KEYTAKEAWAYS

- Arbitrum DAO Approves Proposal to "Allocate 35 Million ARB for RWA Investment"

- Tether and Circle Issue Over $10.75 Billion Since Beginning of Year

- CATI Enters Deflationary Era: 9 Million Tokens Consumed in Q4, Expected to Exceed 100 Million in 2025

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

ARBITRUM DAO APPROVES PROPOSAL TO “ALLOCATE 35 MILLION ARB FOR RWA INVESTMENT”

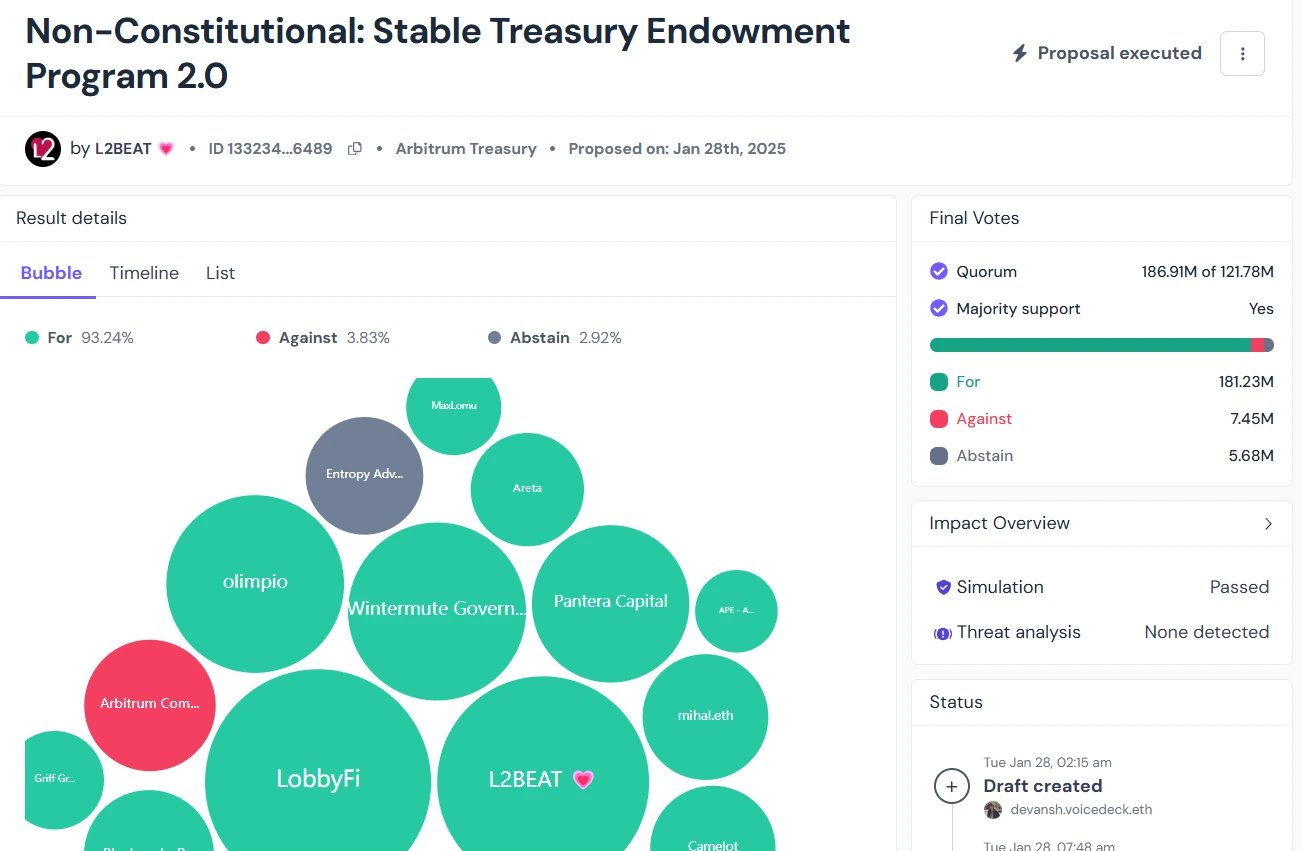

Arbitrum DAO has announced that the community has approved allocating 35 million ARB to various stable assets, with a total investment value of approximately $15.5 million. These funds come from the project’s Stable Treasury Enhancement Program (STEP), which had previously allocated 35 million ARB to investments in six products in June 2024.

Source:Arbitrum

Analysis:

STEP is a program designed to invest 1% of Arbitrum DAO funds in tokenized RWAs (Real World Assets), aiming to diversify DAO funds while leveraging industry growth to generate returns.

