- Microsoft Shareholders Vote Against Bitcoin Investment Proposal

- An 8-year-old wallet transferred 680 ETH to Binance

- Bitwise predicts that the target prices of BTC, ETH and SOL in 2025 will be US$200,000, US$7,000 and US$750 respectively

TABLE OF CONTENTS

MICROSOFT SHAREHOLDERS VOTE AGAINST BITCOIN INVESTMENT PROPOSAL

On December 11, voting results revealed that Microsoft’s major shareholders rejected a proposal to allocate 1% of the company’s total assets to Bitcoin as a hedge against inflation. This proposal, put forth by the National Center for Public Policy Research, was earlier advised against by Microsoft’s board.

During the annual meeting, MicroStrategy founder Michael Saylor delivered a three-minute speech in an attempt to persuade shareholders to support the idea. However, with institutional investors like Vanguard and BlackRock being Microsoft’s largest stakeholders, the proposal ultimately failed.

Analysis and Commentary

1. Traditional Institutional Investors’ Stance: Microsoft’s major shareholders, predominantly traditional institutional investors, tend to favor conservative investment strategies. They may view cryptocurrency as too volatile to serve as a reliable hedge, particularly when managing large portfolios.

2. Board’s Opposition: The Microsoft board’s recommendation against the proposal highlights the conservative approach of tech giants toward Bitcoin. This indicates that even tech companies are cautious about venturing into cryptocurrency investments.

3. Conflict Between Crypto and Traditional Businesses: The voting outcome underscores the ongoing reluctance of mainstream enterprises to embrace Bitcoin. While some companies, like MicroStrategy, actively promote Bitcoin adoption, larger corporations remain wary of the risks.

