KEYTAKEAWAYS

- Scott Bessent’s Asset Divestment and Its Impact on the Crypto Market

- Jamie Dimon’s Negative Remarks on Bitcoin

- Fidelity Digital Assets’ Outlook on Ethereum and Solana

CONTENT

SCOTT BESSENT’S ASSET DIVESTMENT AND ITS IMPACT ON THE CRYPTO MARKET

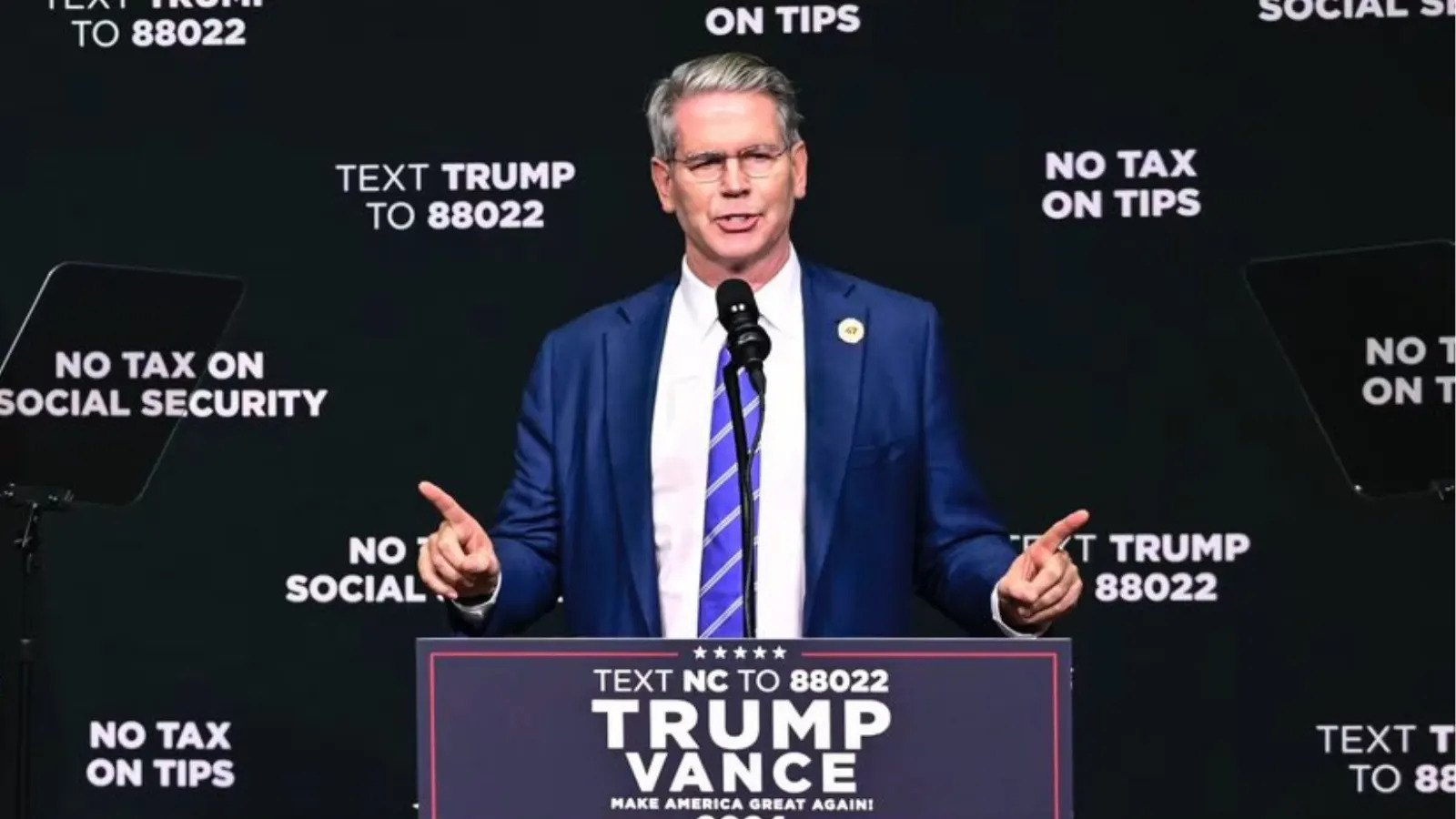

According to Decrypt, Scott Bessent, the incoming U.S. Treasury Secretary, is preparing to sell several assets, including his holdings in BlackRock’s Bitcoin ETF (IBIT), and step down from his position at Key Square Group, the hedge fund he founded, to comply with federal ethics guidelines.

Analysis:

Scott Bessent’s asset divestment may have a notable impact on the cryptocurrency market, especially on Bitcoin and related financial products. As a holder of BlackRock’s Bitcoin ETF (IBIT), Bessent’s sale could signal uncertainty in the Bitcoin market, particularly since he has been favored by the crypto community for his past support of cryptocurrency.

1.Short-Term Market Reaction: Bessent’s asset sales may attract market attention, especially in the cryptocurrency space. Some investors may perceive this as a negative signal for the future of Bitcoin ETFs, leading to market sell-offs, especially if large-scale sales occur.

2.Policy-Level Impact: As an important nominee for the position of Treasury Secretary, Bessent’s asset divestment could present conflicts with his forthcoming duties, particularly regarding potential conflicts of interest. The cryptocurrency industry may have concerns about his appointment, especially regarding how it might influence future crypto policies.

3.Market Expectation Changes: If Bessent is confirmed and completes his asset divestment, it could increase transparency in crypto policy. However, if a large portion of the divestment involves cryptocurrency-related assets, it could affect market sentiment.

JAMIE DIMON’S NEGATIVE REMARKS ON BITCOIN

JPMorgan CEO Jamie Dimon recently stated, “At some point, we will have some form of digital currency. I’m not opposed to cryptocurrencies. But you know, Bitcoin has no intrinsic value. It’s used a lot by sex traders, money launderers, and ransomware. So, I don’t have much affection for Bitcoin.” He even compared Bitcoin to smoking, saying, “People may have the right to smoke, but that doesn’t mean smoking is a good idea.”

Analysis:

From the perspective of cryptocurrency supporters, Jamie Dimon’s comments do not shake the core value of Bitcoin. On the contrary, these remarks highlight Bitcoin’s uniqueness and revolutionary nature as a decentralized, intermediary-free financial tool.

As more people recognize the potential of digital currencies, the traditional financial sector’s opposing views may actually become a driving force behind Bitcoin’s development. Crypto supporters believe that Bitcoin is not just a payment tool but also a key component of the future global financial system.

FIDELITY DIGITAL ASSETS’ OUTLOOK ON ETHEREUM AND SOLANA

In its 2025 outlook report, Fidelity Digital Assets acknowledged Ethereum’s advantages while also recognizing Solana’s growth. The report emphasized Ethereum’s strong fundamentals, including developer activity, TVL (Total Value Locked), and stablecoin supply. While Solana’s revenue and TVL growth are faster, much of its income comes from Meme token trading.

Analysis:

Ethereum holds a long-term advantage due to its strong fundamentals (such as developer activity, TVL, and stablecoin supply), making it a good fit for long-term investors. While Solana shows faster revenue and TVL growth, it is largely dependent on Meme token trading, a trend that may fade in a bear market.

Solana’s growth is more driven by short-term market sentiment, whereas Ethereum exhibits less speculation and is more stable. For long-term investors, Ethereum’s fundamentals are more reliable.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!