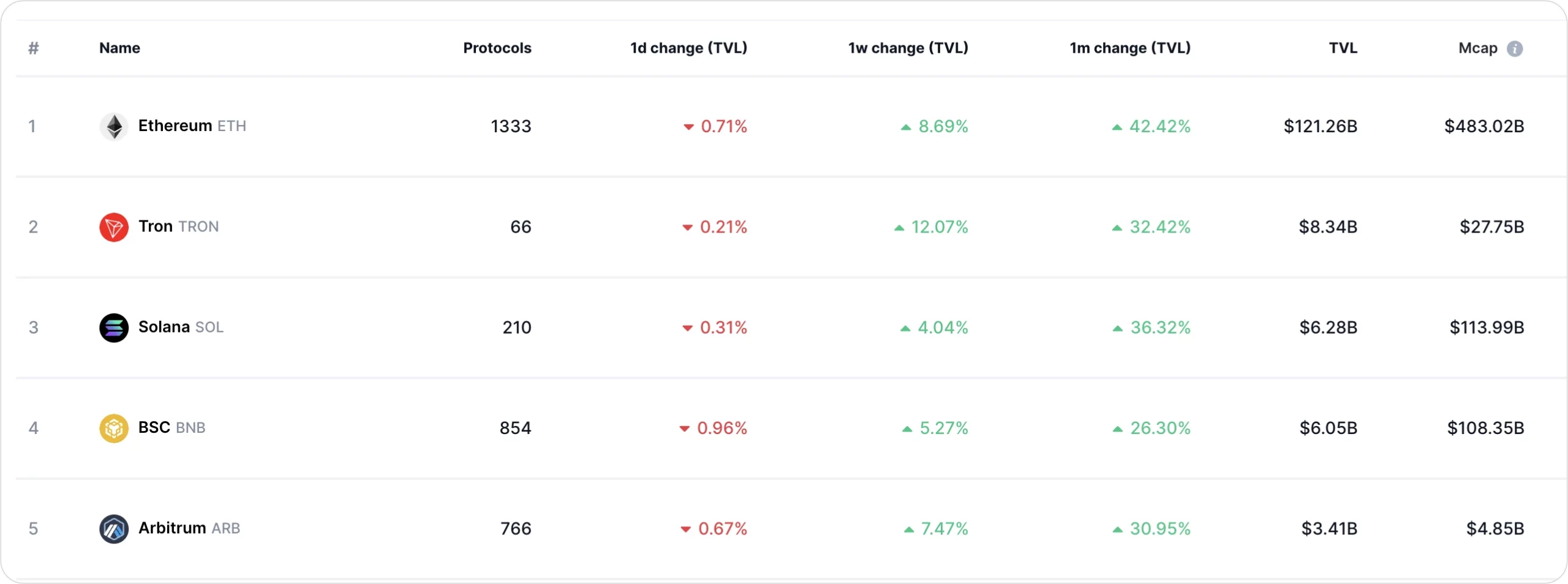

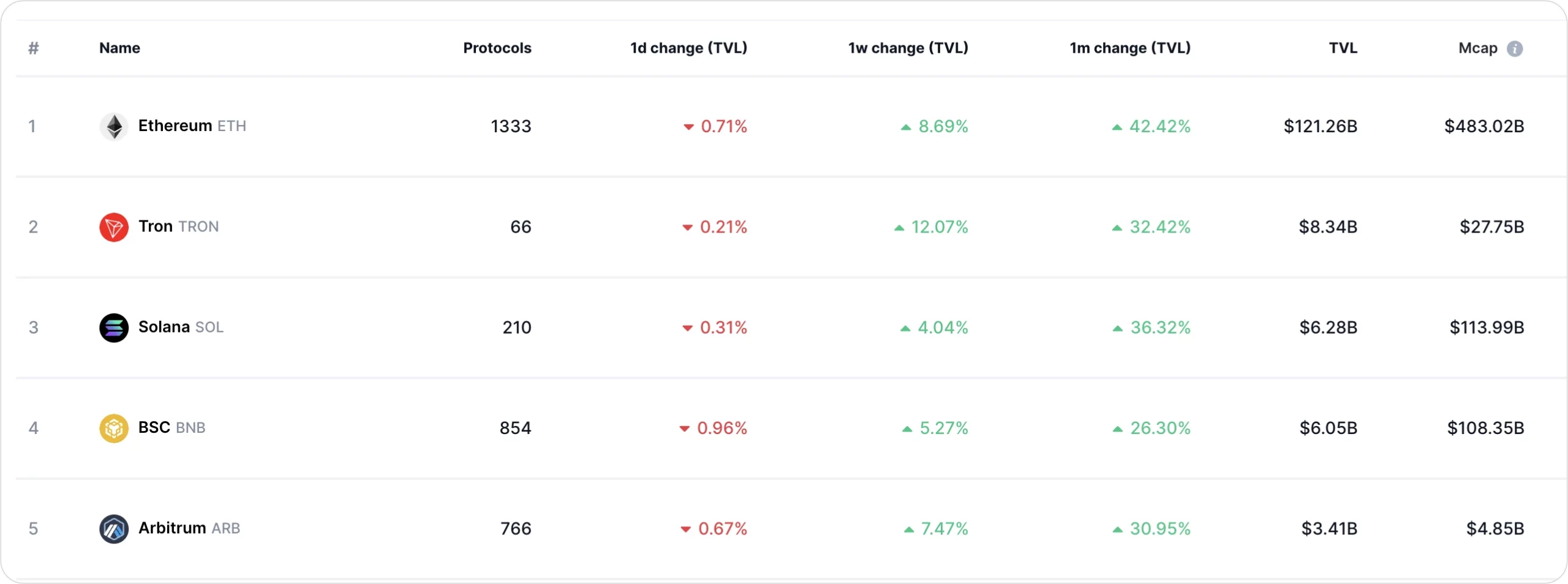

- Ethereum leads with $121.26B in TVL, followed by Tron, Solana, BSC, and Arbitrum, each showing unique strengths in technology and ecosystem growth.

- TVL rankings are driven by transaction efficiency, ecosystem depth, market sentiment, incentives, and security.

- Long-term success will depend on technological innovation, user experience, and regulatory compliance.

TABLE OF CONTENTS

Ethereum dominates the latest TVL rankings, with Tron, Solana, BSC, and Arbitrum showcasing their strengths. TVL performance reflects transaction efficiency, incentives, and security, while future competition will hinge on innovation, experience, and compliance.

OVERVIEW OF THE TVL RANKINGS AND DATA INTERPRETATION

In the blockchain industry, Total Value Locked (TVL) serves as a key metric to gauge the activity and market competitiveness of various blockchain ecosystems. TVL reflects the total amount of funds locked within on-chain protocols, providing insight into the flow of capital, market trust in different blockchains, and the maturity of their ecosystems.

As the blockchain space continues to evolve, competition among mainstream blockchains is intensifying. By analyzing the latest TVL rankings, we can better understand the current state of the blockchain ecosystem and anticipate its future trends.

