KEYTAKEAWAYS

- Crypto Market Now Holds Around $130 Billion in U.S. Treasury Bills

- Tether Announces USDT Global Users Exceed 400 Million

- Hyperliquid Experiences Capital Outflow: Over $150 Million in USDC Net Outflow After Liquidation Event

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

CRYPTO MARKET NOW HOLDS AROUND $130 BILLION IN U.S. TREASURY BILLS

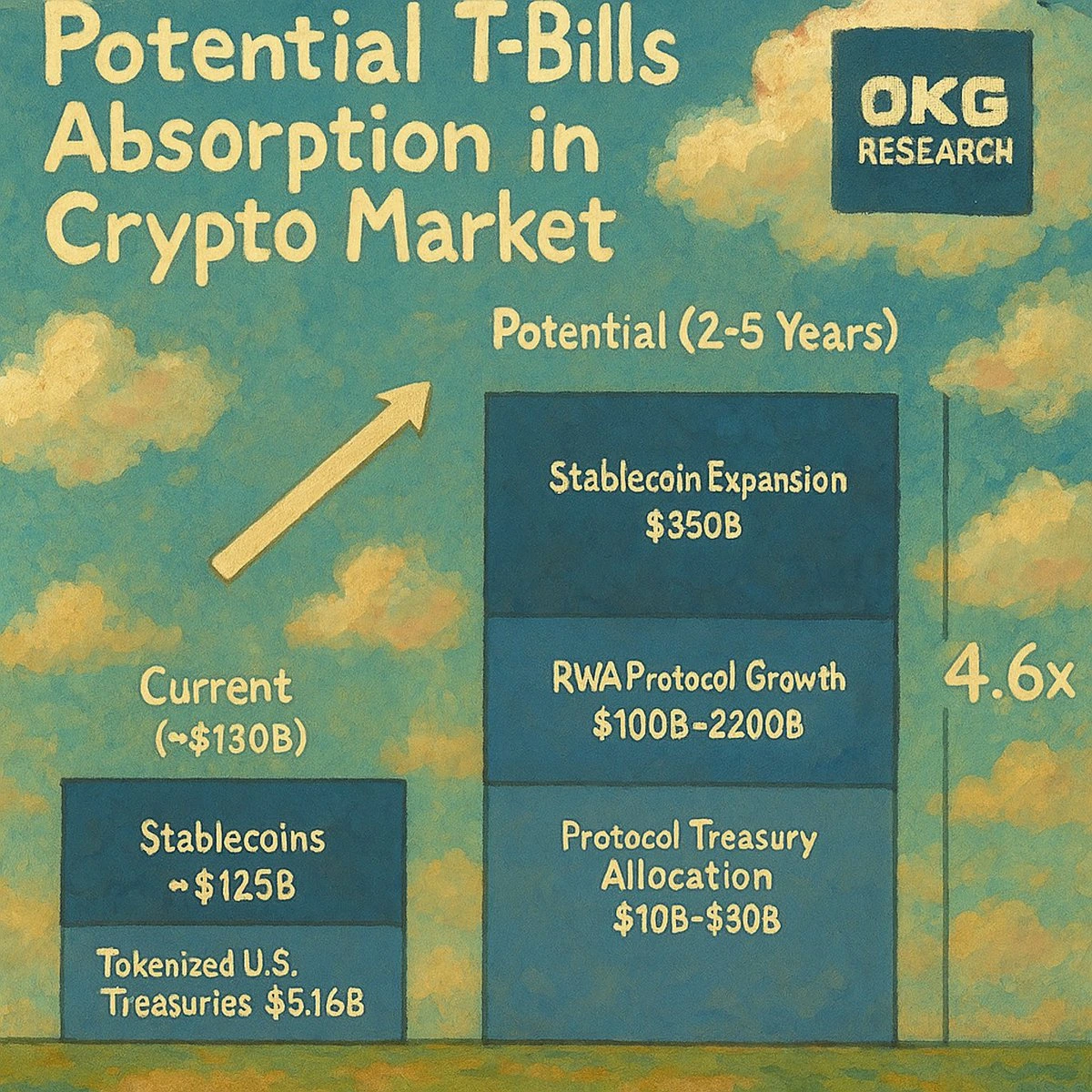

According to OKG Research data, to date, the crypto market has accumulated approximately $130 billion in U.S. short-term Treasury bills (T-Bills), representing about 2% of the total outstanding T-Bills in circulation in the United States. Of this amount, stablecoins (USDT and USDC) hold about $125 billion, accounting for 56.8% of the total stablecoin supply; tokenized T-Bill products (32 in total) are estimated at approximately $5.213 billion. Since 2025, the growth rate of tokenized Treasury bills has been significant, with a monthly compound growth rate of 14% over the past year.

