KEYTAKEAWAYS

- Bitcoin, Ethereum and Hyperliquid rank in the top three in TVL growth

- Hyperliquid USDC cross-chain volume exceeds $2 billion

- Bitcoin mining difficulty increased by 4.43% to 108.52 T

CONTENT

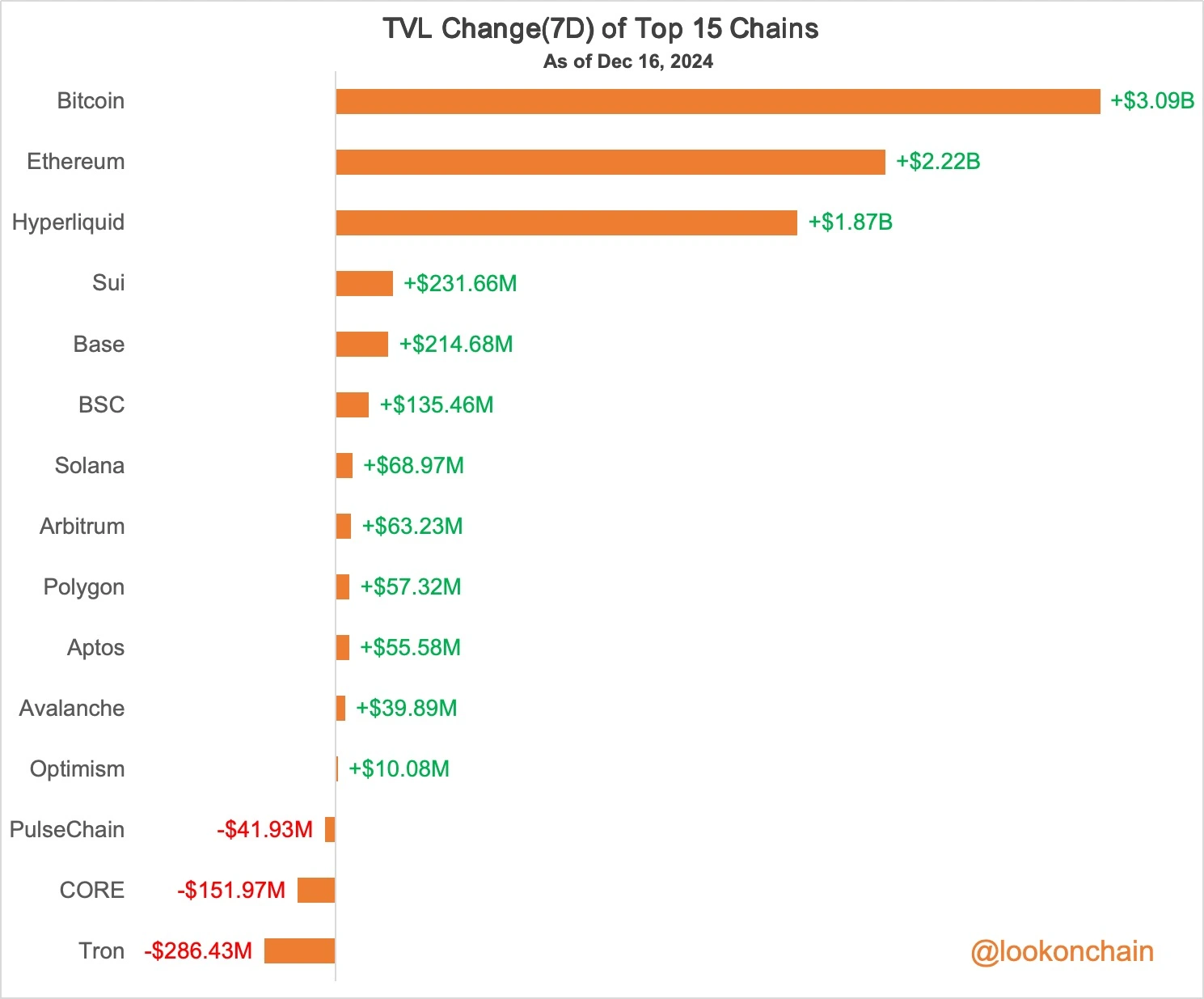

DATA: BITCOIN, ETHEREUM AND HYPERLIQUID RANK IN THE TOP THREE IN TVL GROWTH RECENTLY

According to Lookonchain data, over the past 7 days, the TVL of Bitcoin, Ethereum, and Hyperliquid increased by $3.09 billion, $2.22 billion, and $1.87 billion, respectively, showing significant capital inflows.

