KEYTAKEAWAYS

- CeFi sector demonstrates resilience during market downturn, benefiting from year-end trading momentum and restored confidence following post-FTX recovery measures.

- Bitget Token (BGB) emerges as standout performer, driven by strategic BWB merger announcement and successful Launchpool campaigns fueling demand.

- Investor sentiment shifts away from speculative meme and AI tokens toward established CeFi platforms, suggesting a broader market preference for stability

CONTENT

Amid broader crypto market decline, CeFi sector stands strong with 0.36% gain. Bitget Token (BGB) leads the rally with 367% monthly surge, while AI and meme tokens retreat. Analysis reveals shifting investor sentiment towards established platforms.

CEFI SECTOR DEFIES THE TREND

Over the past two days, the crypto market has seen a steady pullback, but the CeFi sector stood out with a 0.36% 24-hour increase.

CEX tokens led the charge, with Bitget Token (BGB) surging 28.86% in 24 hours, 72.8% in 7 days, and a massive 367.69% over the past month. Other notable gains include Huobi (HT) up 11.64%, OKB up 7.01%, and Gate (GT) up 6.69%.

(Source:Tradingview)

Even HYPE rebounded 6.64% after a 10% drop yesterday, while Hypeliquid tokens like PURR and HFUN rose by 5.43% and 7.52%.

In contrast, other sectors struggled: DeFi dropped 2.78%, Layer 1 and Layer 2 fell 3.05% and 3.88%, Meme tokens slid 4.71%, and AI Agents suffered a sharp 7.7% pullback, with Fartcoin plummeting 17.05%. Virtuals tokens like VIRTUAL, LUNA, and AIXBT also dipped significantly.

WHY DID THE CEFI SECTOR DEFY THE DOWNTREND?

The CeFi sector’s unexpected rally is driven by a combination of factors. In the dynamic game of market forces, CeFi appears to have seized a critical turning point.

Shift in Market Sentiment: Cooling Off of Meme and AI Hype

Capital flow in the crypto market often mirrors changes in investor sentiment. Over the past few months, Meme and AI sectors have been in the spotlight, but after a period of intense speculation, their popularity is waning.

With capital leaving these overhyped sectors, CeFi, known for its relative stability, has become a safe haven. Particularly, CEX-related tokens like BGB have attracted significant investor attention during the market’s turbulence.

