KEYTAKEAWAYS

- 5 Tokens in Crypto Market Cap Top 100 Including RAY, TRUMP, WIF Drop Over 50% Monthly

- Interest-Bearing Stablecoins Market Share Expected to Exceed 10% in Next 3-5 Years

- US Spot Bitcoin ETFs See $3.2 Billion Net Outflow Over Past Eight Days

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

5 TOKENS IN CRYPTO MARKET CAP TOP 100 INCLUDING RAY, TRUMP, WIF DROP OVER 50% MONTHLY

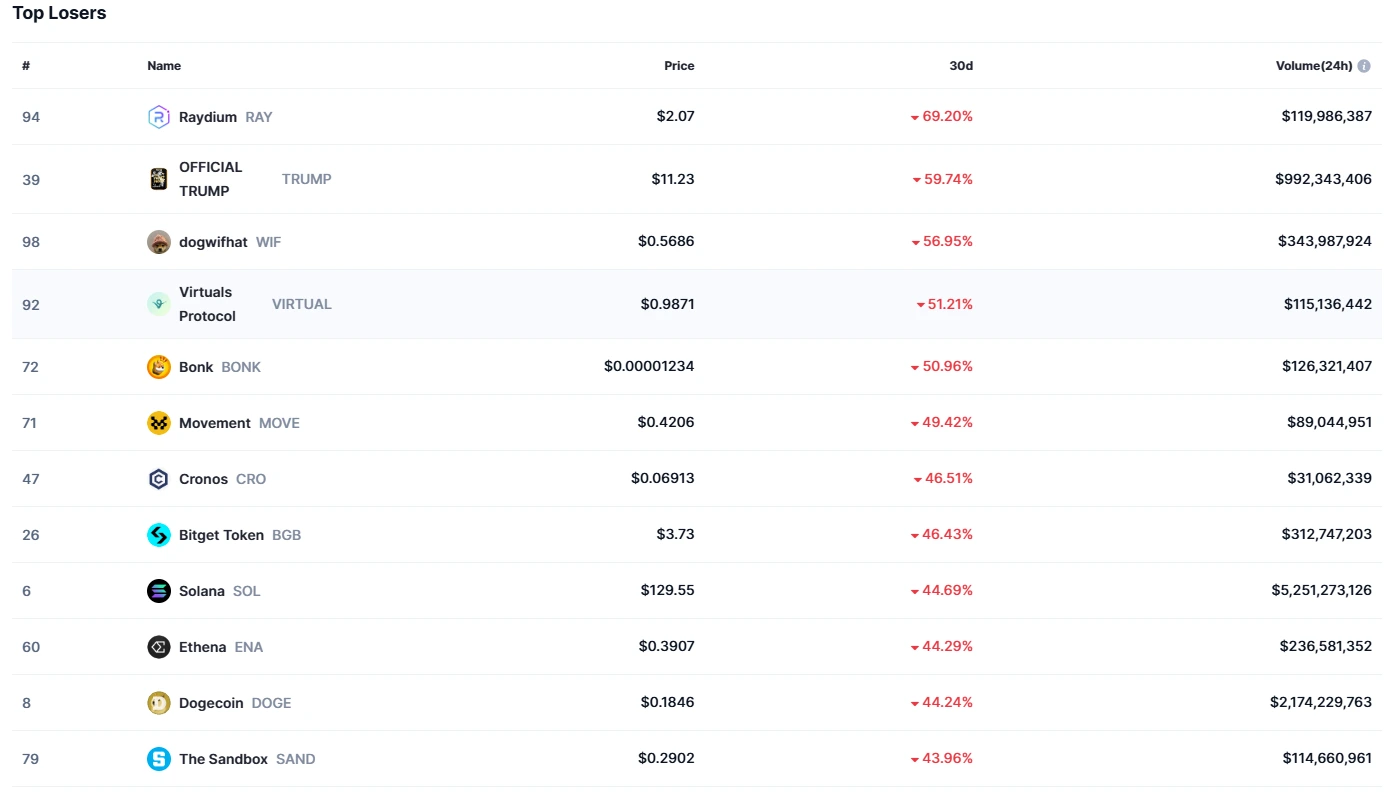

According to CoinMarketCap data, within the past month, 5 tokens among the top 100 cryptocurrencies by market cap have fallen more than 50%, including:

- Raydium (RAY): down 69.20%, currently priced at $2.07;

- OFFICIAL TRUMP (TRUMP): down 59.74%, currently priced at $11.23;

- dogwifhat (WIF): down 56.95%, currently priced at $0.5686;

- Virtuals Protocol (VIRTUAL): down 51.21%, currently priced at $0.9871;

- Bonk (BONK): down 50.96%, currently priced at $0.00001234;

Source: CoinMarketCap

Analysis:

The cryptocurrency market has recently experienced a significant correction, with five tokens in the top 100 by market cap shrinking by more than 50%. The downward trend in the crypto market appears to be continuing, with meme coins and emerging projects facing particularly strong selling pressure, requiring users to stay vigilant.