Meanwhile, chains like Sui, Base, and BSC also recorded notable growth, while Tron, CORE, and PulseChain saw a decrease in TVL, with reductions of $286 million, $152 million, and $41.93 million, respectively.(Original Link)

Analysis:

This shift in capital inflows reflects strong demand for major blockchain platforms, especially Bitcoin and Ethereum, which have long been the backbone of the crypto market. The growth of Hyperliquid also highlights the vibrancy of the decentralized finance (DeFi) sector across different platforms.

The increases in Sui, Base, and BSC may be related to the development of specific ecosystems and user growth, while the decline in TVL for Tron, CORE, and PulseChain could indicate changes in market sentiment or challenges facing their ecosystems.

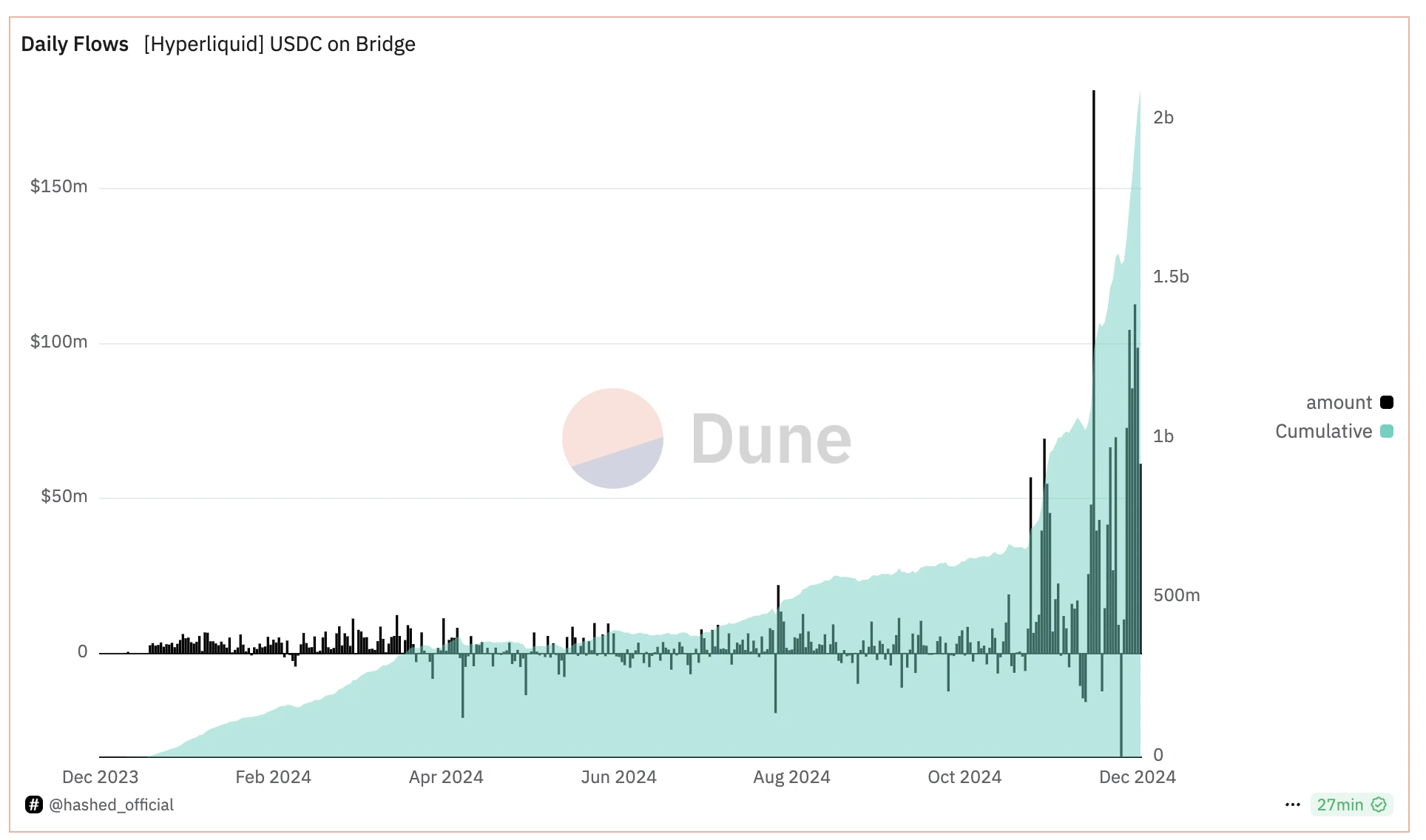

HYPERLIQUID USDC CROSS-CHAIN VOLUME EXCEEDS $2 BILLION

On December 16, according to Dune data panel, the total cross-chain volume of USDC on the Hyperliquid platform has surpassed $2.09 billion.

Analysis:

Hyperliquid is a decentralized perpetual contract trading platform built on the Arbitrum network, using L3 scaling solutions and zero-knowledge proof technology to provide performance and user experience close to centralized exchanges.

