KEYTAKEAWAYS

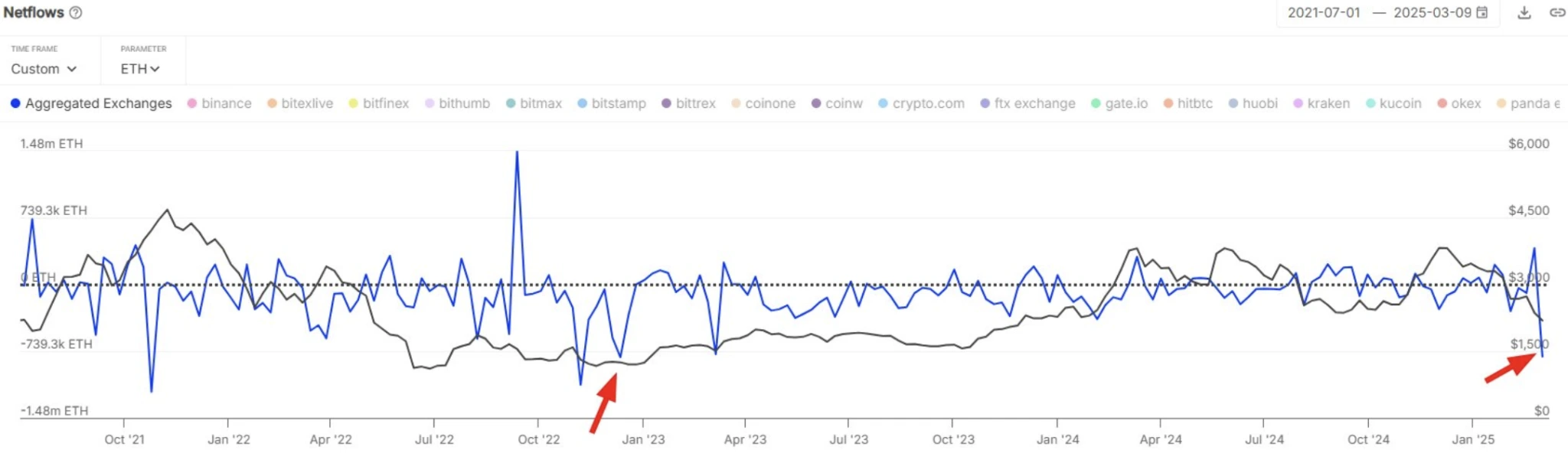

- $1.8 Billion ETH Withdraws from Exchanges, Creating Largest Weekly Outflow Since December 2022

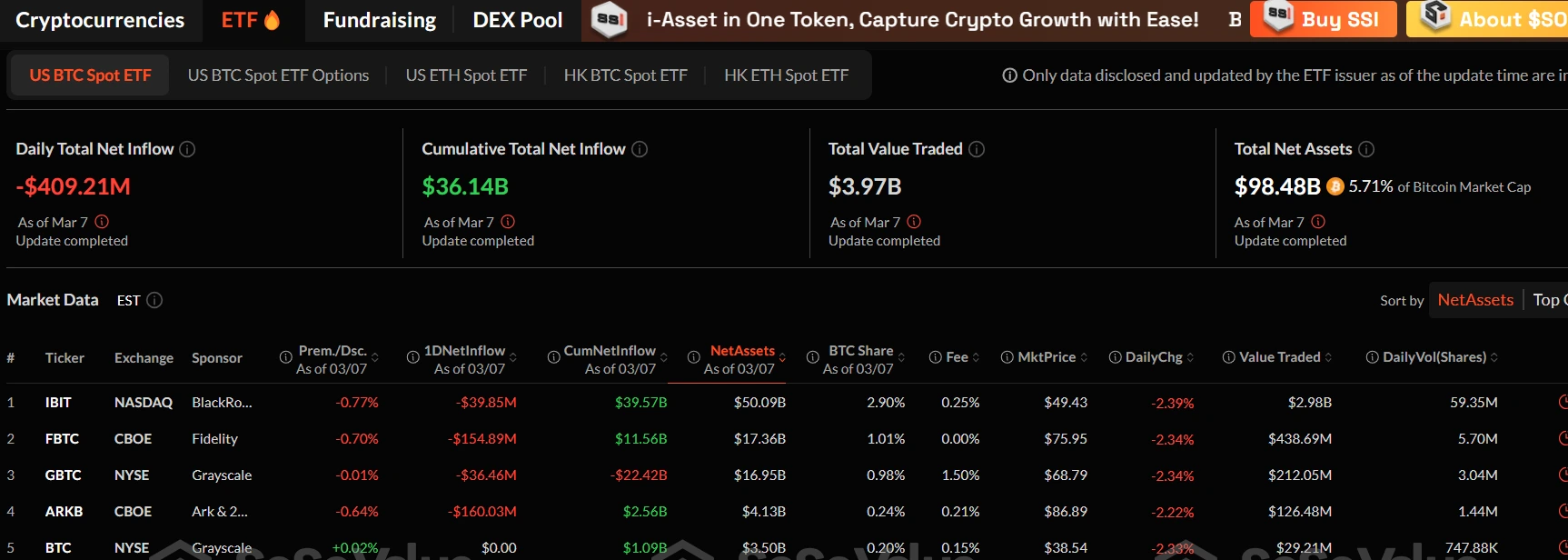

- Bitcoin Spot ETFs See $799 Million Net Outflows Last Week, Only Grayscale Mini Trust BTC Records Net Inflows

