- Matrixport: Bitcoin Sentiment Shifts to “Greed” with Index Surpassing 90%

- Michael Saylor: Committed to Bitcoin, Even at $1 Million

- Crypto Market Faces Broad Correction, BTC and CeFi Show Resilience

TABLE OF CONTENTS

MATRIXPORT: BITCOIN SENTIMENT SHIFTS TO “GREED” WITH INDEX SURPASSING 90%

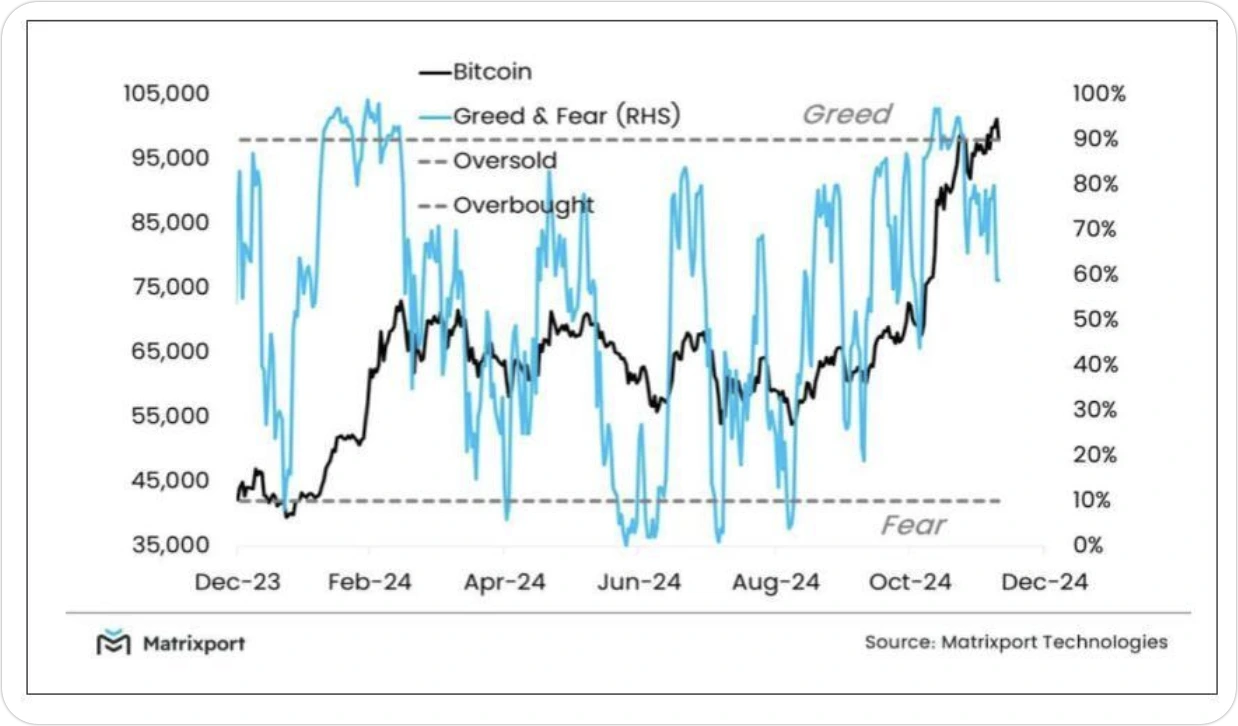

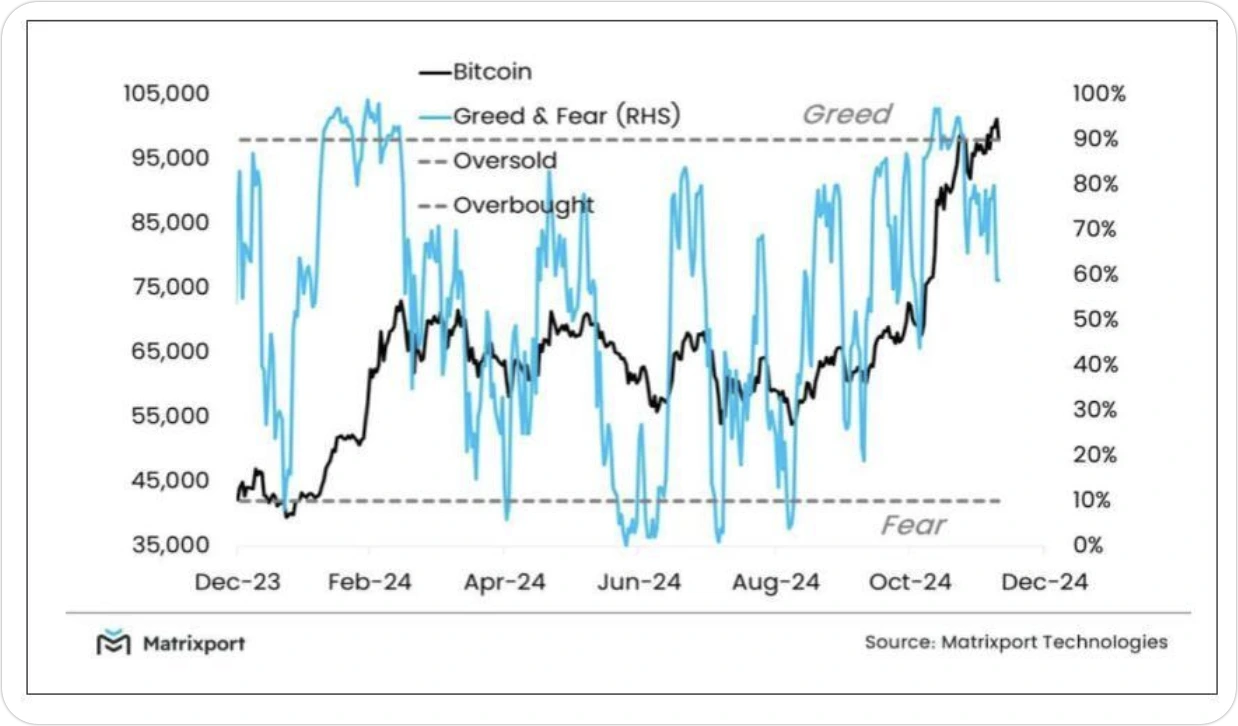

On December 10, Matrixport released its Greed and Fear Index model data, indicating that Bitcoin market sentiment has recently shifted from “fear” to “greed,” with the index exceeding 90%. Such a signal is often regarded as a precursor to profit-taking. Earlier this year, the index marked five critical entry points when it dropped below 10%, indicating market panic.

Over the past seven months, Bitcoin has undergone prolonged consolidation. Despite multiple “fear” signals during this period, the lack of rebound momentum prevented the market from entering the “greed” zone. The recent breakthrough above 90% suggests that Bitcoin may face another consolidation phase before potentially resuming its upward trend. (Original Link)

Analysis:

The shift in Bitcoin’s sentiment index to the “greed” level reflects heightened optimism in the market, which is often associated with overbought conditions. Historically, extreme greed has been a reliable indicator for short-term profit-taking, as investors may capitalize on gains during such periods.

However, the prolonged consolidation phase over the past several months has allowed the market to reset, potentially strengthening its foundation for future growth. The recent surge in sentiment could attract both retail and institutional investors, boosting liquidity and trading activity.

