KEYTAKEAWAYS

- BGB Market Cap Rises to 25th in Crypto Rankings

- Ai16z Market Cap Surpasses $1 Billion

- Solana has maintained positive net inflows since early September 2023

CONTENT

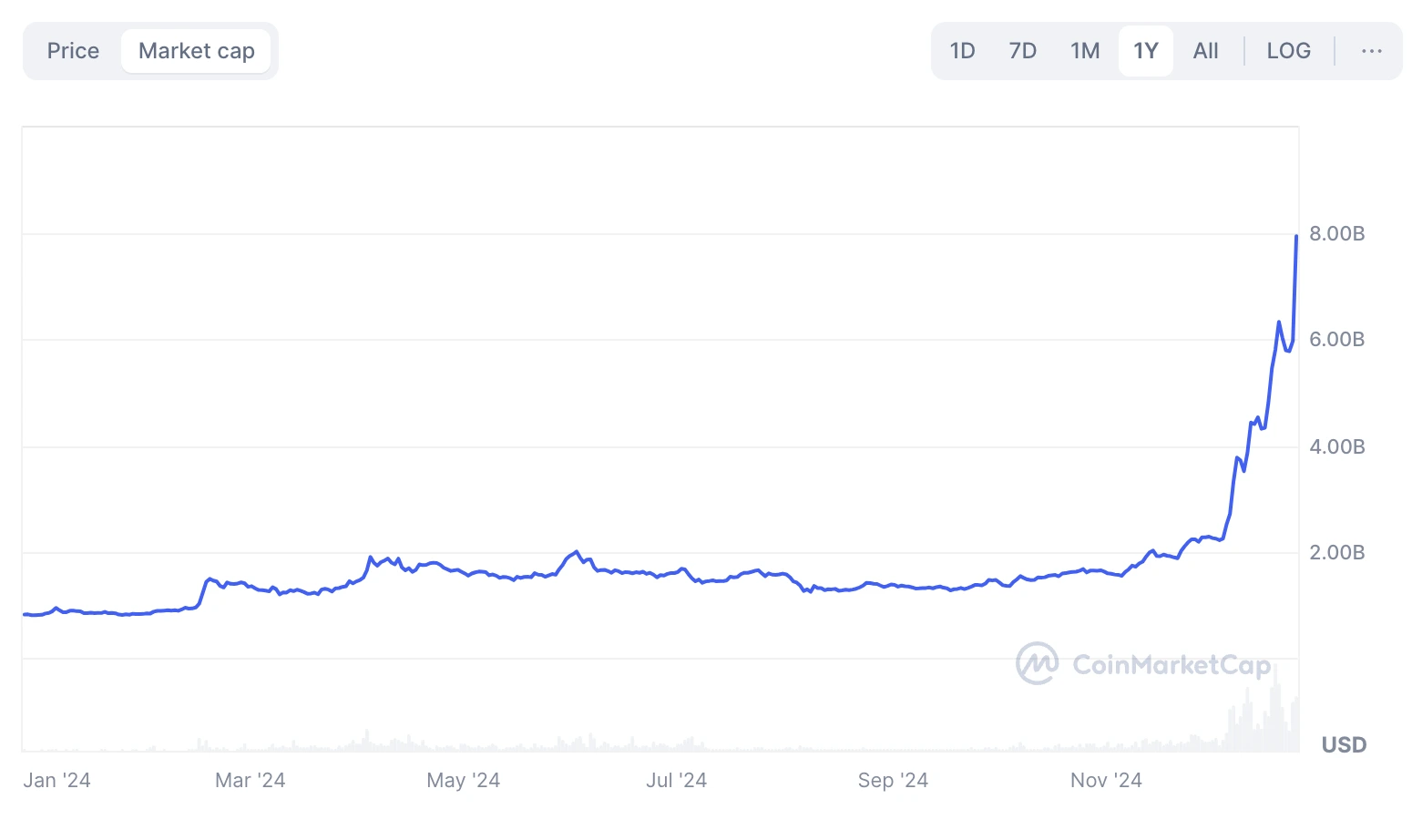

BGB MARKET CAP RISES TO 25TH IN CRYPTO RANKINGS

On December 25, CoinMarketCap data showed that BGB (Bitget Token) has risen to the 25th position in the cryptocurrency rankings, with a total market capitalization of $7.43 billion. The price of BGB briefly touched $5.39 USDT, currently priced at $5.35 USDT, reflecting a 14.02% increase over the past 24 hours, setting a new all-time high.

