KEYTAKEAWAYS

- Solana Transaction Fees Fall to Lowest Level Since September 2024

- BNB Ecosystem DEX 24H Trading Volume Temporarily Reports $2.664 Billion, Ranking First

- Ethereum Spot ETFs See Net Outflow of $52.8156 Million Yesterday, Marking 10 Consecutive Days of Capital Outflows

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

SOLANA TRANSACTION FEES FALL TO LOWEST LEVEL SINCE SEPTEMBER 2024

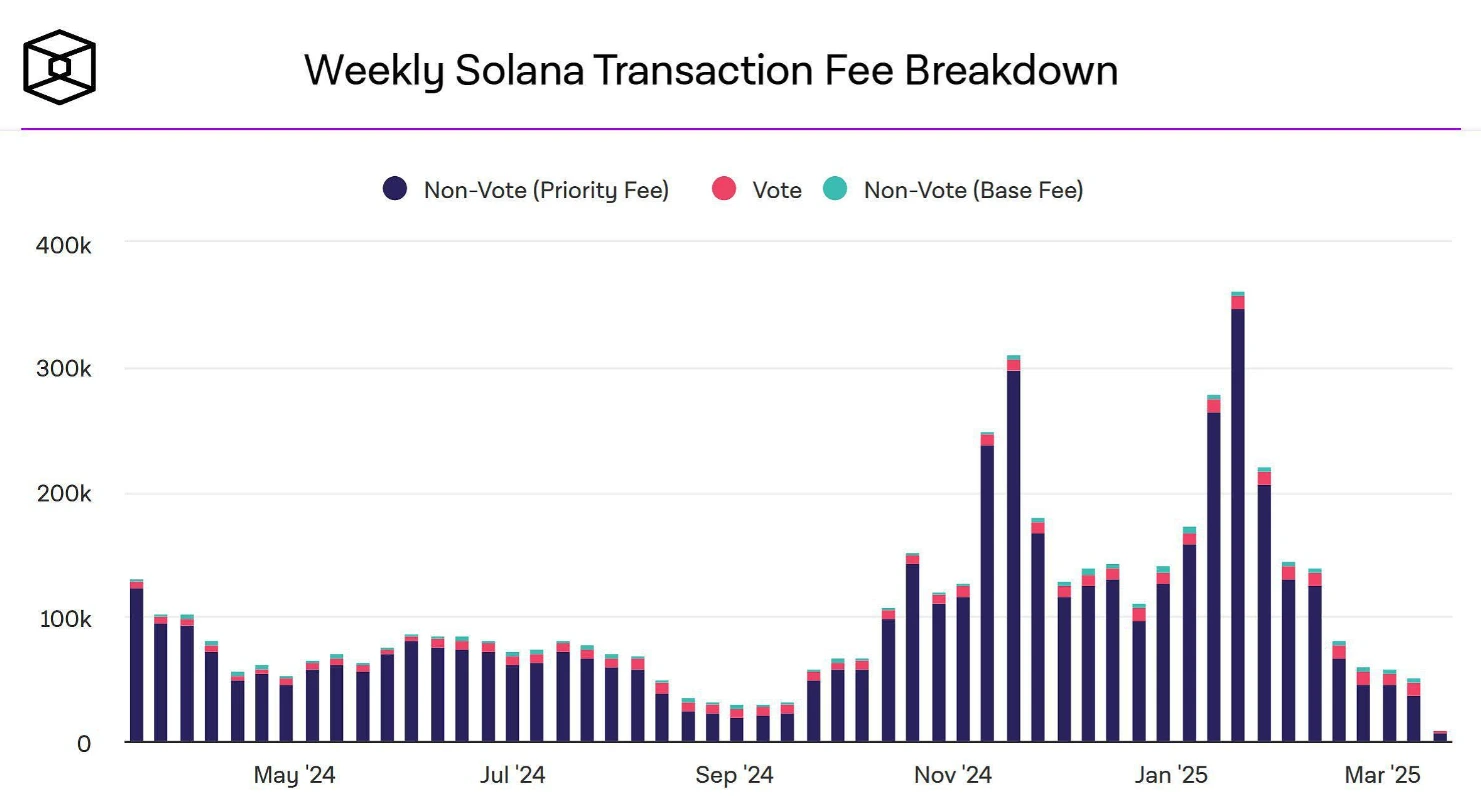

According to Dune Analytics data, as of March 19, 2025, transaction fees on the Solana network have fallen to their lowest level since September 2024. The chart shows that Solana transaction fees peaked between November 2024 and January 2025, followed by a continuous downward trend, with recent weekly transaction fees dropping to less than $100,000.

