KEYTAKEAWAYS

- Two Mystery Wallets Sell 14,000 ETH Within 8 Hours, Cashing Out $27.5 Million and Drawing Market Attention.

- MOVE Buyback Address Withdraws Another 10 Million Tokens from Binance, Worth $4.94 Million.

- Total DeFi TVL Falls Below $10 Billion, Ethereum Still Dominates Half the Market.

- KEY TAKEAWAYS

- TWO MYSTERY WALLETS SELL 14,000 ETH WITHIN 8 HOURS, CASHING OUT $27.5 MILLION AND DRAWING MARKET ATTENTION

- MOVE BUYBACK ADDRESS WITHDRAWS ANOTHER 10 MILLION TOKENS FROM BINANCE, WORTH $4.94 MILLION

- TOTAL DEFI TVL FALLS BELOW $10 BILLION, ETHEREUM STILL DOMINATES HALF THE MARKET

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

TWO MYSTERY WALLETS SELL 14,000 ETH WITHIN 8 HOURS, CASHING OUT $27.5 MILLION AND DRAWING MARKET ATTENTION

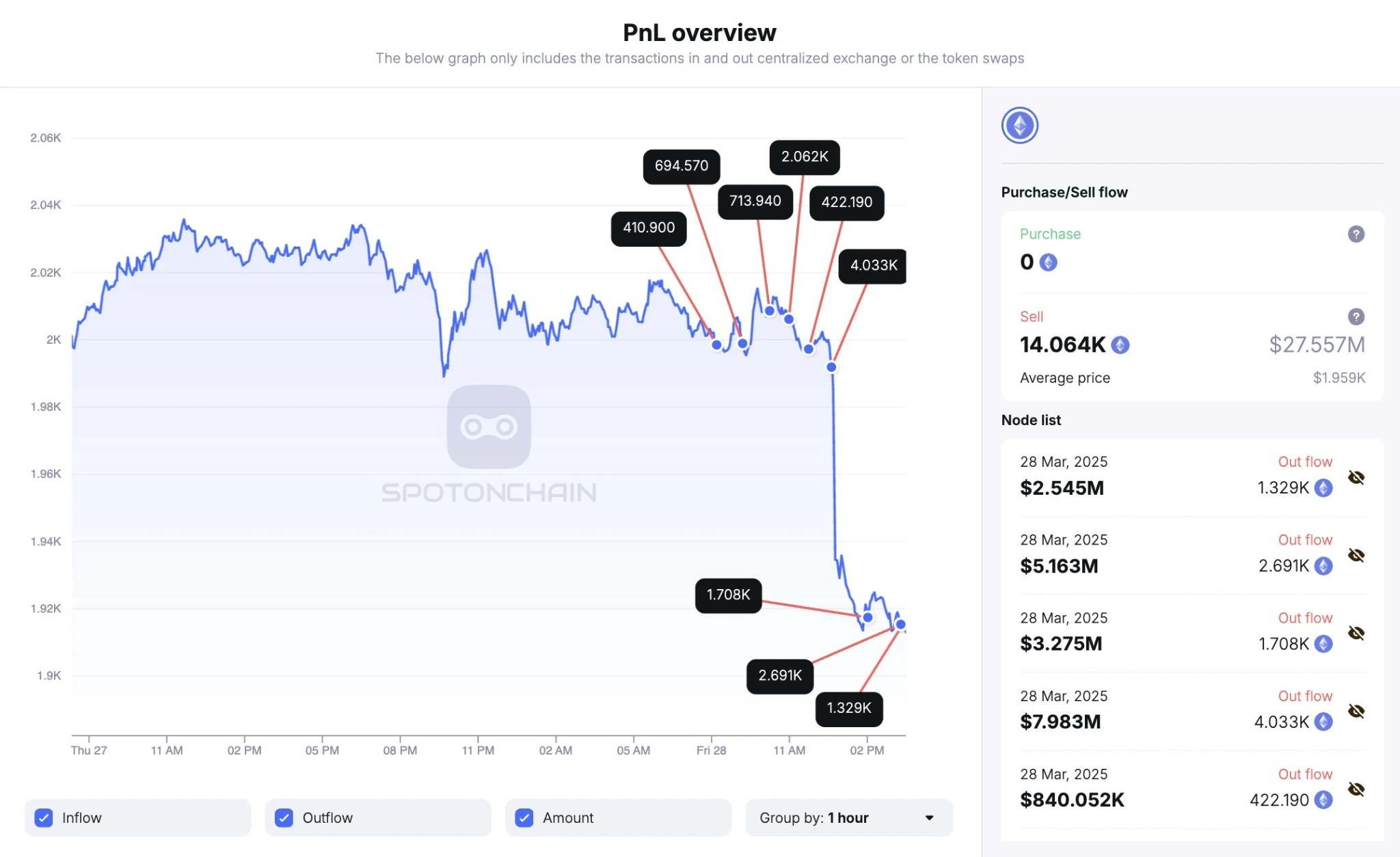