That said, the likelihood of a near-term correction or continued consolidation remains high as market participants reassess valuations. Investors should approach this phase with caution, balancing the potential for short-term fluctuations with Bitcoin’s longer-term prospects, which remain tied to macroeconomic factors and the evolution of blockchain adoption.

MICHAEL SAYLOR: COMMITTED TO BITCOIN, EVEN AT $1 MILLION

Michael Saylor, founder of MicroStrategy, stated in a recent interview with Barstool Sports founder Dave Portnoy that he would continue buying Bitcoin even if its price reaches $1 million. He emphasized that the real challenge lies in how long people can hold Bitcoin, as it gives them control over their own funds. Saylor also praised Bitcoin’s creator, Satoshi Nakamoto, for designing a system that benefits everyone.(Original Link)

Analysis:

Michael Saylor’s remarks once again highlight his unwavering belief in Bitcoin and his long-term optimism. His steadfast stance not only reinforces his status as a prominent figure in the crypto space but also instills confidence in the market. His praise for Satoshi Nakamoto suggests that he views Bitcoin as more than just an asset—it is a revolutionary innovation disrupting traditional finance.

Saylor’s focus on long-term holding is particularly significant, as Bitcoin’s volatility often tests the patience of many investors. His comments may inspire more people to adopt a buy-and-hold strategy, potentially mitigating short-term market fluctuations.

However, as Bitcoin’s price approaches historical highs, investors should remain cautious about potential market volatility and profit-taking activities. For individual investors, it’s crucial to make rational decisions aligned with their own investment goals and risk tolerance, even when influenced by institutional or celebrity opinions.

