KEYTAKEAWAYS

- Tron Chain Stablecoins Issue Over 824.51 Million in Past 7 Days

- SOL Market Cap Shrinks by About $57.67 Billion in a Month

- DeFi TVL Drops to $103B

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

TRON CHAIN STABLECOINS ISSUE OVER 824.51 MILLION IN PAST 7 DAYS

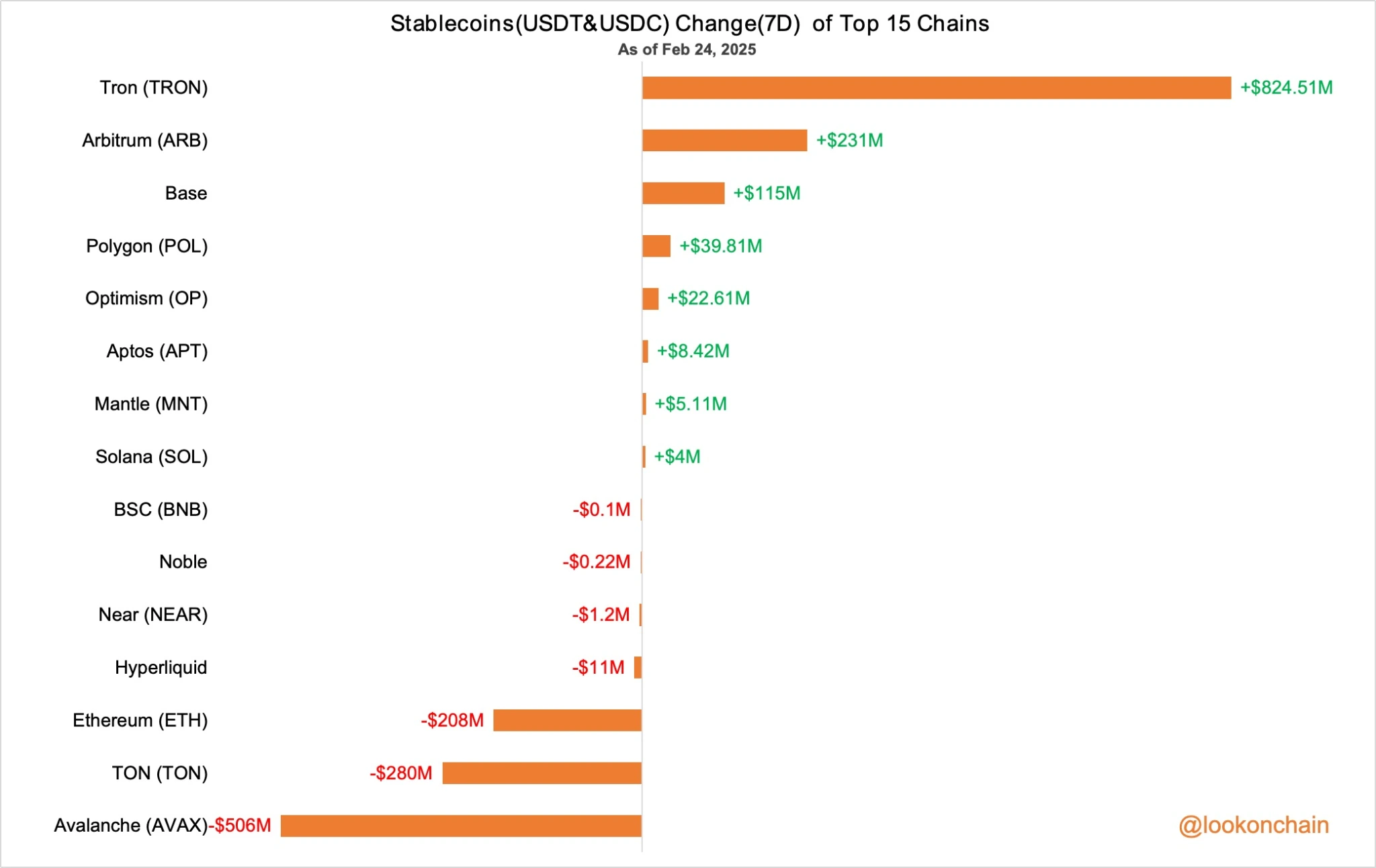

According to Lookonchain monitoring data, over the past week, stablecoins (USDT and USDC) on the Tron chain have been issued in the amount of 824.51 million, ranking first among all public chains. Following closely is the Arbitrum chain with 231 million stablecoins issued, ranking second. The Base chain ranks third with 115 million issued.

Source: LookChain

In terms of burns, stablecoins (USDT and USDC) on the Avalanche chain had the highest burn amount, reaching 506 million. The TON chain ranks second with 280 million burned, while the ETH chain’s stablecoin burn amount was 208 million, ranking third.

Analysis:

The issuance and burning of public chain stablecoins are mainly related to market demand and liquidity management. Issuance typically occurs when demand rises, as users need more stablecoins for trading, reserves, or DeFi operations; while burning occurs when market demand decreases, with the purpose of reducing stablecoin supply in the market to maintain price stability.