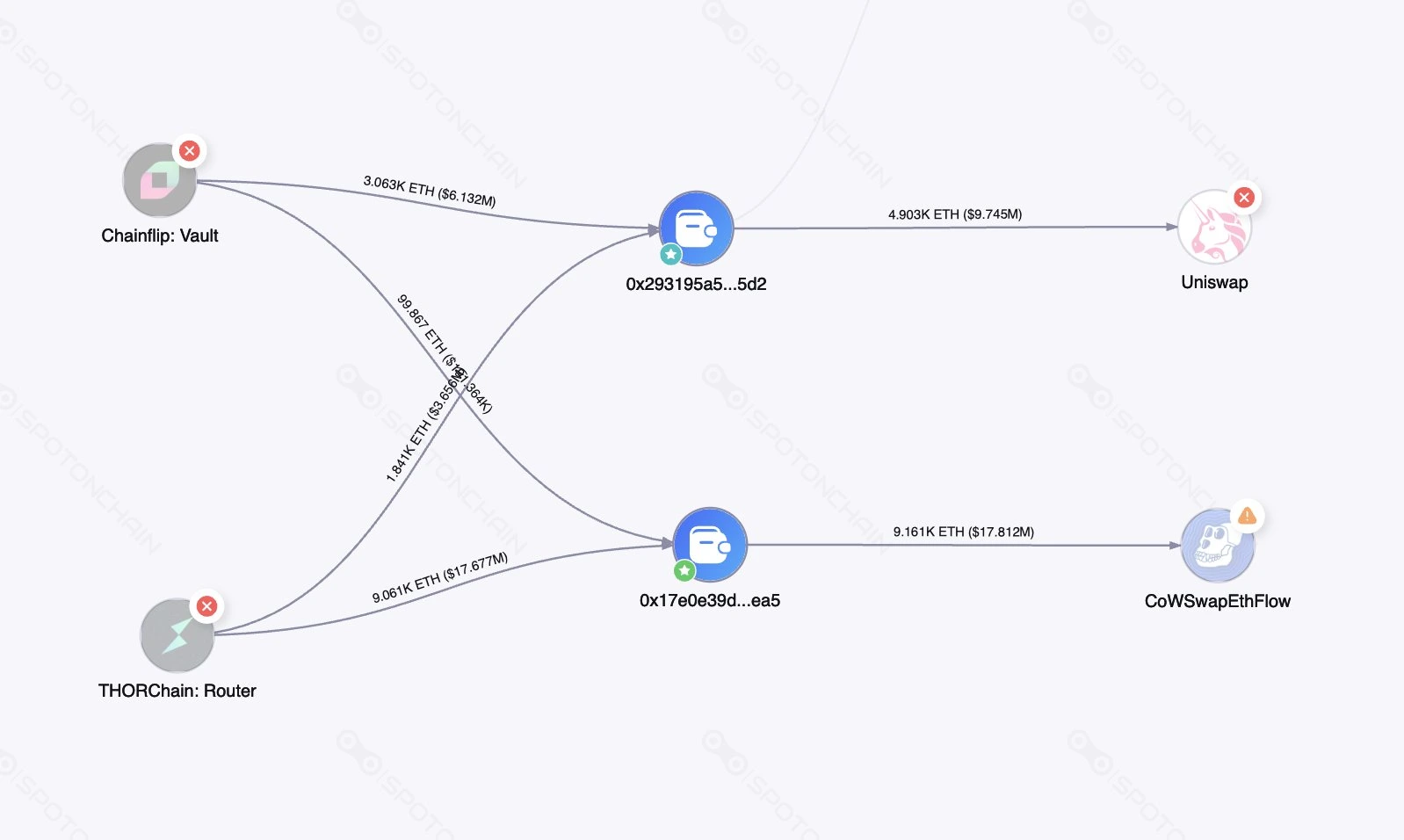

According to blockchain analytics platform Spot On Chain, two unusually large ETH transactions were detected today: within 8 hours, two new wallets received substantial amounts of ETH through THORChain and Chainflip, then quickly sold off 14,064 ETH, exchanging them for 27.5M DAI, at an average price of $1,959.

Analysis:

This concentrated selling activity displays three significant characteristics, suggesting it could be institutional investors or whales making strategic portfolio adjustments, though project team profit-taking cannot be ruled out.

- Professional execution: Using cross-chain protocols to receive funds, avoiding traceability.

- Precise timing: Completing the cash-out at a relatively high ETH price (close to $1,960).