CRYPTO MARKET FACES BROAD CORRECTION, BTC AND CEFI SHOW RESILIENCE

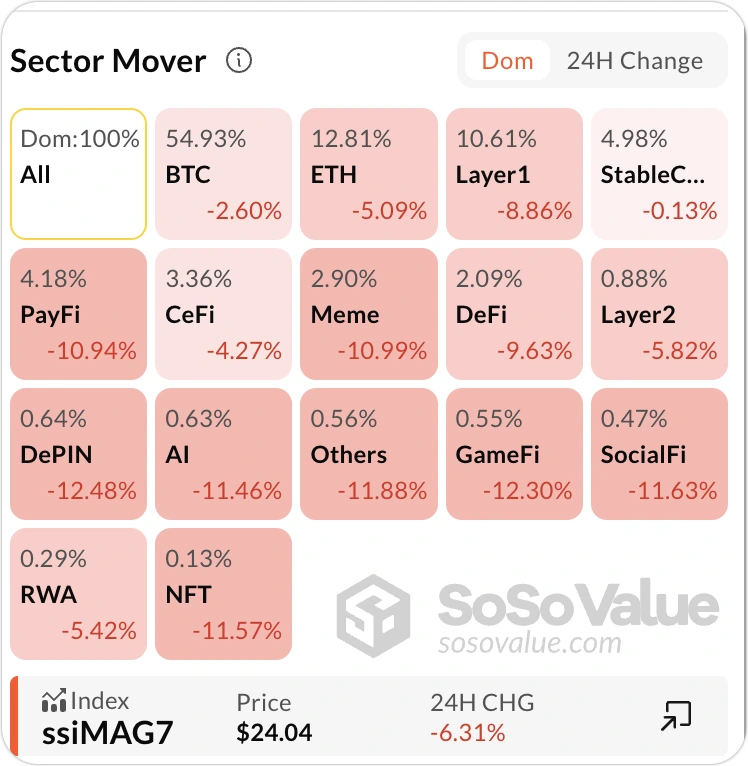

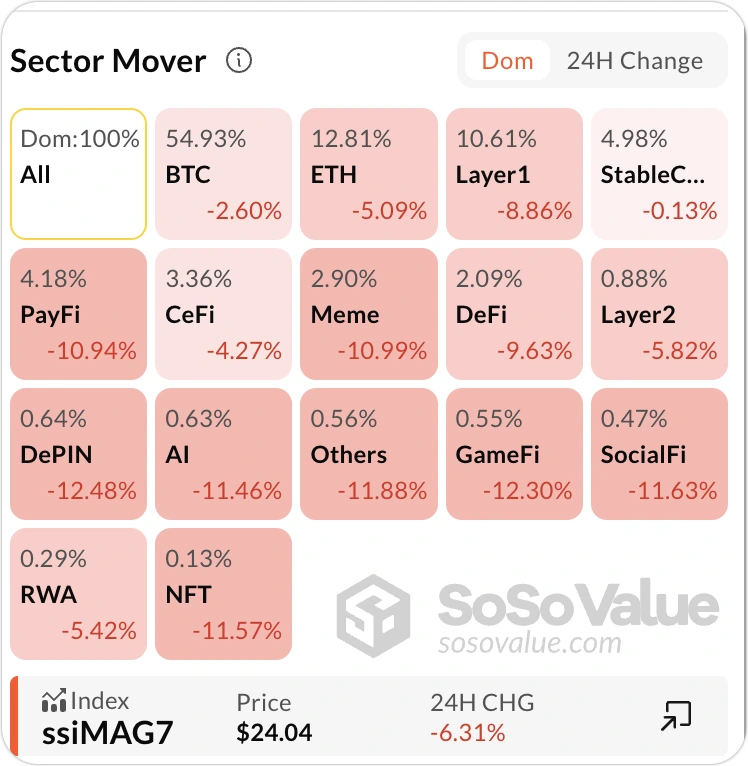

According to SoSoValue data, the entire cryptocurrency market sector has experienced a pullback, with declines of over 10%. Among them, BTC has fallen by 2.60% in the last 24 hours, ETH has dropped by 5.09%, and the CeFi sector has decreased by 4.27%, showing relatively better performance.

Other sectors have seen larger declines, with the Layer 1 sector down by 8.86%, the Layer 2 sector down by 5.82%, the Meme sector down by 10.99%, the RWA sector down by 5.42%, and the DeFi sector down by 9.63%.

Analysis:

The market-wide correction reflects short-term bearish sentiment, likely driven by macroeconomic factors or capital outflows. Bitcoin (BTC), as the market’s cornerstone, showed limited losses, underscoring its resilience. The CeFi sector’s relative stability could be attributed to its more mature market structure.

In contrast, high-volatility sectors such as Layer 1, Layer 2, Meme, RWA, and DeFi faced steeper declines, suggesting that riskier assets bear the brunt during a market downturn. This indicates a shift in investor risk appetite, with capital flowing toward more stable assets.

Despite the widespread correction, the relative strength of BTC and CeFi offers some confidence to investors. Moving forward, it will be crucial to monitor whether these resilient sectors can help stabilize the market and whether macroeconomic conditions will introduce new variables impacting market sentiment.

CoinRank x Bitget – Sign up & Trade to get $20!