KEYTAKEAWAYS

- BNB Chain Ecosystem DEXs Reach $14.34 Billion in Weekly Trading Volume, Firmly in First Place Among All Chains

- Ethereum Daily Burn Hits Historic Low as On-Chain Activity Continues to Cool

- SHELL Buyback Progress Reaches 81.2%, Token Price Rises Over 4%

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

BNB CHAIN ECOSYSTEM DEXS REACH $14.34 BILLION IN WEEKLY TRADING VOLUME, FIRMLY IN FIRST PLACE AMONG ALL CHAINS

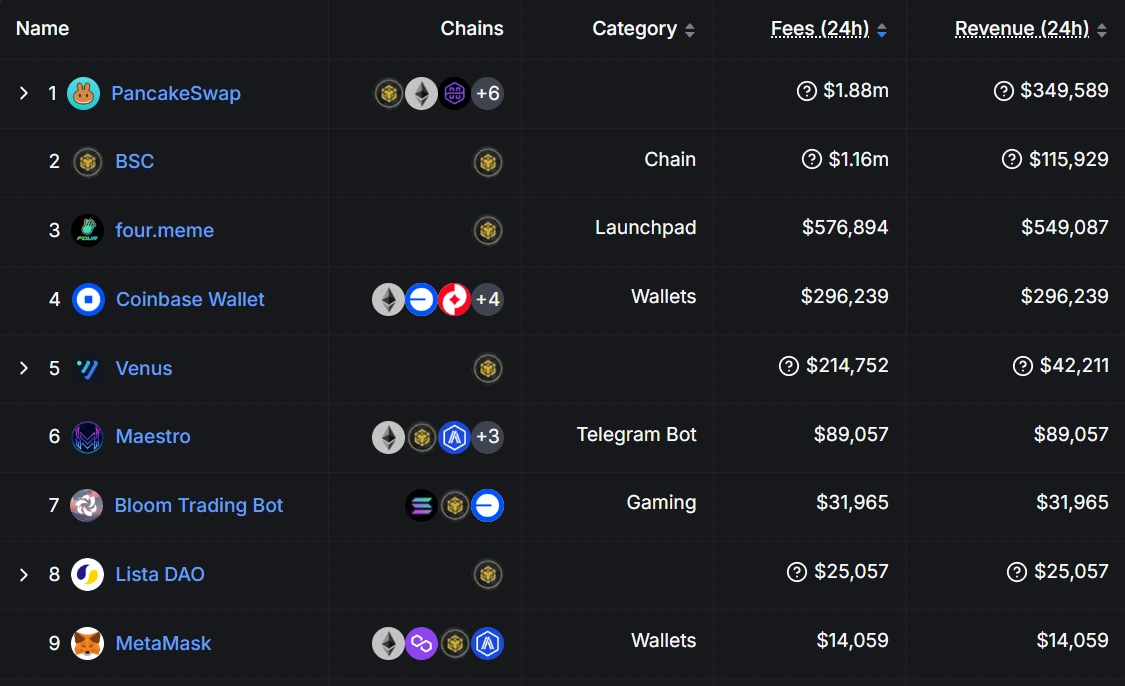

According to DeFiLlama data, BNB Chain ecosystem DEXs achieved a cumulative trading volume of $14.34 billion last week, ranking first among all chains and demonstrating strong market activity.

In the past 24 hours, the protocol generating the most fees on BNB Chain was PancakeSwap, with fees reaching $3.43 million and protocol revenue of $709,000; four.meme generated fees of $747,000 and protocol revenue of $711,000.

Analysis :

The popularity of Meme coins has made BNB Chain ecosystem DEX trading very active. PancakeSwap, as a leading protocol, continues to contribute high fees and revenue. Four.meme’s outstanding performance reflects the impact of the Meme coin boom on on-chain activity.

