KEYTAKEAWAYS

- Three major Bitcoin drops in December followed distinct patterns, with whales strategically using Fed news and low liquidity to shake out retail positions.

- Historical "Christmas crash" phenomenon often brings heightened crypto volatility due to reduced holiday liquidity and year-end portfolio adjustments.

- While short-term volatility persists, the overall halving bull market remains intact with each pullback reaching higher lows despite liquidations.

CONTENT

Bitcoin’s triple 10k-point December decline follows Fed’s hawkish stance, with whales exploiting the seasonal “Christmas crash” phenomenon. Analysis reveals systematic market manipulation targeting retail investors amid holiday volatility.

*Ready to explore these opportunities? Trade on Bitget now. Remember: This content is informational only – always trade responsibly.

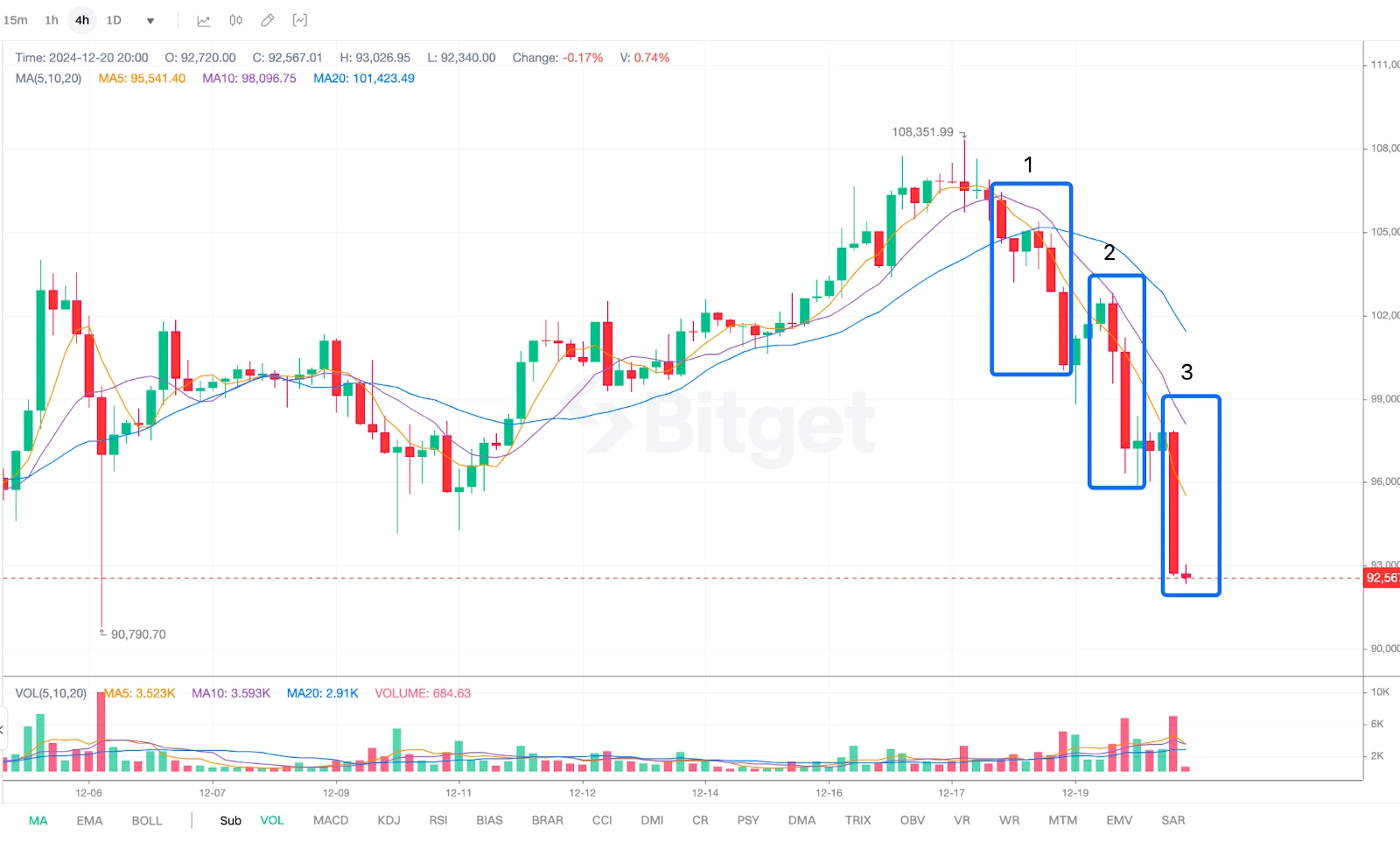

In the early hours of December 19th, the Federal Reserve’s final rate decision of 2024 was announced, with an unsurprising 25 basis point rate cut. However, Fed Chairman Powell’s subsequent hawkish remarks suggested a slowdown in the rate-cutting pace. The Fed’s dot plot showed that the projected number of rate cuts in 2025 decreased from four times in September to two times this month. The median rate expectation also rose from 3.4% in September to 3.9% in this meeting.

Subsequently, Bitcoin led the market in a downward trend, culminating in a steep decline. As of publication, Bitcoin fell from its peak of 108,351 to a low of 92,474 (Bitget data), a 14.6% drop. ETH declined from its high of 4,106 to a low of 3,102, falling 24.4%. Altcoins generally saw drops of 40% or were cut in half, causing widespread market losses.

Bitcoin accelerates its decline following the Federal Reserve’s interest rate decision

(Source: Bitget)

Including this decline, Bitcoin has experienced three major “10,000-point” drops in December, with the other two occurring on December 5th and December 9th. These three crashes within a single month have alarmed many investors, with some choosing to cut their losses and exit. What’s causing this situation, and should investors sell off or boldly buy the dip?

THE WHALES’ STRATEGY: USING ALL NEGATIVE NEWS FOR MARKET MANIPULATION!

Reviewing this market cycle, since Bitcoin broke $100,000 on December 5th, its upward movements have occurred on lower volume days, while sharp declines happened on higher volume days. This indicates heavy whale participation during downturns. After these drops, whales can push prices up with minimal effort by exploiting retail investors’ fear or delayed reactions, causing FOMO buying before another drop forces retail investors to sell at a loss. This pattern has repeated three times:

