KEYTAKEAWAYS

CONTENT

Explore why Bitcoin soars to new heights while altcoins stagnate, and discover when the altcoin season might begin. Learn about investment strategies and market patterns during this crucial crypto cycle.

Recently, Bitcoin hit another all-time high, reaching $108,351 (according to Bitget data). Meanwhile, altcoins not only failed to keep up with the rise but showed signs of potential decline!

This has caused many investors, especially retail investors, to express frustration on social media: When Bitcoin was at $40,000, their altcoins were at a certain price level, and now with Bitcoin approaching $110,000, these altcoins are still at the same price!

Previously, when Bitcoin surged, other cryptocurrencies would typically follow suit, but this pattern seems to have stopped working.

This has led many investors to believe that this is a Bitcoin-only bull market, and altcoins won’t have their chance during this halving cycle.

So why do altcoins continue to stagnate while Bitcoin keeps breaking new highs, even after surpassing the psychological barrier of $100,000? Will we see an altcoin season? How should we approach the upcoming market conditions?

Bitcoin Upward Trend Chart

(Source: Bitget)

INVESTIGATING WHY BITCOIN KEEPS BREAKING RECORDS WHILE ALTCOINS STAGNATE

Since Bitcoin’s drop to $49,000 in August this year, it has continued to rise until breaking through the $100,000 psychological barrier this month.

Although there was a major correction right after breaking $100,000, it only took 4 days to reach new all-time highs again, showing impressive momentum.

Bitcoin’s rise is mainly attributed to Federal Reserve rate cuts, institutional investors entering the market after spot ETF approval, halving expectations, and changes in the international policy environment.

Analyzing these factors helps explain why Bitcoin continues to break new highs while most altcoins remain stagnant.

Regarding Federal Reserve rate cuts, while lower rates should improve market liquidity and lead to overall market growth led by Bitcoin, the reality is that there isn’t enough money in the market for widespread growth.

Since the Fed’s rate cuts began in September, it’s been about 3 months, and the released funds have just reached the crypto market after moving through banks, bond markets, stock markets, and real estate markets.

These funds are now being poured into Bitcoin through ETFs, inflating Bitcoin’s price, and only after Bitcoin’s “pool” is filled will excess liquidity flow into other cryptocurrencies.

After Bitcoin spot ETF approval, large institutions entered the market, with most funds concentrated in Bitcoin. This logic is easy to understand – currently, only Bitcoin’s market is large enough to accommodate these large capital flows and allow free entry and exit.

Moreover, large capital prioritizes risk control over returns, unlike smaller investments.

After these institutional funds drive up Bitcoin’s price, any overflow typically goes to established mainstream coins that have passed market tests, such as XRP, DOGE, BCH, etc., while smaller altcoins or new tokens show relatively little notable performance.

Regarding the current international environment, things are not particularly peaceful. According to relevant data, at least 30 countries are in a state of war or near-war conditions.

Bitcoin’s proven status as a safe-haven asset makes it particularly attractive in such situations. As a global, decentralized asset, it attracts many investors rushing to buy, driving Bitcoin’s continuous rise to new highs.

Moreover, whether it’s El Salvador declaring Bitcoin as legal tender, newly elected US President Trump planning to build Bitcoin reserves, or publicly listed companies like Tesla and MicroStrategy continuing to buy Bitcoin, all these factors have pushed Bitcoin to new heights – advantages that altcoins don’t possess.

Latest Data on Institutional and National Bitcoin Holdings

(Source: Treasuries)

In the current market with limited liquidity and a volatile environment, it’s normal for funds to concentrate in Bitcoin as the face and foundation of the entire crypto space.

