KEYTAKEAWAYS

- DeFi TVL Falls Below $100B

- Bitcoin Drops Out of Top Ten in Global Asset Market Cap Rankings

- Circle Issues Additional 250 Million USDC, Bringing 2025 USDC Issuance on Solana to $8.5 Billion

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

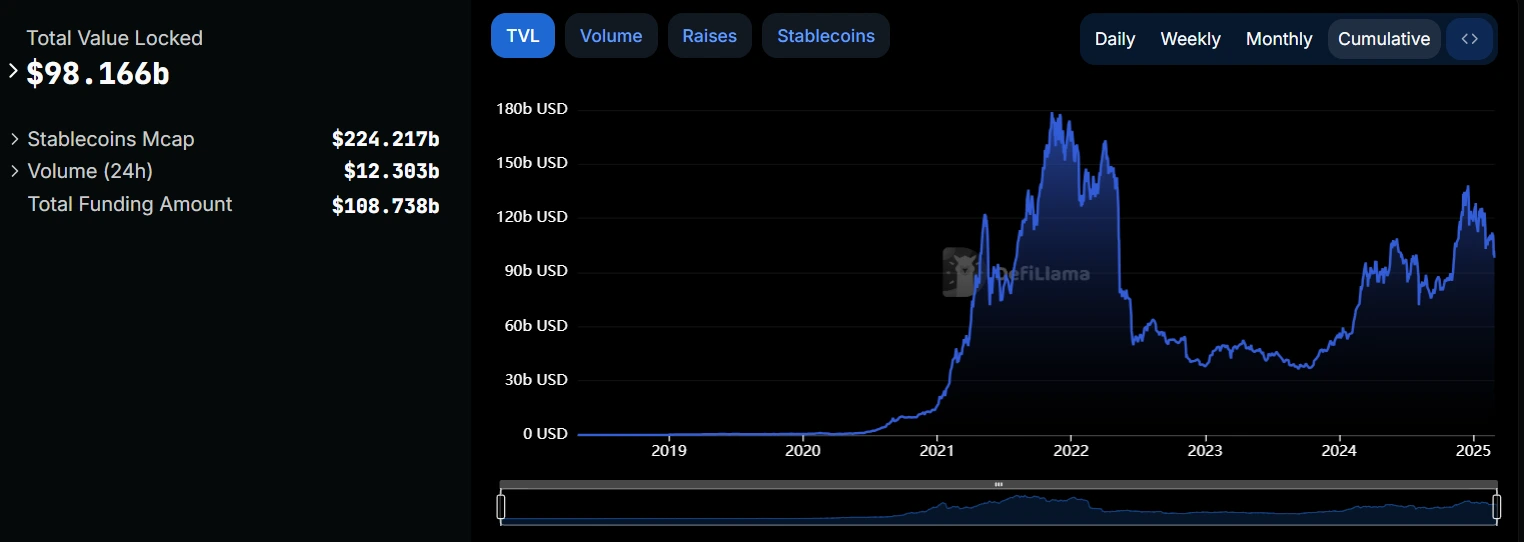

DEFI TVL FALLS BELOW $100B

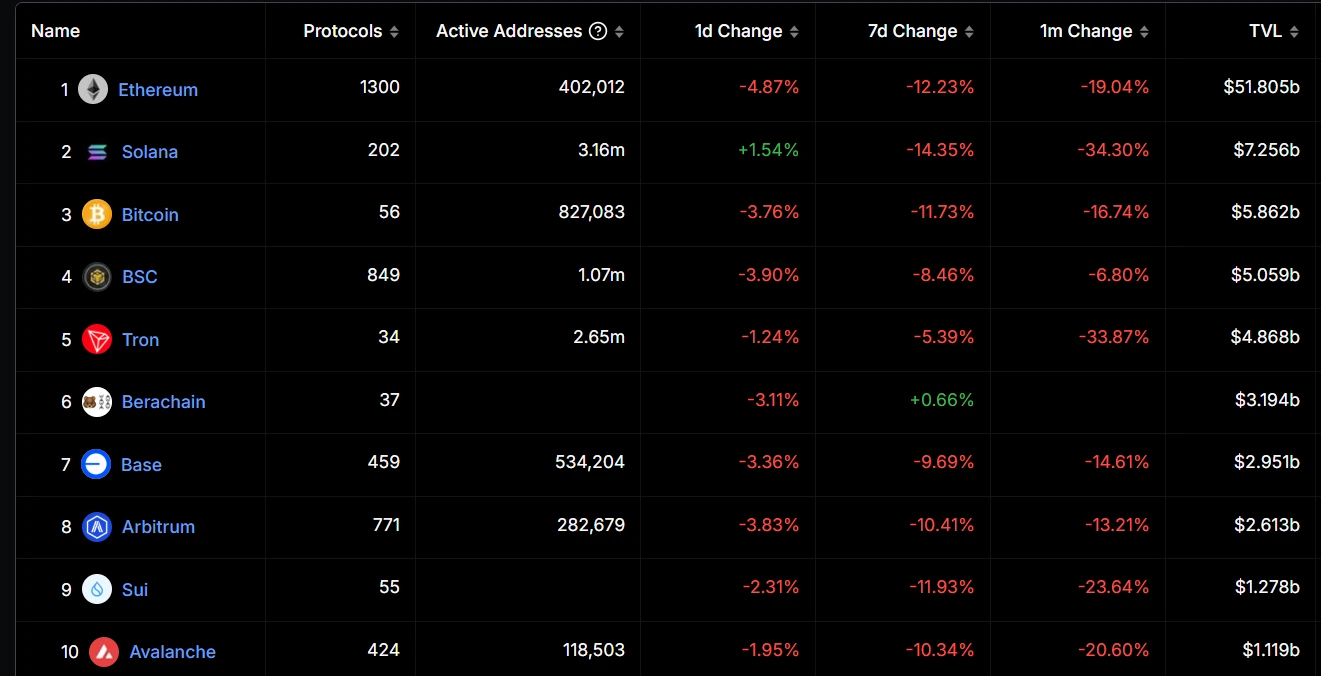

According to the latest data from DeFiLlama, the total value locked (TVL) in DeFi has dropped to $98.166 billion, falling below the $100 billion mark for the first time in nearly three months. Over the past week, among the top 10 public chains by ranking, all experienced varying degrees of decline except Berachain, which saw its TVL grow against the trend by 0.66%.

Source: DefiLlama

Ethereum’s TVL stands at $51.805 billion, down 12.23% for the week; Solana’s TVL is $7.526 billion, down 14.35% for the week; BNB Chain’s TVL is $5.059 billion, down 8.64% for the week; and Tron’s TVL is $4.86 billion, down 5.39% for the week.

Source: DefiLlama

Analysis:

DeFi TVL falling below the $100 billion mark reflects depressed market sentiment and capital outflow pressure. The significant drops in TVL on mainstream public chains like Ethereum and Solana are closely related to cryptocurrency price fluctuations.

Berachain’s growth against the trend indicates some capital is shifting toward emerging ecosystems. In the short term, the market may continue to face pressure, with the crypto market showing weakness in upward corrections.

