KEYTAKEAWAYS

- Solana On-Chain Vote SIMD 228 Reaches 72% Participation Rate

- 2025 Q1 AI Industry Venture Capital Approaches $20 Billion, While US Crypto Venture Funding Only $861 Million

- Total DeFi TVL Across All Chains Reaches $88.35 Billion, Ethereum Accounts for Over 51%

- KEY TAKEAWAYS

- Solana on-chain vote SIMD-228 reaches 72% participation rate

- 2025 Q1 AI industry venture capital approaches $20 billion, while US crypto venture funding only $861 million

- Total DeFi TVL across all chains reaches $88.35 billion, with Ethereum accounting for over 51%

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

Solana on-chain vote SIMD-228 reaches 72% participation rate

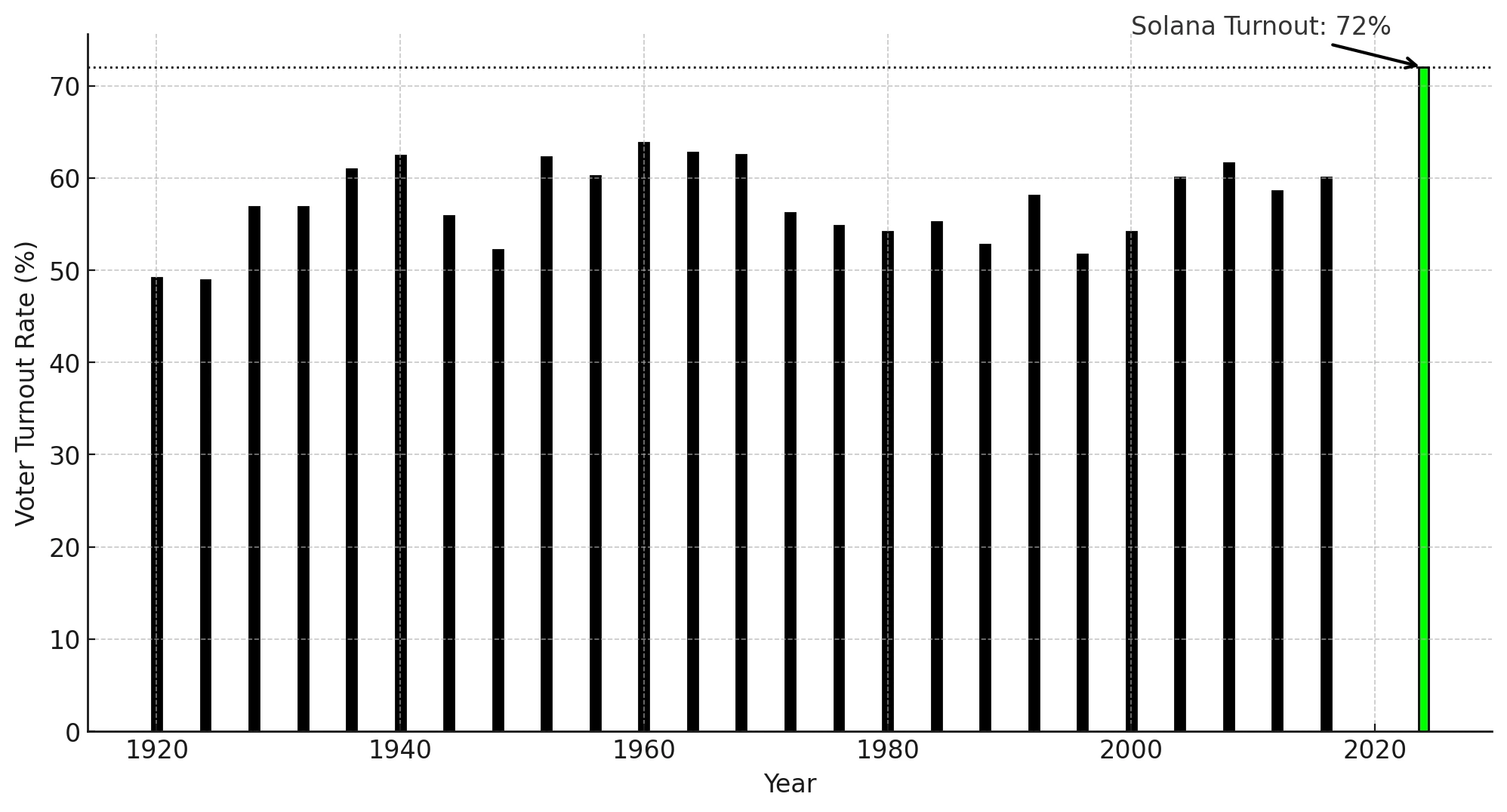

According to Solana officials, the participation rate for Solana’s on-chain governance proposal SIMD 228 reached 72%, exceeding the voting rates of all US presidential elections over the past 100 years. Charts show that historical US presidential election participation rates typically range between 50%-65%.

Analysis:

The 72% participation rate reflects the Solana community’s active involvement in on-chain governance, indicating a significant increase in community members’ attention and sense of responsibility toward ecosystem development. Compared to US presidential election turnout, SIMD 228’s participation rate is particularly outstanding, highlighting the unique advantages of blockchain governance models in stimulating user participation.

This high participation rate may provide valuable lessons for other blockchain projects, encouraging more communities to adopt on-chain governance models and further enhancing the transparency and democratization of decentralized ecosystems.

2025 Q1 AI industry venture capital approaches $20 billion, while US crypto venture funding only $861 million