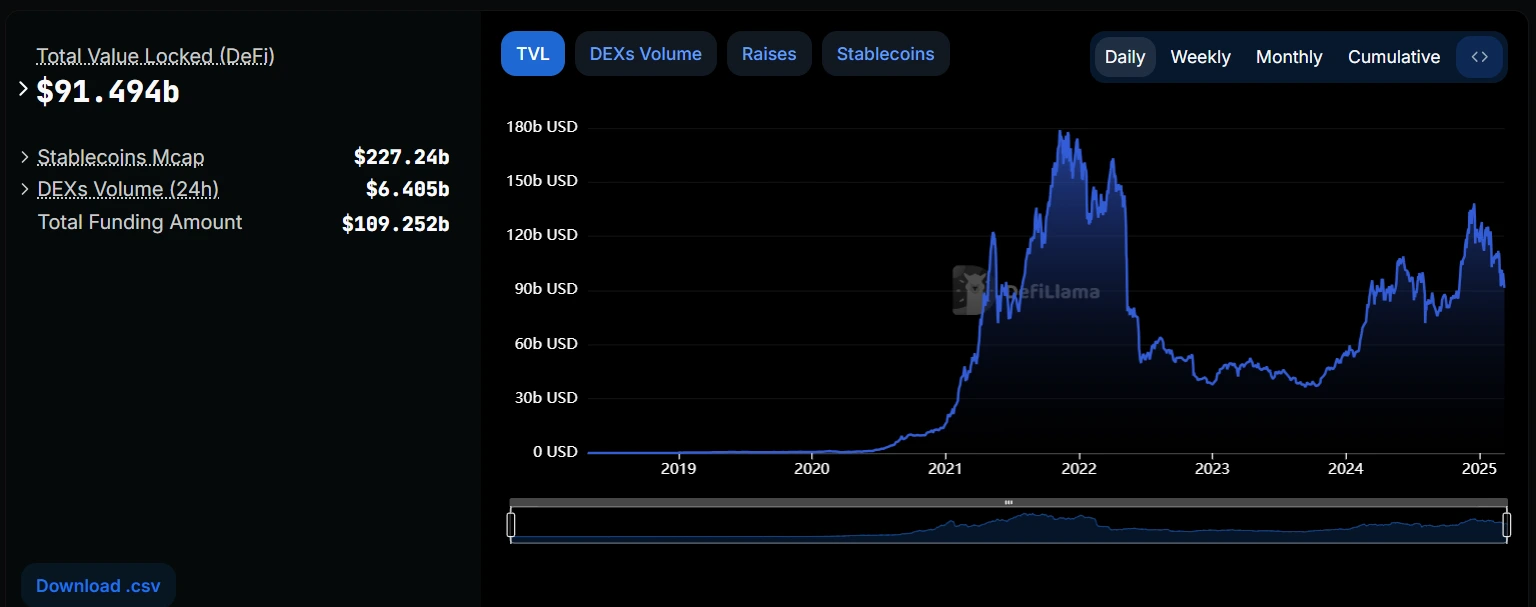

- DeFi TVL Drops to $91.49 Billion

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

$1.8 BILLION ETH WITHDRAWS FROM EXCHANGES, CREATING LARGEST WEEKLY OUTFLOW SINCE DECEMBER 2022

According to data from IntoTheBlock, approximately $1.8 billion worth of ETH flowed out of exchanges last week, marking the highest weekly outflow since December 2022. Despite ongoing bearish sentiment regarding ETH prices, this trend indicates that many holders view current price levels as a strategic buying opportunity.

Analysis:

From an investor perspective, choosing to withdraw coins during a price downturn reflects market participants’ confidence in ETH’s long-term value. The reduction in ETH reserves on exchanges typically suggests decreased selling pressure, potentially creating favorable conditions for a price rebound.

BITCOIN SPOT ETFS SEE $799 MILLION NET OUTFLOWS LAST WEEK, ONLY GRAYSCALE MINI TRUST BTC RECORDS NET INFLOWS

According to SoSoValue data, between March 3 and March 7, Bitcoin spot ETFs recorded weekly net outflows of $799 million. Only Grayscale’s Bitcoin Mini Trust BTC recorded net inflows of $35.77 million, bringing its historical total net inflows to $1.09 billion.

Currently, the total net asset value of Bitcoin spot ETFs stands at $98.483 billion, with ETF market value representing 5.71% of Bitcoin’s total market capitalization. Historical cumulative net inflows have reached $36.142 billion.

Analysis:

The net outflow data from Bitcoin spot ETFs last week indicates market sentiment is trending toward caution. Trump held a crypto summit at the White House, which became the most important focal point in the Web3 sector that week, but the crypto market doesn’t appear to have experienced significant buying activity.

DEFI TVL DROPS TO $91.49 BILLION

According to the latest data from DeFiLlama, the Total Value Locked (TVL) in Decentralized Finance (DeFi) has fallen to $91.49 billion, showing a significant decline compared to last week. The performance of top protocols has been particularly weak:

- Lido, ranked first, saw its TVL drop by 13.46% over the week to $19.39 billion

- AAVE, ranked second, experienced a TVL decrease of 8.91% to $13.45 billion

- EigenLayer, ranked third, also fell by 13.45%, currently at $9.132 billion

Analysis:

The DeFi market is undergoing a cyclical adjustment. Investors may be withdrawing due to market volatility and declining yields. The widespread drop among leading protocols indicates that even industry leaders are struggling to resist the overall downward pressure in the crypto market.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!