First Wave: On December 5th, right after Bitcoin broke $100,000, it experienced a sharp $10,000 drop, though altcoins remained relatively stable. Bitcoin recovered above $100,000 the next day and consolidated there for three days on low volume, making it seem like the $100,000 level was just a minor hurdle. Since altcoins didn’t crash significantly, many believed Bitcoin’s drop was merely to clear its own leveraged positions, leading to FOMO buying, especially in altcoins.

Second Wave: On December 9th, Bitcoin deliberately broke below $100,000 again, with the second dip nearly touching the previous low. While Bitcoin’s decline was limited this time, it dragged down altcoins significantly! This deleveraging was more thorough than the first time, with 570,000 positions liquidated! However, just four days later, Bitcoin reached a new all-time high. Despite no significant increase in trading volume, many investors believed the market was ready for healthy growth after these two drops cleared leverage in both Bitcoin and altcoins. Then came the third drop!

Third Wave: December 18th-20th saw three consecutive days of decline, with Bitcoin’s largest overall drop of the three instances and the longest duration. After reaching a new high, Bitcoin’s gradual decline followed by a sharp drop once again brought down altcoins! Although altcoins’ decline wasn’t as rapid as during the second drop, the extended duration created greater psychological pressure on investors, causing at least one-third of retail investors to exit their positions!

From Bitcoin’s perspective, this decline showed a classic three-phase drop pattern (as shown below). Each time retail investors thought the price would stabilize and bounce back, it hit new lows instead. These three successive drops not only crashed altcoin prices but also broke many retail investors’ confidence, including experienced traders.

Bitcoin price decline chart from December 18-19

(Source: Bitget)

Looking at the broader development of the crypto market, especially during Bitcoin’s halving bull markets, whales consistently use various methods for extreme market manipulation. These techniques include psychological warfare, news manipulation, technical analysis plays, financial and macroeconomic events, black swan events, and flash crashes and pumps.

The pattern is similar: controlling market sentiment and information flow to create panic, expectations, and emotional volatility, forcing retail investors to make poor decisions in price swings, chasing highs and selling lows, while whales profit at highs and accumulate at lows.

The methods are diverse and deceptive, making it difficult for most retail investors to defend against them. Most end up following their emotions rather than overcoming them, which is why investing goes against human nature! Few can overcome their emotions, which is why few profit in this market!