It features fast transaction speeds, low fees, good liquidity, and also includes MEV protection mechanisms and a validator system to ensure fair trading. It supports high-leverage trading of cryptocurrency perpetual contracts.

This milestone marks strong growth for the Hyperliquid platform, reflecting increased user activity and trust in its cross-chain functionality.

The significant transfer volume of USDC indicates that Hyperliquid is becoming a key platform for facilitating value transfer between different blockchains, which is crucial for expanding the entire decentralized finance (DeFi) ecosystem.

It also highlights the growing demand for stablecoins in the DeFi space, further reinforcing USDC’s role as a vital medium for cross-platform transactions.

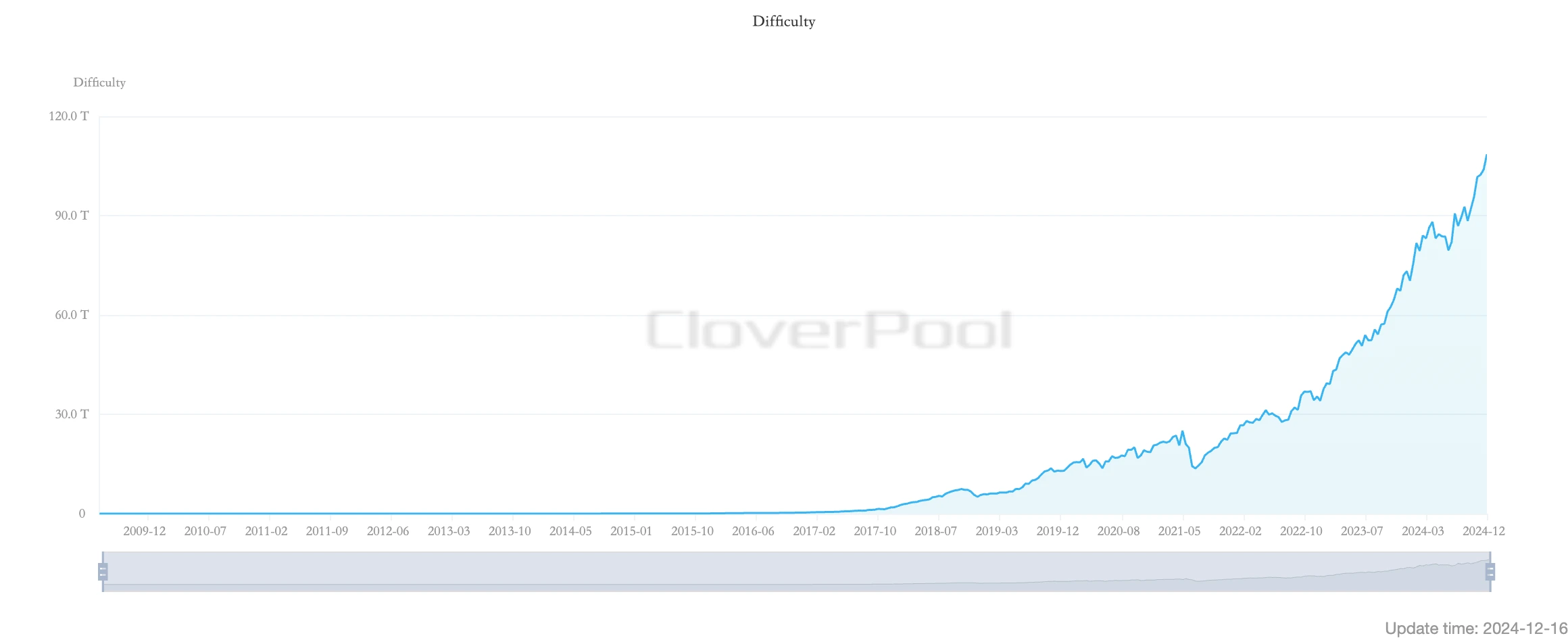

BITCOIN MINING DIFFICULTY INCREASED BY 4.43% TO 108.52 T

On December 16, CloverPool data showed that Bitcoin’s mining difficulty was adjusted at block height 874,944 (2024-12-16 09:33:30), increasing by 4.43% to 108.52 T, setting a new all-time high. The total network hash rate is now 812.02 EH/s.

Analysis:

The increase in Bitcoin’s mining difficulty means that miners need more computational power to mine new bitcoins. The Bitcoin network automatically adjusts the difficulty based on the total computational power of all miners, ensuring that a new block is produced approximately every 10 minutes.

As more miners join and technology improves, mining becomes more difficult, which also indicates the growing popularity of Bitcoin, with miners willing to invest more resources to ensure the network’s security and stability.

▶ Buy Crypto at Bitget