(Source: CMC)

Analysis:

The factors driving BGB’s price increase include the recovery in market sentiment, Bitget’s expansion of its platform ecosystem, and supply-demand dynamics. The recent market sentiment boost is likely due to the general rise in exchange token prices, which has helped restore confidence in the crypto market.

Bitget has strengthened its position by expanding into the Middle East, launching new products, and initiating the $100 million EmpowerX fund. Additionally, the limited circulation of BGB makes its price more susceptible to upward pressure when demand increases.

Despite the overall market downturn, Bitget achieved a market share of 9.43% in September, making it one of the fastest-growing exchanges, which has provided strong support for BGB’s price.

AI16Z MARKET CAP SURPASSES $1 BILLION

On December 25, market data from GMGN revealed that the AI-driven VC DAO token ai16z on the Solana blockchain reached a market capitalization of over $1 billion, currently valued at $1.04 billion, marking an all-time high with a 24-hour increase of 46.93%.

ai16z is introduced as the first AI-focused venture capital fund, managed by Marc Andreessen, with investments determined by recommendations from DAO members. The fund aims to not only replicate Andreessen’s work but also outperform him and surpass his expertise in the field.

Analysis:

The surge in the value of ai16z highlights the growing interest in AI-driven projects within the cryptocurrency space. With Marc Andreessen, a well-known venture capitalist, managing the fund, it’s attracting significant attention from both AI and blockchain enthusiasts.

The DAO structure provides a novel approach, involving community-driven decisions for investments, making it more decentralized and aligning with the broader ethos of Web3.

The 46.93% rise in just 24 hours shows that the market has responded positively to ai16z’s unique positioning at the intersection of venture capital and AI. Given the increasing integration of AI across various industries, the success of ai16z highlights the potential for blockchain technology and AI to collaborate in novel ways.

This could set a new precedent for decentralized investment models, particularly for funds that leverage emerging technologies like AI. However, the volatility in the token’s price suggests that while there is strong speculative interest, this market could still face fluctuations.

The long-term sustainability of the token’s value will depend on the success of the fund’s investments and the continued development of both the AI and blockchain sectors.