Analysis:

The decline in fees may reflect a certain degree of slowdown in Solana network activity, particularly a significant decrease in MEME coin trading activity. This period of cyclical adjustment in user demand presents an opportunity for Solana to attract more developers and projects to join its ecosystem.

BNB ECOSYSTEM DEX 24H TRADING VOLUME TEMPORARILY REPORTS $2.664 BILLION, RANKING FIRST

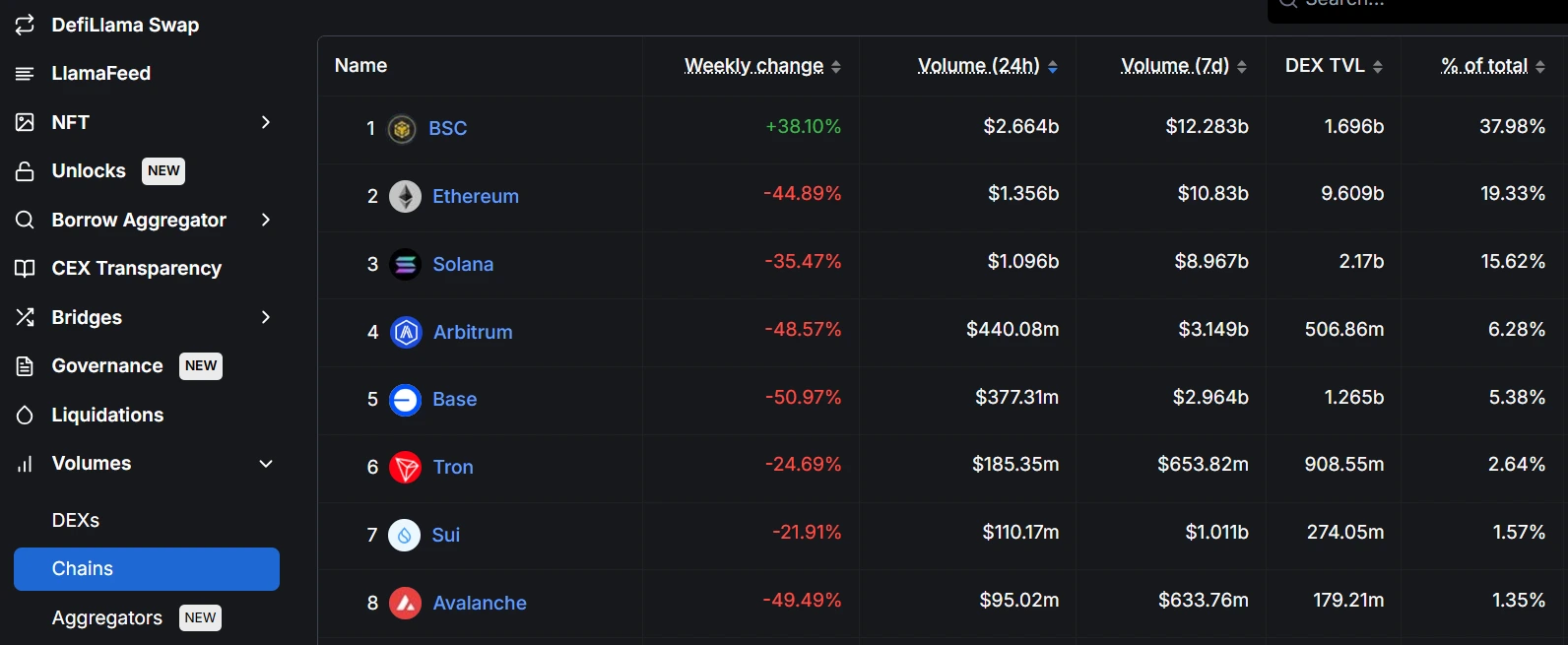

According to DefiLlama data, BNB ecosystem DEX 24-hour trading volume is temporarily reported at $2.664 billion, ranking first, continuing to surpass Ethereum ($1.356 billion) and Solana ($1.096 billion). Additionally, BNB ecosystem DEX trading volume increased by 38.1% over the past week.

Analysis:

The significant increase in DEX weekly trading volume indicates that the BNB ecosystem is attracting more funds and user participation. This is attributed to BNB Chain’s low transaction costs, high-performance efficiency, and rich ecosystem applications. Compared to Ethereum’s high Gas fees, the BNB ecosystem provides users with a more attractive trading environment.

