KEYTAKEAWAYS

- Stablecoin Total Market Cap Exceeds $230 Billion for the First Time

- Trader achieves 1586x return through BUBB token, turning $304 into $482,000

- US Ethereum Spot ETFs See Net Outflows for 12 Consecutive Days, Single Day Outflow of $12.41 Million

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

STABLECOIN TOTAL MARKET CAP EXCEEDS $230 BILLION FOR THE FIRST TIME

According to DefiLlama data, the total market capitalization of stablecoins has exceeded $230 billion for the first time, currently reaching $230.36 billion, with an increase of $2.3 billion over the past seven days. Compared to the same period last year, stablecoin market cap has grown by 56%. Among them, Tether’s USDT dominates with a market cap of nearly $144 billion, accounting for 62.6%; followed by Circle’s USDC with a market cap of $59 billion.

Analysis:

The stablecoin total market cap breaking through $230 billion comes as US regulators are actively promoting stablecoin adoption. Stablecoins are becoming increasingly important in payments, trading, and as a hedge. USDT’s dominant position is difficult to shake in the short term, while market demand for compliant stablecoins has led to USDC’s steady growth.

TRADER ACHIEVES 1586X RETURN THROUGH BUBB TOKEN, TURNING $304 INTO $482,000

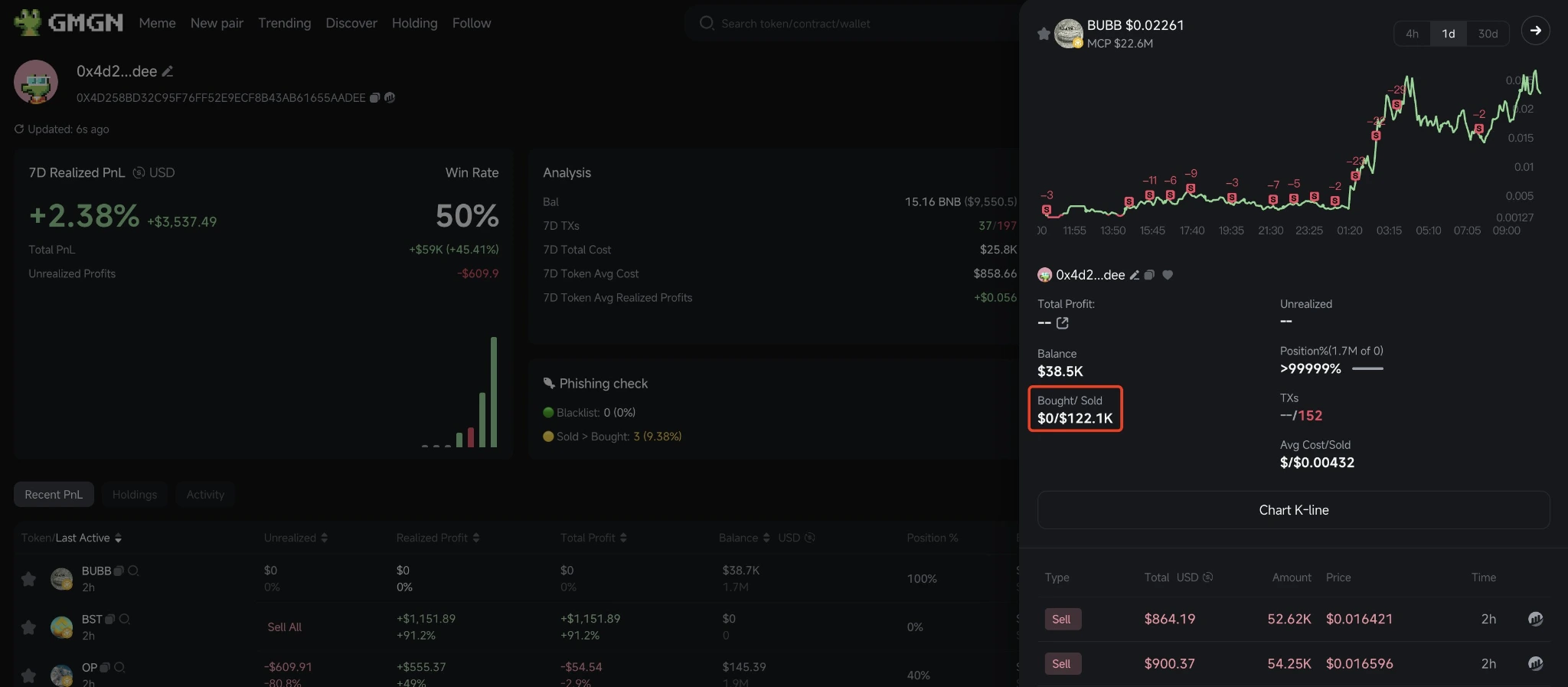

According to Lookonchain monitoring, a trader turned $304 into $482,000 by trading BUBB tokens, achieving a return rate of 1,586x. The trader initially spent just $304 to purchase 43.94 million BUBB, then sold 28.9 million BUBB for $122,000, and currently still holds 15.64 million BUBB worth approximately $360,000.

Analysis:

The astonishing return highlights the high-risk and high-reward nature of the cryptocurrency market. BUBB token’s surge may be related to project popularity, market hype, and liquidity changes. The trader chose to partially realize profits while retaining some holdings, showing a cautiously optimistic attitude toward future market trends. It’s crucial for ordinary investors to avoid blindly following trends and to rationally evaluate project fundamentals and market trends.

US ETHEREUM SPOT ETFS SEE NET OUTFLOWS FOR 12 CONSECUTIVE DAYS, SINGLE DAY OUTFLOW OF $12.41 MILLION

According to SoSoValue data, yesterday Ethereum spot ETFs saw a total net outflow of $12.41 million, marking 12 consecutive days of capital outflow trends. Among them, BlackRock’s ETF ETHA and Fidelity’s ETF FETH were the products with the largest single-day net outflows.

Currently, the total net asset value of Ethereum spot ETFs stands at $6.79 billion, with an ETF net asset ratio (market cap compared to Ethereum’s total market cap) of 2.84%, and historical cumulative net inflows reaching $2.44 billion.

Analysis:

The continued capital outflow from Ethereum spot ETFs may reflect investor concerns about short-term market volatility or profit-taking behavior. Although the long-term prospects of the Ethereum ecosystem remain positive, recent market sentiment and macroeconomic factors may be influencing capital flows. The large outflows from ETFs of mainstream institutions like BlackRock and Fidelity are partly due to their larger base sizes.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!