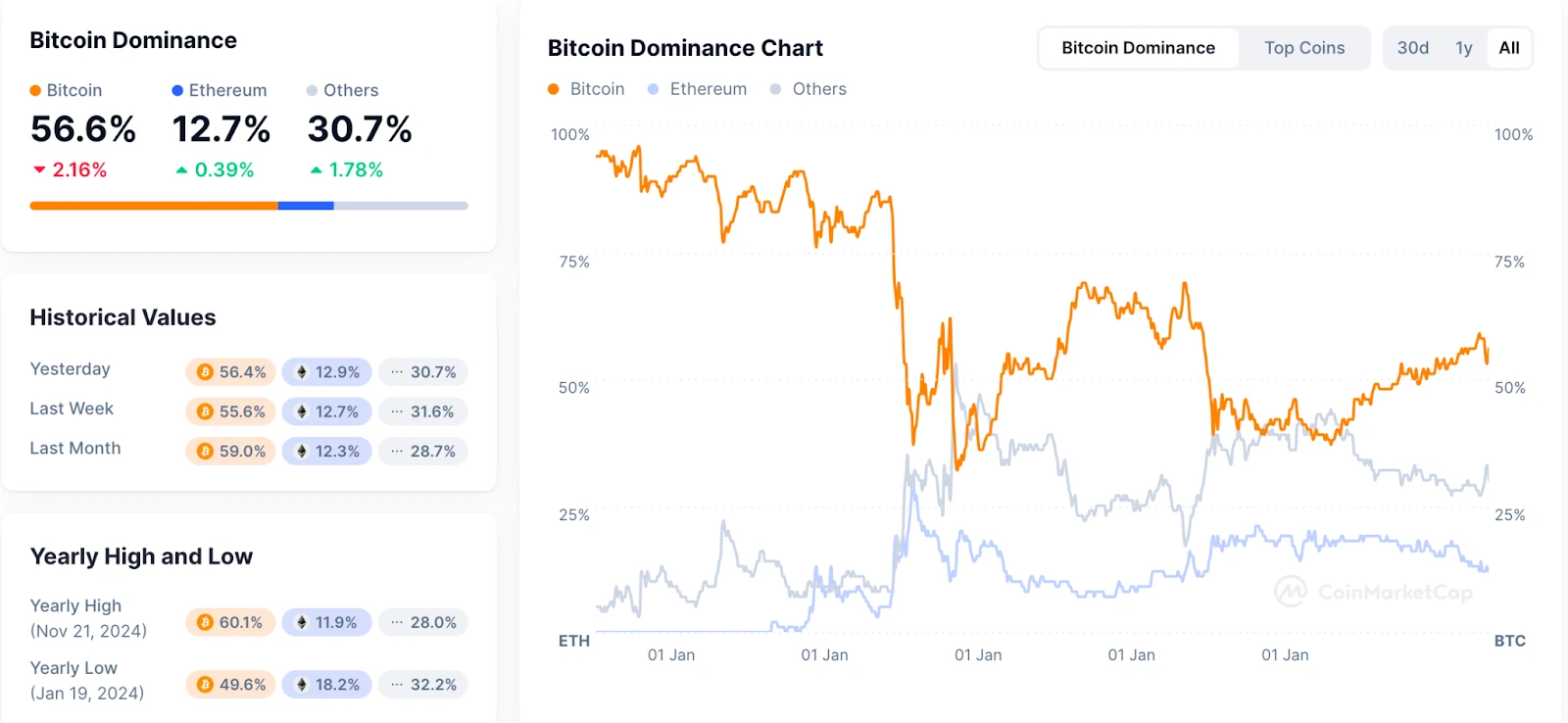

Currently, Bitcoin’s market dominance has reached 56.6%, down from 59.3% in early November, indicating that funds are beginning to overflow from Bitcoin, and the altcoin stagnation might soon reverse.

Bitcoin and ETH Market Cap Dominance

(Source: CoinMarketCap)

BULL RUN ARRIVAL – HARVEST SEASON FOR ALTCOINS!

In this current upward trend, the market generally believes Bitcoin will target the $120,000 node. At this point, regardless of how Bitcoin’s push toward $120,000 plays out, it’s time for the “liquidity flow” to spill over into other altcoins. This is supported by 4 main points:

1. On the 16th (this Monday), ETH finally broke through its high point from the mini bull run in March, surpassing $4,100 after 8 months. As the bellwether for altcoins, the winds of change are blowing.

ETH has been heavily criticized this year, with SOL fans claiming it would replace ETH as the king of public chains, and XRP holders saying it would take ETH’s second place in market cap… it almost seemed like ETH was dying.

But well, its poor performance this year didn’t help!

However, as the public chain with the richest ecosystem and consistently second-largest market cap, ETH’s breakthrough signals that the altcoin season countdown has truly begun.