Currently, Ethereum remains the undisputed leader, with a TVL of $121.26B, dominating the market. It is followed by Tron ($8.34B), Solana ($6.28B), Binance Smart Chain (BSC, $6.05B), and Arbitrum ($3.41B). These blockchains showcase unique competitiveness in terms of TVL through their technical strengths and ecosystem strategies.

》》Also Read:

What Is Ethereum & How Does It Work?

What is Solana? The Ethereum Killer

KEY FACTORS INFLUENCING TVL RANKINGS

The rankings of TVL are not coincidental but are shaped by multiple factors. Below is a systematic analysis of the core drivers influencing blockchain TVL rankings:

1. Technical Performance and User Experience

Transaction Speed and Costs: Ethereum, plagued by high congestion and gas fees, relies on Layer 2 solutions (e.g., Arbitrum) to enhance its competitiveness. In contrast, Solana’s ultra-low fees and high throughput have attracted significant TVL.

Network Stability: Efficient and stable networks build user trust. For example, Solana experienced a crisis due to multiple outages but has improved significantly through technical upgrades, boosting user retention.

2. Ecosystem Richness and Innovation

DeFi Project Volume and Quality: Iconic projects on Ethereum, such as Uniswap and Aave, continue to attract substantial capital inflows.

NFT and GameFi Development: Solana’s thriving NFT ecosystem (e.g., Magic Eden) has significantly boosted its TVL.