The issuance and burning of stablecoins are important means for public chains to regulate market liquidity and ensure currency stability through algorithms or governance mechanisms. The substantial issuance of stablecoins on the Tron chain reflects the activity of its ecosystem and the growth of user demand.

SOL MARKET CAP SHRINKS BY ABOUT $57.67 BILLION IN A MONTH

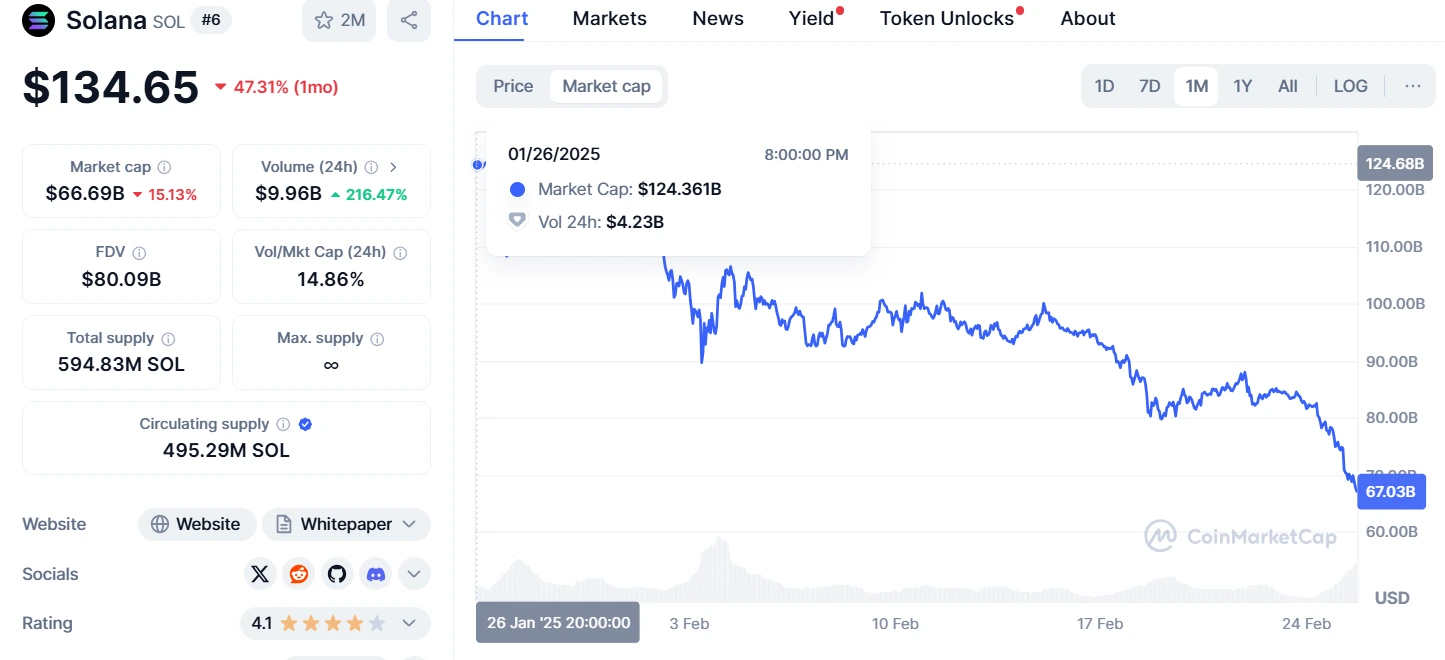

According to CoinMarketCap data, SOL’s current market cap is $66.69 billion, down significantly by $57.67 billion from $124.36 billion on January 26, representing a 47% drop in a single month. A report from digital asset management company Arca points out that since mid-December last year, most tokens have lost between 30% and 80% of their value.

Source: CoinMarketCap

Analysis:

The rapid decline in SOL’s market cap is primarily due to two factors: first, the recent scandal involving a Meme coin called Libra has impacted market confidence; second, approximately $1.72 billion worth of Solana tokens are scheduled to be “unlocked” (trading restrictions removed) on March 1, raising concerns about selling pressure. These factors have collectively led to cautious investor sentiment, intensifying SOL’s price volatility.

DEFI TVL DROPS TO $103B

According to DeFiLlama data, the total value locked (TVL) in DeFi has decreased to $103 billion, with major public chains generally experiencing significant drops today. Specifically, Ethereum chain TVL dropped 6.83%, Solana chain TVL fell 7.08%, BNB Chain decreased 5.36%, and TRON chain declined 4.57%. Among the top 10 public chains by TVL, only Berachain showed growth against the trend, rising 2.73% daily, with TVL increasing to $3.368 billion.

Source: DefiLlama

Analysis:

The significant decline in DeFi TVL is primarily influenced by the overall cryptocurrency market downturn. For instance, BTC price fell to $88,671, down 7.42% intraday; ETH price dropped to $2,385, falling 11%; and TRC price decreased to $0.2279, down 7.37% intraday. Although the number of tokens locked on-chain may not have decreased, TVL shows a declining trend due to falling asset prices. This indicates that the DeFi ecosystem is highly correlated with overall crypto market performance, necessitating attention to market sentiment changes and capital flows in the future.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!