According to Pitchbook data, in the first quarter of 2025, total venture capital funding in the US cryptocurrency sector was approximately $861 million, while the AI industry attracted nearly $20 billion, showing a clear capital flow preference toward artificial intelligence.

In the AI sector, major funding rounds included $15.3 billion for Databricks and $2 billion for Anthropic, with a total of 795 transactions. In comparison, the largest funding in the crypto industry was Abu Dhabi MGX’s $2 billion investment in Binance, with other significant deals including $82 million for Mesh, $70 million for Bitwise, and $58 million for Sygnum Bank.

Analysis:

AI funding has grown from $670 million in 2011 to $36 billion in 2020, with overall growth rates far exceeding the crypto sector. The data demonstrates investors’ high confidence in AI technology.

Total DeFi TVL across all chains reaches $88.35 billion, with Ethereum accounting for over 51%

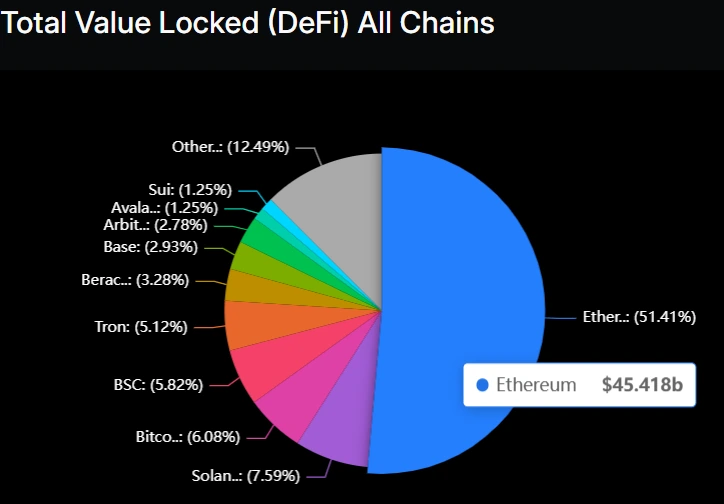

According to DeFiLlama data, the total value locked (TVL) in DeFi has reached $88.35 billion. Ethereum leads with $45.418 billion TVL, accounting for 51.34% and maintaining its dominant position in the DeFi ecosystem. TVL on other public chains includes: Solana ($6.703 billion), Bitcoin ($5.37 billion), BSC ($5.144 billion), Tron ($4.52 billion), Berachain ($2.895 billion), and Base ($2.587 billion).

Analysis:

Emerging chains like Solana, Berachain, and Base are showing impressive performance, demonstrating their strong growth potential in the DeFi sector. While Ethereum maintains its dominant position, the TVL distribution across other chains indicates that the DeFi ecosystem is gradually evolving toward a multi-chain development, with enhanced liquidity flow of users and funds across different chains.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!