KEYTAKEAWAYS

- Solana's 24-hour DEX Trading Volume Ranks First Among All Chains

- SMELANIA Team Sells 6.72 Million Tokens for $4.2 Million Profit in Past 25 Days

- BTC Trading Volume Down 77% from February Peak, Binance Market Share Rises to About 50%

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

SOLANA’S 24-HOUR DEX TRADING VOLUME RANKS FIRST AMONG ALL CHAINS

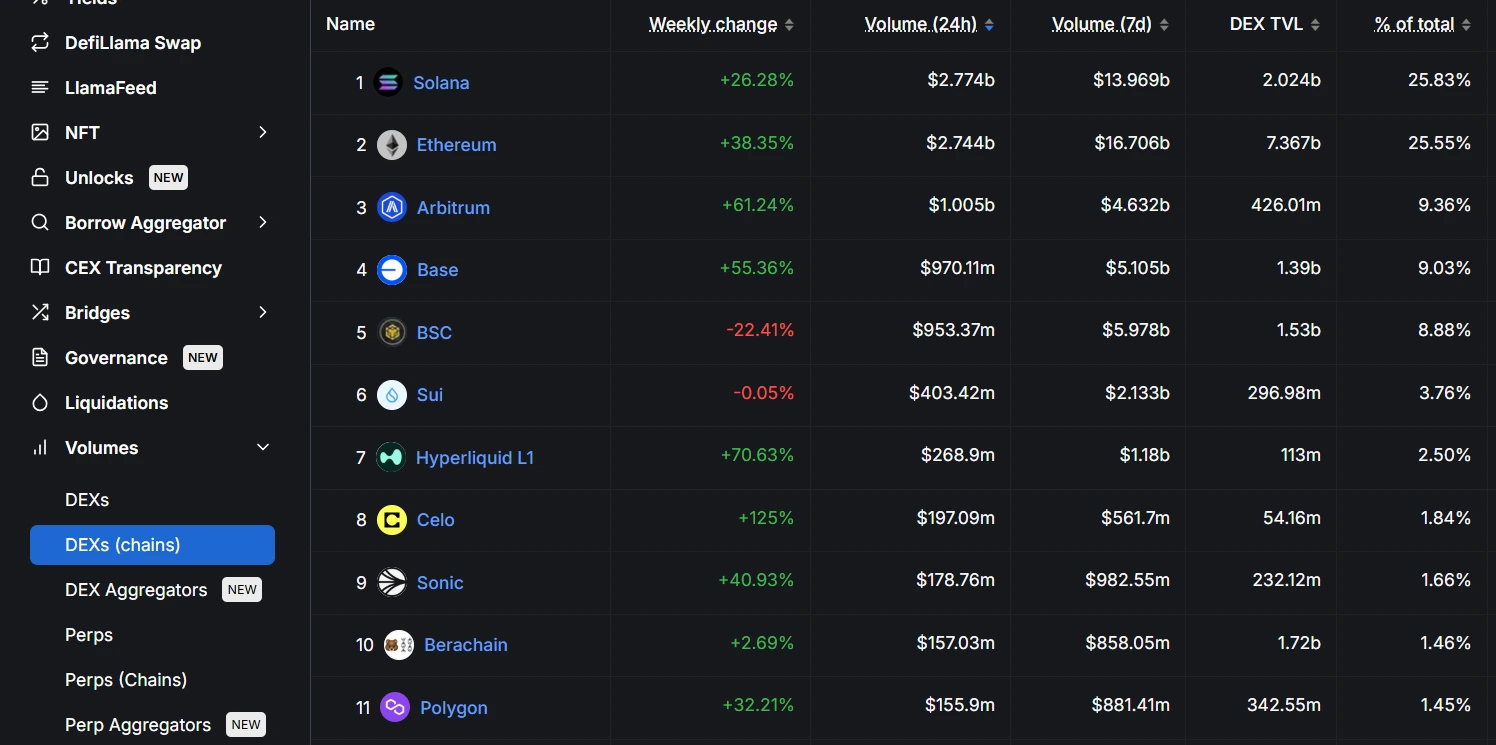

According to DefiLlama data, Solana’s 24-hour DEX trading volume ranks first among all chains, approximately $2.77 billion. Ethereum ranks second with $2.744 billion.

Arbitrum ($1.005 billion) and Coinbase-incubated Base chain ($970 million) rank third and fourth, while former leader BNB Chain has shown weak performance recently, with weekly trading volume plummeting 22.41% to $953 million, slipping to fifth place.

Analysis:

Solana’s DeFi ecosystem resilience has once again gained recognition in this round of on-chain liquidity restructuring. BNB Chain has experienced the most severe decline in DEX trading volume among the top 10 public chains. On one hand, a large amount of liquidity rushed in during the previous memecoin fever, and after the market cooled down, some funds have withdrawn.