- Significant scale impact: The single-day selling volume represents approximately 0.3% of ETH’s average daily trading volume, potentially intensifying short-term market volatility.

MOVE BUYBACK ADDRESS WITHDRAWS ANOTHER 10 MILLION TOKENS FROM BINANCE, WORTH $4.94 MILLION

Today, the MOVE buyback address once again withdrew 10 million tokens from #Binance, valued at $4.94 million. To date, the MOVE buyback address has withdrawn a cumulative total of 20 million tokens, with a total value of $10.37 million, updating the buyback progress to 27.3%.

Analysis:

The project team completing a buyback of $10.37 million in a short period not only validates their financial strength but also conveys confidence in the project’s long-term development to the market. The practice of continuously withdrawing liquidity from exchanges effectively reduces selling pressure in the secondary market, providing substantial support for the token price.

TOTAL DEFI TVL FALLS BELOW $10 BILLION, ETHEREUM STILL DOMINATES HALF THE MARKET

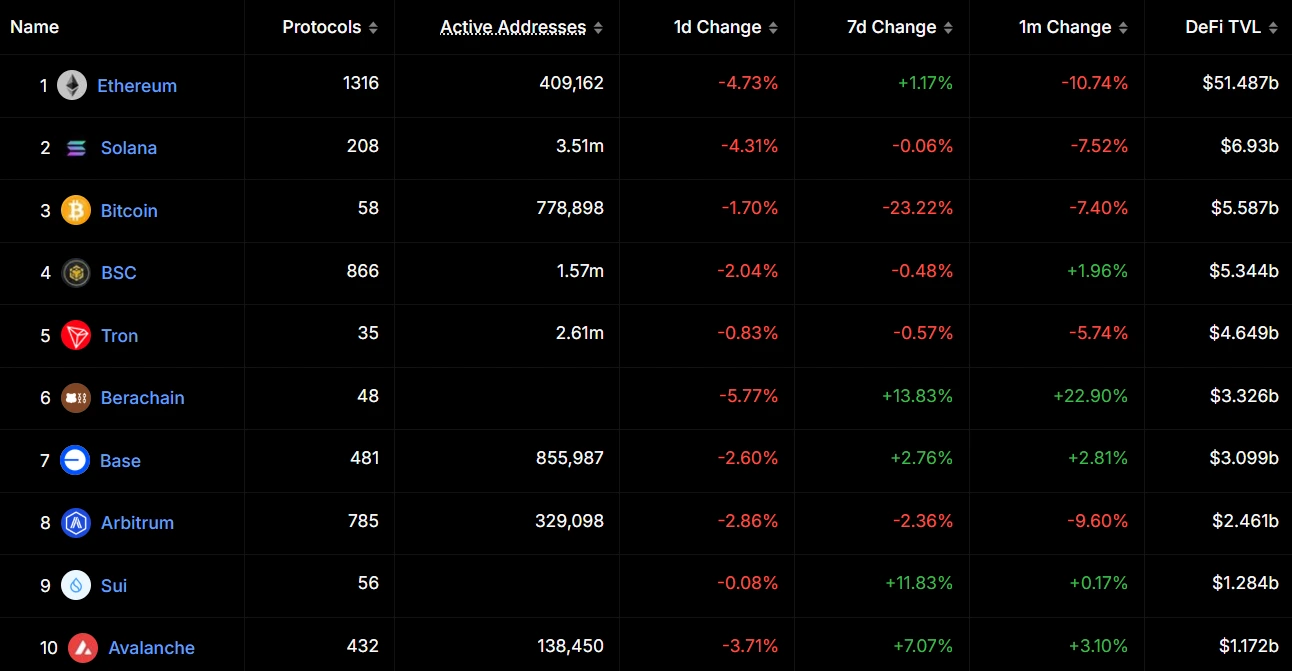

According to DeFiLlama data, the total value locked (TVL) across all blockchain DeFi protocols currently stands at $9.7662 billion, with major blockchains showing varying degrees of decline today. Among them:

- Ethereum (-4.73%): $5.1487 billion

- Solana (-4.31%): $693 million

- Bitcoin (-1.70%): $558.7 million

- BSC (-2.04%): $534.4 million

- Tron (-0.83%): $464.9 million

- Berachain (-5.77%): $332.6 million

Analysis:

The current DeFi market shows a widespread downtrend. Although Ethereum has dropped 4.73%, it maintains absolute dominance with a 52.7% market share.

- The emerging blockchain Berachain experienced the largest decline, reflecting reduced market risk appetite for emerging ecosystems

- The Bitcoin ecosystem showed relatively better resistance to the decline, potentially benefiting from recent long-term holding signals from Bitcoin enthusiasts

- Tron showed the smallest decline, with its stablecoin-dominated ecosystem demonstrating defensive characteristics in a volatile market

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!