The approval of the proposal to invest in RWAs demonstrates Arbitrum DAO’s emphasis on tokenized real-world assets. This move not only helps diversify DAO funds but also enables the DAO to gain returns through industry growth.

TETHER AND CIRCLE ISSUE OVER $10.75 BILLION SINCE BEGINNING OF YEAR

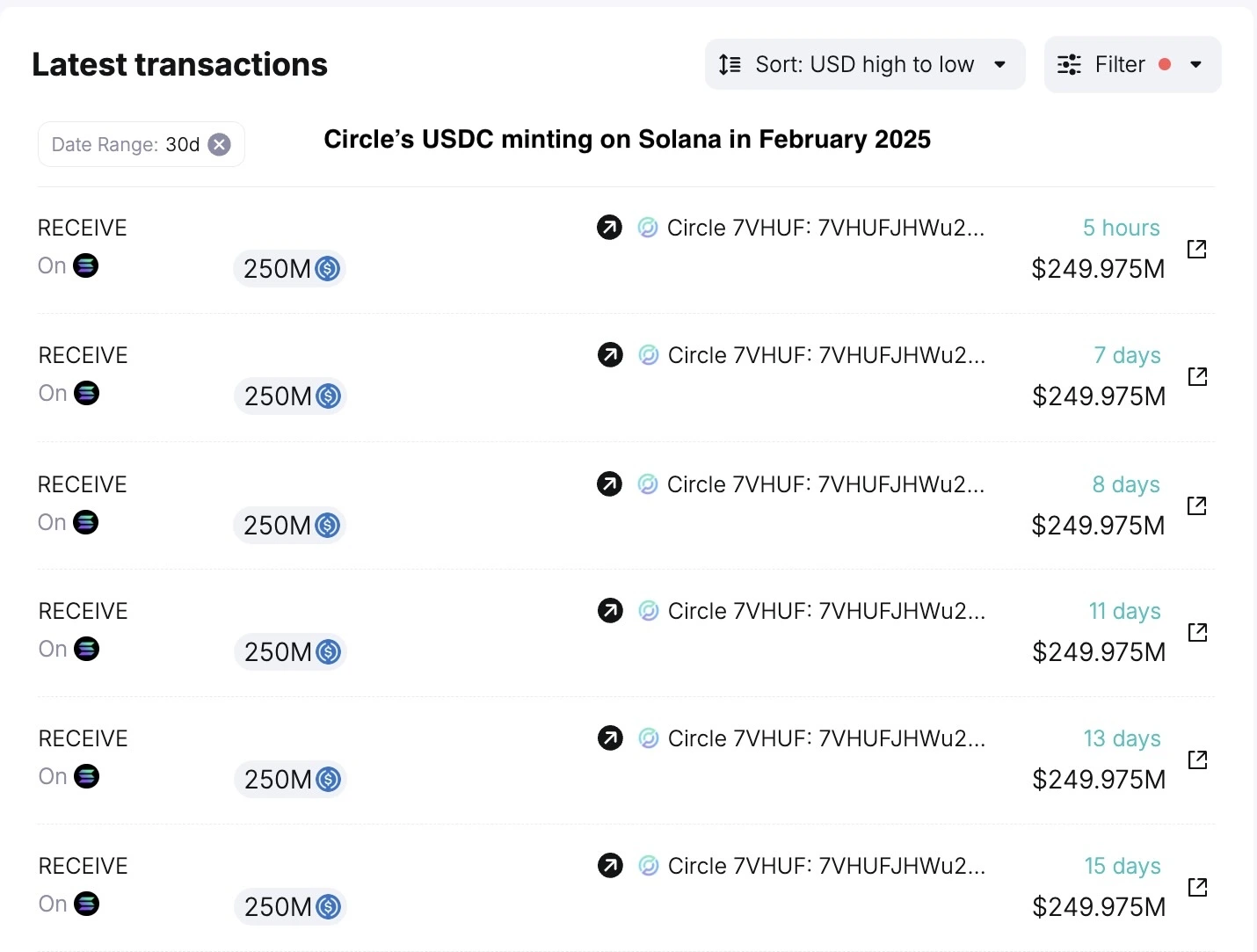

According to Spot On Chain monitoring, since the beginning of 2025, the two major stablecoin issuers Tether and Circle have shown strong momentum in token issuance, with total new issuance exceeding $10.75 billion. Specifically, Tether has minted 3 billion USDT on the Tron network, while Circle has minted 7.75 billion USDC on the Solana network.

Source: Spotonchain

Analysis:

The massive issuance volume reflects strong market demand for stablecoins during the bull market.

