KEYTAKEAWAYS

- Circle Mints 7.5 Billion USDC on Solana Chain in 2025

- Fluid Becomes Second Largest DEX by Trading Volume on Ethereum Mainnet, Daily Trading Volume Reaches $232 Million

- US Bitcoin Spot ETF Institutional Holders Surge to 3,323, Up 54.5x in 11 Months

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

CIRCLE MINTS 7.5 BILLION USDC ON SOLANA CHAIN IN 2025

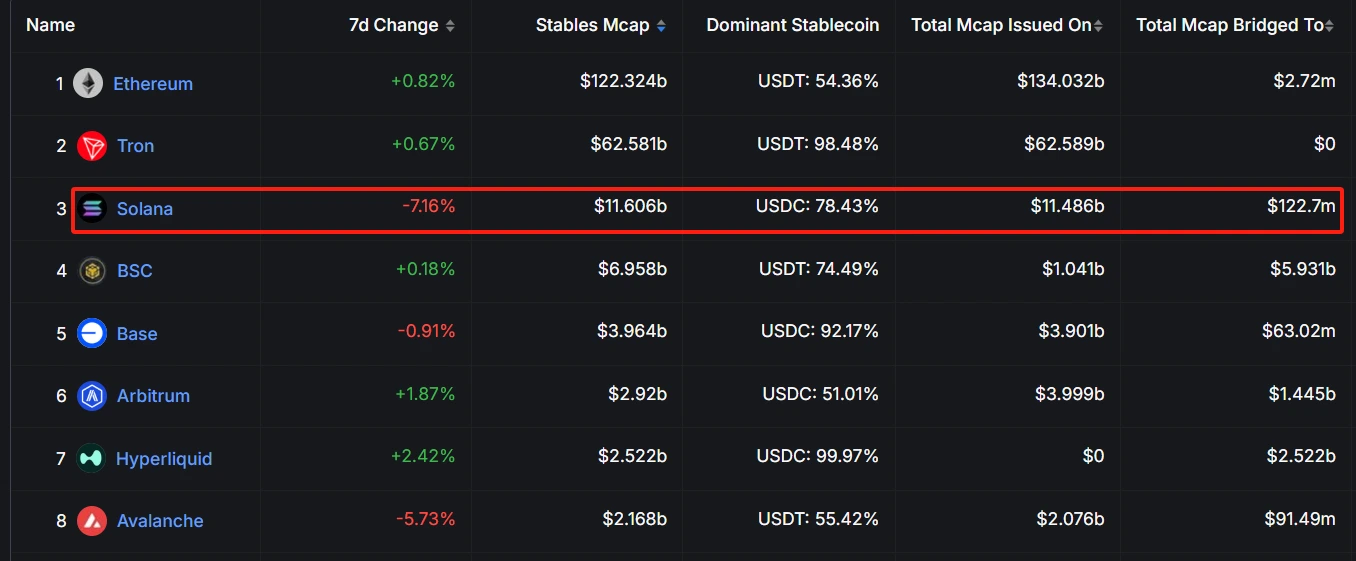

Circle minted 250 million USDC on the Solana chain early today. With this, Circle’s total USDC minting on Solana in 2025 has reached 7.5 billion.

Source: DefiLlama

According to DeFiLlama data, the total stablecoin market cap on Solana has reached $11.606 billion, with USDC accounting for 74.83%.

Analysis:

The USDC minting highlights Solana ecosystem’s growth potential. As a mainstream stablecoin, USDC’s minting reflects increased activity in DeFi, payments, and other financial applications on Solana. Projects like MEME tokens on Solana are attracting more projects and users, further driving demand for stablecoins.

USDC’s dominant position consolidates Solana’s stablecoin market structure. USDC’s 74.83% share of Solana’s stablecoin market demonstrates its absolute dominance. This high percentage not only reflects market trust in USDC but also shows Circle’s deep integration with the Solana ecosystem.

