KEYTAKEAWAYS

- Monad Testnet User Base Experiences Explosive Growth: Total Addresses Exceed 61 Million

- "Market Maker Misconduct" Incident Tracking: SHELL Buyback Progress Reaches 81.12%

- Curve Founder Suspected of Selling Another 1 Million CRV, Cashing Out $515,000

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

MONAD TESTNET USER BASE EXPERIENCES EXPLOSIVE GROWTH: TOTAL ADDRESSES EXCEED 61 MILLION

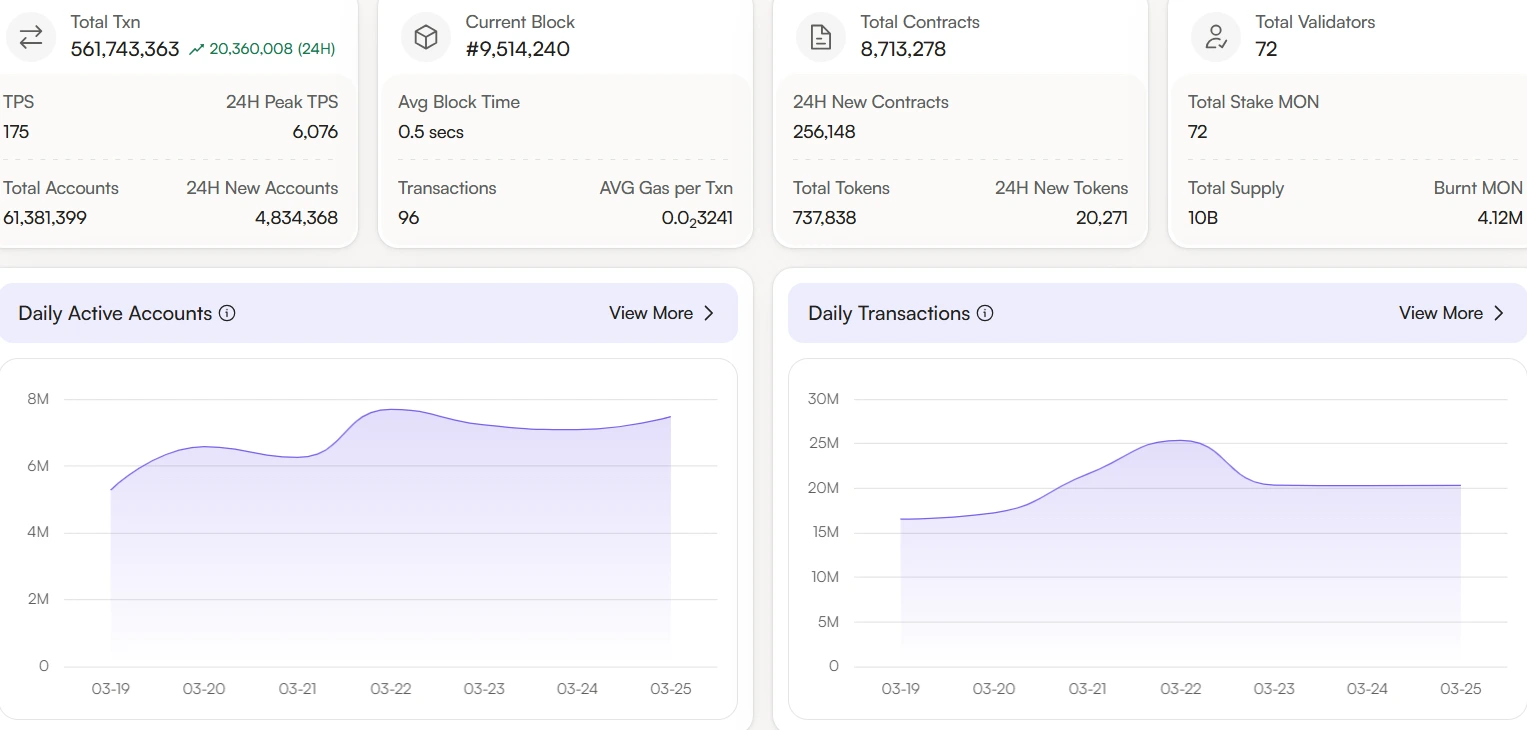

According to the latest on-chain data, the high-performance blockchain project Monad testnet is showing explosive growth. As of publication, the total number of addresses on the testnet has reached 61,381,399, officially surpassing the 61 million milestone. More notably, in the past 24 hours, the number of new addresses reached 5,041,374, setting a new record for single-day growth since the project’s testnet launch.

Analysis:

Monad’s unique parallel execution architecture has attracted attention from numerous developers; the incentivized testnet activities recently launched by the project team have shown significant results; of course, investors should still pay attention to the subsequent technical implementation of the project.

