KEYTAKEAWAYS

- On December 9th, Bitcoin flash-crashed to $94,000, causing a severe market shakeup and $1.7 billion in liquidations, the largest in two years.

- The flash crash was triggered by market panic, leverage risks, and whale manipulation, leading to large-scale liquidations.

- The event resulted in a loss of investor confidence, decreased market liquidity, and may lead to increased regulatory pressure.

CONTENT

Bitcoin’s flash crash caused massive liquidations, shaking the market and lowering investor sentiment, with potential for heightened regulatory scrutiny.

EVENT RECAP

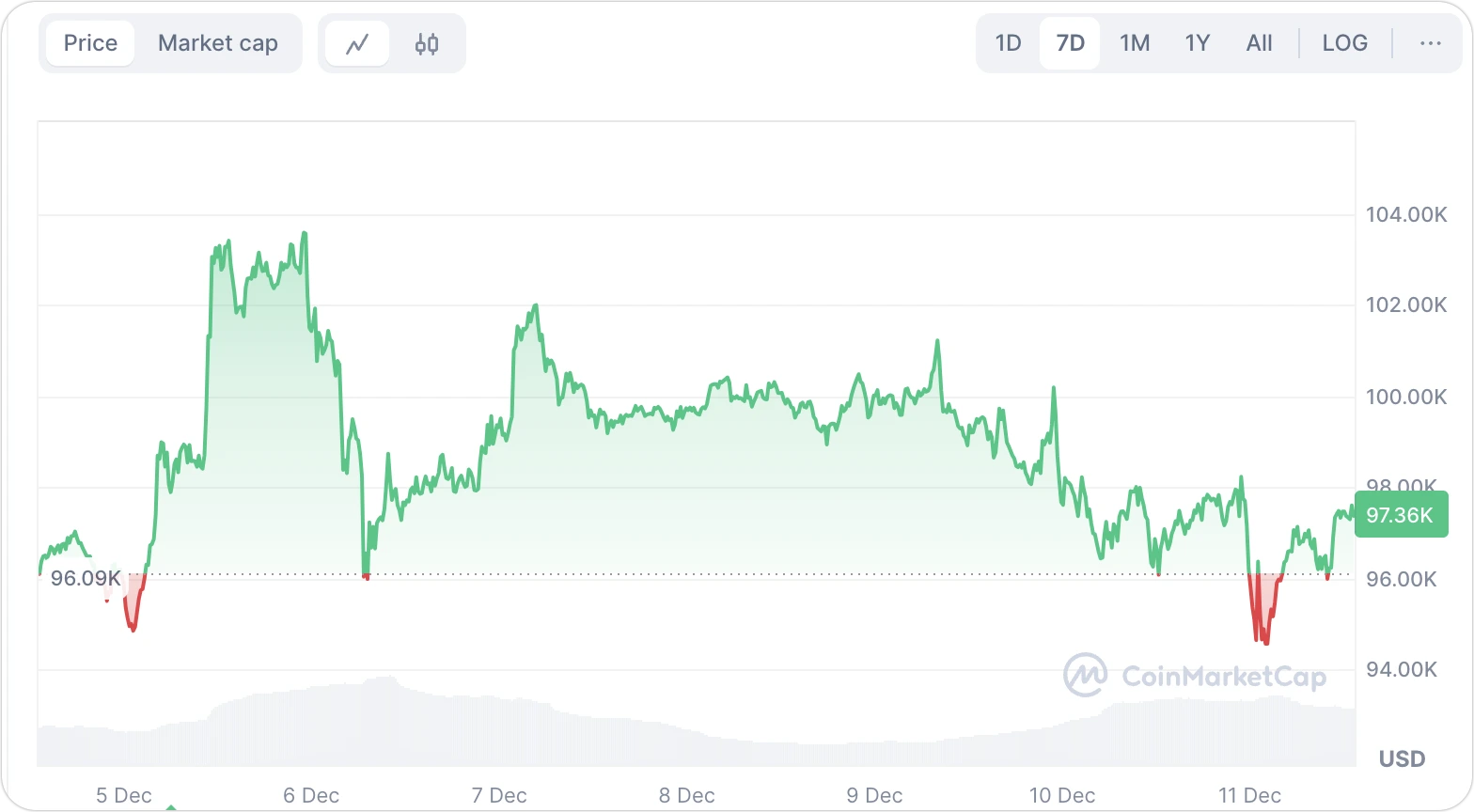

Early yesterday morning, the Bitcoin market experienced a rare flash crash, with the price plunging to a low of $94,000 before slightly recovering. This flash crash not only impacted Bitcoin’s price but also triggered significant turbulence across the cryptocurrency market.

