- Alipay Promotes Crypto Funds: Is This a Sign of Regulatory Loosening in China

- Bitcoin’s Market Share Fell Again

- Compound Finance Launches $1 Million Bug Bounty Program

TABLE OF CONTENTS

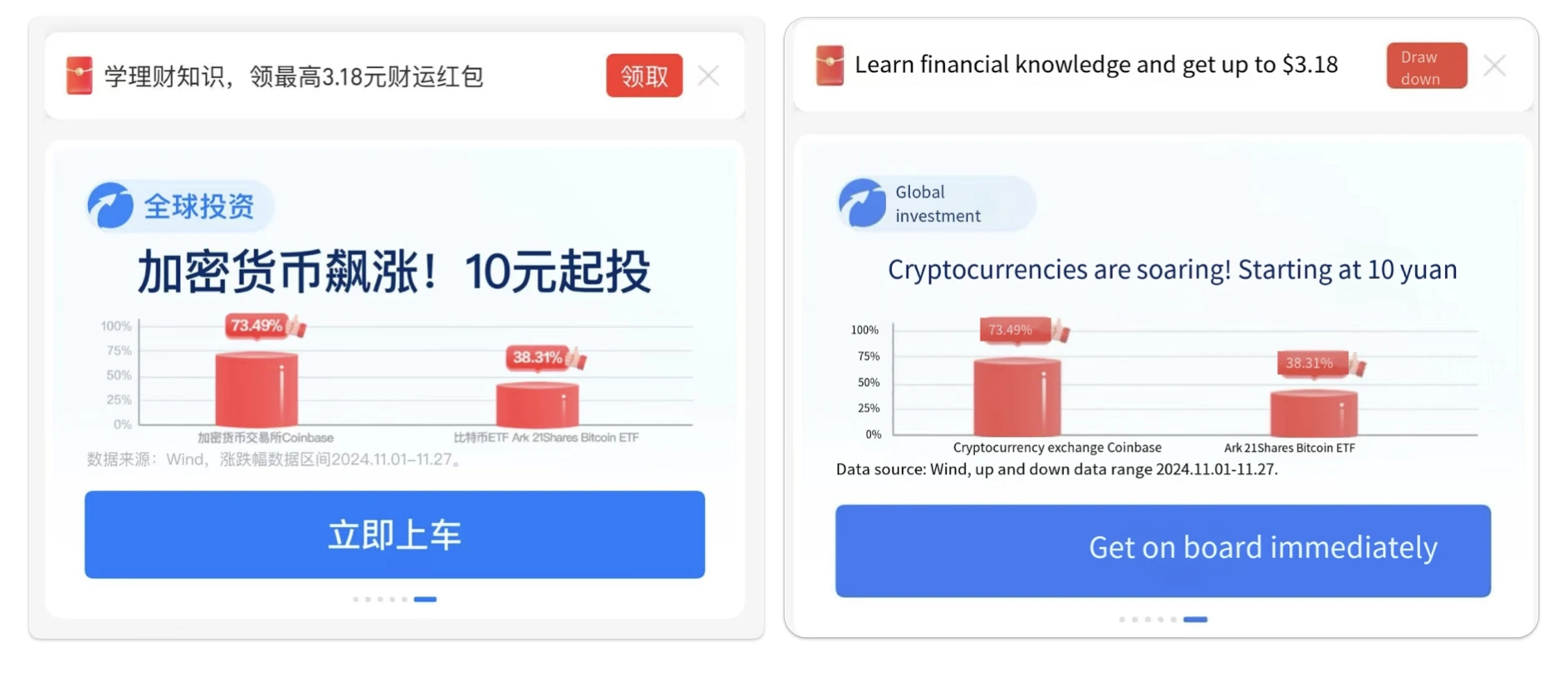

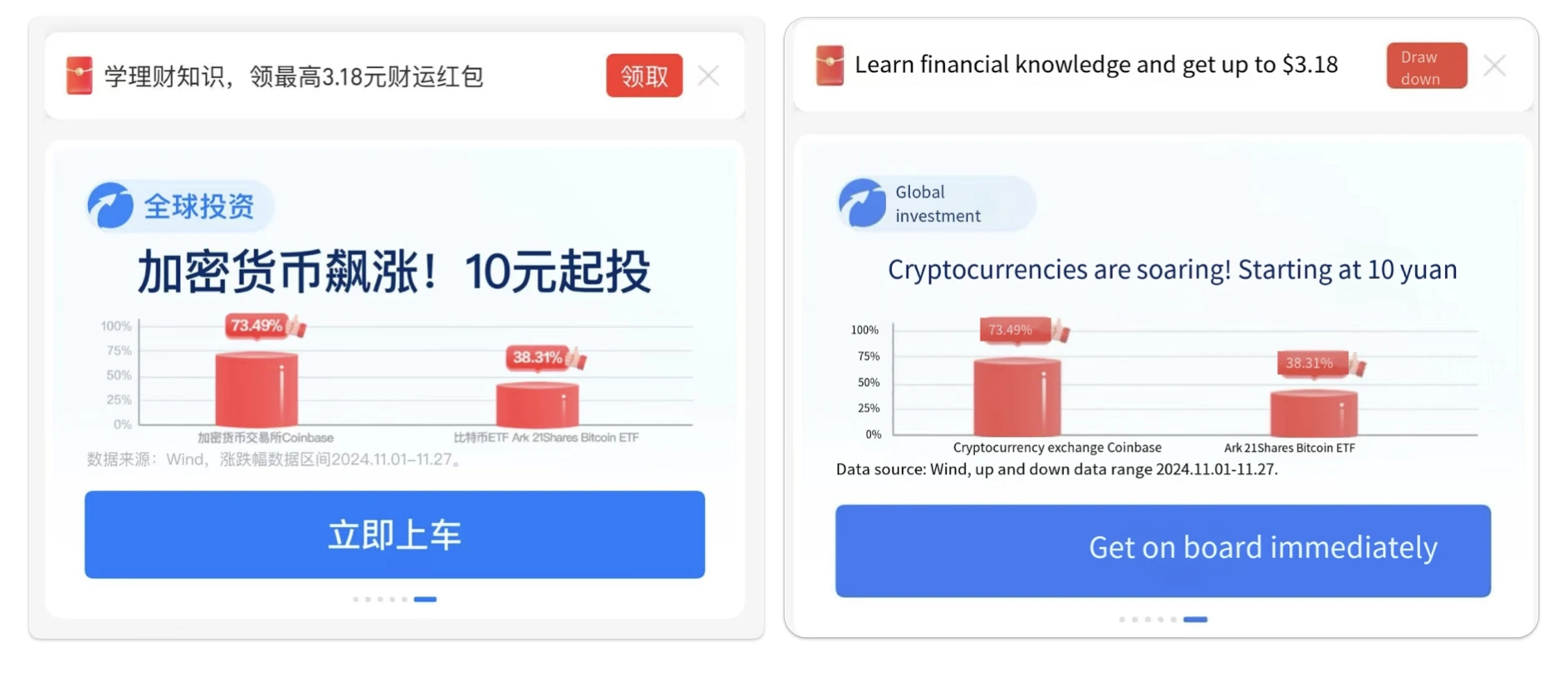

According to reports from Wu Says Blockchain, recent reports from users in mainland China indicate that they received advertisements for cryptocurrency funds on the Alipay homepage.

The ad included phrases like “Global investment, cryptocurrency soaring, start investing from 10 yuan, get on board now.” Upon investigation, the fund mentioned in the ad is HuaBao Overseas Technology C (QDII-FOF-LOF).

This fund adopts a compliant model for investing in overseas assets, indirectly holding Coinbase stock and ARK Invest’s Bitcoin spot ETF. Currently, the fund has a purchase limit of 1,000 yuan per person per day.

Analysis and Commentary

This event reflects the growing attention to cryptocurrency and digital assets in the Chinese market. Despite strict regulations on cryptocurrencies in mainland China, investors can still indirectly access cryptocurrency-related investment opportunities through compliant fund channels.

Alipay, as one of the leading payment platforms in China, promoting a cryptocurrency fund through its platform marks further integration of traditional financial systems with the crypto asset market.

BITCOIN’S MARKET SHARE FELL AGAIN

According to TradingView data, Bitcoin’s market dominance (BTC.D) peaked on December 10 before retreating, now standing at 56.1%, with a 24-hour decline of 1.95%.

Additionally, the total market capitalization of altcoins excluding Ethereum (TOTAL3) also surged after a significant drop on December 10, now reporting a market value of $1.09 trillion, with a 24-hour increase of 8.72%.

Analysis and Commentary

1. Bitcoin’s Market Dominance

