KEYTAKEAWAYS

- 86% of Traders Lost Money on LIBRA, Total Losses Reach $251 Million

- Pump.fun Deposits 2.34 Million SOL to Kraken, Total Earnings Exceed $500 Million

- Berachain On-chain TVL Exceeds $3.115 Billion, Surpasses Arbitrum to Rank Among Top Seven Public Chains

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

86% OF TRADERS LOST MONEY ON LIBRA, TOTAL LOSSES REACH $251 MILLION

According to data from research firm Nansen, approximately 86% of traders lost money after investing in LIBRA, which was “endorsed” by Argentina’s President Javier Milei, with cumulative losses reaching $251 million, while a small number of profitable traders collectively earned $180 million.

Source: Bloomberg

Nansen researcher Nicolai Sondergaard analyzed over 15,000 crypto wallets and found on-chain evidence suggesting “insiders” profited from retail investors.

Analysis:

LIBRA’s high loss rate and cumulative losses of $251 million reflect potential serious market manipulation and information asymmetry issues with the project. Although President Javier Milei’s “endorsement” attracted numerous retail investors, it failed to provide actual value support, resulting in losses for most participants.

The fact that a small number of “insiders” profited through early positioning and strategic operations further reveals market unfairness. This phenomenon warns investors to be cautious of celebrity-endorsed projects and strengthen risk management.

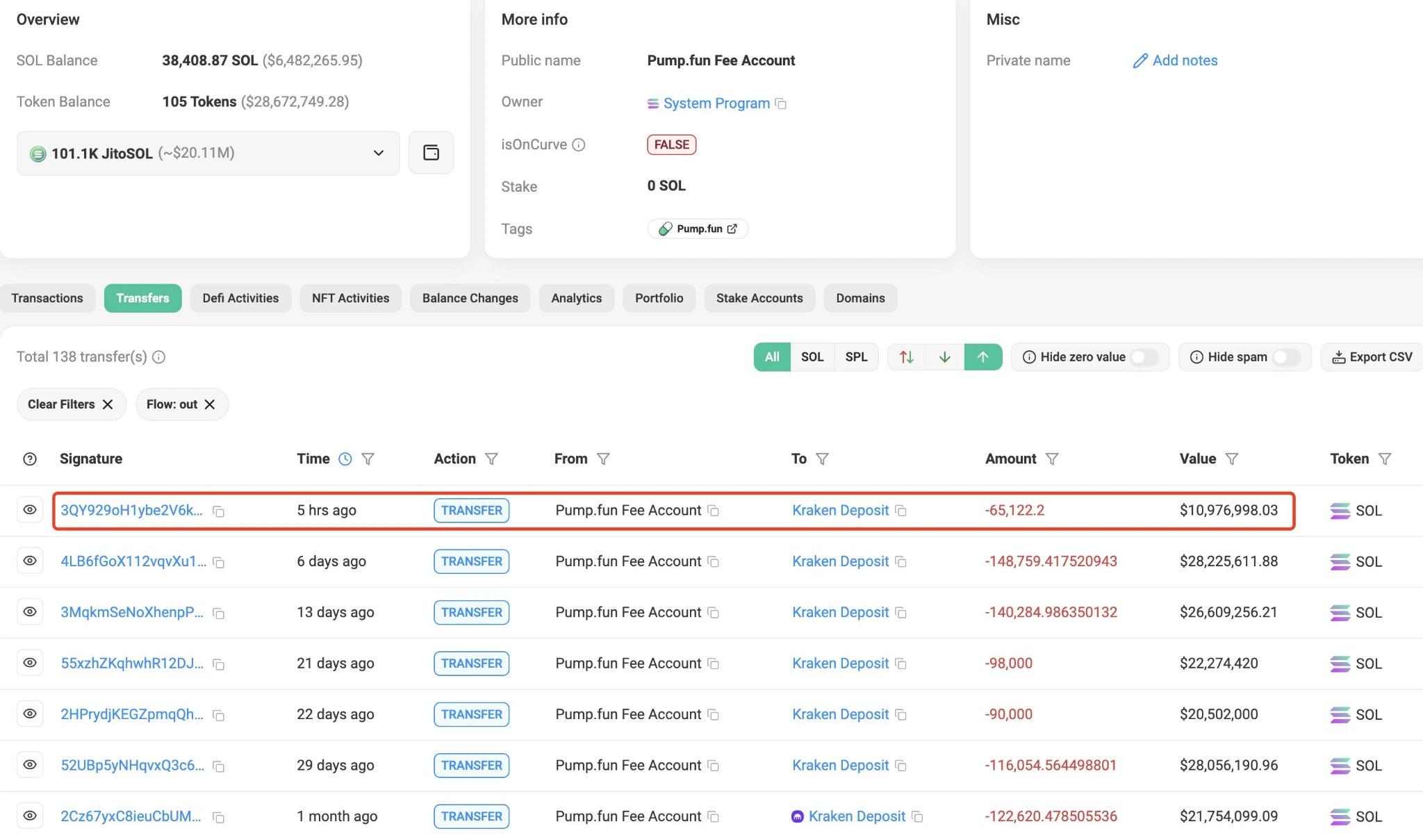

UMP.FUN DEPOSITS 2.34 MILLION SOL TO KRAKEN, TOTAL EARNINGS EXCEED $500 MILLION

According to monitoring data from Lookonchain, to date, pump.fun has deposited 2,345,499 SOL (approximately $473 million) to Kraken, and sold 264,373 SOL, receiving 41.64 million USDC.

Source: LookChain

With this, pump.fun has accumulated earnings of 2.93 million SOL (approximately $515 million).

Analysis:

Pump.fun has demonstrated strong profitability in the cryptocurrency market, likely stemming from the hot memecoin market during the crypto bull run.

Pump.fun is a memecoin issuance and trading platform based on the Solana blockchain. It allows users to create and trade memecoins with extremely low costs and simple operations, greatly reducing technical barriers and enabling anyone to participate easily.

BERACHAIN ON-CHAIN TVL EXCEEDS $3.115 BILLION, SURPASSES ARBITRUM TO RANK AMONG TOP SEVEN PUBLIC CHAINS

According to DeFiLlama data, Berachain’s Total Value Locked (TVL) has exceeded $3.115 billion, officially surpassing Arbitrum (TVL of $2.908 billion) to rise to 7th place in public chain rankings. Currently, Base ranks 6th with an on-chain TVL of $3.253 billion, followed by Arbitrum in 8th place.

Source: DefiLlama

Analysis:

Berachain’s TVL ranking among the top seven public chains demonstrates its ecosystem’s rapid expansion and strengthened user confidence. This growth may be attributed to its technological innovation, high-yield DeFi projects, and community support, attracting significant capital inflow.

The on-chain TVL differences between Berachain, Base, and Arbitrum are minimal. Whether Berachain can maintain its growth momentum depends on continued ecosystem innovation and user experience optimization.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!