Analysis:

The crypto market could potentially absorb $300-600 billion in U.S. Treasury bills, increasing penetration to 5-10%, which implies:

- It will become a significant allocation force in the Treasury market that cannot be ignored.

- It will promote the scaled construction of asset bridges between crypto and traditional finance.

- It will accelerate the regulatory compliance process for RWA (Real World Assets) track infrastructure.

TETHER ANNOUNCES USDT GLOBAL USERS EXCEED 400 MILLION

Tether CEO Paolo Ardoino recently announced on Twitter that USDT global users have conservatively surpassed 400 million, emphasizing that “we will soon reach 1 billion users.” In his tweet, he introduced the concept of a “stablecoin multiverse,” pointing out that hundreds of companies and governments worldwide are launching or preparing to launch their own stablecoins. As the pioneer that first created this technology in 2014, Tether’s “grassroots approach” strategy stands in stark contrast to traditional financial institutions.

Analysis:

This announcement highlights USDT’s absolute leading position in the stablecoin market, with its 400 million user base far exceeding other competitors. The CEO’s inclusion of government issuance in the stablecoin development landscape may indicate that future stablecoin regulations will tend toward standardization. Tether’s emphasis on grassroots penetration strategy also reflects how cryptocurrencies are moving from the margins toward the mainstream.

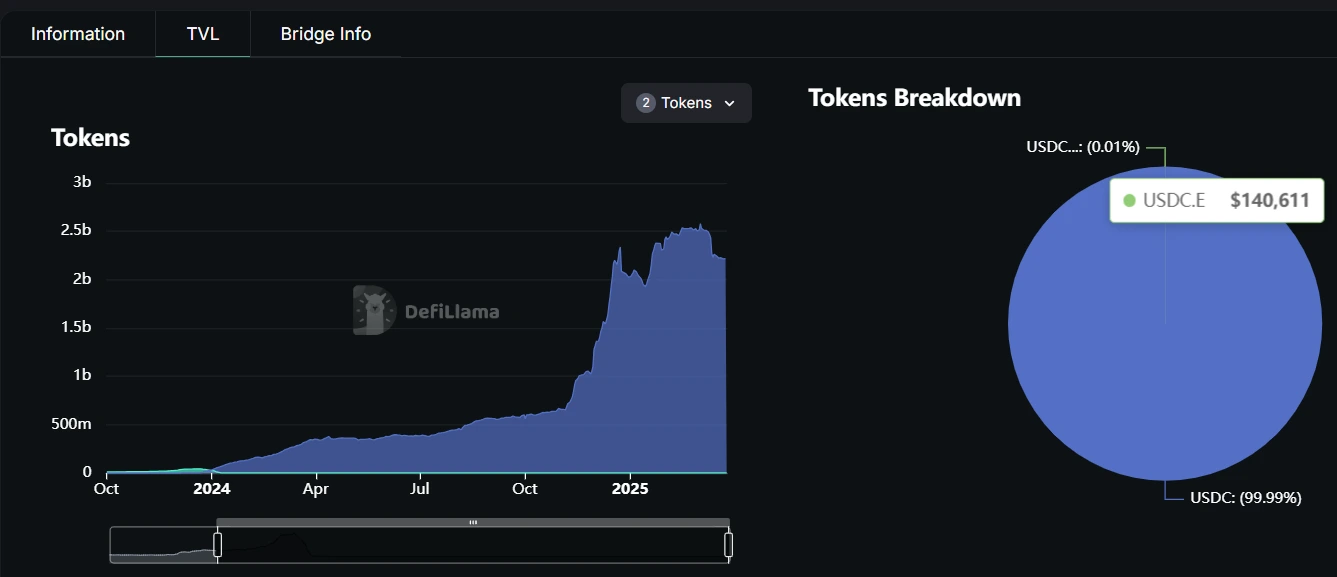

HYPERLIQUID EXPERIENCES CAPITAL OUTFLOW: OVER $150 MILLION IN USDC NET OUTFLOW AFTER LIQUIDATION EVENT

According to DefiLlama data, Hyperliquid has experienced massive outflows of USDC funds following the platform’s liquidation event. As of the report, the platform’s net USDC outflow has reached $153 million, with total balances plummeting from $2.217 billion to $2.064 billion.

Analysis:

The liquidation event has not only affected investor confidence but also triggered a liquidity crisis. Although current USDC reserves still remain above $2 billion, if the capital outflow trend continues, it could pose challenges to platform operations and user asset security. Hyperliquid may need to rebuild market trust, optimize risk control mechanisms, and improve crisis management capabilities to alleviate market concerns about the platform’s risks.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!