FLUID BECOMES SECOND LARGEST DEX BY TRADING VOLUME ON ETHEREUM MAINNET, DAILY TRADING VOLUME REACHES $232 MILLION

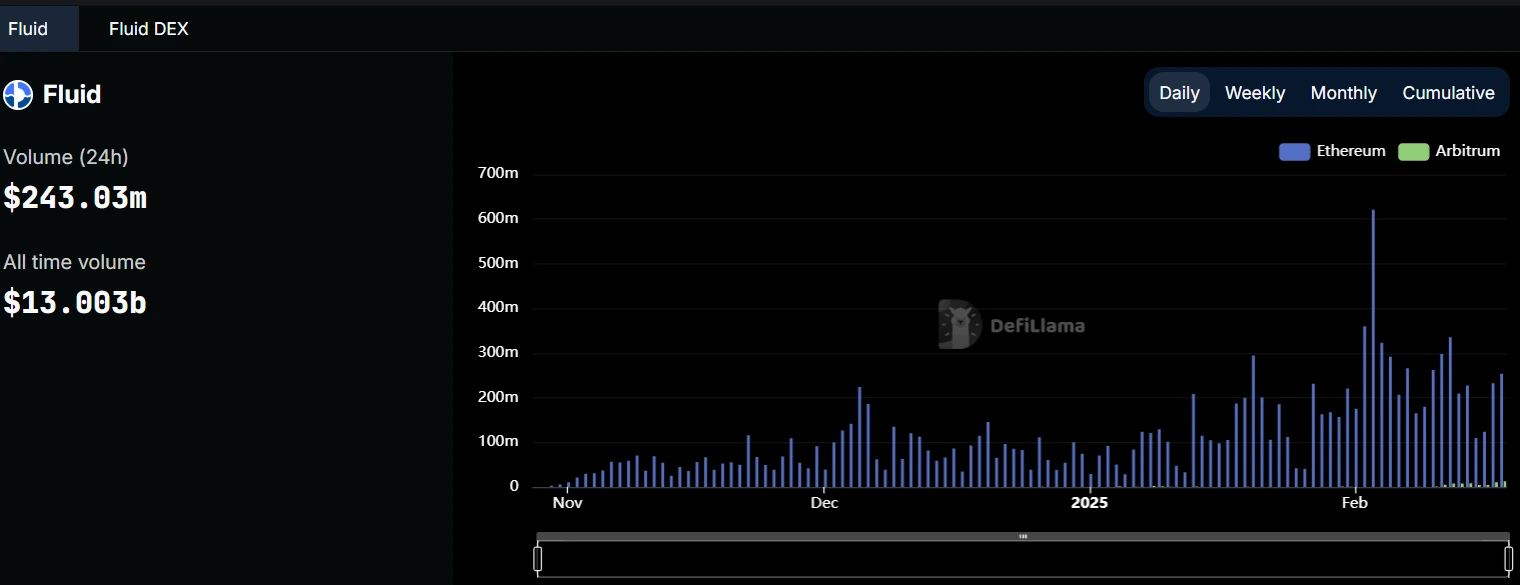

Ethereum lending protocol Fluid’s daily trading volume surpassed $232.47 million, successfully rising to become the second-largest DEX by trading volume on Ethereum mainnet, with a market share of 10.17%. Currently, Uniswap maintains its lead with 69% market share (daily trading volume of $1.587 billion), while Curve Finance ranks third with daily trading volume of $170.91 million.

Source: DefiLlama

Analysis:

Fluid’s rapid rise highlights its strong growth momentum in the decentralized trading sector. The growth in daily trading data not only demonstrates user recognition of Fluid’s lending protocol functionality but also reflects the diversification trend in the DEX market.

Uniswap’s dominant position remains stable, but competition intensifies. Although Uniswap still maintains its lead with 69% market share, Fluid’s rise indicates increasing market competition. The DEX market landscape may become more dynamic, and users will benefit from richer choices and higher quality services.

US BITCOIN SPOT ETF INSTITUTIONAL HOLDERS SURGE TO 3,323, UP 54.5X IN 11 MONTHS

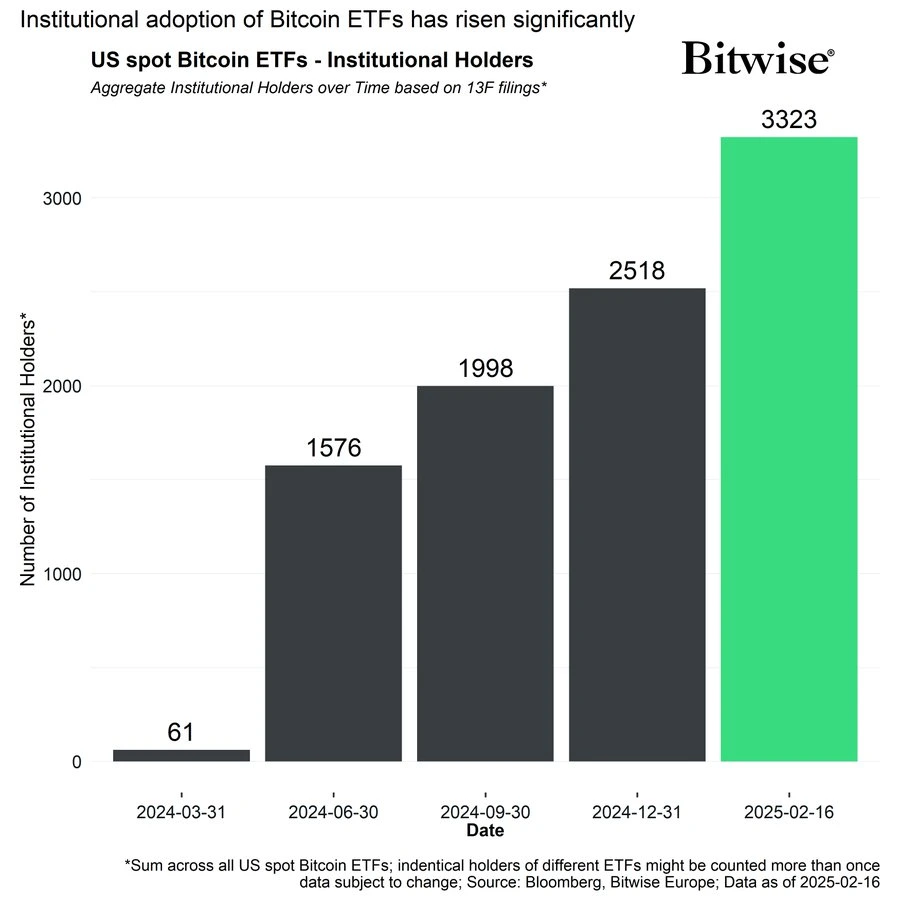

According to a Bitwise report, the number of institutional holders of US Bitcoin spot ETFs has grown significantly, reaching 3,323 as of February 16. The number of institutional holders has increased 54.5 times over the past 11 months.

Source: Bitwise

Analysis:

This reflects a substantial increase in institutional investors’ interest and participation in Bitcoin and the cryptocurrency market. This trend further consolidates Bitcoin’s position in mainstream finance.

This phenomenon may be attributed to Bitcoin market’s gradual maturation and clearer financial market regulations, encouraging more institutions to participate. If it continues to attract more institutional investment, Bitcoin ETFs could potentially become a mainstream investment tool in the future.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!