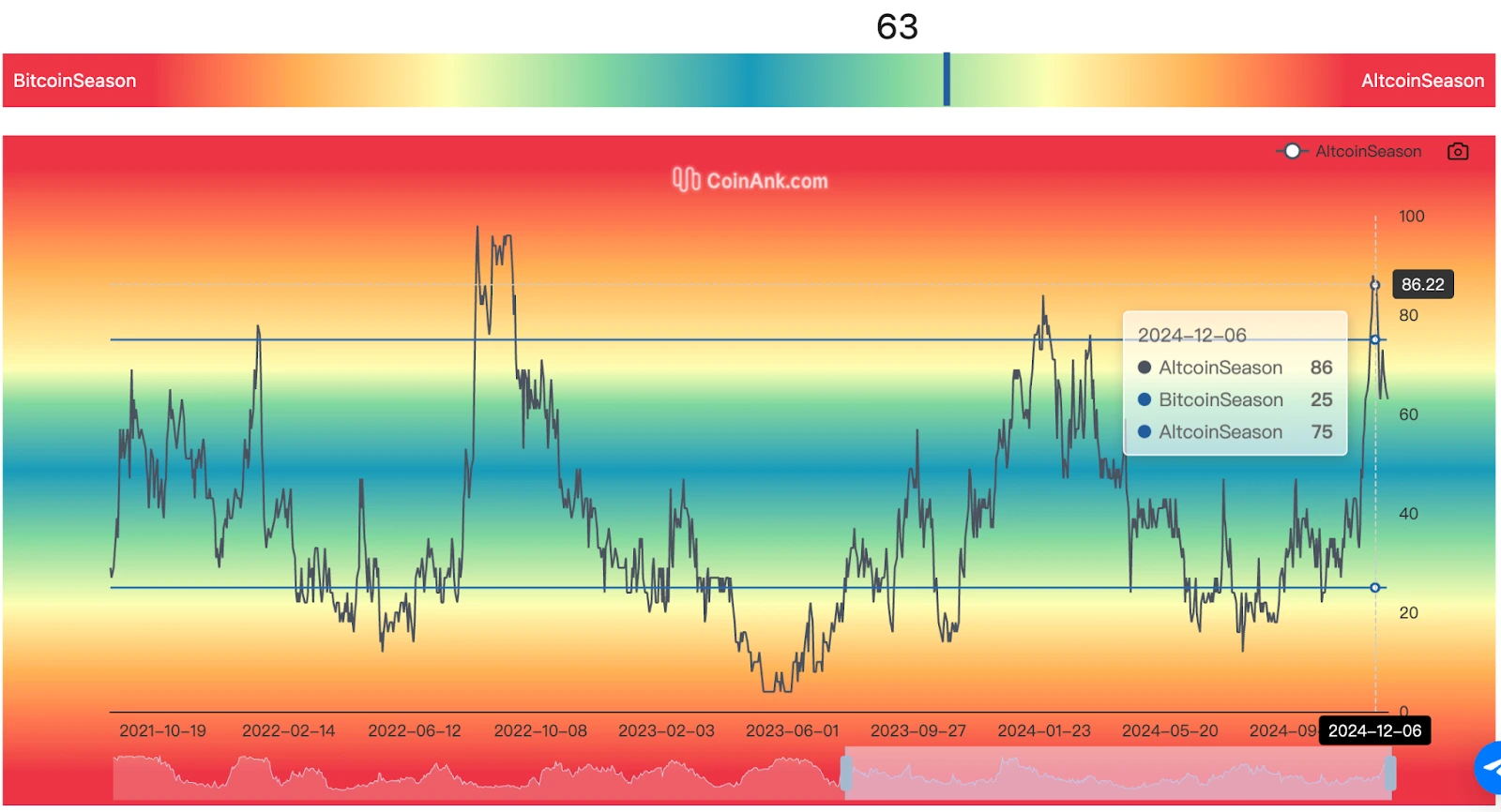

2. The Altcoin Season Index actually rose to 86 in early December, but due to a sharp decline that hit altcoins particularly hard, while Bitcoin broke through first, the index has now dropped to 63. However, it’s just a paper-thin distance from the 75 threshold that marks the beginning of altcoin season.

Altcoin Season Index

(Source: CoinAnk)

3. Looking at historical patterns, altcoin season typically explodes 7-8 months after the halving. For example, after Bitcoin’s second halving in July 2016, seven months later in early 2017, Bitcoin’s price rose to around $1,000, ushering in an epic bull market.

ETH became the altcoin leader with a 140x increase, while LTC, XRP, and other altcoins also began explosive growth during this period.

After Bitcoin’s third halving in May 2020, 7-8 months later (late 2020 to early 2021), Bitcoin broke through $20,000, and the altcoin market began experiencing “DeFi fever” and “NFT fever.”