(Source:CMC)

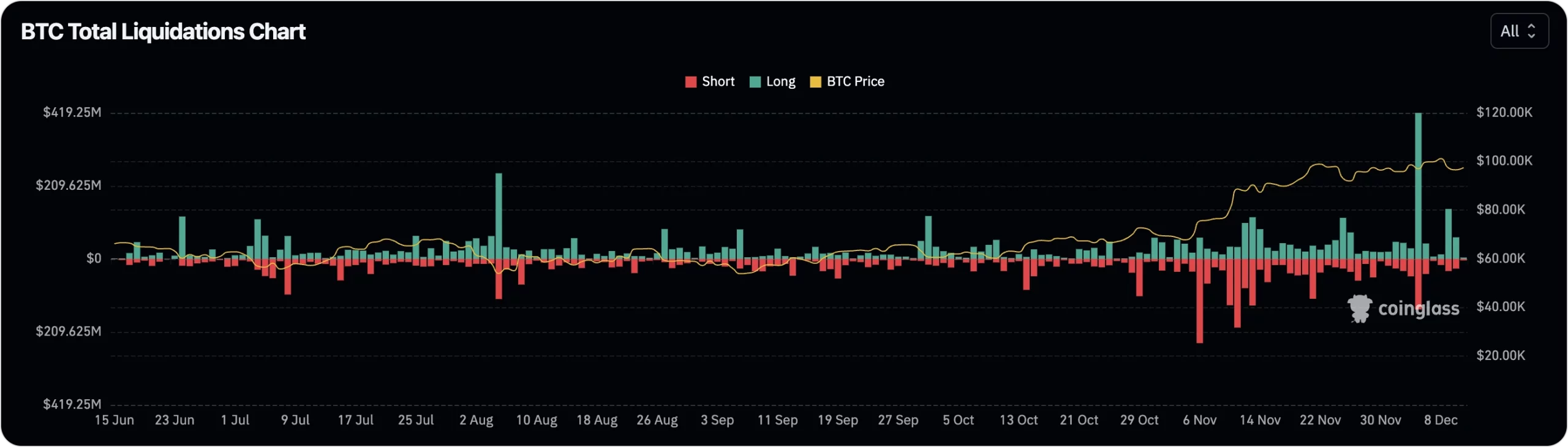

Altcoins were hit particularly hard, with most tokens seeing declines of 20%-30%. The immediate consequence of this market volatility was a total liquidation of $1.716 billion across the network, affecting 570,876 traders—marking the largest liquidation event in nearly two years. This sudden event has become one of the most talked-about topics in the crypto industry recently.

(Source:coinglass)

》》Also Read

Bitcoin Whales Capitalize on Market Dip, Triggering Surge in Large Transactions

ANALYSIS OF THE CAUSES

Experts believe that the flash crash was caused by a combination of factors:

1.Market Sentiment Panic

The cryptocurrency market has been experiencing significant volatility in recent weeks, leaving investor sentiment fragile. Negative news or sudden events can quickly spark panic selling, amplifying price swings and destabilizing the market.

2.Leverage Risk

High-leverage trading is prevalent in the cryptocurrency market, and it played a critical role in this flash crash. Every price drop in a highly leveraged market can trigger a cascade of stop-loss orders, resulting in a wave of liquidations. In this case, the leverage risks were magnified, leading to a snowball effect that exacerbated the market downturn.

3.Whale Manipulation

Market manipulation by “whales” (large holders of cryptocurrency) is another factor that cannot be ignored. Some large players may deliberately create panic by executing massive sell-offs, driving prices down to buy back at lower levels for higher profits. This behavior further intensifies irrational market fluctuations.

IMPACT OF THE EVENT

The flash crash has had profound short-term and long-term effects on the cryptocurrency market:

1.Loss of Investor Confidence

Flash crashes often shake investor confidence in the market’s stability. New entrants, in particular, may exit after incurring significant losses, reducing the influx of new capital into the market.

2.Decreased Market Liquidity

The large-scale liquidations have reduced overall market liquidity, making short-term trading more prone to price volatility.

3.Increased Regulatory Pressure

Such large-scale market turbulence may draw the attention of global regulatory bodies. This could lead to stricter regulations, such as limits on leverage trading or enhanced risk control requirements for exchanges.

INVESTOR RECOMMENDATIONS

To navigate such sudden events, investors should adopt more rational investment strategies:

1.Stay Calm and Rational

During periods of extreme market volatility, investors should avoid panic selling or blindly following the crowd. It’s essential to assess asset allocation and investment strategies rationally.

2.Focus on Risk Management

Set reasonable stop-loss levels and maintain balanced position sizes to mitigate exposure to high-volatility risks. Avoid over-leveraging funds in pursuit of short-term gains.

3.Pay Attention to Fundamentals

Investors should focus on the fundamentals of cryptocurrency projects, such as their underlying technology, team strength, and application potential, choosing assets with long-term promise.

4.Diversify Investments

Avoid putting all funds into a single asset or market. Diversifying investments can effectively reduce overall losses caused by market-specific volatility.

CONCLUSION

This Bitcoin flash crash serves as a reminder that while the cryptocurrency market is full of opportunities, it also comes with significant risks. Investors must develop a more mature understanding of the market, act cautiously, and continually refine their investment strategies.

At the same time, this extreme volatility sends a strong signal to regulators and industry participants: balancing market innovation with risk management will be a crucial focus for future development.

▶ Buy Crypto at Bitget