KEYTAKEAWAYS

- BTC Hashrate Drops 5.796%

- There Are hundreds of Tokens Based On The POW Mechanism

- Only BTC and DOGE from POW Tokens have Entered The Top 10 Cryptocurrencies By Market Cap

- Cryptocurrency Hashrate Competition Heats Up

CONTENT

BTC Hashrate Drops 5.796%. There Are hundreds of Tokens Based On The POW Mechanism. Only BTC and DOGE from POW Tokens have Entered The Top 10 Cryptocurrencies By Market Cap. Cryptocurrency Hashrate Competition Heats Up.

BTC HASHRATE DROPS 5.796%

According to F2Pool, the BTC network’s total hashrate dropped to 776.95 EH/s at 19:00 on January 22, compared to 818.72 EH/s on January 15, marking a 5.796% decrease over the past week.

Bitcoin mining involves using computational power to solve complex mathematical problems, verifying transactions and generating new bitcoins. This process is analogous to treasure hunting in the digital world, where miners use computing power to solve specific hash puzzles. Successful solutions grant the right to generate new blocks and earn bitcoin rewards.

Typically, higher bitcoin prices incentivize more mining activity. However, short-term hashrate decline results from multiple factors, potentially including:

- Network difficulty adjustments: Bitcoin network adjusts mining difficulty every 2016 blocks (about two weeks) based on total hashrate. If hashrate grows too quickly or mining profitability drops, some miners may exit, causing hashrate decline.

- Supply-demand imbalance for mining equipment: Bull markets increase demand, but production faces chip supply constraints. Inability to expand/upgrade equipment can limit hashrate growth. Older machines being retired due to inefficiency also causes short-term drops.

- Miner strategy shifts: Some miners may halt operations to sell bitcoin holdings for profit rather than continue mining, causing temporary hashrate reduction.

To date, 19,813,612 BTC have been mined, with 1,186,388 BTC remaining.