Unlike previous years, the proportion of stablecoins directly minted on the Ethereum network has significantly decreased, reflecting subtle changes in stablecoin issuance strategies and blockchain ecosystem landscape. Stablecoin issuance strategies are trending toward high-performance public chain。

CATI ENTERS DEFLATIONARY ERA: 9 MILLION TOKENS CONSUMED IN Q4, EXPECTED TO EXCEED 100 MILLION IN 2025

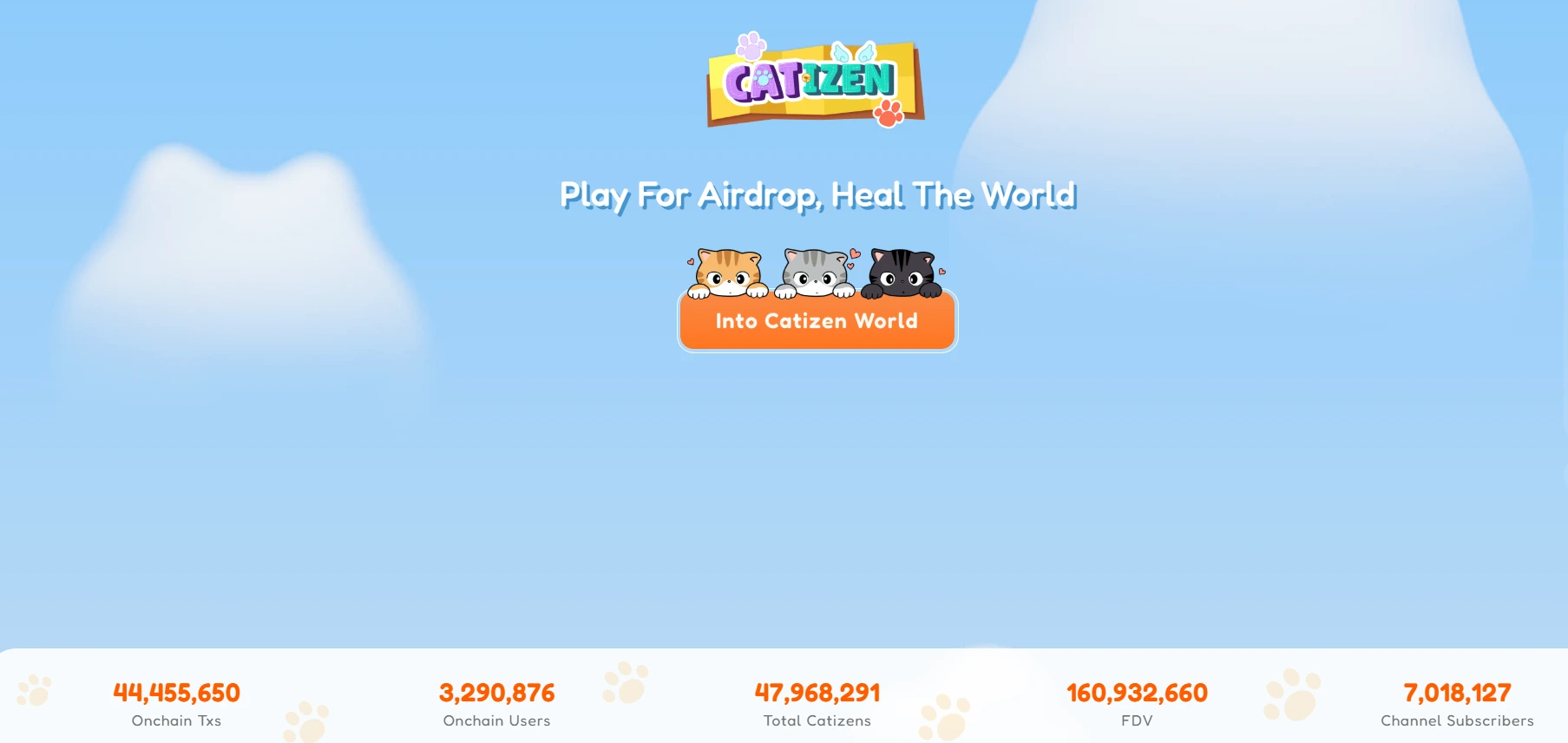

According to CoinDesk’s report during Consensus, the CATIZE platform has upgraded to a Mini App Center and launched 21 mini games, achieving Q4 revenue of $19.77 million with over 9 million CATI tokens consumed. CATI token consumption is expected to exceed 100 million in 2025, with platform revenue projected to reach $80-100 million.

Source: CATI

Analysis:

CATIZE platform’s success stems from its upgrade from a single gaming platform to a Mini App Center. This transformation has led to rapid growth, with user numbers exceeding 55 million and on-chain active users reaching 3.3 million.

The surge in $CATI token consumption reflects the successful transformation of the Catizen platform into a Mini App Center and increased user engagement.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!