KEYTAKEAWAYS

- WLFI's USD Stablecoin USD1 Circulation on BSC Exceeds 100 Million

- Bitcoin Spot ETF Single-Day Net Outflow of $772 Million, Largest Single-Day Fund Withdrawal in Nearly Three Months

- Pump.fun Daily Trading Volume Exceeds $500 Million, Ranking Fourth Among DEXs

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

WLFI’S USD STABLECOIN USD1 CIRCULATION ON BSC EXCEEDS 100 MILLION

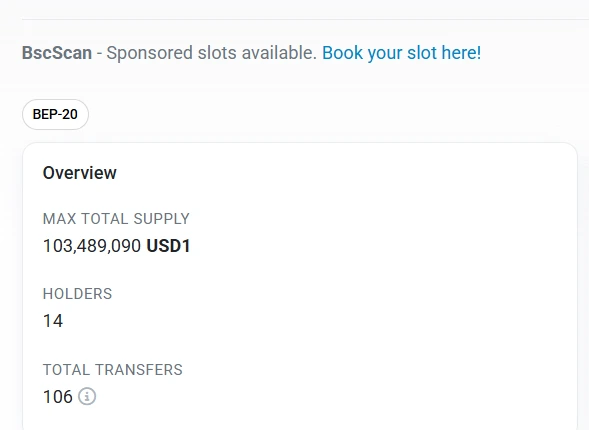

April 11, on-chain information shows that the USD stablecoin USD1, launched by Trump crypto project WLFI, has exceeded 100 million in circulation on BSC, currently at 103,489,090 coins.

Analysis:

This milestone growth indicates USD1 is rapidly integrating into the BSC decentralized finance ecosystem. BSC network’s low transaction fees and high throughput provide an ideal environment for stablecoin transactions.

BITCOIN SPOT ETF SINGLE-DAY NET OUTFLOW OF $772 MILLION, LARGEST SINGLE-DAY FUND WITHDRAWAL IN NEARLY THREE MONTHS

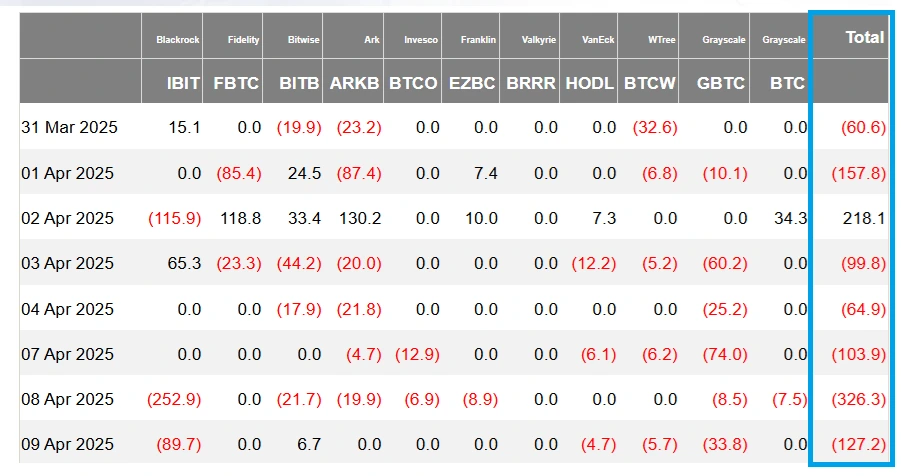

U.S. Bitcoin spot ETFs experienced a massive net outflow of $772 million yesterday, marking the largest single-day fund withdrawal in nearly three months. Among them, BlackRock’s IBIT saw its first single-day net outflow of $460 million, while capital outflows from Grayscale’s GBTC accelerated to $210 million.

Analysis:

This large-scale fund withdrawal was mainly influenced by macroeconomic policy expectations. News of the Trump administration’s plan to impose 125% tariffs on Chinese goods not only intensified market concerns about a global trade war but also triggered panic about potential resurgence of U.S. inflation.