INTEREST-BEARING STABLECOINS MARKET SHARE EXPECTED TO EXCEED 10% IN NEXT 3-5 YEARS

Market data shows that since 2024, interest-bearing stablecoins have achieved a significant leap in market share within the Ethereum ecosystem, rapidly growing from 0.4% at the beginning of the year to the current 5.4%. According to OKG Research’s latest report, as the U.S. Securities and Exchange Commission’s (SEC) regulatory stance toward interest-bearing stablecoins gradually clarifies, this market segment is expected to experience explosive growth in the next 3-5 years, with market share projected to exceed 10%, becoming a core crypto asset class attracting large-scale institutional capital allocation after Bitcoin.

Analysis:

The SEC’s recent approval of Figure Markets’ first interest-bearing stablecoin YLDS marks a milestone, signaling that U.S. crypto regulatory policy is transitioning from “passive defense” to “active guidance.” YLDS’s successful approval stems from its innovative avoidance of core controversial points in current U.S. stablecoin regulation. By actively adapting to current securities laws, it resolves the long-standing compliance dilemmas faced by traditional stablecoins like USDT and USDC, pioneering a new path for the compliant development of interest-bearing stablecoins.

US SPOT BITCOIN ETFS SEE $3.2 BILLION NET OUTFLOW OVER PAST EIGHT DAYS

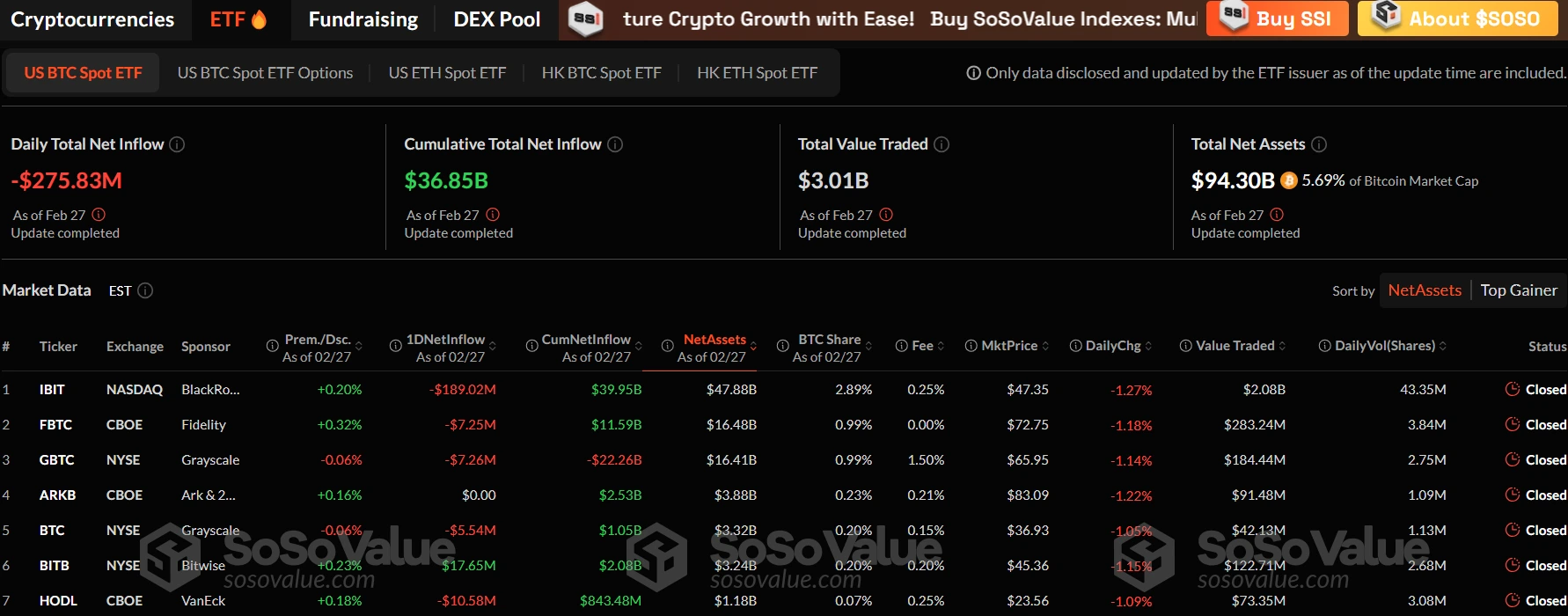

Data shows that over the past eight days, Bitcoin ETFs have experienced a total net outflow of $3.2 billion, matching the consecutive net outflow record set in August 2024 and becoming the longest period of capital outflow since the establishment of Bitcoin funds.

Source: SoSoValue

The cumulative total net inflow for the 12 Bitcoin ETFs has decreased to $36.85 billion, the lowest level since January 14. Currently, the total net asset value of these ETFs is $94.3 billion, accounting for approximately 5.7% of Bitcoin’s total market capitalization.

Analysis:

The large-scale capital outflow from Bitcoin ETFs not only reflects short-term market volatility but also shows the combined impact of multiple factors. The recent continuous correction in Bitcoin price has further intensified the outflow pressure from ETFs. Additionally, uncertainty in the macroeconomic environment has heightened investors’ risk-averse sentiment, causing high-risk assets to generally face pressure.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!