ETHEREUM DAILY BURN HITS HISTORIC LOW AS ON-CHAIN ACTIVITY CONTINUES TO COOL

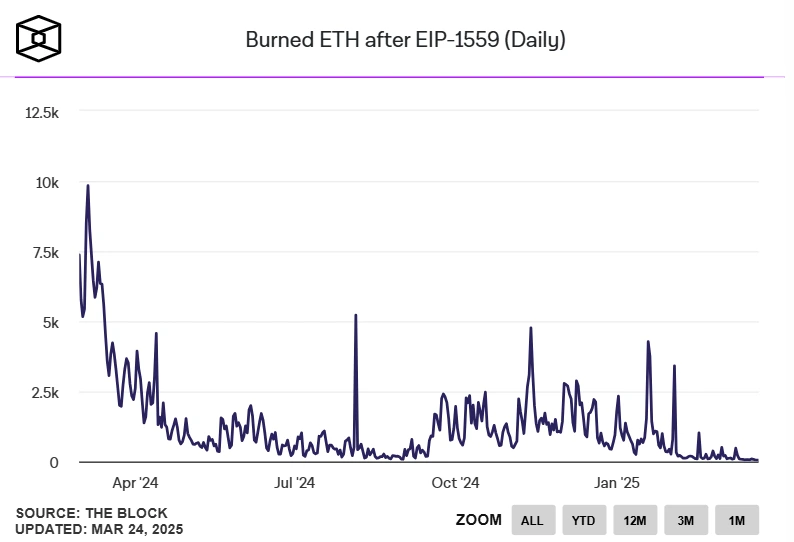

According to The Block, the amount of ETH burned by the Ethereum network due to transaction fees fell to 53.07 coins on Saturday, approximately $106,000, marking a historic low. Simultaneously, on-chain active addresses, transaction volume, and transaction count have also declined in recent weeks.

Ultrasound.money data shows that based on the past 7 days, ETH’s annual supply growth rate is 0.76%. Standard Chartered Bank has reduced its ETH price expectation for 2025 from $10,000 to $4,000.

Analysis:

The significant decline in Ethereum on-chain activity and the historic low in burn rate may reflect current market sentiment depression and user sensitivity to high Gas fees. The popularity of Layer 2 solutions and competition from other public chains have diverted some activity from the Ethereum mainnet. Standard Chartered Bank’s downward adjustment of ETH price expectations indicates a cautious attitude toward Ethereum’s short-term performance.

SHELL BUYBACK PROGRESS REACHES 81.2%, TOKEN PRICE RISES OVER 4%

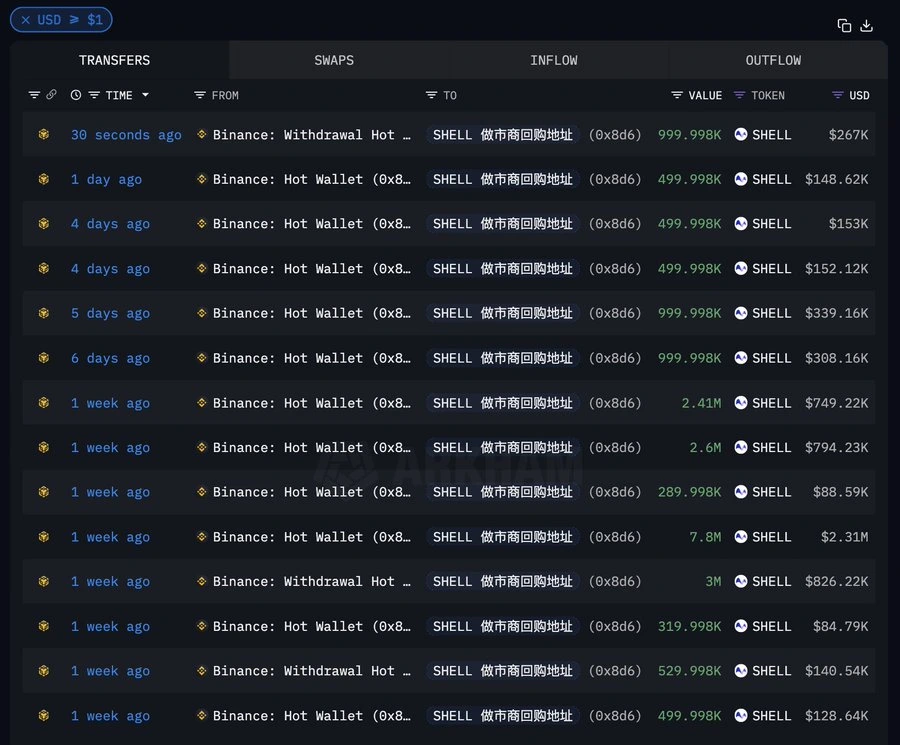

According to on-chain monitoring, the SHELL buyback address withdrew 1 million tokens from Binance two minutes ago, bringing the cumulative buyback total to 21.95 million tokens and increasing the buyback progress to 81.2%. Since the buyback launched on March 14, SHELL token price has risen by 4.56%, from $0.2565 to $0.2682.

Analysis:

The steady progress of the SHELL buyback program has provided positive support for the token price, showing market’s positive feedback to the buyback action. Although the price increase is relatively moderate, the deflationary effect and improved investor confidence brought by the buyback may lay the foundation for further price appreciation.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!