KEYTAKEAWAYS

- Bitcoin's Profit and Loss Index near 365-day moving average indicates possible further pullback.

- Stagnant USDT market cap growth is hindering Bitcoin's rebound potential.

- Long-term bullish factors include upcoming Ethereum ETFs, improving macroeconomic conditions, and the US election.

CONTENT

Bitcoin is at a bull-bear crossroads with two key indicators signaling potential price shifts while whales continue buying despite market struggles.

WILL BITCOIN CONTINUE TO FALL?

After the US CPI data was released on July 11, Bitcoin briefly moved upward but failed to break through $60,000. At the time of writing, it’s fluctuating around $57,000.

This week, Bitcoin rebounded from a low of around $53,485. However, from a technical analysis perspective, Bitcoin has been in a downtrend since hitting a high of $73,777 in early March, with several lower highs at $72,797, $71,997, and $63,861.

On July 10, CoinDesk reported that data from CryptoQuant shows Bitcoin is entering a crucial bull-bear phase in the current market cycle. Several indicators suggest it could continue to fall or potentially rise.

>>> Read more: Is the Least Profitable Bitcoin Bull Run in History Coming to an End?

INDICATOR 1: BITCOIN BULL-BEAR CYCLE METRIC

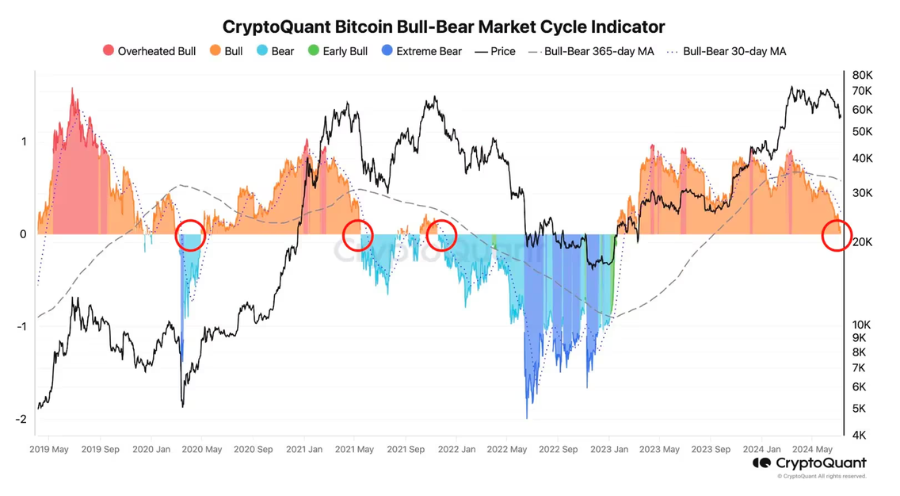

CryptoQuant data shows the Bitcoin Profit and Loss Index hovering near its 365-day moving average, suggesting a further pullback may be imminent. The last time this occurred was in May and November 2021, coinciding with two major peaks in the previous bull market, followed by deep corrections.

CryptoQuant’s bull-bear cycle indicator also shows Bitcoin is approaching key bear market levels.

(source: CryptoQuant)

INDICATOR 2: STAGNANT USDT MARKET CAP GROWTH

CryptoQuant also points out that the stagnant market cap growth of the US dollar stablecoin USDT (Tether) is making it difficult for Bitcoin to rebound. Historical data suggests that when stablecoin liquidity increases, the market usually sees a recovery.

>>> Read more: Stablecoin Liquidity: Key to Reviving Bitcoin’s Bull Market

BITCOIN STRUGGLES, BUT WHALES ARE ACTIVELY BUYING THE DIP

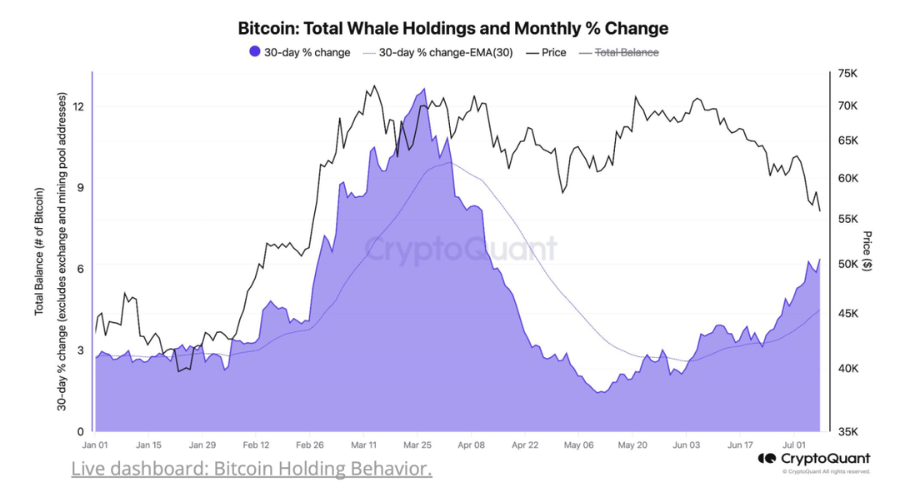

Although some data suggests Bitcoin’s short-term outlook isn’t optimistic, CryptoQuant notes that whales (large holders) are actively buying the dip as Bitcoin falls. Data shows Bitcoin whale holdings are growing at a rate of 6.3% per month, the fastest pace since April 2023, with most of these whales being long-term holders.

>>> Read more: Bitcoin ETF Investors Capitalize on Market Dip

For long-term holders, bullish factors for Bitcoin include the potential launch of Ethereum ETFs in July, improving macroeconomic conditions, and the US election in November.

CryptoQuant analysts state that these whales sold part of their holdings when Bitcoin hit all-time highs, securing significant profits. As Bitcoin falls, they experience some losses and are less willing to sell, which could be an early sign of a price bottom.

However, whether Bitcoin has truly bottomed out depends on the growth of stablecoin liquidity, with the aforementioned USDT market cap changes being one of the key indicators to watch.

(source: CryptoQuant)

>>> Read more:

-

Bitcoin Plunge: One Statistic Reveals Who’s Panicking and Who’s Not

-

2024 Crypto Market Alert: Dangerous Bubbles in Altcoins, Tap-to-Earn, and AI Stocks

▶ Buy Bitcoin & Ethereum at Binance

Enjoy up to 20% off on trading fees! Sign up Now!

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!