ONLY BTC AND DOGE FROM POW TOKENS HAVE ENTERED THE TOP 10 CRYPTOCURRENCIES BY MARKET CAP

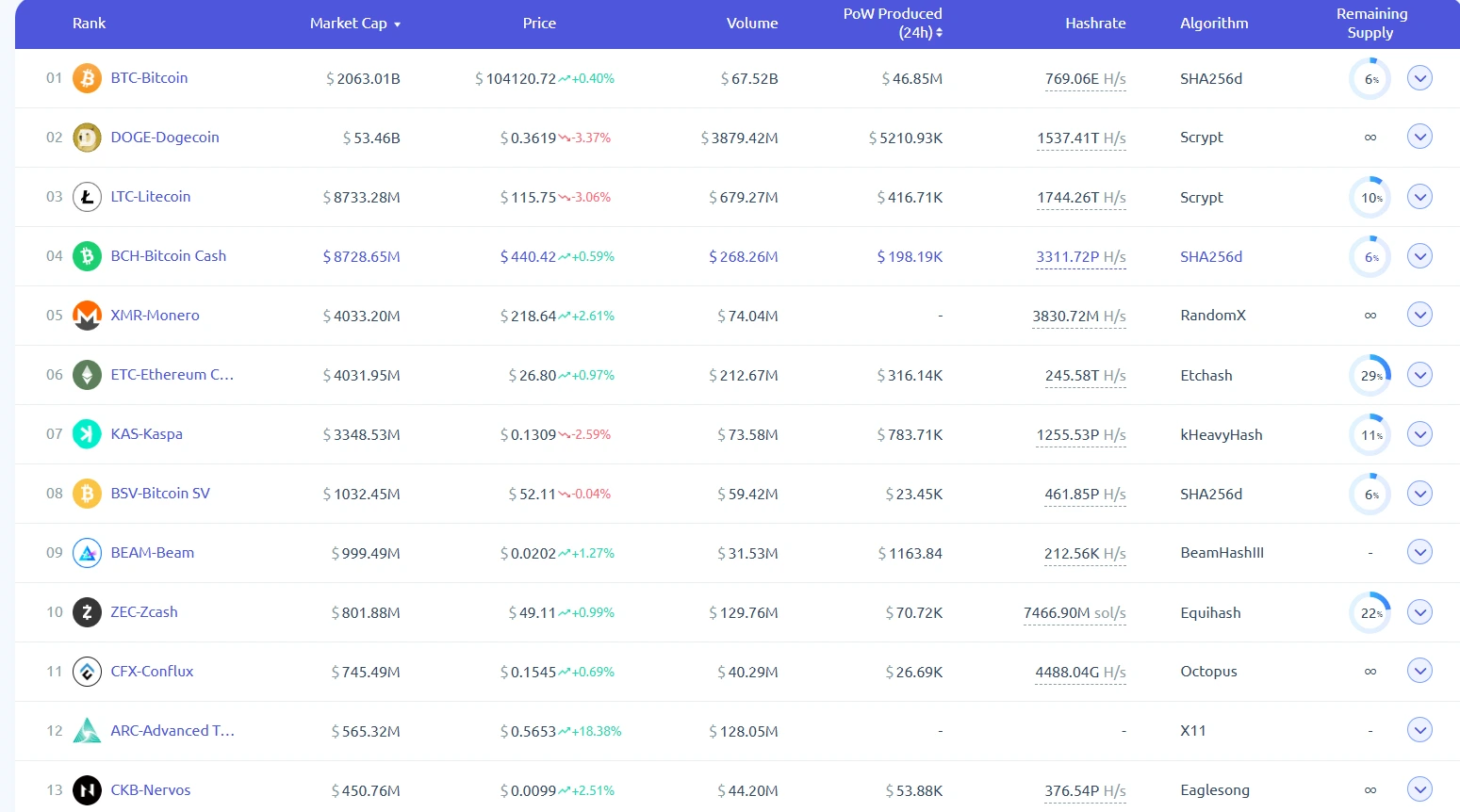

There are now hundreds of POW-based tokens in the cryptocurrency market, attracting a large number of crypto mining enthusiasts. Market cap Rankings for PoW Cryptocurrencies: BTC leads at $206.3B, followed by DOGE at $53.46B (ranked 7th globally). Other notable caps include LTC, BCH ($8.733B), XMR ($4.033B), ETC ($4.031B), KAS ($3.348B), BSV ($1.032B), BEAM ($999M), and ZEC ($802M).

Source:F2Pool

Hashrate Distribution: BCH at 3,311.72P, KAS at 1,255.3P, BSV at 461.85P, CKB at 376.54P. Legacy coins DOGE and LTC show 1,537.41T and 1,744.26T respectively.

The market cap and hashrate distribution reveal significant disparities among PoW projects, reflecting varying network effects and ecosystem development. BTC dominates with its $206.3B market cap and superior hashrate. DOGE and LTC maintain high market caps despite lower hashrates than BCH, showing diverse community positioning and use cases. Emerging projects like KAS and CKB demonstrate growth potential through steady hashrate increases. This indicates that while BTC dominates, other PoW coins find niches, with hashrate competition remaining crucial for security and decentralization.

CRYPTOCURRENCY MINING TRENDS AND FUTURE

Bitcoin mining maintains dominance, with institutional investment driving network hashrate and security growth. However, block reward halving and increasing difficulty squeeze miner profits. Energy-efficient equipment and low-cost power become crucial, pushing miners toward renewable energy regions to reduce costs and improve sustainability.

Other PoW cryptocurrencies explore new mining models. DOGE and LTC utilize merge mining to improve hashrate efficiency, while emerging projects like Kaspa (KAS) attract miners through energy-efficient algorithms. Small miners may shift to these lower-barrier projects as mainstream mining consolidates.

Regulatory dynamics significantly impact mining trends. Countries vary in approach – some restrict energy consumption while others incentivize miner relocation. This policy divergence shapes mining’s geographic distribution and growth patterns, potentially concentrating hashrate in crypto-friendly regions.

Overall, cryptocurrency mining presents opportunities amid challenges. Industry focus shifts to efficiency, environmental sustainability, and compliance. Success requires balancing economic returns with policy adaptation and industry trends, finding equilibrium between global and local operations in an increasingly competitive landscape.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!