KEYTAKEAWAYS

- USDT Flexible Savings Rate on OKX Soars to 40%

- $1.93 Billion BTC Options Expire Today with a Maximum Pain Point at $97,000

- Total Bitcoin Open Interest Across All Exchanges Drops to $57.7 Billion

CONTENT

USDT FLEXIBLE SAVINGS RATE ON OKX SOARS TO 40%

On January 3, the annualized interest rate of the “Simple Earn” flexible savings product for USDT on OKX surged from 7% to 40%. Similar phenomena have occurred during the early stages of previous bull markets. For instance, on November 10, 2024, when BTC broke through $76,677, the rate climbed to 44%.

Analysis

Reflection of Liquidity Demand: The sharp increase in USDT flexible savings rates typically reflects a sudden surge in liquidity demand, possibly driven by a spike in trading volume, increased leverage requirements, or short-term market volatility. Exchanges may raise rates to attract more funds and ensure sufficient liquidity.

Driven by Short-term Market Sentiment: Following BTC’s record high at the end of 2024 and its subsequent pullback, the market is now in a highly volatile phase. High returns on savings products may draw in more capital, further intensifying the long/short sentiment divide. The market’s direction in the coming days, especially BTC’s ability to hold key support levels, will shape the prevailing sentiment.

$1.93 BILLION BTC OPTIONS EXPIRE TODAY WITH A MAXIMUM PAIN POINT AT $97,000

According to Greekslive data, approximately $2.6 billion in crypto options will expire today, including:

BTC options: 20,000 contracts with a notional value of $1.93 billion. The Put-Call Ratio (PCR) is 0.69, and the maximum pain point is $97,000.

ETH options: 206,000 contracts with a notional value of $710 million. The Put-Call Ratio (PCR) is 0.81, and the maximum pain point is $3,400.

Analysis

Impact of Options on Price

Maximum Pain Point Effect: The maximum pain points of $97,000 for BTC and $3,400 for ETH indicate that the majority of option positions are clustered around these levels. When options expire, prices may gravitate toward these levels due to market positioning.

Interpreting Put-Call Ratios (PCR): With BTC and ETH PCRs at 0.69 and 0.81, respectively, the market sentiment remains predominantly bullish but slightly cautious.

Market Divergence and Adjustment Trend

Trading volume has gradually recovered this week, but the focus has shifted across different assets, possibly influenced by macroeconomic news, technical corrections, and investor caution at higher levels. Short-term price volatility for BTC and ETH may increase as positions adjust following the option expiration.

TOTAL BITCOIN OPEN INTEREST ACROSS ALL EXCHANGES DROPS TO $57.7 BILLION

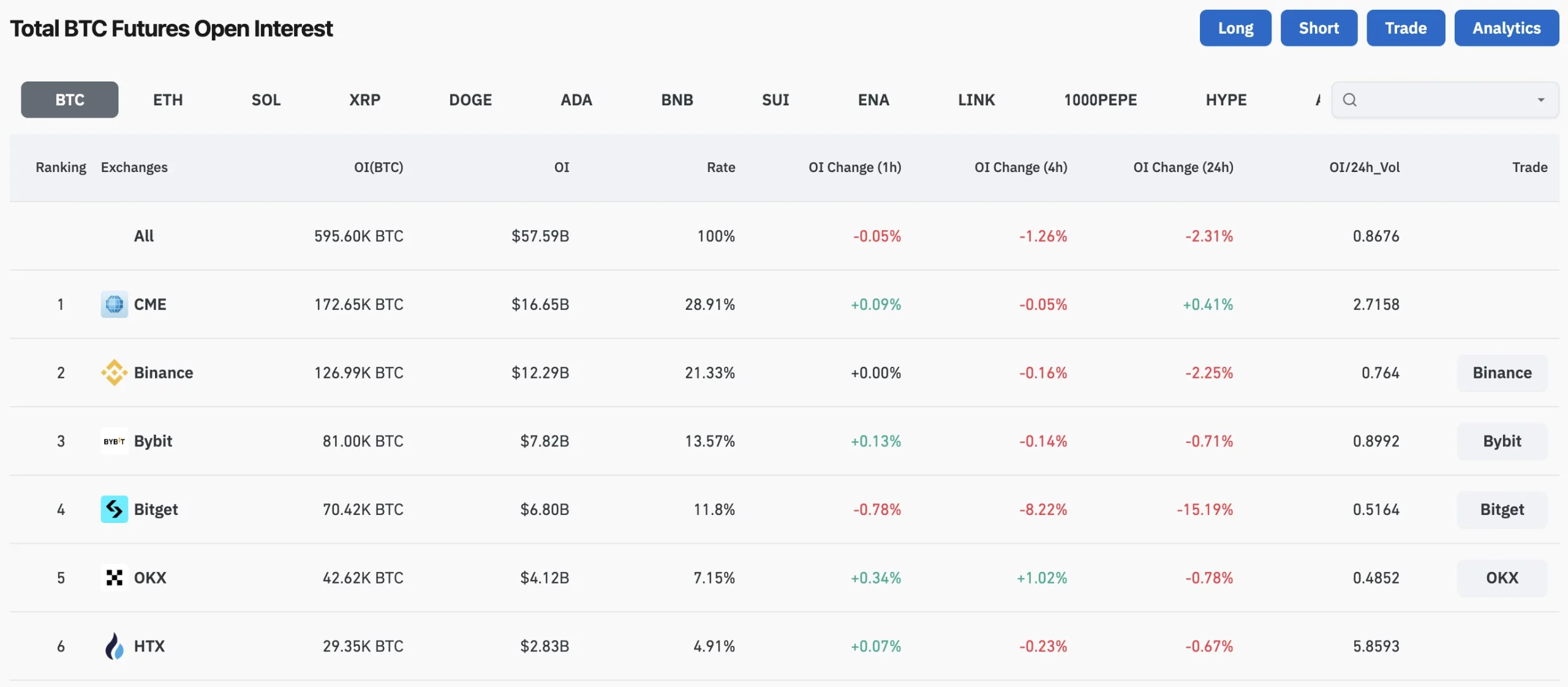

According to Coinglass data on January 3, the total Bitcoin futures open interest across all exchanges stands at 596,120 BTC (approximately $57.7 billion).

(Source:Coinglass)

Among these:

- CME Bitcoin contracts: 172,650 BTC (approximately $16.67 billion), ranking first.

- Binance Bitcoin contracts: 126,970 BTC (approximately $12.3 billion), ranking second.

Analysis

Market Depth and Trading Activity

The total open interest of nearly 600,000 BTC reflects a highly active trading environment. Despite recent market corrections, investor enthusiasm for Bitcoin remains strong.

CME’s Dominance

CME accounts for about 29% of the market share, indicating growing institutional participation. As a bridge between traditional finance and crypto markets, CME’s dominance suggests significant institutional interest in Bitcoin, which could influence price discovery and market volatility.

Binance’s Activity

Binance closely follows CME with an open interest of 126,970 BTC, highlighting the critical role of retail and high-frequency traders. Compared to CME, Binance’s positions are more likely to be influenced by short-term market sentiment.

The large-scale open interest across all exchanges underscores the market’s keen attention and potential for volatility. Investors should remain cautious of potential liquidation risks while staying attuned to shifts in market sentiment.

Also Read:

CoinRank Crypto Digest: December 30, 2024

CoinRank Crypto Digest: December 31, 2024

CoinRank Crypto Digest: January 01, 2025

CoinRank Crypto Digest: January 02, 2025

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!