Specifically, the reasons for this decline, whether Powell’s hawkish comments (delaying/reducing rate cuts) or the previously mentioned “Christmas crash” phenomenon, are just triggers. The fundamental reason is that Bitcoin has risen significantly, and new money isn’t sufficient. After four halvings, the consensus is too strong, making it difficult to shake out positions, forcing repeated market manipulation in a short time to make retail investors give up and surrender their positions. However, news shows that while retail investors are selling, institutions are raising funds to buy!

IS THE ANNUAL “CHRISTMAS CRASH” REALLY THIS POWERFUL?

Another reason for this decline is the “Christmas crash” phenomenon, where the crypto market often experiences violent price fluctuations, particularly significant pullbacks or losses around Christmas. This pattern has become a tradition, though it doesn’t occur every year but appears more frequently when market sentiment is sensitive.

For example, during Christmas 2017, Bitcoin experienced a brief correction from nearly $20,000 to about $13,000, a drop of over 35%. In 2021, Bitcoin fell from $64,000 to around $46,000 during the Christmas period, approximately a 28% decline. Of course, 2017 and 2021 were at the end of bull markets when they encountered the “Christmas crash,” amplifying the decline. The current period is early in the bull market, so the broader context is different, and we can’t simply apply the same analysis.

During Christmas periods in 2018 and 2020, Bitcoin also showed significant price volatility, causing the entire crypto market to fluctuate with sharp movements.

Historical Christmas period performance of Bitcoin

(Source: TradingView)

There are several reasons why Christmas becomes a “crash” period, varying each year but generally including these factors:

- Market liquidity decreases during Christmas and New Year holidays as many traders, investors, and institutions take breaks, leading to significantly reduced trading volume. During low liquidity periods, even small orders can cause dramatic price movements.

- Holiday effects and market sentiment impact trading as Christmas is the most important holiday period in Western countries and connects with New Year. Before holidays, market sentiment often shifts, with many investors tending to lock in profits or exit the market, triggering short-term selling and increasing volatility. Additionally, some investors conduct tax planning or portfolio reassessment at year-end, which can cause market fluctuations.

- News impact is amplified because many traditional financial institutions close for holidays, making any news have a stronger effect. For example, this time the Fed’s 25 basis point rate cut was overshadowed by Powell’s hawkish comments, amplifying market panic. Fears about insufficient liquidity for effective fund-raising led to temporary market exits, making the 25 basis point cut feel like a rate hike.

- Additionally, short-term speculation increases around Christmas, with some investors and traders attempting to capitalize on holiday market volatility. These speculative activities intensify market fluctuations. Short-term high-frequency trading and capital flows can cause price instability, especially when large orders concentrate, and the widespread use of leverage in the crypto market infinitely amplifies these fluctuations.

HOW SHOULD INVESTORS HANDLE THE POTENTIAL “CHRISTMAS CRASH”?

Investors can adopt cautious operational approaches during this period by maintaining vigilance during Christmas and holidays, avoiding large-scale transactions, setting strict stop-losses and take-profits to handle extreme market volatility, reducing positions, and diversifying risk by avoiding full investment in small-cap, highly volatile altcoins.

Overall, the “Christmas crash” doesn’t occur every year, and we need to view it from a long-term perspective. For long-term investors, Christmas period volatility is temporary, and they should remain calm and maintain their long-term investment strategy.

LOOKING AHEAD: MARKET OUTLOOK AND INVESTMENT STRATEGY

As mentioned in previous articles, Bitcoin typically confirms important price levels at least three times. This pattern held true as Bitcoin crossed $100,000, fell below it, and repeated this cycle three times, with higher peaks each time. This means that despite Bitcoin’s three major drops in a month, the overall price level kept rising! Regarding liquidations, this time saw about $1.4 billion worth of positions liquidated over three days, lower than the $1.7 billion on December 9th, affecting 450,000 people, also less than the previous 570,000, indicating that leverage has been largely cleared.

Eight months have passed since Bitcoin’s April halving, and whether it’s the Christmas crash or Powell’s hawkish stance, neither affects the rhythm of this halving bull market in the long term. While negative news may delay the bull market, whales often use it for more thorough market manipulation, potentially pushing the bull market‘s peak higher and extending its duration. So don’t rush – take a long-term view of market developments!

▶ Buy Crypto at Bitget