Increased Trading Demand: End-of-Year Momentum

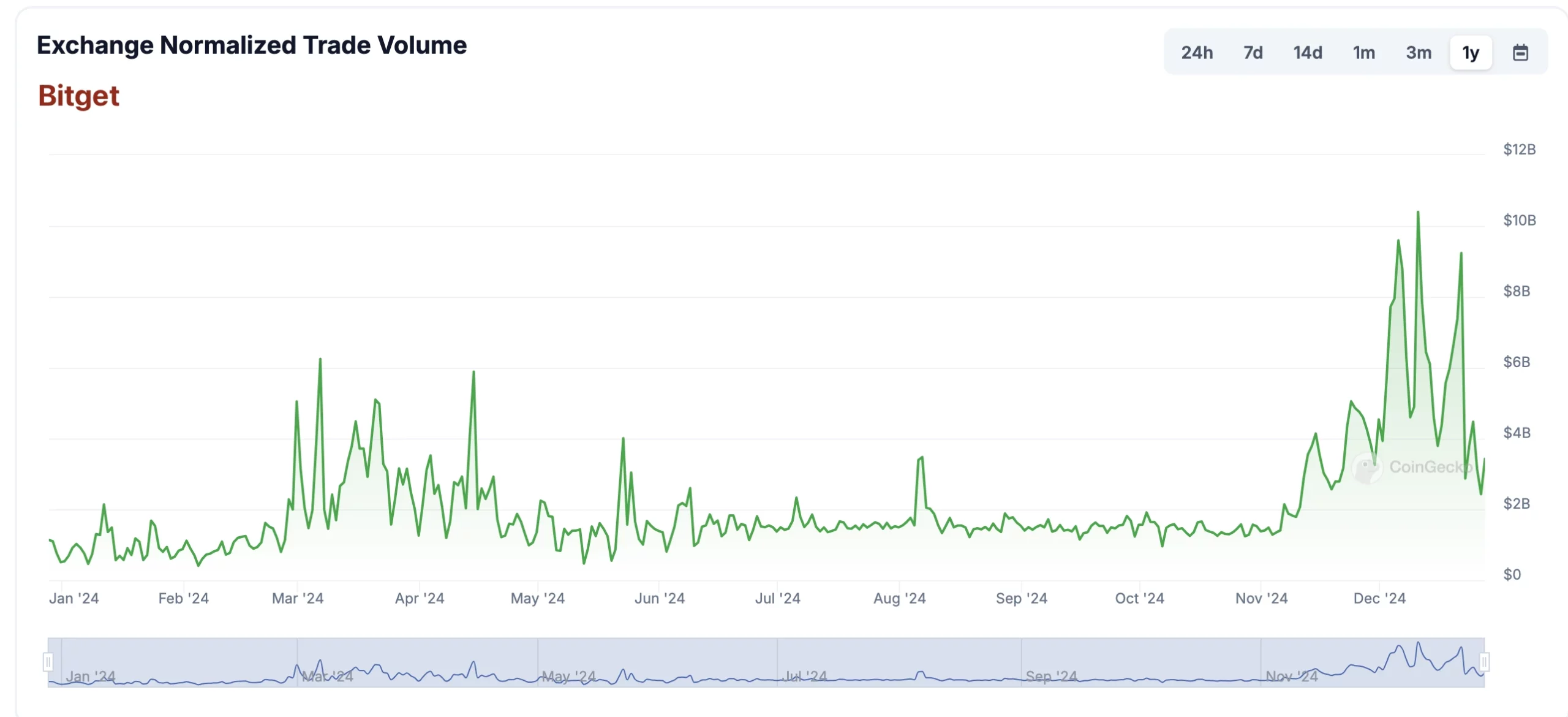

(Source:CoinGecko)

As the year-end approaches, trading activity typically picks up, benefiting exchange tokens naturally. Rising demand for platform tokens has driven up their prices. For instance, Bitget’s recent promotional activities and feature enhancements have garnered widespread user attention, contributing to the surge in BGB prices.

Restored Investor Confidence Post-FTX

Following last year’s FTX collapse, the CeFi sector faced severe trust issues. However, leading exchanges have made efforts to rebuild investor confidence through measures such as publishing regular proof of reserves and introducing insurance mechanisms.

This gradual restoration of trust is reflected in both trading volumes and the prices of related tokens.

Also Read:

Top Memecoins 2024: What You Need to Know

THE SECRETS BEHIND BGB’S SUCCESS

Among all CeFi tokens, Bitget Token (BGB) undoubtedly stands out as the brightest star. With a 24-hour surge of 28.86%, a 7-day increase of 72.8%, and a one-month gain of 367.69%, what’s driving this extraordinary performance?

Merger Plan Ignites Market Excitement

Bitget recently announced plans to merge Bitget Wallet Token (BWB) with BGB. This news acted as a catalyst, sparking strong positive reactions from the market. Investors widely view the merger as an important move to enhance BGB’s utility and value, further fueling its price surge.

Launchpool Activities Drive Demand

Bitget’s Launchpool campaigns have attracted a large number of participants. These “token farming” activities have not only boosted user engagement but also increased the demand for BGB, pushing its price higher.

Strong Market Demand

As the native token of the Bitget platform, BGB’s rise reflects the platform’s robust growth and investors’ confidence in its future development. This strong demand underscores BGB’s appeal in the broader market.

FINAL THOUGHTS

The CeFi sector’s defiance of the broader market downturn has injected a glimmer of hope into the crypto space. From capital flows to market sentiment and the stellar performance of platform tokens, this rally results from a convergence of factors.

Whether CeFi can maintain its momentum as the market evolves remains to be seen.

Meanwhile, the remarkable rise of BGB offers investors a key takeaway: high-quality tokens from leading platforms might just be the bright spots in a challenging market.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!