“MARKET MAKER MISCONDUCT” INCIDENT TRACKING: SHELL BUYBACK PROGRESS REACHES 81.12%

Recently, the crypto market has seen multiple projects initiate token buyback plans due to “market maker misconduct” incidents. As of now, the buyback progress and price performance of the mainly affected tokens are as follows:

- GPS: Buyback progress approximately 0%, price has increased by 4.19% since March 23;

- SHELL: Buyback progress has reached 81.12%, price has increased by 8.07% since March 13;

- MOVE: Buyback progress is 14.31%, price has increased by 31.62% since March 25.

Analysis:

MOVE’s significant price increase may be due to large buyback amounts conducted in a concentrated manner, with the market responding positively to rapid buybacks. SHELL’s high buyback progress demonstrates strong execution capability from the project team. Despite GPS’s buyback not yet starting, its price has still risen slightly, possibly due to optimistic market expectations for the upcoming buyback plan.

It should be noted that on-chain buyback address holdings may not fully reflect actual buyback volumes, as some project teams may have completed buybacks but not yet withdrawn from exchanges. Investors should make comprehensive judgments by combining project announcements and market dynamics.

CURVE FOUNDER SUSPECTED OF SELLING ANOTHER 1 MILLION CRV, CASHING OUT $515,000

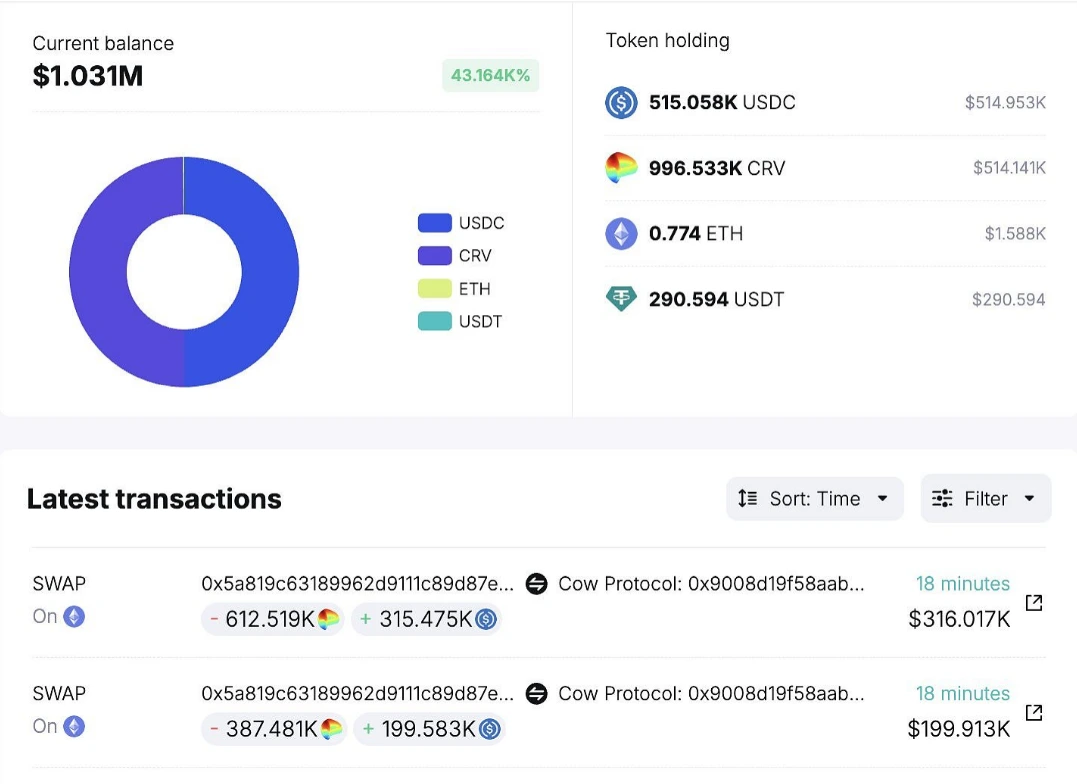

According to monitoring data from Spot On Chain, Curve Finance founder Michael Egorov is suspected of selling CRV tokens again. The specific on-chain actions were:

- 18 hours ago: Egorov transferred 1.997 million CRV (worth approximately $1.03 million) to wallet address “0x5a8”

- Subsequent operations: This address sold 1 million CRV at an average price of $0.515, receiving 515,000 USDC

- Current holdings: The wallet still holds 997,000 CRV (worth approximately $514,000)

Analysis:

This is Egorov’s Nth CRV reduction operation in recent times, continuing his token disposal pattern since 2023. Although the founder’s continuous selling has not caused a drop in the token price, with CRV price at $0.5563 and daily gain of 12%, it may have raised concerns in the community about Curve’s future development direction.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!