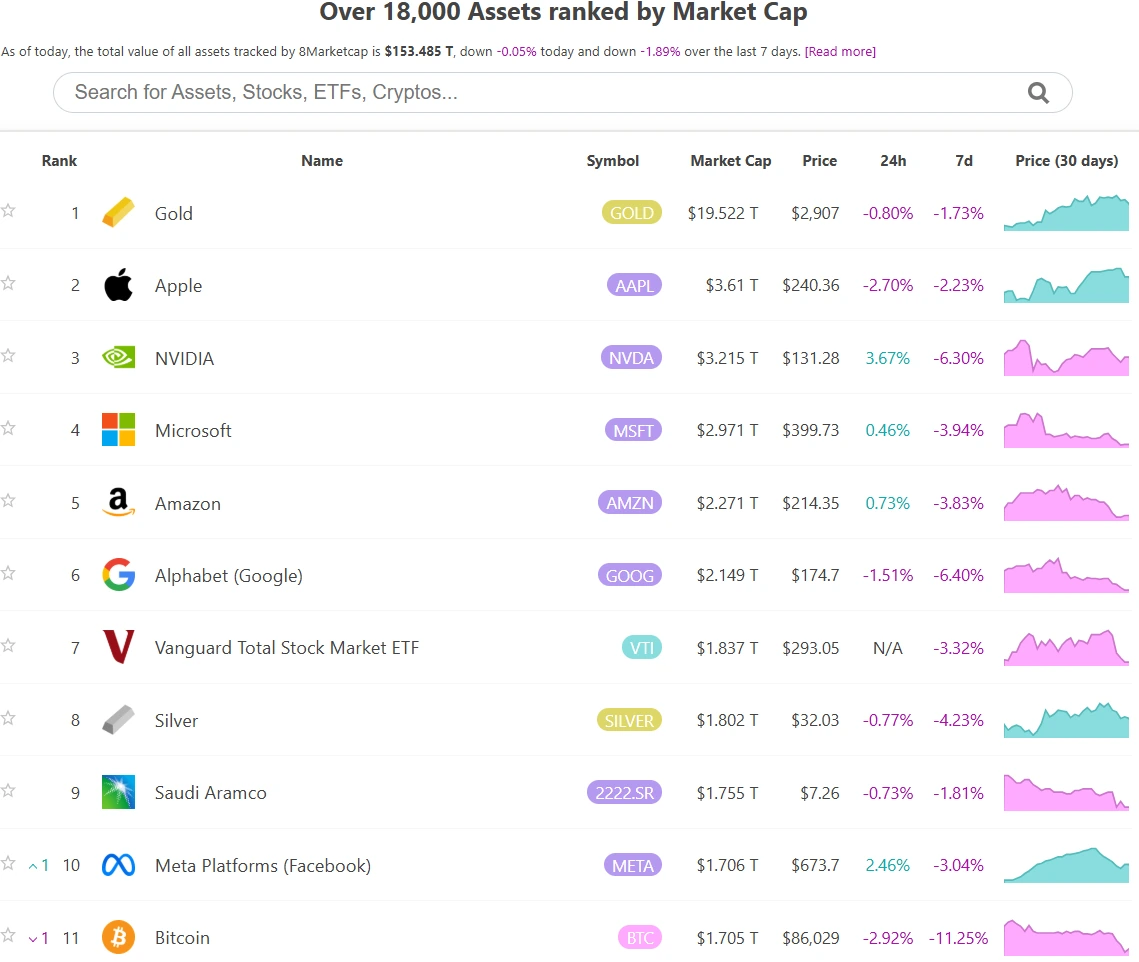

BITCOIN DROPS OUT OF TOP TEN IN GLOBAL ASSET MARKET CAP RANKINGS

According to the latest data from 8marketcap, Bitcoin has fallen out of the top ten in global asset market capitalization rankings, currently ranking eleventh. Meta Platforms, with a market cap of $1.706 trillion, has surpassed Bitcoin ($1.705 trillion) to enter the top ten. Notably, over the past seven days, Meta Platforms’ market cap decreased by 3.04%, while Bitcoin’s market cap plummeted by 11.25%.

Source: 8 Market Cap

Analysis:

Bitcoin’s exit from the global top ten in market capitalization reflects the significant pressure on the cryptocurrency market recently. Bitcoin’s rapid market cap decline reflects investors’ preference for high-risk assets while maintaining caution.

The trend of shrinking market caps may be related to macroeconomic uncertainties and cooling market sentiment, with the cryptocurrency market potentially facing continued volatility in the short term.