Cross-Chain Compatibility: Blockchains like BSC and Arbitrum attract more capital flow by offering convenient cross-chain functionality.

3. Market and Capital Trends

Market Sentiment and Token Price Fluctuations: Bull markets see active capital inflows and rapid TVL growth, whereas bear markets often lead to capital outflows.

•Incentive Mechanisms: High returns from liquidity mining attract substantial funds, as seen with Arbitrum’s early-stage incentive programs that spurred rapid TVL growth.

4. Security and Regulatory Compliance

Smart Contract Security: Hacking incidents or vulnerabilities severely undermine user confidence, as seen in multiple cross-chain bridge attacks.

Regulatory Impact: Tron’s growth in the stablecoin sector has been driven by USDT’s popularity but faces potential regulatory challenges.

5. Community and Developer Support

Developer Ecosystem: Ethereum’s high developer activity is the foundation of its prosperous ecosystem.

Community Size: Solana’s vibrant community has significantly contributed to its ecosystem recovery.

》》Also Read:

TON Ecosystem Sees Phishing Surge Amid 4,500% TVL Increase

2024 Crypto Asset Industry Regulations Trend Forecasts

ECOSYSTEM ANALYSIS: DISSECTING THE COMPETITIVENESS OF MAJOR BLOCKCHAINS

The performance of different blockchains in the TVL rankings reflects not only their technical capabilities but also the interplay of ecosystem development, capital flows, user behavior, and market strategies. Below is a multi-dimensional analysis of the competitive landscape of major blockchains:

1. Ethereum (ETH): How Can the Smart Contract Leader Maintain Its Dominance?

Technical Advantages: Ethereum’s standardized smart contracts and extensive toolkits (e.g., Solidity, Web3.js) provide strong network effects in DeFi, NFTs, and DAOs.

Challenges and Responses: High gas fees and congestion are Ethereum’s major drawbacks, making its growth reliant on Layer 2 scalability. Additionally, the success of ETH 2.0’s sharding technology in meeting market demands remains a key test.

Long-Term Competitiveness: With its balanced decentralization and security, as well as a large user and developer base, Ethereum is unlikely to be surpassed by emerging blockchains in the near term.

2. Tron (TRX): A Stablecoin Powerhouse, But Can It Expand Beyond Its Niche?

Strengths: Tron’s dominance in stablecoin circulation (especially USDT) is backed by its low fees and high throughput, making it a preferred platform for stablecoin transactions.

Weaknesses: Its ecosystem is relatively narrow, lacking innovative applications in areas like DeFi and NFTs.

Future Potential: Tron may elevate its market position by diversifying into broader use cases. Otherwise, its reliance on stablecoins poses a significant risk.

3. Solana (SOL): A Rising Star Recovering from Technical Setbacks

Core Strengths: Low fees and high throughput give Solana an edge in DeFi and NFTs.

Recent Growth Drivers: Solana’s standout performance in the NFT market (e.g., Magic Eden) and the rise of new GameFi projects have significantly boosted its TVL.

Challenges: Network outages have lingering effects on user trust, and its lack of decentralization may limit its growth.

4. Binance Smart Chain (BSC): A Centralized Chain Backed by a Giant

User and Ecosystem Strengths: Leveraging Binance’s global resources, BSC attracts a large retail user base and DeFi projects like PancakeSwap.

Challenges: Its high degree of centralization may diminish its appeal to institutional capital.

5. Arbitrum (ARB): A Scaling Pioneer for Ethereum

Advantages: By leveraging Optimistic Rollup technology, Arbitrum enhances Ethereum’s transaction performance and attracts high-quality DeFi projects.

Future Growth: As more projects migrate to Arbitrum, its ecosystem depth is expected to increase further.

SIGNIFICANCE AND LIMITATIONS OF TVL RANKINGS

TVL rankings serve as a “mirror” reflecting the development of the blockchain industry, offering a valuable perspective on ecosystem competitiveness. However, over-reliance on TVL as a measure of blockchain value risks overlooking deeper factors such as technical potential, ecosystem diversity, and regulatory adaptability.

The future of blockchain competition will involve more than capital and projects. It will center on technological innovation, user experience, and compliance capabilities. Understanding the logic behind TVL rankings provides critical insights for market participants and helps predict industry trends.