KEYTAKEAWAYS

- Unlock hidden signals: The inverted hammer pattern, with its long upper shadow and short body, appears at downtrend bottoms, potentially indicating a shift in buying pressure and a coming price surge.

- Boost your trading accuracy: Don't be fooled by single candlesticks. Look for confirmation signals like higher trading volume or subsequent green candles to solidify the bullish reversal.

- Stay ahead of the curve: Combine the inverted hammer with other technical tools like moving averages and support/resistance levels for a robust trading strategy.

- KEY TAKEAWAYS

- WHAT IS THE INVERTED HAMMER PATTERN?

- UNDERSTANDING THE BASIC STRUCTURE OF THE INVERTED HAMMER

- SPOTTING THE INVERTED HAMMER IN DIFFERENT MARKET CONDITIONS

- WHAT DOES THE INVERTED HAMMER MEAN IN TRADING?

- HOW TO TRADE WITH THE INVERTED HAMMER IN CRYPTOCURRENCY

- BEST PRACTICES IN USING THE INVERTED HAMMER FOR CRYPTO TRADING

- THE INVERTED HAMMER: A POWERFUL TOOL

- DISCLAIMER

- WRITER’S INTRO

CONTENT

WHAT IS THE INVERTED HAMMER PATTERN?

The inverted hammer pattern is a bullish reversal indicator that signals potential market momentum shifts in cryptocurrency trading. Resembling a deciphering task of ancient scripts, trading involves identifying standout patterns like the inverted hammer, which often precedes market changes. To leverage this pattern, traders must combine keen observation with a deep understanding of market dynamics.

But what exactly elevates the inverted hammer to a position of such importance in the unpredictable world of cryptocurrency? Its significance lies in its ability to foreshadow a possible uptrend in the volatile crypto market.

UNDERSTANDING THE BASIC STRUCTURE OF THE INVERTED HAMMER

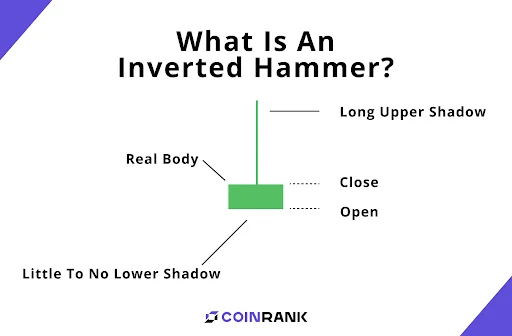

For those new to chart patterns, the inverted hammer might just seem like another point on the graph. However, for the discerning trader, it represents a possible beacon of imminent market change.

- Visual Characteristics: Imagine a candlestick that features a small body at its lower end, topped by a significantly longer upper shadow. This particular formation, characterized by the upper shadow being at least twice as long as the body, signifies a trading session in which the bulls made a noticeable effort to gain control, albeit temporarily.

Let’s break down the elements of a candlestick:

Body: This segment illustrates the range between the opening and closing prices.

Wick: Often referred to as shadows, the wicks indicate the highest and lowest prices achieved during the day.

Color: The hue of the candlestick body indicates the movement of the asset’s price. A white or green body indicates an upward trend in price, while a black or red body denotes a decrease in price.

[Explore live charts and see the inverted hammer in action on CoinRank.io.]

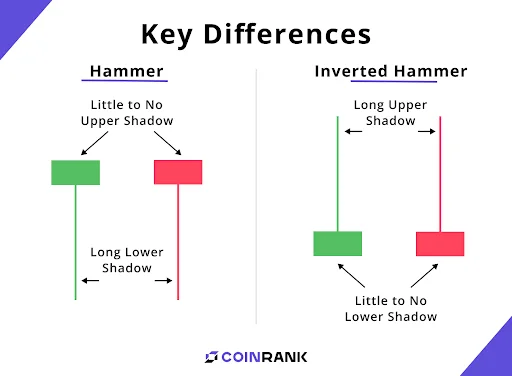

- The Hammer vs. The Inverted Hammer: While both the hammer and the inverted hammer candlestick patterns are considered bullish reversal indicators, their occurrence in different market trends is what sets them apart.

The classic hammer pattern usually appears during a downtrend and suggests a potential bullish reversal. On the other hand, the inverted hammer is often spotted during periods of uptrend and may warn of a possible bearish reversal ahead.

- Interpreting Colors: Red Inverted Hammers vs. Green Inverted Hammers

-

Red Inverted Hammers:

A red inverted hammer, where the small body is at the bottom of the price range, indicates that buyers managed to push the price up within the session, but not with enough conviction to maintain a higher closing price.

This lack of sustained buying pressure can serve as a cautionary signal for traders. This signal suggests that although buyers tried to push the price up, there wasn’t enough momentum to sustain the growth.

-

Green Inverted Hammers:

In contrast, a green inverted hammer, characterized by the price closing higher than it opened, signals stronger buying pressure.

A green inverted hammer is a sign of more substantial buying pressure. This pattern is typically viewed as a bullish indicator. It implies that buyers had gained the upper hand by the close of the session, which could be a harbinger of a continued upward trend.

Both color variations of the inverted hammer necessitate careful consideration of market context and subsequent price action for confirmation.

SPOTTING THE INVERTED HAMMER IN DIFFERENT MARKET CONDITIONS

The inverted hammer is not an isolated pattern; its significance is highly dependent on the market context in which it appears.