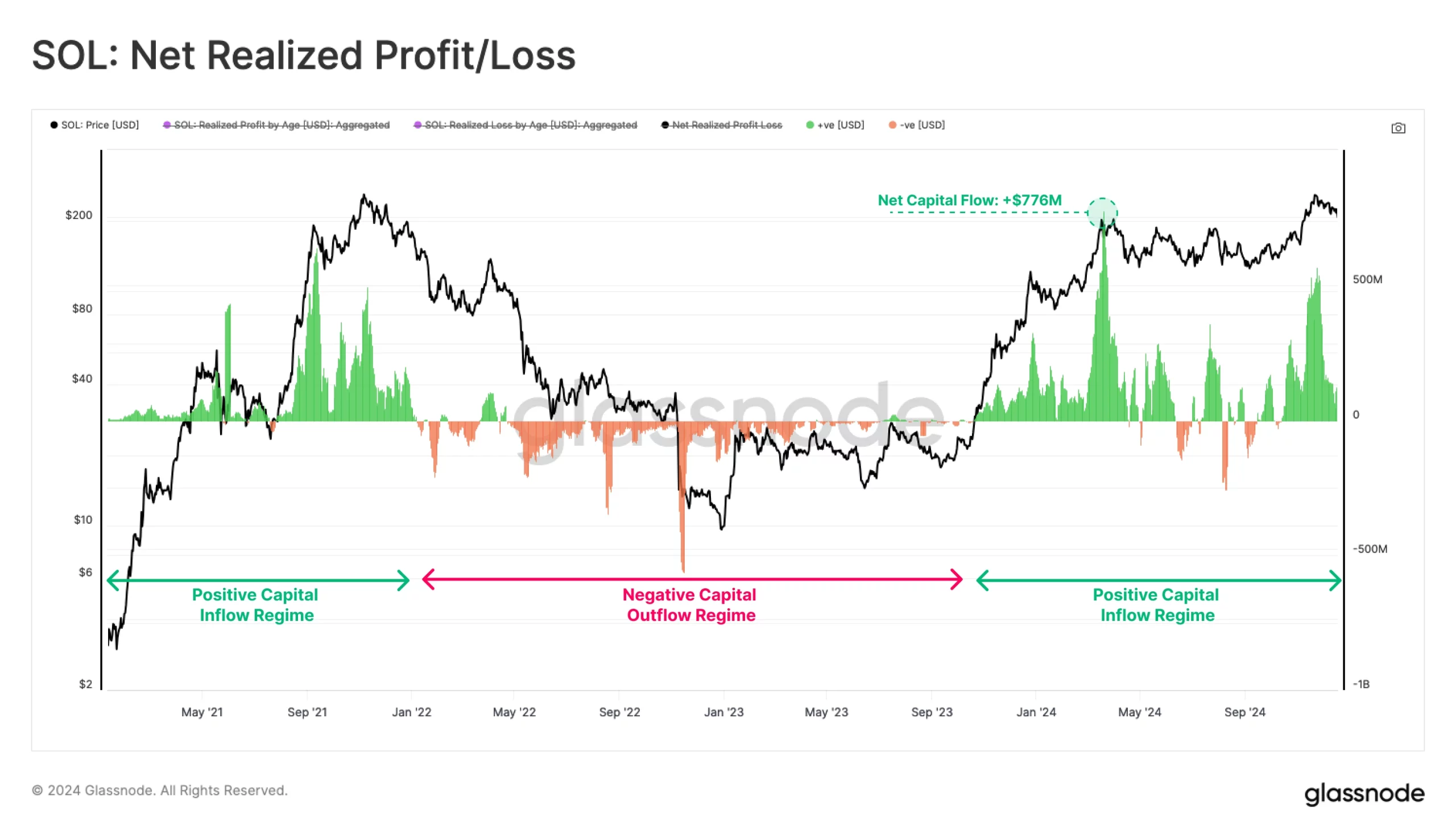

SOLANA HAS MAINTAINED POSITIVE NET INFLOWS SINCE EARLY SEPTEMBER 2023

On December 25, Glassnode posted on X platform stating that since early September 2023, Solana has maintained positive net capital inflows with only a small amount of outflows during this period.

(Source: Glassnode)

The report pointed out that this continuous liquidity influx has played a key role in stimulating Solana’s growth and price increase, reaching a significant peak of $776 million in new daily fund inflows.

Analysis:

Solana’s sustained net capital inflow is a key driver of the network’s growth and price increase. The continuous attention and influx of capital from investors indicate growing confidence in Solana’s ecosystem.

Especially with the recovery of market sentiment, Solana continues to attract new funds, signaling strong investor optimism. The ongoing growth in capital inflows suggests that Solana has regained its position as one of the leading public blockchains, particularly in areas like DeFi and NFTs.

The $776 million peak in fund inflows indicates that Solana is restoring its momentum, which could strengthen the network effect and provide support for its long-term growth. This continued influx of capital is a positive signal that investors see Solana as a strong contender in the blockchain space, especially as the market looks for projects with growing utility.

Recent Daily Articles:

CoinRank Crypto Digest: December 23, 2024

CoinRank Crypto Digest: December 24, 2024

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!