KEYTAKEAWAYS

- Ark Invest: Stablecoins outpace Visa and Mastercard

- JPMorgan: Bitcoin hashrate slows, mining difficulty drops

- Semler purchases 871 Bitcoins, gains over 150%

CONTENT

ARK INVEST: STABLECOIN GROWTH CONTINUES, TRADING VOLUME EXCEEDS VISA AND MASTERCARD

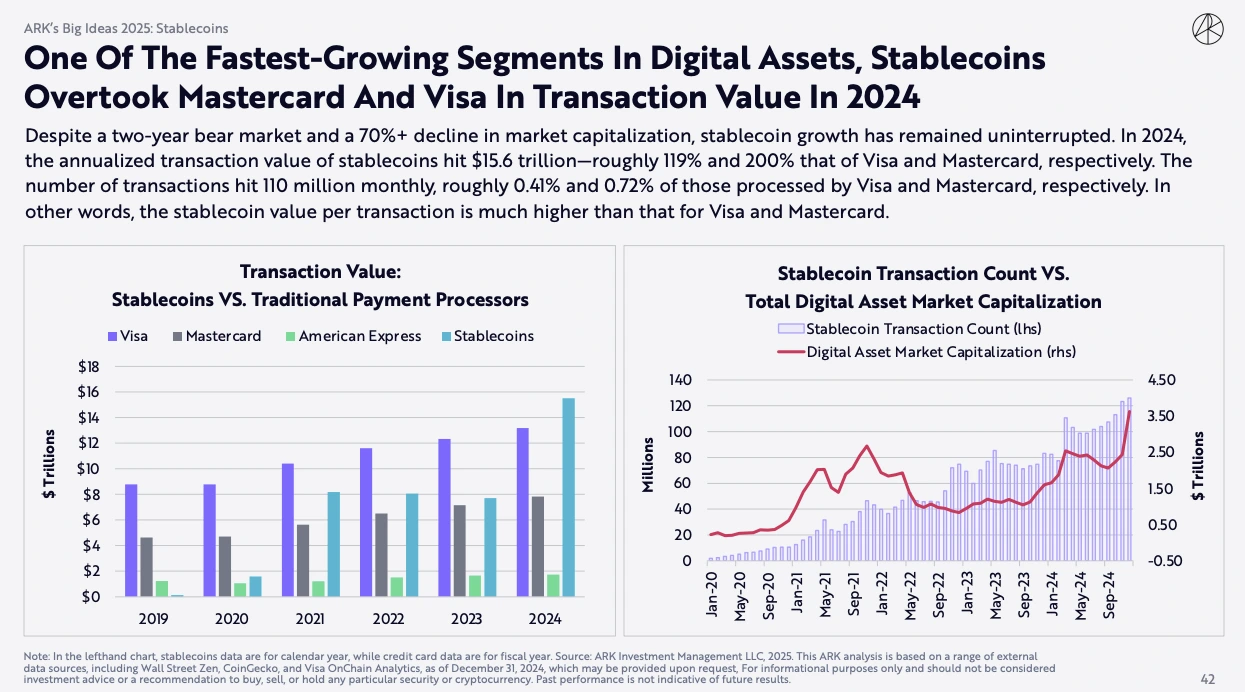

In its Big Ideas 2025 report, ARK Invest highlighted that stablecoins have become one of the fastest-growing sectors in the digital asset space. Despite a two-year bear market and a market cap drop of over 70%, stablecoins continue to show strong growth.

The report predicts that stablecoin transaction volume will reach $15.6 trillion in 2024, surpassing Visa and Mastercard by 119% and 200%, respectively. While monthly transaction count is 110 million (just 0.41% and 0.72% of Visa and Mastercard’s volumes), the value of each transaction is much higher than those of these payment giants.

Analysis:

Stablecoins are emerging as a major player in the crypto world. Even after a bear market and a sharp decline in market cap, their growth remains strong. The report mentions that stablecoin transaction volumes are expected to exceed those of Visa and Mastercard in 2024, positioning them as giants in the digital currency world.

This shows that stablecoins have not only broad usage but also higher transaction values, far surpassing credit card companies.

In simple terms, stablecoins are becoming more important in the crypto market. Though their transaction counts are much lower than Visa’s, each transaction is worth significantly more, cementing their role in the global payment system.

JPMORGAN: BITCOIN NETWORK HASHRATE SLOWS DOWN IN JANUARY, MINING DIFFICULTY DROPS BY 2%

JPMorgan’s report shows that Bitcoin network hashrate growth slowed in January, with an average increase of only 1%, reaching 785 EH/s. At the same time, mining difficulty dropped by 2%, which is a rare occurrence.

However, by the end of January, the 7-day moving average hashrate reached a new high of 833 EH/s. Despite this, the hashrate at the end of January was 2% lower than at the end of December, falling to 781 EH/s.

Analysis:

In short, this suggests that Bitcoin mining competition remains tough, but the slower hashrate growth could be influenced by various factors like rising miner costs or network difficulty adjustments. This change could indicate some market fatigue, especially when price volatility affects miner profitability.

The drop in mining difficulty might be a move to balance these changes and ensure miners stay active in the system.

MEDICAL TECH COMPANY SEMLER PURCHASES 871 BITCOINS, YIELDING OVER 150% RETURN

Medical tech company Semler announced on February 4th that it bought 871 bitcoins between January 11 and February 3, totaling $88.5 million, with an average purchase price of $101,616 per BTC. The company also stated that from July 1 (the first full quarter after adopting the Bitcoin strategy) to February 3, it saw a return of 152%, with a 22% return so far this year.

Analysis:

Semler’s Bitcoin purchase can be seen as a sign of growing recognition of Bitcoin as a store of value, especially amid high inflation and an uncertain economic environment. Despite market volatility, Semler managed to buy at high prices and secure substantial profits through holding Bitcoin.

This move suggests that more traditional companies may increasingly view Bitcoin as a reliable asset allocation tool, rather than just a speculative asset. As more companies follow Semler’s lead, Bitcoin could become a part of corporate balance sheets, further driving its mainstream adoption.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!