SMELANIA TEAM SELLS 6.72 MILLION TOKENS FOR $4.2 MILLION PROFIT IN PAST 25 DAYS

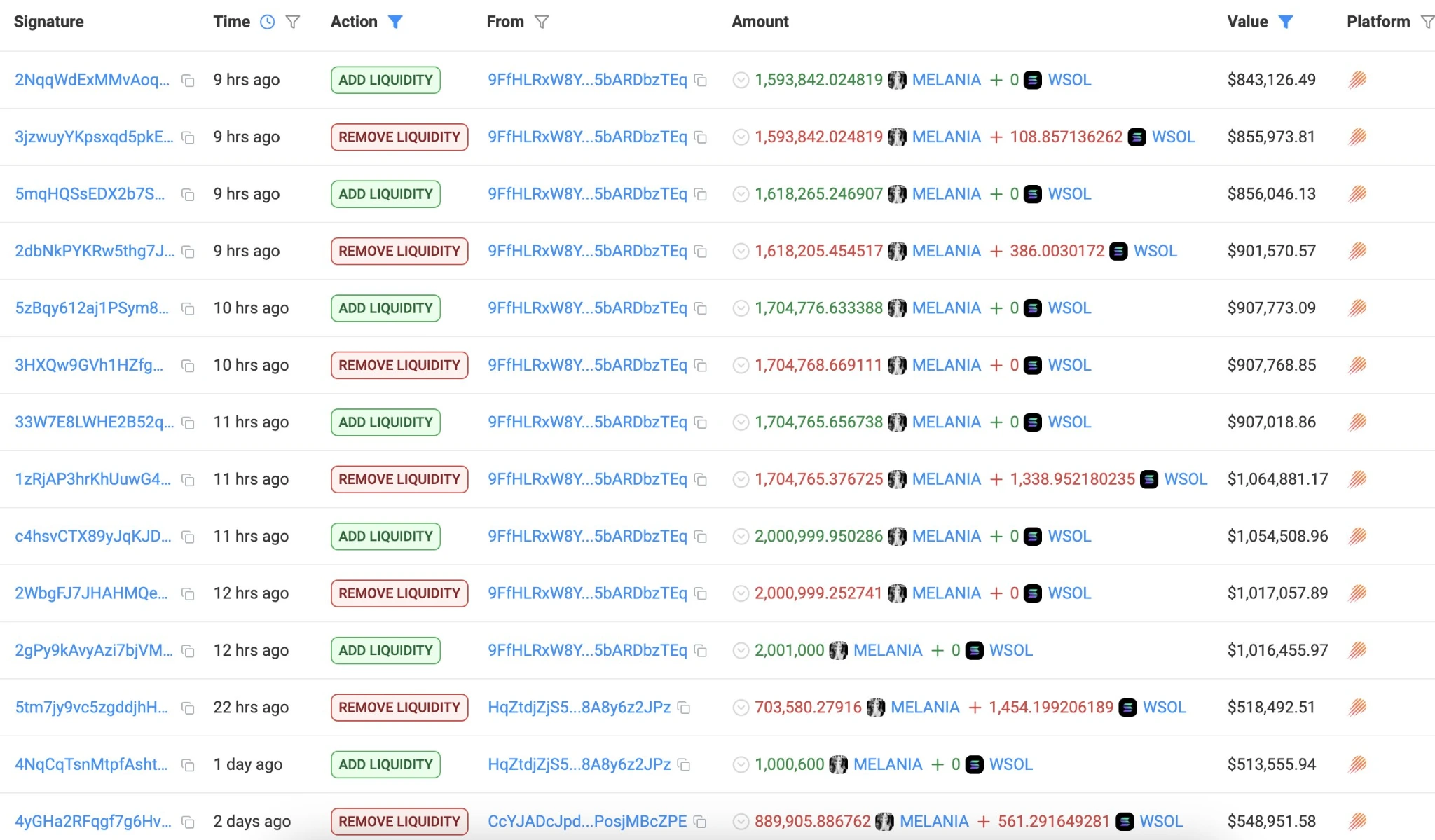

According to Lookonchain monitoring, the Meme coin MELANIA team has been selling MELANIA by adding and removing liquidity. In the past 25 days, they have sold a total of 6.72 million MELANIA tokens worth 34,168 SOL (approximately $4.2 million) by manipulating liquidity across 8 wallets.

Analysis:

This selling behavior by the MELANIA team exposes the common liquidity manipulation risks in the Meme coin market. The team’s choice to cash out in SOL (rather than stablecoins) may indicate their dependence on short-term liquidity in the Solana ecosystem.

BTC TRADING VOLUME DOWN 77% FROM FEBRUARY PEAK, BINANCE MARKET SHARE RISES TO ABOUT 50%

According to a CryptoQuant report, Bitcoin spot trading volume has dropped from its February 3rd peak of $44 billion to $10 billion by the end of the first quarter, representing a 77% decrease. Meanwhile, altcoin spot trading volume fell from $122 billion to $23 billion, a decline of over 80%.

Despite the overall trading volume decline, Binance’s market share has continued to grow, with its daily average Bitcoin spot trading volume increasing from 33% on February 3rd to 49% by the end of the first quarter, bringing its total crypto market trading share to nearly 50%.

Analysis:

The significant decrease in trading volume indicates that investors are reducing participation due to market uncertainty or fear sentiment. During this correction period, leading exchanges are more favored by users, with Binance’s daily average altcoin spot trading volume share also increasing from 38% to 44%. Trading activities for BNB, TON, and EOS on Binance still maintain relatively high levels.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!