UNI, AAVE, COMP, AXS, Flow became hot topics, while other well-known altcoins like BNB, ADA, FIL, DOT also began surging successively, driving a massive explosion in the entire altcoin market.

Counting from the April 2024 halving, it’s now exactly 8 months, and all external conditions are in place – it’s time for altcoins to explode.

4. Looking at the broader environment, the market is currently calm with no significant risk events. The next major events are mainly the Federal Reserve rate decision at 3 AM on the 19th and Trump’s presidential inauguration on January 20, 2025 – both are considered positive financial events.

Whether looking at data indicators or historical patterns, we’ve reached the moment for altcoin explosion. After Bitcoin breaks through key price levels, it will begin overflowing to nourish other coins.

This is the most exciting and crazy bull run in each halving cycle, with altcoin season explosion being its most notable characteristic and the most profitable period for most investors.

HOW TO PREPARE FOR THE BULL RUN?

As we can see from above, a crazy bull run is approaching. So how should we prepare to capture opportunities that could arise at any moment?

The most important point is to establish an investment strategy that suits you and continuously optimize it through practice. Investment strategy includes many aspects and is a comprehensive “project”: including target selection, fund allocation, trading method selection, etc. Due to length limitations, we’ll mainly discuss asset allocation here.

The crypto market is relatively “young” compared to traditional investment markets, and many mature strategies from traditional markets can be borrowed.

For example:

The 80 Rule: In this rule, the proportion of risk investment depends on age. The formula is: Crypto market total investment ratio = (80 – your age) * 100%. For example, if you’re 25 this year, then your crypto market investment can be (80-25)*100% = 55% of your total assets. As age increases and risk tolerance decreases, the risk investment ratio should gradually decrease.

The 4321 Rule: This rule is an investment principle summarized from long-term investment planning, guiding people on fund allocation ratios. Applied to the crypto market, it can be used as follows:

40% of funds for stable investment, such as holding BTC, ETH, and participating in coin savings on mainstream exchanges like Binance, Bitget, etc.

30% of funds for insurance investment, choosing leading coins in various concept sectors, such as previously mentioned public chain projects: SUI, TIA, APT, DOT, AVAX, etc., and AI concepts: FET, AGIX, AI, WLD; Memetokens: DOGE, SHIB, PEPE, etc.

20% of funds for venture investment, choosing some small-cap coins, or even entering primary markets as a “10U warrior,” taking certain risks for higher returns.

10% of funds for risk investment, choosing derivative products like futures trading, coin margin trading, etc., using leverage to risk liquidation for excess returns.

Facing numerous types of coins and market strategies with varying risks, only reasonable allocation and scientific investment can achieve the optimal balance between investment returns and risks.

MAKING LOGICAL INVESTMENT DECISIONS IN THE CURRENT CRYPTO CYCLE

After introducing some specific methodologies, let’s explore some metaphysical theories. Whether judging what stage the entire bull market is in or formulating specific investment strategies, everything should be logical rather than making arbitrary decisions and repeatedly falling into the same pit.

For example, using the principle of “development view” to look at the overall process of Bitcoin’s fourth halving: The essence of development is the emergence of new things and the extinction of old things, corresponding to the sharp drops at the beginning of each halving cycle and the gradual recovery to new highs;

The path of development is the unity of progress and twists, corresponding to corrections caused by internal and external factors, while maintaining an overall upward trend;

The state of development is the unity of quantitative and qualitative changes, corresponding to Bitcoin’s repeated testing and consolidation at important resistance levels before finally breaking through and soaring;

It’s crucial to judge which development stage the overall market is in and which development stage a particular coin’s rise is in. This is important because participating in the early stages of development yields ultra-high returns.

To put it figuratively: even if a coin is garbage or a scam project, joining early allows you to “eat it while it’s hot”; conversely, even if it’s a mountain of gold, joining in its late development stage only lets you dig up a pile of stones.

Making logical judgments about things is far more reliable than judgments based solely on feelings, and it better supports you in seeing through phenomena to essence, making correct decisions, and persisting to the end.

Looking at the current specific market conditions, now every time Bitcoin breaks a new high, it immediately forms a spike, almost without exception, mainly to liquidate those who chase with high leverage.

The three-steps-forward-two-steps-back growth pattern is annoying, but isn’t “pulling up while washing out” a more pleasant way to put it?

Barring unexpected circumstances, Bitcoin is heading toward $120,000 in this wave, and when Bitcoin’s growth slows down, that’s when altcoins will take over the rally.

▶ Buy Crypto at Bitget