Against this backdrop, some institutional investors chose to shift toward traditional safe-haven assets, resulting in a 1.2% single-day increase in gold prices and an 8-basis-point decrease in 10-year U.S. Treasury yields. This event highlights the strengthening correlation between the cryptocurrency market and the traditional financial system, with policy risk becoming a key variable affecting digital asset price trends.

PUMP.FUN DAILY TRADING VOLUME EXCEEDS $500 MILLION, RANKING FOURTH AMONG DEXS

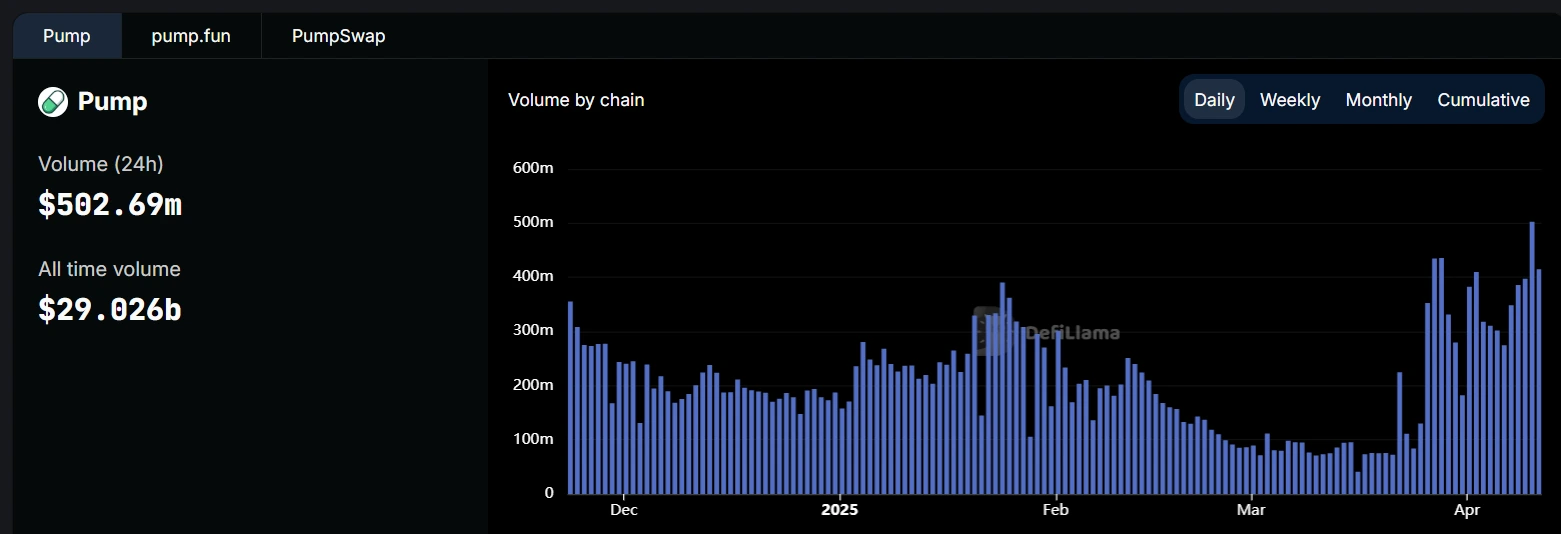

Latest data shows that Pump.fun’s daily trading volume has strongly rebounded to $502.69 million, ranking fourth on the decentralized exchange leaderboard. The current top three DEXs by trading volume are: Uniswap ($2.36 billion), PancakeSwap ($1.048 billion), and Orca ($445.75 million). Notably, Pump.fun’s recent trading volume has approached that of Orca, demonstrating strong growth momentum.

Analysis:

Pump.fun’s rise is closely tied to its strategic transformation in March. The platform announced the development of its own AMM (Automated Market Maker) system, gradually reducing its dependence on Raydium, marking a shift in their relationship from cooperation to direct competition. This change has triggered an “internal war” in the Solana ecosystem, with established DEX Raydium facing a strong challenge from Pump.fun.

As Pump.fun continues to improve its independent liquidity system, the liquidity battle within the Solana ecosystem may have just begun, and this competition could reshape the competitive landscape of Solana’s DeFi ecosystem.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!