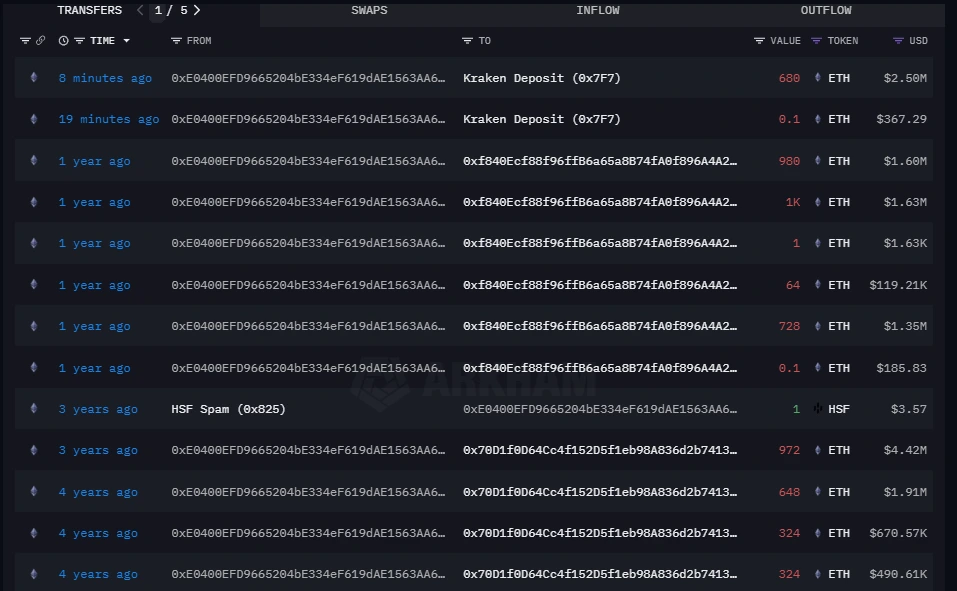

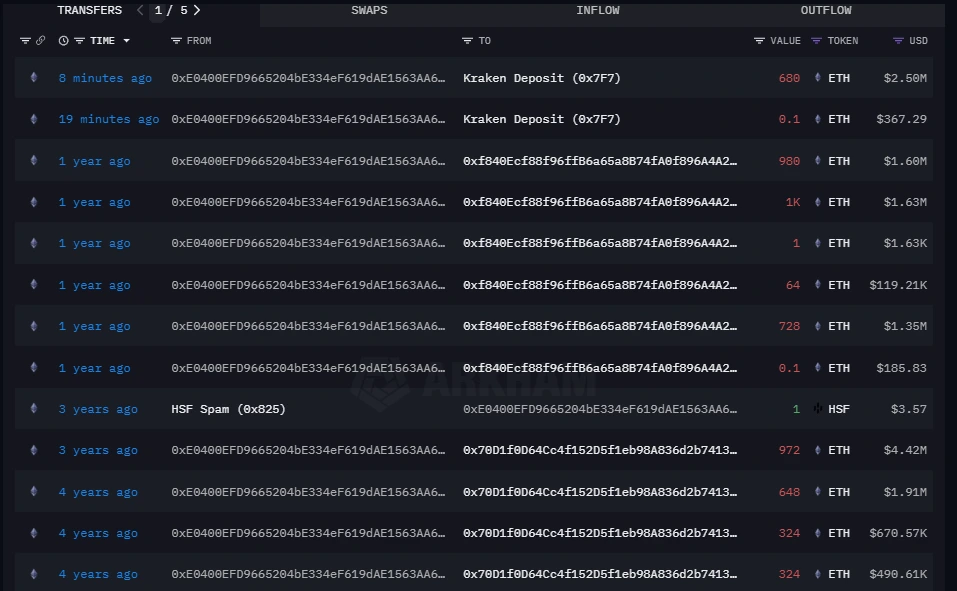

AN 8-YEAR-OLD WALLET TRANSFERRED 680 ETH TO BINANCE

According to monitoring data from The Data Nerd,, a wallet created 8 years ago transferred 680 ETH, worth approximately $2.5 million, to Binance. The wallet had purchased a total of 10,678 ETH 8 years ago at an average cost of $49.57 per ETH. If all the transferred ETH is sold, it would yield a profit of approximately $2.46 million.

Currently, the wallet still holds 3,228 ETH, valued at approximately $11.88 million, with an unrealized profit of about $11.78 million.Original Link

Analysis and Commentary

1. High Returns from Long-Term Holding

The wallet holder purchased ETH at significantly lower prices 8 years ago and has since achieved returns in the thousands of percent. This highlights the potential high rewards of long-term holding of quality crypto assets. The recent transfer to Binance may indicate an intention to partially realize profits.

2. Optimistic Holding Structure

Despite this potential sale, the wallet still holds a substantial amount of ETH worth over $11 million, reflecting the holder’s continued confidence in ETH’s long-term growth potential.