-

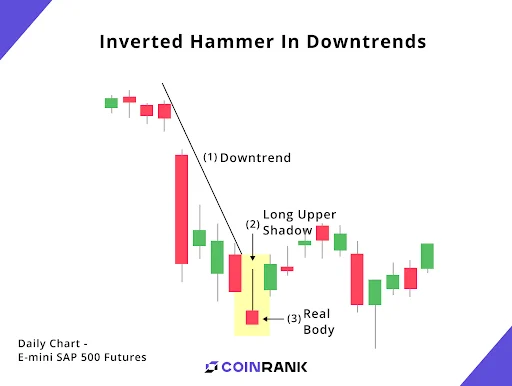

Inverted Hammer in Downtrends:

This pattern, when spotted in a downtrend, may hint at a burgeoning shift towards bullish sentiment. It often acts as a glimmer of hope, suggesting a potential trend reversal might be on the horizon.

-

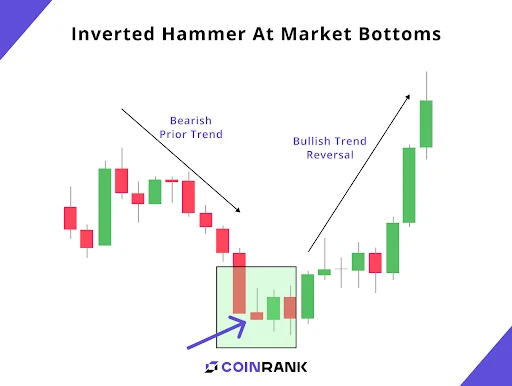

Inverted Hammer at Market Bottoms:

The occurrence of an inverted hammer at market bottoms is particularly noteworthy. It frequently indicates that the ongoing bearish phase might be nearing its end, signaling a possible turning point in the market dynamics.

[Monitor the inverted hammer and other patterns as they unfold in the market at CoinRank.io.]

WHAT DOES THE INVERTED HAMMER MEAN IN TRADING?

The inverted hammer symbolizes a period where buyers attempted to steer the market in their favor, providing valuable insight for traders seeking optimal times to enter or exit the market.

Grasping the inverted hammer is akin to mastering a new dialect of the trading language. It’s about more than recognizing the pattern—it’s about comprehending its subtle messages and market implications.

- A Sign of Shifting Dynamics: The appearance of an inverted hammer often suggests a change in market sentiment. It’s a signal that buyers are starting to contest the previously dominant selling pressure. This change can be a precursor to a trend reversal, making it a vital pattern to recognize for traders.

- Inverted Hammer in Crypto Trading: The significance of the inverted hammer is magnified due to the crypto market’s inherent volatility, serving as a guiding light through the uncertainty. The pattern’s occurrence can be a key indicator for potential market shifts, making it an essential tool in a crypto trader’s arsenal.

HOW TO TRADE WITH THE INVERTED HAMMER IN CRYPTOCURRENCY

Employing the inverted hammer in trading is a strategic endeavor. Recognizing the pattern is just the start; traders need to couple this with an analysis of market indicators to make informed decisions.

- Recognize the Inverted Hammer Pattern: Traders should closely monitor the candlesticks that appear after the inverted hammer for effective validation. The main aspect to watch for is the trajectory following the pattern. If the subsequent candlesticks exhibit a consistent upward movement, it significantly supports a potential shift from a bearish to a bullish market trend.

- Volume as a Validator: The trading volume accompanying the inverted hammer pattern is also a significant validator. A high volume during its formation signals strong market interest at these critical price levels, lending credence to the pattern’s implications.

- Anticipating Future Trends: Beyond validation, astute traders also focus on predicting future occurrences of the inverted hammer pattern. This involves monitoring market conditions that commonly precede the pattern, such as a downtrend or high selling pressure.

- Risk Management: Given the rapid and often unpredictable swings in the crypto market, implementing stop-loss orders is essential. This approach helps manage risk and protect investments from sudden market movements

BEST PRACTICES IN USING THE INVERTED HAMMER FOR CRYPTO TRADING

Here are some tips to effectively use the inverted hammer in your trading strategy:

- Synergize with Other Indicators: The inverted hammer should not be used in isolation. Pairing it with other technical analysis tools like Relative Strength Index (RSI) and moving averages can provide a more comprehensive view of the market. This combined approach helps in making more informed and nuanced trading decisions.

- Stay Up-to-Date: In the ever-changing landscape of cryptocurrency markets, staying abreast of market news and global events is crucial. External factors can have a significant impact on crypto markets. Keeping up with news ensures that you’re aware of potential market-moving events, allowing you to adapt your strategies accordingly.

- Exercise Patience: Trading requires a disciplined approach, especially when interpreting patterns like the inverted hammer. It’s important to wait for clear confirmation signals before making a move. Acting prematurely or without sufficient evidence can lead to misjudged trades.

THE INVERTED HAMMER: A POWERFUL TOOL

The inverted hammer candlestick pattern is a powerful tool in the arsenal of a crypto trader. It’s not just a pattern, but a story of market sentiment, a drama of buyers and sellers played out in the form of candlesticks. Understanding and utilizing this pattern can provide valuable insights, aiding traders in navigating the often-turbulent crypto markets.

[Stay ahead of the curve by tracking the latest market trends and patterns with CoinRank.io.]

Remember, the key to successful trading lies in a balanced approach that combines pattern recognition with solid risk management and an ever-curious, learning mindset. Keep exploring, keep learning, and may your trades be as dynamic and rewarding as the market itself!

▶ Buy Crypto at Bitget

ꚰ CoinRank x Bitget – Sign up & Trade to get $20!