ETHEREUM SPOT ETFS SEE NET OUTFLOW OF $52.8156 MILLION YESTERDAY

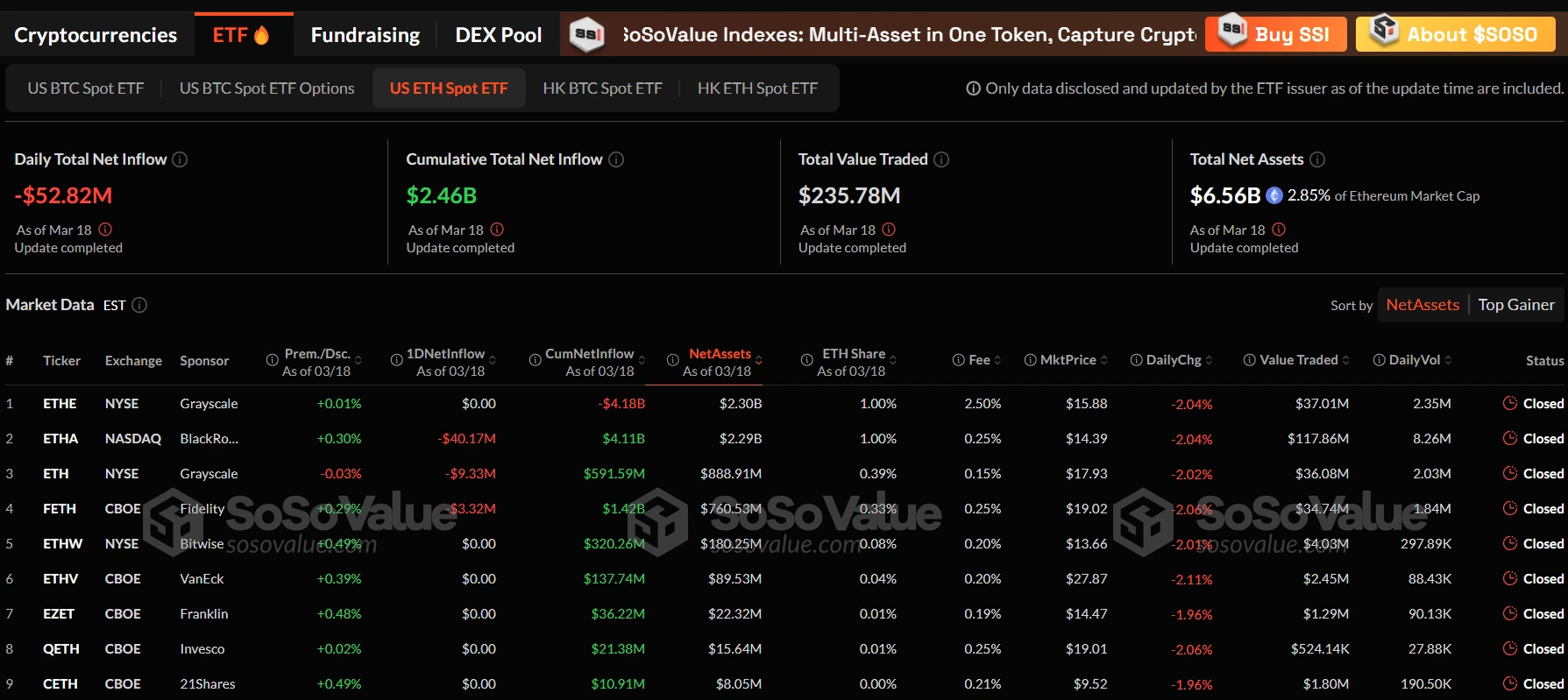

According to SoSoValue data, Ethereum spot ETFs experienced a total net outflow of $52.8156 million yesterday, marking 10 consecutive days of capital outflows. Currently, Ethereum spot ETFs have a total net asset value of $6.561 billion, with an ETF net asset ratio (market value as a percentage of Ethereum’s total market value) of 2.85%. The historical cumulative net inflow stands at $2.460 billion.

Analysis:

The continuous capital outflows from Ethereum spot ETFs may reflect investors’ concerns about short-term market volatility or profit-taking behavior. Although Ethereum’s ecosystem long-term prospects remain positive, recent market sentiment and macroeconomic factors may be influencing capital flows.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!