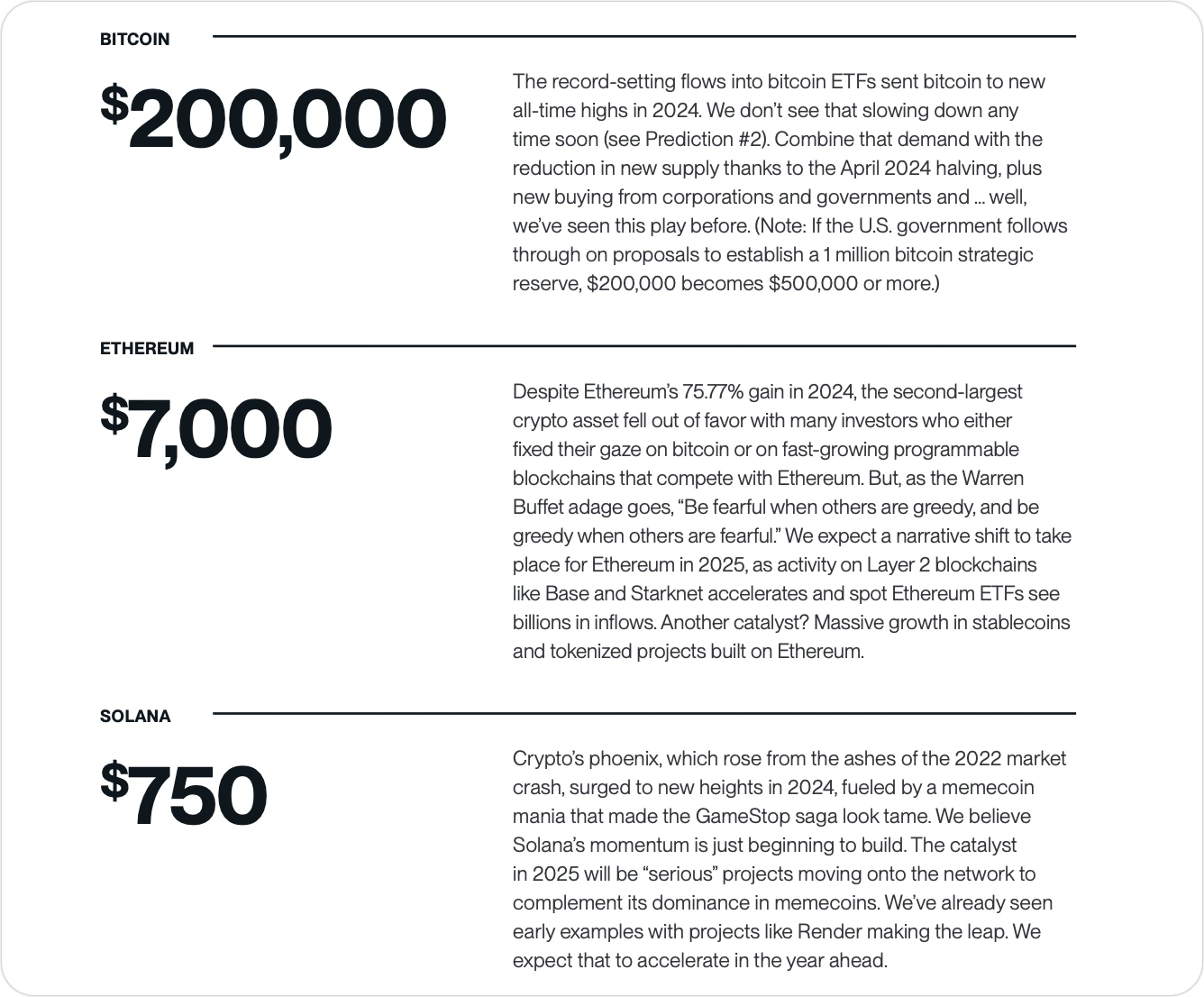

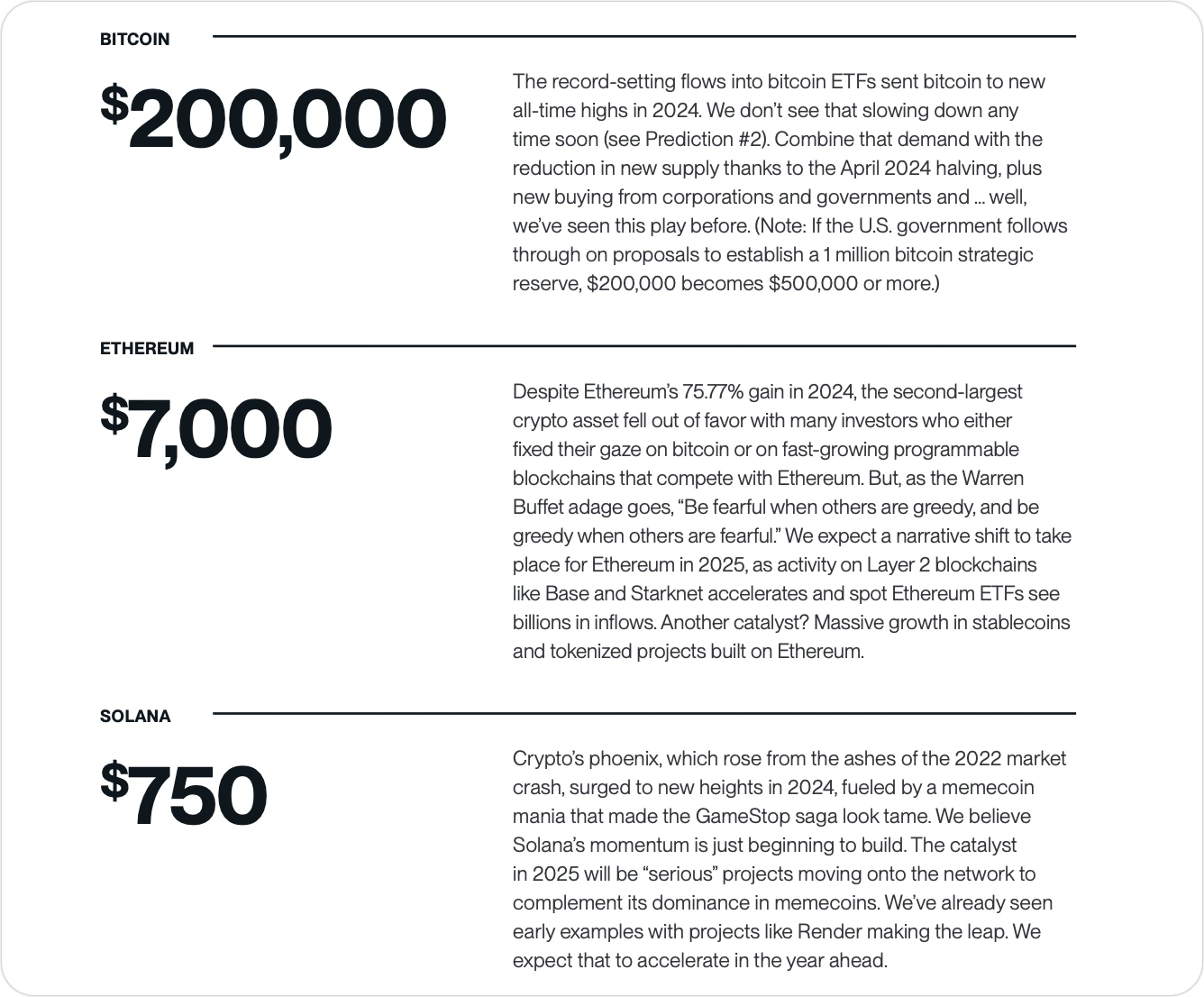

BITWISE PREDICTS THAT THE TARGET PRICES OF BTC, ETH AND SOL IN 2025 WILL BE US$200,000, US$7,000 AND US$750 RESPECTIVELY

Asset management company Bitwise has released its predictions for the crypto market in 2025 and beyond. According to their forecast, Bitcoin, Ethereum, and Solana will reach new all-time highs in 2025, with target prices of $200,000, $7,000, and $750, respectively. Additionally, Bitcoin ETF inflows will surpass those of 2024, and Coinbase’s stock price will exceed $700 per share. Bitwise also predicts that at least five crypto unicorns will go public in the US, AI-issued tokens will spark a new meme coin craze, and the number of countries holding Bitcoin will double.

Furthermore, Bitwise forecasts that by 2029, Bitcoin will surpass the $18 trillion gold market, with each Bitcoin trading for over $1 million.Original Link

Analysis and Commentary

1. Potential of Bitcoin and the Crypto Market

Bitwise’s forecast suggests an optimistic outlook for Bitcoin and other major cryptocurrencies, with new all-time highs expected by 2025. This prediction could attract more investor attention to the crypto market, especially with the increased inflows into Bitcoin ETFs, potentially accelerating institutional acceptance of crypto assets.

2. Mainstreaming of Crypto Assets

The mention of the stablecoin market, tokenization of RWA, and the listing of crypto unicorns in the US indicates that crypto assets are becoming increasingly mainstream. The US Department of Labor easing restrictions on cryptocurrency in 401(k) plans will also enable more retail investors to participate.

3. Long-Term Investment Prospects

The forecast of Bitcoin exceeding $1 million per coin shows long-term investor confidence in Bitcoin. This price breakthrough could signal crypto assets entering a broader global investment market.

Also Read:

CoinRank Crypto Digest: December 10, 2024

CoinRank Crypto Digest: December 9, 2024

CoinRank x Bitget – Sign up & Trade to get $20!