Bitcoin’s market dominance reaching a peak before receding suggests ongoing volatility within the cryptocurrency market. This fluctuation indicates investors’ shifting preferences between Bitcoin and altcoins, contributing to the overall market dynamics.

2. Altcoin Surge

The rebound in the market capitalization of altcoins (excluding Ethereum) shows renewed investor interest and confidence in the broader cryptocurrency ecosystem. This may signal a shift in focus towards altcoins after Bitcoin’s recent dominance, highlighting the growing diversity within the market.

COMPOUND FINANCE LAUNCHES $1 MILLION BUG BOUNTY PROGRAM

On December 12, Compound Finance, a DeFi protocol, announced the launch of a $1 million bug bounty program on the Immunefi platform to improve platform security and protect users. The latest version, Compound III, streamlines the process of borrowing underlying assets (currently USDC) using crypto assets as collateral. This version is deployed across multiple chains, including Ethereum, Polygon, and Arbitrum. All rewards are denominated in USD but paid in COMP tokens.(Original link)

Commentary

As one of the leading protocols in the DeFi space, Compound Finance has always placed a high emphasis on platform security. The launch of the million-dollar bug bounty program not only reflects its commitment to security but also highlights the growing focus on security across the DeFi industry as a whole.

However, its success depends on the level of engagement and the actual effectiveness of the bug bounty program in preventing exploits. The program could also enhance trust in Compound’s protocol by demonstrating a proactive stance on safeguarding user funds.

Also Read:

CoinRank Crypto Digest: December 11, 2024

CoinRank Crypto Digest: December 10, 2024

CoinRank Crypto Digest: December 9, 2024

CoinRank x Bitget – Sign up & Trade to get $20!