KEYTAKEAWAYS

- Tether Mints Total of 6 Billion USDT in 2025, Adding Another 1 Billion on Tron Network

- Over $360 Million in Liquidations Across the Market in Past 24 Hours, Short Positions Account for Over 70% of Losses

- SHELL Market Maker Buyback Progress Reaches 74%, Accumulating 19.95 Million Tokens

- KEY TAKEAWAYS

- TETHER MINTS TOTAL OF 6 BILLION USDT IN 2025, ADDING ANOTHER 1 BILLION ON TRON NETWORK

- OVER $360 MILLION IN LIQUIDATIONS ACROSS THE MARKET IN PAST 24 HOURS, SHORT POSITIONS ACCOUNT FOR OVER 70% OF LOSSES

- SHELL MARKET MAKER BUYBACK PROGRESS REACHES 74%, ACCUMULATING 19.95 MILLION TOKENS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

TETHER MINTS TOTAL OF 6 BILLION USDT IN 2025, ADDING ANOTHER 1 BILLION ON TRON NETWORK

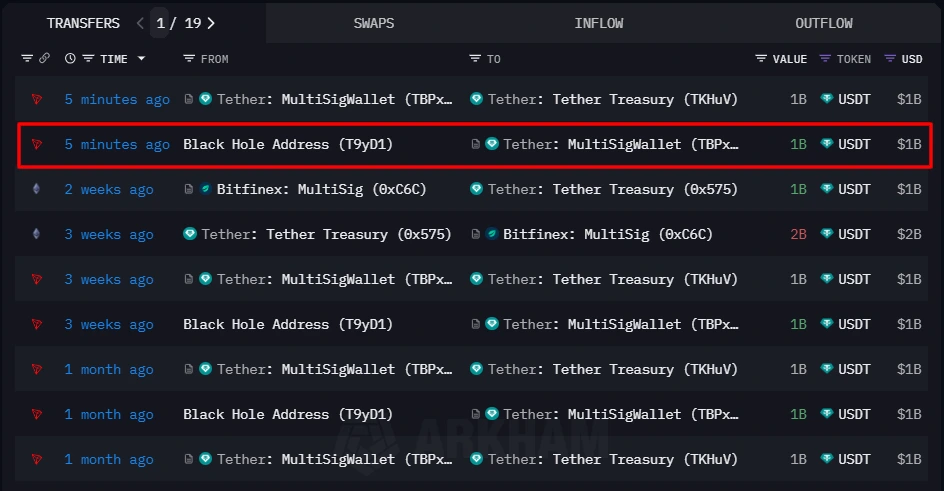

According to Onchain Lens monitoring, Tether has minted another 1 billion USDT on the Tron network, bringing the total minting since the start of 2025 to 6 billion USDT.

Analysis:

Tether’s continuous large-scale minting of USDT reflects strong growth in market demand for stablecoins and also signals a further increase in market liquidity. Tron’s recent series of meme coin market activities may have increased demand for stablecoins.

OVER $360 MILLION IN LIQUIDATIONS ACROSS THE MARKET IN PAST 24 HOURS, SHORT POSITIONS ACCOUNT FOR OVER 70% OF LOSSES

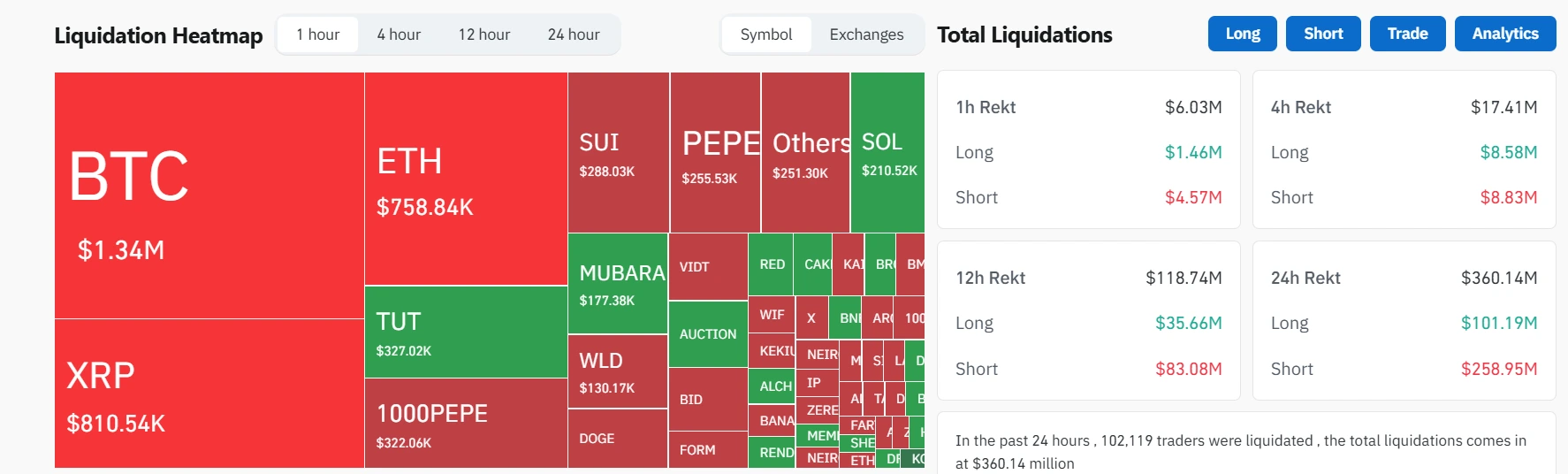

According to Coinglass data, cryptocurrency market contract liquidations reached $360 million in the past 24 hours, with $101 million in long position liquidations and $259 million in short position liquidations, with short position losses accounting for over 70% of the total. Of these, BTC liquidations totaled $134 million, while ETH liquidations amounted to $75.884 million.

Analysis:

This large-scale liquidation primarily affected short positions, possibly indicating an unexpected upward market movement in the short term, forcing short sellers to close their positions. BTC and ETH, as market leaders, account for a significant proportion of the liquidation amounts, reflecting the notable impact of their price fluctuations on market sentiment.

SHELL MARKET MAKER BUYBACK PROGRESS REACHES 74%, ACCUMULATING 19.95 MILLION TOKENS

On-chain data shows that the balance in the SHELL market maker’s public buyback address has increased to 19.95 million tokens, estimated to be worth $5.92 million at the proposed price, meaning 74% of the buyback has been completed. However, SHELL’s token price has not shown a significant increase, currently at $0.3008.

Analysis:

The large-scale buyback by SHELL market makers demonstrates confidence in the token’s value, but the token price’s failure to rise correspondingly may be related to the current bearish sentiment in the entire crypto market. If market sentiment improves after the buyback is completed, SHELL’s price may experience a rebound.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!