KEYTAKEAWAYS

- Uniswap Daily Trading Volume Exceeds $3.61 Billion, Firmly Holding First Place Among DEXs

- pump.fun Platform Trading Volume Down 63% Month-on-Month in February

- WLFI's Token Portfolio Currently Has Unrealized Losses of $87.83 Millionqu

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

UNISWAP DAILY TRADING VOLUME EXCEEDS $3.61 BILLION, FIRMLY HOLDING FIRST PLACE AMONG DEXs

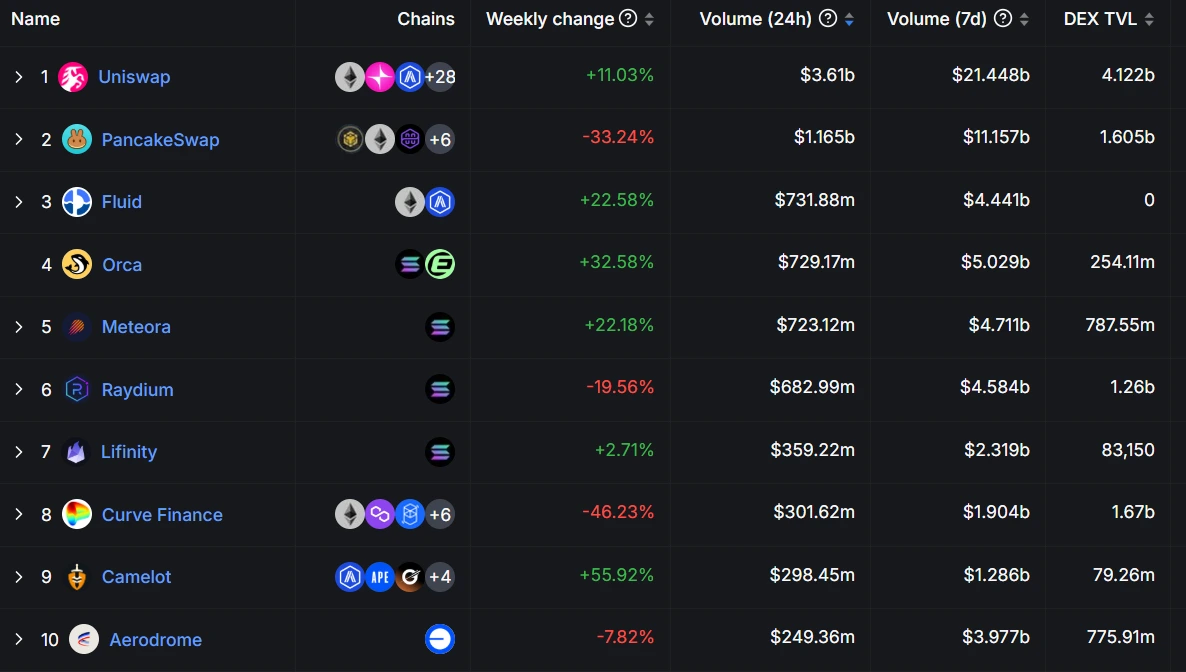

According to the latest data from DeFiLlama, Uniswap continues to lead the decentralized exchange (DEX) market with a daily trading volume of $3.61 billion, achieving a weekly growth rate of 11.03%. PancakeSwap ranks second with a daily trading volume of $1.165 billion, but has decreased by 33.24% compared to last week.

Fluid has performed impressively, with daily trading volume reaching $731.88 million and a weekly increase of 22.58%, successfully breaking into the top three. Raydium ranks 6th with a daily trading volume of $682.99 million, down 19.58% from last week.

Analysis:

During the cryptocurrency correction period, Uniswap’s leadership reflects its dominant position in the DEX market, with higher trading depth. The decline in PancakeSwap and Raydium’s daily trading volumes may be influenced by the decreasing popularity of MEME concept tokens.

PUMP.FUN PLATFORM TRADING VOLUME DOWN 63% MONTH-ON-MONTH IN FEBRUARY

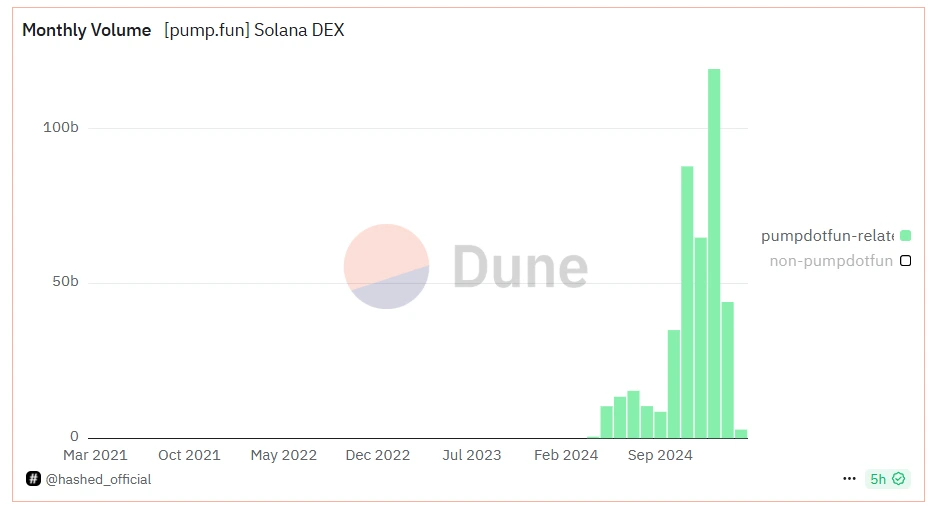

According to the latest data from Dune, pump.fun platform’s February trading volume experienced a significant decline, decreasing 63% month-on-month, plummeting from $119 billion in January to $44 billion.

Analysis:

pump.fun quickly captured market share in the Meme launch platform space thanks to excellent operations and the ability to create successful token launches. The core reason for the decline in trading volume may be that Meme coin enthusiasm has shifted from the Solana chain to BNB Chain, with pump.fun platform users moving to platforms offering higher returns.

WLFI’S TOKEN PORTFOLIO CURRENTLY HAS UNREALIZED LOSSES OF $87.83 MILLION

According to the latest monitoring data from well-known on-chain analyst @ai_9684xtpa, the Trump family-backed cryptocurrency project WLFI is facing severe challenges. Data shows that WLFI’s token portfolio currently has accumulated unrealized losses of $87.83 million. Against the backdrop of an overall market correction, all tokens held by WLFI are in a loss position, with Ethereum (ETH) showing the most significant loss at $67.02 million, accounting for 76% of the total losses.

Analysis:

WLFI has not conducted any token purchases for 13 consecutive days, demonstrating the project’s cautious attitude in the current market environment.

The recent overall correction in the cryptocurrency market is the main reason for WLFI’s portfolio losses. WLFI’s heavy position in Ethereum may be the key factor leading to the enormous losses. An overly concentrated investment strategy amplified risks during the market downturn.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!