure. The key factor to watch is subsequent capital inflow.

Grayscale’s selling pressure (450,000 ETH sold in four days) has been significant. They still hold 2.3 million ETH (~$7.4 billion). ETF buy-ins aren’t yet offsetting outflows, but this may change soon.

>>> Read more:

▶ Buy Bitcoin at BingX

Sign up to claim 5,000+ USDT in rewards & 20% off trading fees!