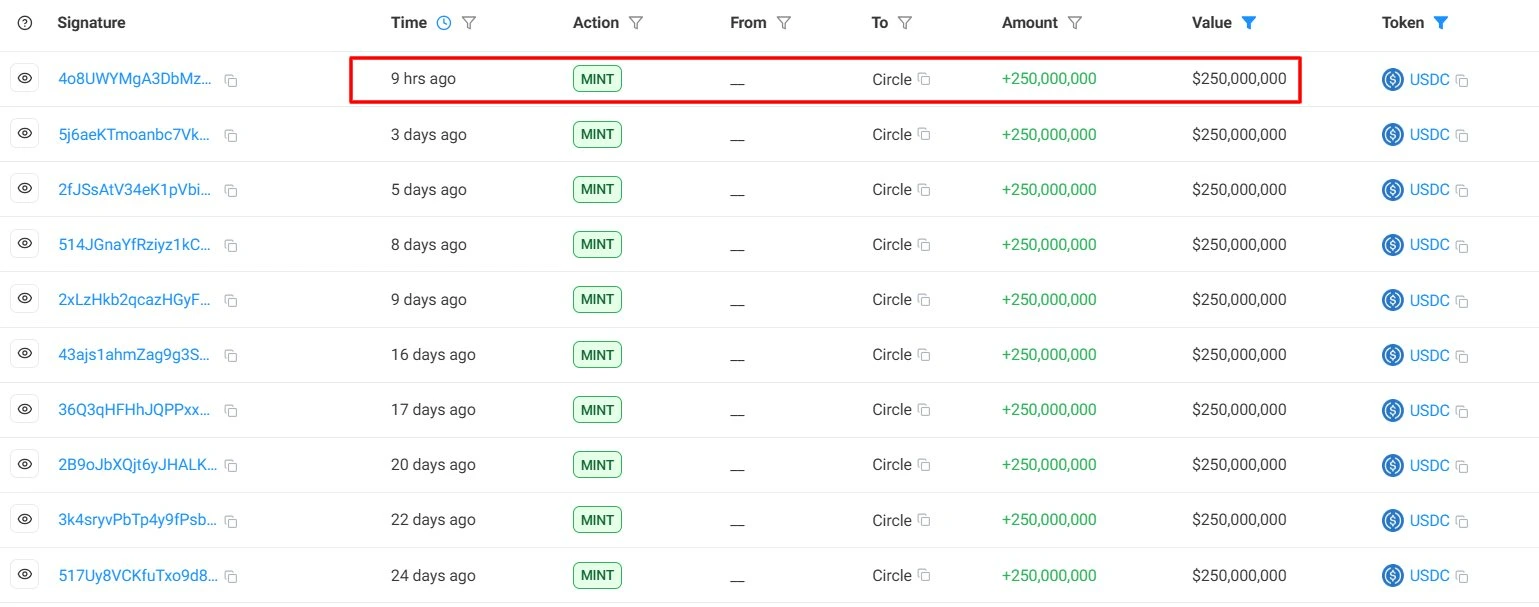

CIRCLE ISSUES ADDITIONAL 250 MILLION USDC, BRINGING 2025 USDC ISSUANCE ON SOLANA TO $8.5 BILLION

According to monitoring data from Onchain Lens, Circle recently issued an additional 250 million USDC on the Solana network. With this, Circle’s cumulative USDC issuance on the Solana chain in 2025 has reached $8.5 billion.

Source: OnchainLens

Analysis:

The $8.5 billion issuance volume demonstrates strong growth in stablecoin demand within the Solana ecosystem. This trend is closely related to Solana’s advantages of high performance and low transaction costs, attracting more developers and users to participate in its DeFi, payment, and other application scenarios.

Additionally, the recent approval of USDC and EURC as the first recognized stablecoins by the Dubai Financial Services Authority has further strengthened market confidence, providing policy support for the global expansion of compliant stablecoins like USDC.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!