KEYTAKEAWAYS

- Bitcoin spot ETFs and Wall Street adoption signal the cryptocurrency's integration into mainstream finance.

- Experts warn of impending financial disaster, advocating for Bitcoin as a potential stabilizer and hedge against economic uncertainty.

- Bitcoin's price action shows strong support at $53,000, with short-term pullbacks viewed as buying opportunities in a long-term bullish trend.

CONTENT

An analysis of Bitcoin’s growing role as a financial safe haven amid political uncertainty and potential economic turmoil following the 2024 U.S. election.

>>> Recent Bitcoin News:

-

Crypto Market Update in Early July: Ethereum ETFs, Bitcoin Trends, and Future Influences

-

Memecoins Outshine Bitcoin in First Half of 2024, Forbes Reports

BITCOIN IS INCREASINGLY VIEWED AS A SAFE HAVEN

In January 2024, following the approval of Bitcoin spot ETFs, Wall Street giants held approximately $60 billion worth of Bitcoin. This marked Bitcoin’s first large-scale integration with the traditional financial system, becoming part of asset allocation portfolios. Of course, this is just the beginning.

>>> Read more: ETH Spot ETFs Nearing Approval: Impact on ETH Price and Ecosystem Projects to Keep an Eye On

Currently, global finance, trade, technology, and military sectors are in a state of flux. Nations are burdened with debt, and the traditional financial system, especially the fiat currency system, is on the brink of collapse. In contrast, the crypto financial system is flourishing. Crypto finance is becoming a global focal point, and this might just be the start.

Recently, gold prices broke through the historic high of $2,480 per ounce. Driving factors include the market’s increasing hope for Fed rate cuts and some traders increasing their bets on Trump’s re-election. Besides these two factors, the market is also concerned about an uncertain “financial disaster,” prompting preemptive hedging operations, with gold being the preferred asset.

>>> Read more: Bitcoin vs Gold Amidst War- Is Bitcoin a Risk Asset or a Safe Haven Asset?

INVESTOR ADVOCATES BITCOIN AS A POTENTIAL STABILIZER

Shapeshift founder Erik Voorhees warns that the U.S. national debt is heading towards a catastrophic disaster. He predicts the bond market will crash and burn, calling it the most catastrophic event of our lifetime. Voorhees advocates for Bitcoin as a safeguard against this financial disaster and urges former President Trump and his potential VP pick to create a lenient environment for cryptocurrencies, ultimately helping to weather the impending financial collapse.

He emphasizes that under either a Trump or Biden administration, the U.S. national debt is expected to increase by at least $1 trillion annually.

This is, of course, the real threat.

Trump, Biden… doesn’t really matter. Both will increase by >$1T per year minimum.

It cannot be corrected. The math cannot be made to work under any set of plausible assumptions.

It ends in bond market collapse and ruination.

It will be… https://t.co/fi426oNkNn

— Erik Voorhees (@ErikVoorhees) July 16, 2024

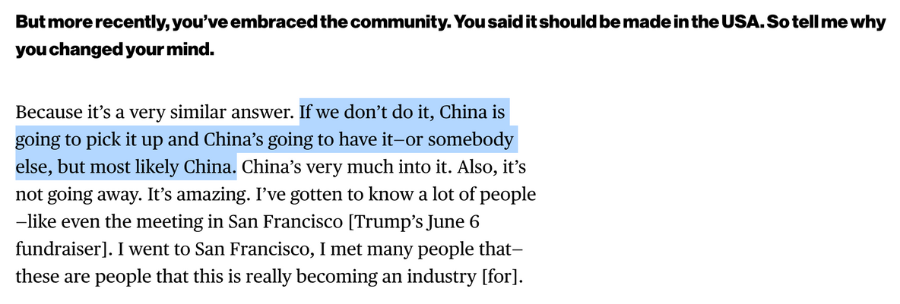

In fact, Trump stated in a recent Bloomberg interview that if re-elected, he would support Bitcoin and other cryptocurrencies being “Made in America.” He believes, “If we don’t do it, China is going to pick it up and China’s going to have it—or somebody else, but most likely China.” This indicates Trump’s awareness of the importance of cryptocurrencies in the future financial system.

(source: Bloomberg)

Bitcoin is a key factor in this transition. Voorhees asserts: “Bitcoin’s existence may be a prerequisite for a ‘good civilization on the other side,’ not because it solves all the world’s problems, but because it may prevent inflation through economic game theory.”

Bitcoin’s existence (or anything like it) is perhaps a prerequisite for the “good civilization on the other side,” not because it solves all the world’s problems, but because it may, through economic game theory, prevent the monetary debasement (inflation) which enables large…

— Erik Voorhees (@ErikVoorhees) July 16, 2024

The Shapeshift founder suggests that the government’s best course of action is to create an environment where cryptocurrencies can thrive without persecution. He states:

The best thing Trump/Vance can do during their administration, since they cannot (and won’t) materially reduce the debt situation, is to create four years of permissive space in which crypto may thrive, unpersecuted. Then, its roots seep deeper into the soil of our culture, and…

— Erik Voorhees (@ErikVoorhees) July 16, 2024

Then, at some point, when crypto assets can one day withstand a financial disaster, they will officially become mainstream assets.

BITCOIN TRADING ANALYSIS

Bitcoin’s price has risen to $66,000, leading to a standoff between bulls and bears, raising concerns among recent investors wary of potential declines and fearing missing further gains. Despite these concerns, historical patterns suggest that periods of market fear often precede price rallies. Currently, the market has established strong support around $53,000, unlikely to break unless impacted by a major unforeseen event.

The long-term bullish trend is secure, unaffected by short-term dips or negative news. Bitcoin has increased about 24% from its lows and is now facing a critical resistance level. Short-term pullbacks are possible but are likely to be followed by quick recoveries, making each dip a potential buying opportunity.

>>> Read more:

▶ Buy BTC & ETH at Binance

Enjoy up to 20% off on trading fees! Sign up Now!

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!